Bernanke Gets Behind 2nd Stimulus Bill

Fed Chairman Ben Bernanke gave a boost to congressional Democratic leaders, bolstering their plan for additional economic infusion.

Jul 31, 2020136.2K Shares2M Views

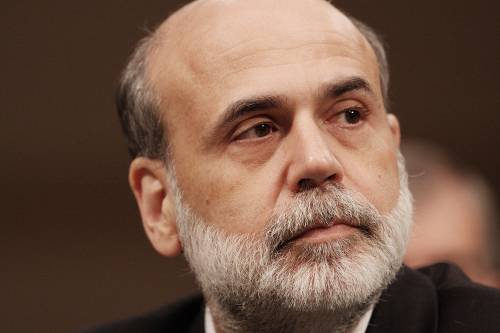

Ben Bernanke (WDCpix)

Democratic leaders, who hope to inject billions more borrowed dollars into the economy before the end of the year, got a little boost from the chairman of the Federal Reserve on Monday.

Appearing before the House Budget Committee, Fed Chairman Ben Bernanke emphasized the importance of the recently enacted $700-billion Wall Street bailout, but he endorsed additional steps to help the ailing economy.

“Given the uncertainties about the near term, and the risk that still exists,” Bernanke said, “I think that it is appropriate for Congress to be thinking about a fiscal program.”

Illustration by: Matt Mahurin

Bernanke was careful, however, not to endorse any specific plan, saying only that “the size and the composition of that are, obviously, items for the Congress to determine.” Asked to assign a dollar figure, the Fed chief declined. “It should be significant,” he said, “but I can’t give you a number.”

Last month, House Democrats passed a $58-billion proposal designed to create jobs and stimulate consumer spending, but Senate Republicans — lining up behind a White House veto threat — blocked the measure. Democratic leaders, hoping to return to the issue next month, were quick to grab Bernanke’s comments as ammunition in the partisan debate.

“I urge President Bush and congressional Republicans to work with Democrats to make a targeted, fiscally-responsible recovery a reality,” House Majority Leader Steny Hoyer (D-Md.) said in a statement.

The Democrats’ stimulus strategy would expand benefits to the unemployed, help states with health-care and other costs and pump billions into the country’s ailing infrastructure. Many economists have endorsed those steps, saying they would do for Main Street what the bailout package did for Wall Street. New funding for food stamps and low-income heating programs, for example, “gets money in the hands of the people who are most likely to spend it immediately,” said Heidi Shierholz, an economist at the Economic Policy Institute, a liberal policy group.

But the White House has opposed the House plan, maintaining it would lead to billions of dollars in “self-perpetuating entitlement spending.”

The White House spokeswoman Dana Perino told reporters,after Bernanke’s testimony Monday, that the administration still opposes the House strategy, but would consider other stimulus options. “We’re continuing to have conversations with members of Congress,” Perino said, “and we’re open to ideas that they would put forward.”

The size of the Democrats’ intervention plan seems to grow by the day. A few weeks after the House passed its $58 billion proposal, House Speaker Nancy Pelosi (D-Calif.) floated the idea that $150 billionwould be needed. By last week, that figure had jumped to $300 billion.

Many economists say the larger figure is appropriate. Dean Baker, co-director of the Center for Economic and Policy Research, said that, since the start of the housing slump, the country has lost $5 trillion in housing wealth — a decline resulting in roughly $300 billion in annual consumption. “The reason that people were spending was that they had the wealth,” Baker said.

Both Baker and Shierholz support a package of at least $300 billion.

Bernanke, even in supporting a new federal intervention, was quick to warn lawmakers that they must weigh its short-term benefits versus the long-term costs. The Treasury is already $168 billion in the hole from another stimulus billpassed earlier in the year. That strategy— which gave every taxpayer a $600 cash refund — is widely credited with buoying retail sales for a few months. But it failed to prevent the larger decline in consumer spending due to the evaporation of home equity.

Much of the success of a second stimulus package, Bernanke said, would hinge on how targeted — and how immediate — the reforms are. New infrastructure projects, for example, tend to take years to develop, he warned, meaning the stimulating effects might arrive too late to do the economy much short-term good.

“If it’s well invested, that’s a very good thing for the economy,” he said. “The question really turns on how much extra spending and employment will you get from infrastructure projects that you would not otherwise have had.”

Targeting states, Bernanke added, is a safer short-term bet — particularly if the new spending prevents cuts in state services or restores programs already slashed. He cautioned, though, against “compensating [states] for past spending or putting money in the rainy-day fund, because that doesn’t help the current situation.”

Not everyone has jumped on the stimulus bandwagon. House Republicans continue to blast the Democrats’ stimulus plan as an expansion of government at the expense of taxpayers. “We should not be under any illusion that this stimulus package will address the core problems of our current financial crisis and economic weakness,” Rep. Paul Ryan (R-Wis.), ranking member of the House Budget Committee, saidduring Monday’s hearing.

Jagadeesh Gokhale, an economist at the libertarian Cato Institute, warned of a broader trend, arguing that the uncertainty created by sporadic government interventions does more economic harm than good. “Policy stability,” Gokhale said, “is much better than short-term shots in the arm.”

Meanwhile, Bernanke declined to say whether the country is in a recession, arguing that it’s merely a technical term tossed around by academics.

“We are in a serious slowdown in the economy, which has very significant consequences for the public,” he said. “Whether it’s called a recession or not is of no consequence.”

Rhyley Carney

Reviewer

Latest Articles

Popular Articles