WSJ Cherry-Picks Data to Label Cap-and-Trade Scheme ‘Regressive’

An editorial in today’s Wall Street Journal attacks President Obama’s cap-and-trade plan to curb carbon emissions as a regressive policy: Hit hardest would

Jul 31, 202024.3K Shares2.7M Views

An editorial in today’s Wall Street Journalattacks President Obama’s cap-and-trade plan to curb carbon emissions as a “regressive” policy:

“„Hit hardest would be the “95% of working families” Mr. Obama keeps mentioning, usually omitting that his no-new-taxes pledge comes with the caveat “unless you use energy.” Putting a price on carbon is regressive by definition because poor and middle-income households spend more of their paychecks on things like gas to drive to work, groceries or home heating.

“„The Congressional Budget Office — Mr. Orszag’s former roost — estimates that the price hikes from a 15% cut in emissions would cost the average household in the bottom-income quintile about 3.3% of its after-tax income every year. That’s about $680, not including the costs of reduced employment and output. The three middle quintiles would see their paychecks cut between $880 and $1,500, or 2.9% to 2.7% of income. The rich would pay 1.7%. Cap and trade is the ideal policy for every Beltway analyst who thinks the tax code is too progressive (all five of them).

Hmm, let’s take a look at this claim.

As the Journal’s editorial board points out later in the editorial, Obama’s plan calls for 80 percent of the revenue generated by selling carbon allowances to be given back to the public through a tax credit of $400 for individuals or $800 for families. If you accept the Journal’s numbers, that means the bottom quintile would *gain *$120 a year, while higher-income families would lose slightly (in the short term, at least, until alternative energy becomes cheaper).

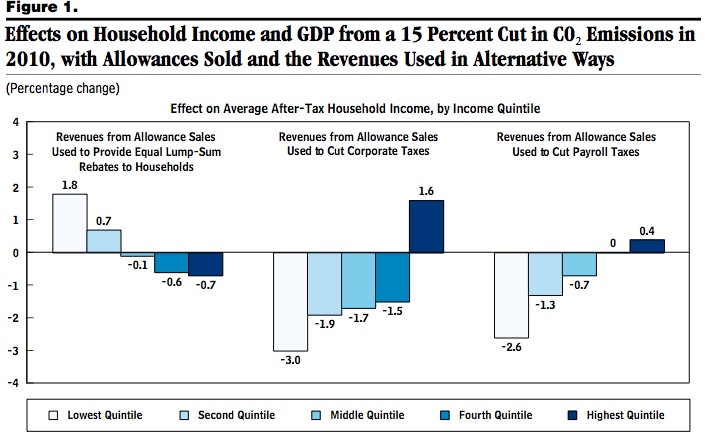

Don’t believe me? Then take a look at this chart from the very same CBO report cited by the Journal:

Note that although Obama’s plan calls for a tax credit, the effect is that of a lump-sum rebate, because every individual/household would receive the same amount. So the Journal’s questionable math notwithstanding, the poorest 40 percent of Americans would gain from this plan (including a substantial gain by the poorest 20 percent), the richest 40 percent would lose and the middle 20 percent would break about even.

If that’s not a progressive tax scheme, what is?

Camilo Wood

Reviewer

Camilo Wood has over two decades of experience as a writer and journalist, specializing in finance and economics. With a degree in Economics and a background in financial research and analysis, Camilo brings a wealth of knowledge and expertise to his writing.

Throughout his career, Camilo has contributed to numerous publications, covering a wide range of topics such as global economic trends, investment strategies, and market analysis. His articles are recognized for their insightful analysis and clear explanations, making complex financial concepts accessible to readers.

Camilo's experience includes working in roles related to financial reporting, analysis, and commentary, allowing him to provide readers with accurate and trustworthy information. His dedication to journalistic integrity and commitment to delivering high-quality content make him a trusted voice in the fields of finance and journalism.

Latest Articles

Popular Articles