How to Sell a Subprime Product

ProPublica and NPR’s Planet Money are up with a great investigation into how banks sustained demand for risky mortgage-backed securities, even as the housing

Jul 31, 202058.9K Shares842.6K Views

ProPublica and NPR’s Planet Money are up with a great investigationinto how banks sustained demand for risky mortgage-backed securities, even as the housing market started to falter and the number of companies available to take the long side of the trades started to dwindle. They, in essence, made the demand up.

“„Faced with increasing difficulty in selling the mortgage-backed securities that had been among their most lucrative products, the banks hit on a solution that preserved their quarterly earnings and huge bonuses: They created fake demand.

“„A ProPublica analysis shows for the first time the extent to which banks — primarily Merrill Lynch, but also Citigroup, UBS and others — bought their own products and cranked up an assembly line that otherwise should have flagged.

“„The products they were buying and selling were at the heart of the 2008 meltdown — collections of mortgage bonds known as collateralized debt obligations, or CDOs. As the housing boom began to slow in mid-2006, investors became skittish about the riskier parts of those investments. So the banks created — and ultimately provided most of the money for — new CDOs. Those new CDOs bought the hard-to-sell pieces of the original CDOs. The result was a daisy chainthat solved one problem but created another: Each new CDO had its own risky pieces. Banks created yet other CDOs to buy those.

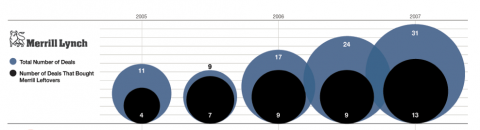

The biggest offender? Not Bear Sterns or Lehman Brothers, but Merrill Lynch, now part of Bank of America.

Just before the financial crisis and credit crunch, it originated 31 collateralized debt obligation deals and ended up purchasing parts of 13 of them, for instance.

Rhyley Carney

Reviewer

Latest Articles

Popular Articles