Race and the Foreclosure Crisis

In a new study, the Center for Responsible Lending analyzes the demographics of the foreclosure crisis, and finds that foreclosure has disproportionately

Jul 31, 2020613.3K Shares9M Views

In a new study, the Center for Responsible Lending analyzes the demographics of the foreclosure crisis, and finds that foreclosure has disproportionately impacted black and Latino homeowners. All in all, a home owned by a black family is 76 percent more likely to go through foreclosure than a home owned by a white family. And the CRL study shows worrying evidence that the foreclosure crisis will wipe out a generation of wealth in communities of color and exacerbate the existing income and equity gap between white and non-white families.

First, some basic statistics. The CRL estimates that 2.5 million homes were foreclosed upon between 2007 and 2009 — the “vast majority” of which were owner-occupied homes with mortgages originated between 2005 and 2008. Once the foreclosure crisis is complete, as many as 10 million homes will go through the foreclosure process, which has cut across all demographic and income groups, from trailers to McMansions, from homes with subprime loans to homes with vanilla mortgages.

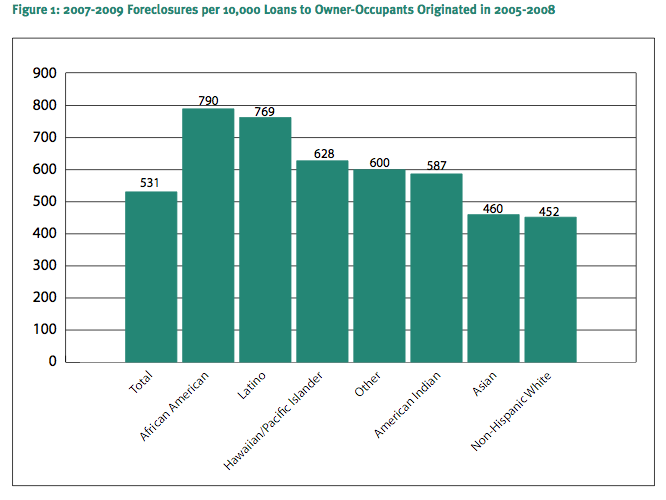

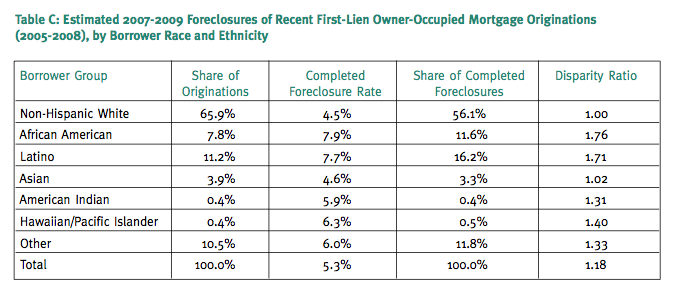

But the crisis has hit communities of color particularly hard — even adjusting for income. About 8 percent of black or Latino homeowners who took out a mortgage or refinanced between 2005 and 2008 lost their homes between 2007 and 2009, compared with 4.5 percent of white homeowners. All in all, 17 percent of Latino homeowners, 11 percent of black homeowners and 7 percent of white homeowners have lost their home to foreclosure since 2007 or are at imminent risk.

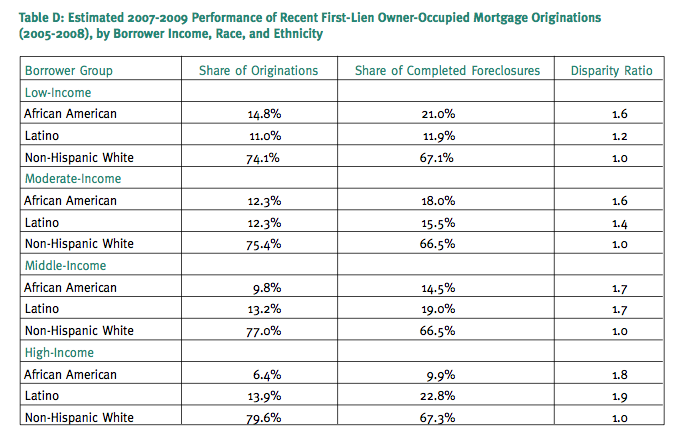

And, the CRL shows, “Racial and ethnic disparities in these estimated foreclosure rates hold even after controlling for differences in income patterns between demographic groups.” In fact, the skew is worse for high-income black and Latino homeowners than for low-income black and Latino homeowners.

From the report:

“„[The costs of foreclosure] are extensive, multifaceted and long-term, extending far beyond individual families to their neighbors, communities, cities and states. As the foreclosure crisis threatens the financial stability and mobility of families across the country, it will be particularly devastating to African-American and Latino families, who already lag their white counterparts in terms of income, wealth and educational attainment. Furthermore, the indirect losses in wealth that result from foreclosures as a result of depreciation to nearby properties will disproportionately impact communities of color. We estimate that, between 2009 and 2012, $193 and $180 billion, respectively, will have been drained from African-American and Latino communities in these indirect “spillover” losses alone.

Essentially, the foreclosure crisis could ultimately end up exacerbating the income and equity gap between white and non-white persons in the United States:

“„Even before the foreclosure crisis, our nation evidenced wide socioeconomic disparities. Home-ownership rates are much lower for African Americans and Latinos and, while homeownership rates have dropped for all populations since the beginning of the foreclosure crisis (down to 45.6 percent for African Americans, 48.5 percent for Latinos and 74.5 percent for non-Hispanic whites), these declines represent greater percentage changes for communities of color. In 2007, the median non-Hispanic white family reported $171,200 in net worth versus only $28,300 for non-white and Hispanic families and there are large gaps in educational attainment, with 46.8 percent and 33.1 percent of African-American and Latino adults having at least some college, compared to 59.3 percent for non-Hispanic whites. Communities of color also commonly experience higher crime and lower tax bases than predominately white neighborhoods. If foreclosures disproportionately impact communities of color, these economic and social disparities stand to grow worse.

Paolo Reyna

Reviewer

Paolo Reyna is a writer and storyteller with a wide range of interests. He graduated from New York University with a Bachelor of Arts in Journalism and Media Studies.

Paolo enjoys writing about celebrity culture, gaming, visual arts, and events. He has a keen eye for trends in popular culture and an enthusiasm for exploring new ideas. Paolo's writing aims to inform and entertain while providing fresh perspectives on the topics that interest him most.

In his free time, he loves to travel, watch films, read books, and socialize with friends.

Latest Articles

Popular Articles