Bailout Wars Begin in Full

Jul 31, 202026.9K Shares1.2M Views

Responding to the Bush administration’s $700-billion Wall Street bailout plan — among the largest in the nation’s history — congressional Democrats countered Monday with a separate proposal that takes additional steps to help struggling homeowners.

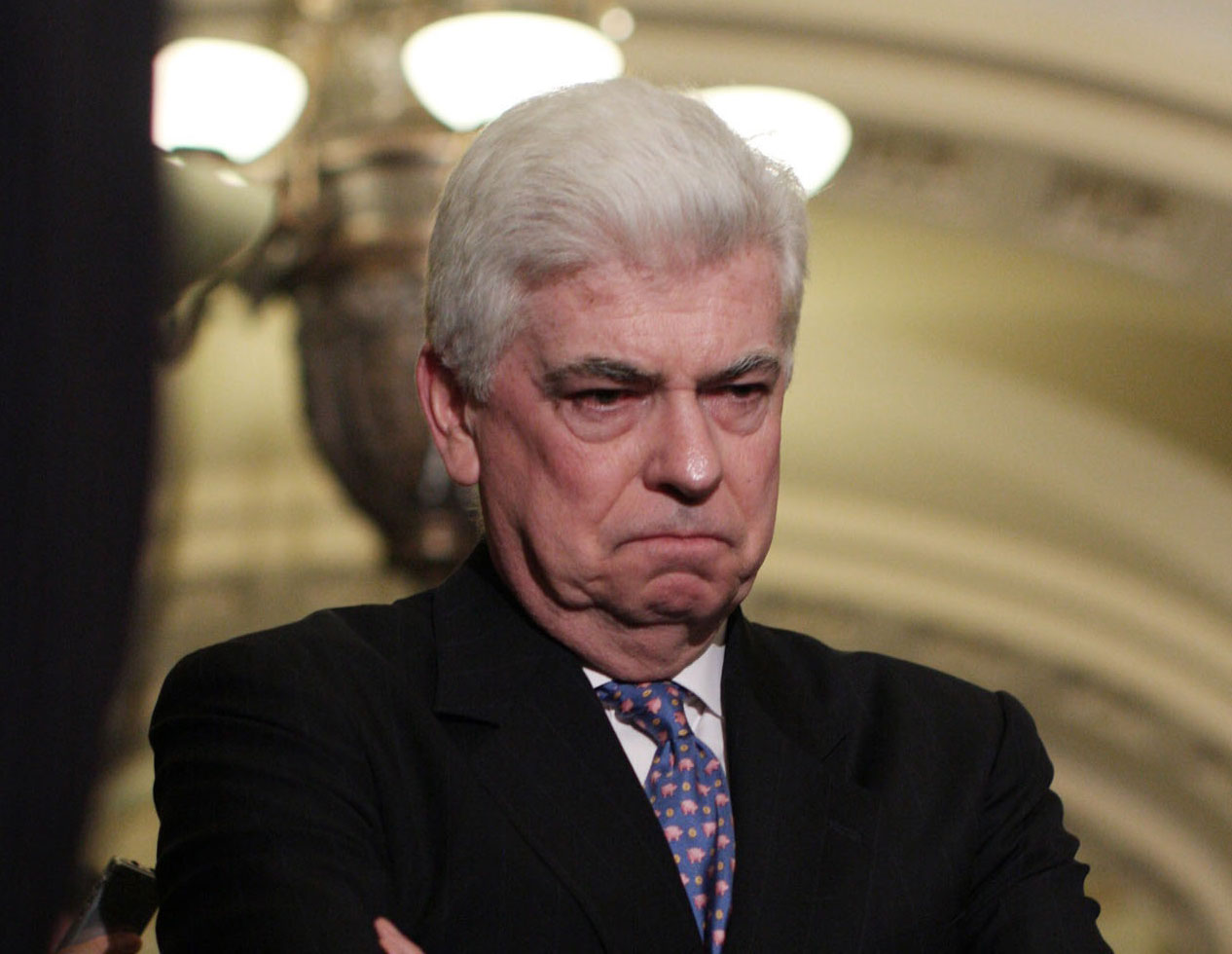

The Democrats’ plan, floated by Senate Banking Committee Chairman Christopher Dodd (D-Conn.), would lend Congress greater oversight of the Treasury Dept., place limits on compensation packages for heads of failed companies and empower bankruptcy judges to force lenders to renegotiate lower rates on troubled loans.

