$40,000 A Year Is How Much An Hour?

How much do you earn right now? If you’re being offered a job earning $40,000 annually, you might have asked the question “$40,000 a year is how much an hour?” A full-time job, contract work, or part-time work such as freelancing are all viable options for making money.

Author:James PierceReviewer:Alberto ThompsonOct 10, 2021395 Shares98.8K Views

How much do you earn right now? If you’re being offered a job earning $40,000 annually, you might have asked the question “$40,000 a year is how much an hour?”

A full-time job, contract work, or part-time work such as freelancing are all viable options for making money. But how much do you get paid per hour when you total up your earnings from all of these sources and the number of hours you work?

How Much Is $40,000 Per Hour, Week, Biweekly, And Monthly?

A salary of $40,000 per year equates to $19.23 per hour. This is calculated on working 40 hours per week for 52 weeks per year (2080 hours). Your compensation would be a few thousand dollars lower after taxes. If you earn $40,000 a year, you will pay between $6,500 and $9,500 in taxes. To earn $40,000 per year after taxes, you would need to earn around $50,000 per year (or $24.04 per hour).

$40,000 per year is divided as follows:

- $19.23 per hour (2080 hours per year)

- $153.84 USD per day (Hourly x 8 hours)

- $769.23 per week (52 weeks per year)

- Biweekly payment of $1,538.46 (Weekly x 2)

- Monthly payment of $3,333.33 (Annual 12 months)

This is based on a 40-hour workweek for 52 weeks in the chart above. Do you get paid time off for vacation or personal reasons? Then you'll be earning more per hour. Listed below are a few examples.

- If you have two weeks of paid time off (PTO) per year, your true hourly pay is $20.

- If you have three weeks of paid time off (PTO) per year, your true hourly pay is $20.41.

Is $19.23 A Good Hourly Rate?

You're undoubtedly curious how your $40,000 annual salary, or $19.23 per hour, compares to others. As an example, the current minimum wage is $7.25 per hour, which means you make more than double (almost three times!) the minimum wage. You will earn $153.84 each day if you earn $40,000 per year (assuming a normal workweek).

A living wage of $19.23 per hour is sufficient to support oneself and a modest family. The federal poverty level for a single person without any dependents in 2020 is $12,760.

The federal poverty limit climbs to $26,200 if you have a modest household of four. After taxes, $40,000 in annual income is around $34,000.

This creates a very thin buffer between your income and what the federal government considers to be the national poverty line.

Furthermore, depending on the cost of living in your location and where you live, this federal poverty level assessment may have different results.

In New York City, $40,000 won't get you as far as $40,000 in Houston, Texas. Before considering if $19.23 is a good hourly rate in your location, consider the cost of living in your area.

If you're a typical American living outside of wealthy metropolitan regions, $19.23 is a decent hourly wage that will allow you to meet your basic necessities, but not live a lavish lifestyle.

Online courses from Udacity and Udemy can give individuals in-demand work skills. The learning portals provide skill training, on-demand lessons, and job placement chances.

Gaining a nano-degree can help you enhance your profession and earn more money.

How Much Tax Do I Pay If I Make $40,000 Per Year?

After taxes, however, $40000 would be lowered to $31,100 – $33,800 per year, depending on your state. Your overall take-home pay would be as follows:

- Weekly salary ranges from $598.08 to $650.

- $1,196.15 to $1,300 biweekly paycheck

- Paychecks range from $2,591.67 to $2,816.67 every month.

The difference between the highest and lowest taxed states is $225 per month. In other words, one person may be paying an extra $2,700 in taxes per year. You might wish to reside in a state that does not tax your income if you want to get the most out of your wage.

States that don’t tax wages:(per Investopedia)

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

- New Hampshire

- Tennessee

Is $40,000 A Good Salary?

Everyone's financial status and circumstances are unique.

Where you reside, the cost of living in that area, and how many others live with you all determine what constitutes a healthy salary. Creating a budget and minimizing your spending may be able to help you survive on $40,000 a year.

