The Racial Politics of Foreclosure

A study in the American Sociological Review released today (PDF) shows that predatory lending aimed at minority neighborhoods has led to an uneven and unfair

Jul 31, 2020320.4K Shares4.9M Views

A study in the American Sociological Review released today(PDF) shows that predatory lending aimed at minority neighborhoods has led to an uneven and unfair distribution of foreclosures. Princeton Prof. Douglas Massey and graduate student Jacob Rugh studied 100 metro areas and found that in black and Hispanic neighborhoods, more so than white neighborhoods, lenders offered homebuyers subprime mortgages when they qualified for prime, jacked up fees and tacked on payment requirements.

Thus, between 1993 and 2000, “the share of subprime mortgages going to households in minority neighborhoods rose from 2 to 18 percent.” And the racial makeup of a neighborhood became a “powerful predictor” of its foreclosure rate. The researchers call for an amendment of the Civil Rights Act to penalize discriminatory lenders.

On top of that, businesses like pawn shops and payday lenders, ones that “charge high fees and usurious rates of interest,” cluster in minority communities, the Princeton researchers say. “By definition, segregation creates minority dominant neighborhoods, which, given the legacy of redlining and institutional discrimination, continue to be underserved by mainstream financial institutions,” the study says.

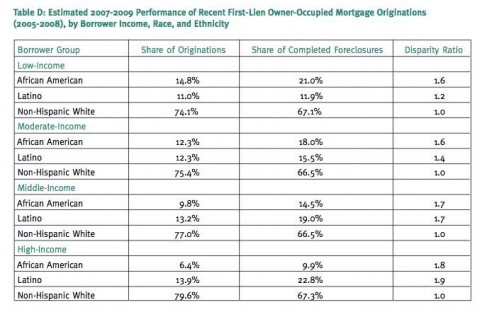

Massey and Rugh’s study comes on the heels of a Center for Responsible Lending reportthat found much the same thing. According to the nonprofit CRL, low-income black homeowners are 60 percent more likely to be foreclosed on than low-income white homeowners. The disparity is worse for the wealthy. High-income black homeowners are 80 percent more likely to be foreclosed on than white homeowners.

The effect is that the recession has wiped out a generation of gains in wealth in communities of color, the CRL says.

Paolo Reyna

Reviewer

Paolo Reyna is a writer and storyteller with a wide range of interests. He graduated from New York University with a Bachelor of Arts in Journalism and Media Studies.

Paolo enjoys writing about celebrity culture, gaming, visual arts, and events. He has a keen eye for trends in popular culture and an enthusiasm for exploring new ideas. Paolo's writing aims to inform and entertain while providing fresh perspectives on the topics that interest him most.

In his free time, he loves to travel, watch films, read books, and socialize with friends.

Latest Articles

Popular Articles