No Recession for Millionaires as Income Inequality Continues to Increase

Via Kevin Drum, Nathaniel Popper at the Los Angeles Times reports that the number and earnings of millionaires have bounced back strongly, though real wages, on

Jul 31, 2020695.3K Shares11.7M Views

Via Kevin Drum, Nathaniel Popper at the Los Angeles Times reportsthat the number and earnings of millionaires have bounced back strongly, though real wages, on aggregate, continue to decline as the hangover from the Great Recession lingers on.

“„No group was immune to the downturn. In 2008, as the financial crisis raged, the stock market hit bottom and the Great Recession ate into the economy, the number of millionaires in the United States plunged.

“„But last year the number of millionaires bounced up sharply, new data show. And after that decline and rebound, the millionaire class held a larger percentage of the country’s wealth than it did in 2007.“It’s been a recession where everyone took a hit — with the bottom taking a bigger hit,” said Timothy Smeeding, a University of Wisconsin professor who studies economic inequality. But “the wealthy alone have bounced back.”…

“„[Boston Consulting Group's] latest report on wealth, one of the first broad depictions of how wealth shifted in 2009, indicates that the number of U.S. households with at least $1 million in “bankable” assets climbed 15 percent last year to 4.7 million after tumbling 21 percent in 2008. “Assets have recovered much faster than we expected, to be candid,” said Monish Kumar, a managing director at Boston Consulting Group.

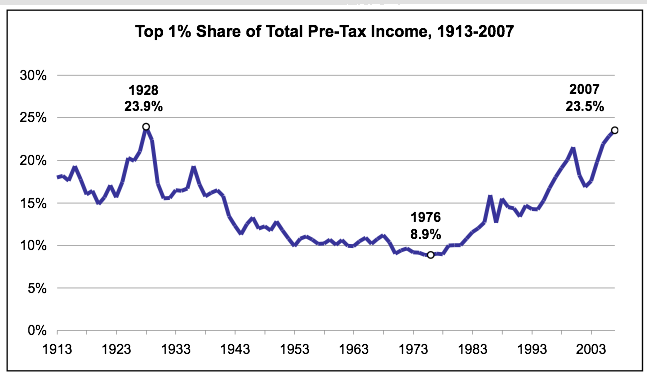

And it is important to contextualize this. During the boom years, between 2000 and 2007, income inequality increased on a number of metrics — including the Gini Coefficient, or the percentage of pre-tax earnings made by the top one percent of households. Now, during the bust years, between 2007 and the present, it seems that income inequality might actually be continuing to increase. Here’s a chartfrom economists Thomas Piketty and Emmanuel Saez showing how the haves have become the have-mores.

Paolo Reyna

Reviewer

Paolo Reyna is a writer and storyteller with a wide range of interests. He graduated from New York University with a Bachelor of Arts in Journalism and Media Studies.

Paolo enjoys writing about celebrity culture, gaming, visual arts, and events. He has a keen eye for trends in popular culture and an enthusiasm for exploring new ideas. Paolo's writing aims to inform and entertain while providing fresh perspectives on the topics that interest him most.

In his free time, he loves to travel, watch films, read books, and socialize with friends.

Latest Articles

Popular Articles