While $40,000 in Houston may not be enough to cover your bills, $40,000 in New Orleans would, but you'll have to live within your means and locate a cost-cutting living situation.

A salary of $40,000 a year can be sufficient for someone who lives alone and is on their own. You could also wish to put money aside for your retirement and build up a healthy net worth.

If you earn $40,000 a year, you can do this, but it will be more difficult than if you earn $50,000 or $60,000.

That isn't to say that you need a six-figure wage to enjoy the American ideal; neither is $100,000 per year.

If your lifestyle isn't excessive, you can make it in most cities and towns in the United States on less than $40,000 per year.

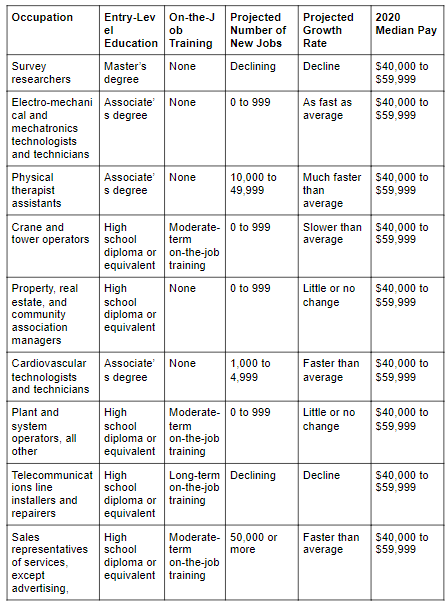

What Types Of Jobs Pay $40,000 Per Year?

These professions appear to pay between $40,000 and $60,000 on average, according to the Bureau of Labor Statistics' Occupational Outlook Handbook.

As a result, you may begin at the bottom of the pay range and work your way up as your experience grows.

Because they provide on-the-job training, several of these positions may not require a high degree of education or have numerous barriers to access.

The high-paying and in-demand employment prospects that come with a tech degree aren't even included on this list. Many of them provide annual salaries of more than $75,000.

Source: Occupational Outlook Handbook

How To Make $40,000 A Year Last

The most important thing on any wage is to live within your means. People get into debt for a variety of reasons, but the most common reason is that they spend more than they make. That is not good if you wish to live a life of financial independence.

The top ten U.S. cities to live in if you make $40,000 per year (in 2020), according to Go Banking Rates, are:

- Cleveland, Ohio

- Akron, Ohio

- Toledo, Ohio

- Brownsville, Texas

- Birmingham, Alabama

- Rochester, New York

- Columbus, Georgia

- Montgomery, Alabama

- Shreveport, Louisiana

- Memphis, Tennessee

The following are the four main steps to being financially secure with your income:

- Adopt a thrifty lifestyle and never spend more money than you earn.

- Create a reasonable budget—the most common reason for budget failure is that people set unrealistic goals. When you normally spend $400 on groceries, don't budget $200. Instead, gradually cut your budget by making minor changes.

- When you get a raise, monetary gifts, or an unexpected windfall of cash, save it instead of throwing it away.

- When you're debt-free, it's a lot easier to live on $40,000 a year (or less) and pay off your debt.

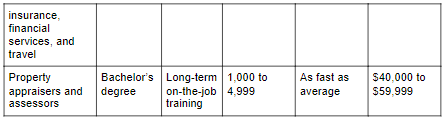

Monthly Budget For $40,000 Salary

Here's an illustration of how much money you should set aside each month for your overall monthly costs. This budget assumes that you earn $2591.67 per month and are single. I encourage you to play about with the amounts if they don't work for your life, but always save first and foremost before you spend anything!

- Savings of 10% = $259

- Rent/ Mortgage= $860 (⅓ of income)

- Utilities= $200

- Car Payment= $200

- Car Insurance= $100

- Health Insurance= $200

- Cellphone= $50

- Internet= $50

- Gas= $60

- Groceries= $150

- Personal & Misc= $200

- Entertainment= $100

- Total = $2429 with $162.67 leftover

So, what are your thoughts? This isn't even a low-budget scenario. Not having a vehicle payment and buying an inexpensive car could save you $200 each month. It is also possible to save money on car insurance, personal, miscellaneous, and entertainment expenses, and so on. An income of $40,000 a year is an excellent starting point for a single person, but it can also support a family.