Those provisions have the support of housing advocates, but have faced staunch opposition from the powerful finance industry and most Republicans on Capitol Hill, as well as the White House. Over the weekend, Treasury Sec. Henry Paulson Jr. had called for a “clean” bailout bill that targets Wall Street almost exclusively.

Democratic leaders indicated Monday afternoon that the fast-moving negotiations with the Bush administration were bearing fruit. The Associated Press reported later that the White House had accepted the Democrats’ demands for greater oversight and help for homeowners. The conflict over CEO compensation had not been resolved, reports claimed.

The negotiations come as the financial crisis has turned the economy — and Washington politics — on its head. The last 10 days have seen the fall of two of the most venerable investment banks on Wall Street, as well as Washington’s bailout of the nation’s largest insurance company.

The turmoil has shaken all but the most dedicated free-marketers, with the Bush administration and most congressional Republicans agreeing that an even broader bailout is necessary to boost investor confidence and rescue what remains of the tattered financial sector.

Sticking points remain, however, over what form the bailout should take. Under Paulson’s plan, the federal government would prop up Wall Street’s ailing investment houses, providing $700 billion in taxpayer dollars to relieve those firms of their troubled debts — mostly mortgage-based investments. The proposal provides little oversight of the Treasury Dept. buyout and scant help for homeowners facing foreclosures.

Early Monday, President George W. Bush had called on Congress to accept the terms of Paulson’s proposal for the sake of expediting the bailout process.

“Obviously,” Bush said, “there will be differences over some details, and we will have to work through them. That is an understandable part of the policy-making process. But it would not be understandable if members of Congress sought to use this emergency legislation to pass unrelated provisions; or to insist on provisions that would undermine the effectiveness of the plan.”

Critics from both left and right have attacked the plan, with all sides claiming the proposal treats the symptoms while failing to acknowledge the underlying disease. “The core problem is foreclosures,” said Jim Carr, chief operating officer at the National Community Reinvestment Coalition, an advocacy group for low-income housing, “and it continues to be ignored.”

Democrats agreed, jump-starting the negotiation process with a call for the White House to provide some help to consumers as well as the financial industry. “We will not simply hand over a $700-billion blank check to Wall Street and hope for a better outcome,” House Speaker Nancy Pelosi (D-Calif.) said Sunday in a statement. “Democrats will act responsibly to insulate Main Street from Wall Street.”

Even some conservative experts found the administration’s plan to ignore struggling homeowners difficult to swallow. “What Paulson was asking for was a bit outrageous,” said Desmond Lachman, an economist at the American Enterprise Institute, a conservative policy organization.

Lawrence Hunter, an economist with the conservative Institute for Policy Innovation, opposes any bailout, claiming the market would correct itself without the government’s intervention. Still, he said the political repercussions for the GOP would be enormous if they went ahead with plans to bail out Wall Street but not those facing foreclosures.

“It’s politically incomprehensible,” Hunter said. “If they do it, it’ll be the end of the Republican Party. It will prove once and for all that they’re unfit to exist.”

Wall Street analysts were left unconvinced. The Dow plunged 372 points Monday, while jittery investors, searching for safe havens to stow their cash, shot the price of oil up $25 per barrel — the highest single-day jump in history — before it closed at $120, a $16.10 gain.

But, even as Wall Street flailed and Democrats attacked the administration’s plan as insufficient, some Republicans were blasting the proposal as too heavy handed.

“The administration was right to call for decisive action to prevent further harm to our economy,” Rep. Mike Pence (R-Ind.) said in a statement, “but nationalizing every bad mortgage in America is not the answer … To have the freedom to succeed, we must preserve the freedom to fail.”

Sentiments like that one brought a new dose of criticism even from some conservative observers.

“Those people are certifiable,” said Lachman, of AEI. “You can’t just let the banks fail. That’s how the Great Depression began.”

Dexter Cooke

Reviewer

Dexter Cooke is an economist, marketing strategist, and orthopedic surgeon with over 20 years of experience crafting compelling narratives that resonate worldwide.

He holds a Journalism degree from Columbia University, an Economics background from Yale University, and a medical degree with a postdoctoral fellowship in orthopedic medicine from the Medical University of South Carolina.

Dexter’s insights into media, economics, and marketing shine through his prolific contributions to respected publications and advisory roles for influential organizations.

As an orthopedic surgeon specializing in minimally invasive knee replacement surgery and laparoscopic procedures, Dexter prioritizes patient care above all.

Outside his professional pursuits, Dexter enjoys collecting vintage watches, studying ancient civilizations, learning about astronomy, and participating in charity runs.

Latest Articles

Popular Articles