Bernanke on the Housing Bubble

Today, Ben Bernanke, the head of the Federal Reserve, testified before the Financial Crisis Inquiry Commission on Too Big to Fail banks and the general

Jul 31, 2020120.2K Shares2.6M Views

Today, Ben Bernanke, the head of the Federal Reserve, testified before the Financial Crisis Inquiry Commission on Too Big to Fail banks and the general financial collapse. (Find Bernanke’s prepared testimony in a PDF here.) But he is getting the most attention for a comment on housing, where he clearly states that monetary policy (including interest rates) was not the primary cause of the housing bubble. And, he says the Fed was not even sure there was a nationwide housing bubble, and therefore could not have tried to pop it.

“„**Even if monetary policy was not a principal cause of the housing bubble, some have argued that the Fed could have stopped the bubble at an earlier stage by more-aggressive interest rate increases. For several reasons, this was not a practical policy option. First, in 2003 or so, when the policy rate was at its lowest level, there was little agreement about whether the increase in housing prices was a bubble or not (or, a popular hypothesis, that there was a bubble but that it was restricted to certain parts of the country). **Second, and more important, monetary policy is a blunt tool; raising the general level o f interest rates to manage a single asset price would undoubtedly have had large side effects on other assets and sectors of the economy. In this case, to significantly affect monthly payments and other measures of housing affordability, the FOMC likely would have had to increase interest rates quite sharply, at a time when the recovery was viewed as “jobless” and deflation was perceived as a threat.

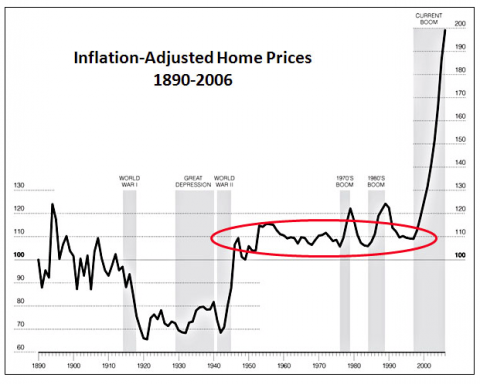

That gives me occasion to publish this astonishing chartof the housing bubble posted by Kevin Drum, showing prices remaining stable until about 2003 before heading skyward. (The Federal Reserve started hiking interest rates before housing prices peaked, in June, 2004.)

An interesting paperflagged by Felix Salmon argues that the primary cause of the housing bubble was an over-investment in mortgage-finance products, priced too low because of a misunderstanding of their risk: “The rise of private-label [mortgage-backed securities] exacerbated informational asymmetries between the financial institutions that intermediate mortgage finance and MBS investors. The result was overinvestment in MBS that boosted the financial intermediaries’ profits and enabled borrowers to bid up housing prices.”

Paula M. Graham

Reviewer

Latest Articles

Popular Articles