Do You Want To Earn More Than $40,000 Per Year?

There are various ways to earn more money if $40,000 isn't enough to support your lifestyle. If you earn $40,000 a year, these are some of the finest ways to increase your earnings.

Work As A Driver For A Ride-sharing Service

While this isn't the most glamorous way to make money, it does work and is quite easy to implement. You may sign up for several ride-hailing services online and be accepted in less than a week.

For your driving time, you can earn as much as $20 per hour, but you'll need to deduct certain regular expenses like gas and car maintenance.

If you're already driving around the city, driving for a ride-hailing service is a terrific way to make money doing nothing. While you won't get rich doing it, it's a terrific way to supplement your income.

Ask For A Raise

Because they are afraid of being rejected, many people skip this opportunity to earn extra money. When asking for a raise, there are only two possible outcomes: yes or no. If you wind up producing more money, you can use it to pay off debt or save for your retirement.

Get A Part-time Job

If you have a regular 9-to-5 job, you'll most likely have some free time on weeknights and weekends. This time might be used to work a part-time job to supplement your income. Even if it doesn't pay as well as your day job, it's still a great method to get out of debt and gain financial control.

Flip Furniture (Or Anything!)

In recent years, the industry for flipping furniture, electronics, footwear, and a variety of other things has flourished. In terms of furniture, people look for vintage items that have a particular character and are willing to spend a lot of money on them because of that.

In some circumstances, electronics can be regarded as easier and faster to flip. Although you may not make as much per piece as you would with furniture, the lesser time requirements allow you to increase the number of sales.

Make Your Money Grow

Allowing your money to work for you is one of the most effective strategies to boost your earnings. This can be accomplished by investing in appreciating assets or diversifying sources of income.

In order to achieve financial independence and independent riches, you must invest.

Pet Sitting

People nowadays are willing to pay more for pet sitting than they are for child care. In addition, starting a pet sitting service requires fewer bureaucratic hurdles.

Make Money On The Internet

There are numerous ways to make extra money online in your leisure time. You can do the following:

- Create a website.

- Learn how to work as a virtual assistant.

- Make a living as a proofreader.

- Take surveys to teach English (Survey Junkie is my fav)

- Get cashback when you shop (I adore Ibotta)

Make And Sell Crafts

If you enjoy creating in your spare time, why not make some money from it? Read some examples of crafts you can sell here

Conclusion

It's safe to say that a salary of $40,000 per year is more than most Americans earn. But if you don't think it's enough, there are a variety of ways to earn extra.

Your alternatives are infinite, from flipping furniture to driving for a ride-hailing business.

Jump to

How Much Is $40,000 Per Hour, Week, Biweekly, And Monthly?

Is $19.23 A Good Hourly Rate?

How Much Tax Do I Pay If I Make $40,000 Per Year?

Is $40,000 A Good Salary?

What Types Of Jobs Pay $40,000 Per Year?

How To Make $40,000 A Year Last

Monthly Budget For $40,000 Salary

Do You Want To Earn More Than $40,000 Per Year?

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Alberto Thompson

Reviewer

Alberto Thompson is an acclaimed journalist, sports enthusiast, and economics aficionado renowned for his expertise and trustworthiness. Holding a Bachelor's degree in Journalism and Economics from Columbia University, Alberto brings over 15 years of media experience to his work, delivering insights that are both deep and accurate.

Outside of his professional pursuits, Alberto enjoys exploring the outdoors, indulging in sports, and immersing himself in literature. His dedication to providing informed perspectives and fostering meaningful discourse underscores his passion for journalism, sports, and economics. Alberto Thompson continues to make a significant impact in these fields, leaving an indelible mark through his commitment and expertise.

Latest Articles

Popular Articles