Top 5 Bitcoin Wallet Types - Secure Your Crypto Fortune Today

Unlock the Secrets of bitcoin wallet types - Explore the Best Types for Ultimate Security! Whether you're a crypto newbie or a seasoned investor, discover the perfect Bitcoin wallet for your needs. From hardware wallets to paper wallets, we've got you covered.

Author:Gordon DickersonReviewer:James PierceJan 30, 202418.3K Shares250.7K Views

Embark on a journey into the dynamic realm of cryptocurrency with our comprehensive guide to Bitcoin wallet types. In the fast-paced world of digital finance, choosing the right wallet is akin to selecting the perfect armor for your crypto assets. Imagine having a vault with multiple doors, each requiring a unique key for access that's essentially what these wallets offer for safeguarding your Bitcoins.

From the robust security of hardware wallets to the convenience of mobile wallets, we delve into a diverse array of options, ensuring you're armed with the knowledge to navigate the complex landscape of cryptocurrency storage.As you explore our guide, you'll not only unravel the mysteries of Bitcoin wallet types but also gain valuable insights into the importance of securing your digital wealth.

What Is A Bitcoin Wallet?

A Bitcoin wallet isn't actually a wallet in the traditional sense. It doesn't physically hold your Bitcoins like bills and cards. Instead, it's a digital tool that stores and manages your Bitcoin information, allowing you to:

1. Securely Hold Your Bitcoins

Think of it as a secure vault for your Bitcoin's private key - a unique code that proves ownership of your digital currency. Without this key, no one can access your Bitcoins.

2. Send And Receive Bitcoins

Your wallet provides an address, similar to a bank account number, that others can use to send you Bitcoins. It also helps you initiate transactions, sending Bitcoins to other wallet addresses.

3. Track Your Bitcoin Balance

Just like a bank app, your wallet shows your current Bitcoin balance and transaction history, providing an overview of your digital finances.

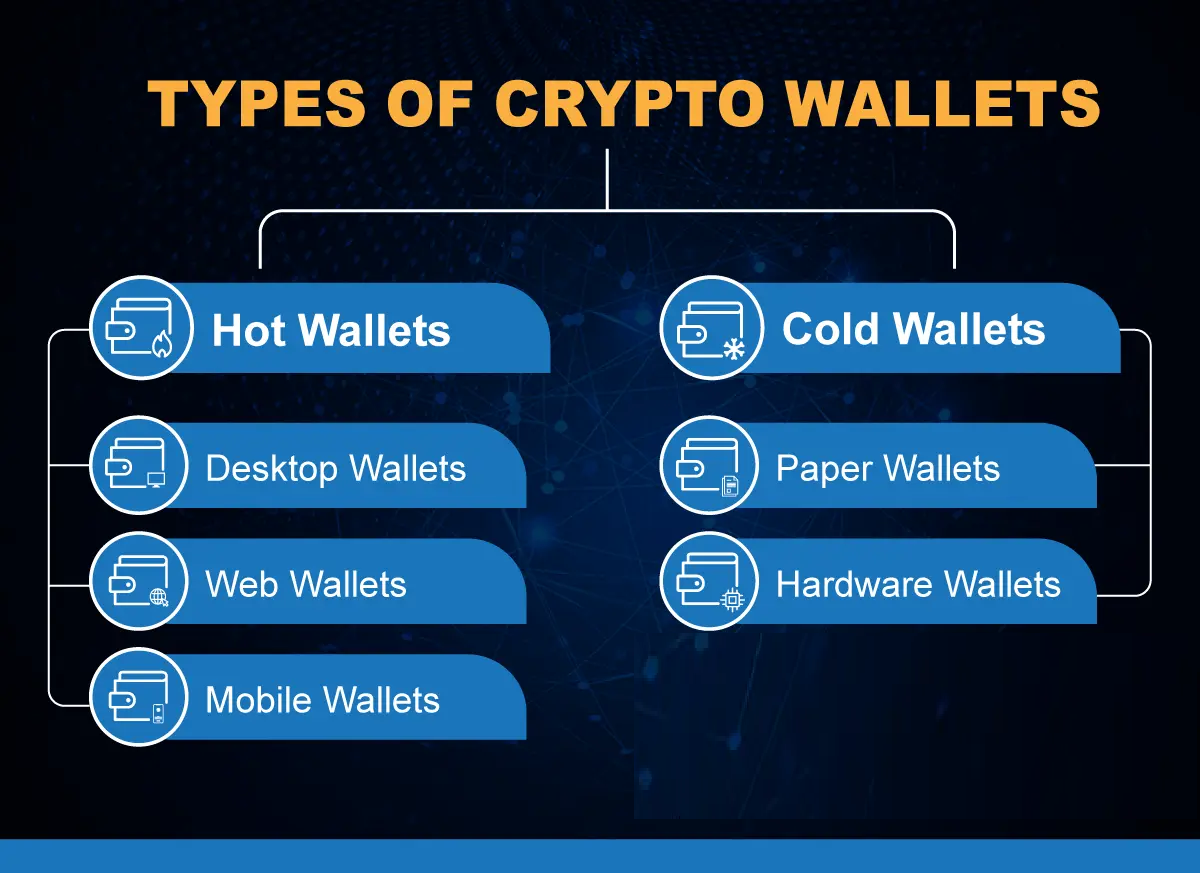

What Are Bitcoin Wallet Types

With Bitcoin prices on the rise again, securing your precious crypto is paramount. But navigating the diverse world of Bitcoin wallets can be overwhelming. Worry not, intrepid investor! Here's a breakdown of the top 5 Bitcoin wallet types:

1. Hardware Wallets

- Fort Knox of wallets -These physical devices store your private keys offline, offering the highest security against hackers and online threats. Think of them as digital safes for your Bitcoin.

- Top Picks -Trezor Model One, Ledger Nano S Plus, KeepKey - known for their robust security and user-friendly interfaces.

2. Desktop Wallets

- Software on your PC -Downloadable programs that manage your Bitcoin locally. They offer more features than hardware wallets, like advanced customization and multi-signature options.

- Top Picks -Electrum (lightweight with advanced features), Exodus (user-friendly with built-in exchange), Atomic Wallet (multi-currency with staking capabilities).

3. Mobile Wallets

- Bitcoin in your pocket -Convenient apps for managing your Bitcoin on the go. Great for everyday transactions and quick purchases.

- Top Picks -Coinbase Wallet (beginner-friendly with integration to Coinbase exchange), Trust Wallet (popular option with wide token support), BlueWallet (dedicated Bitcoin wallet with strong security).

4. Web Wallets

- Cloud-based access -Accessible from any web browser, making them convenient for multi-device use. However, they come with inherent security risks as your private keys are stored online.

- Top Picks -Coinbase Wallet, Blockchain.com Wallet, MyEtherWallet - reputable options with good security practices, but exercise caution compared to offline wallets.

5. Paper Wallets

- Old-school security -Print your private keys onto a piece of paper and store it securely. Offers maximum offline protection, but can be easily lost or damaged.

- Best for long-term storage -Not recommended for frequent transactions due to their offline nature.

Remember

- Choose a wallet type that fits your needs and security preferences. Beginners might prioritize ease of use, while experienced investors might opt for advanced features and maximum security.

- Always research and choose reputable wallets with good security practices.

- Secure your private keys like your life depends on it, because it kind of does in the crypto world!

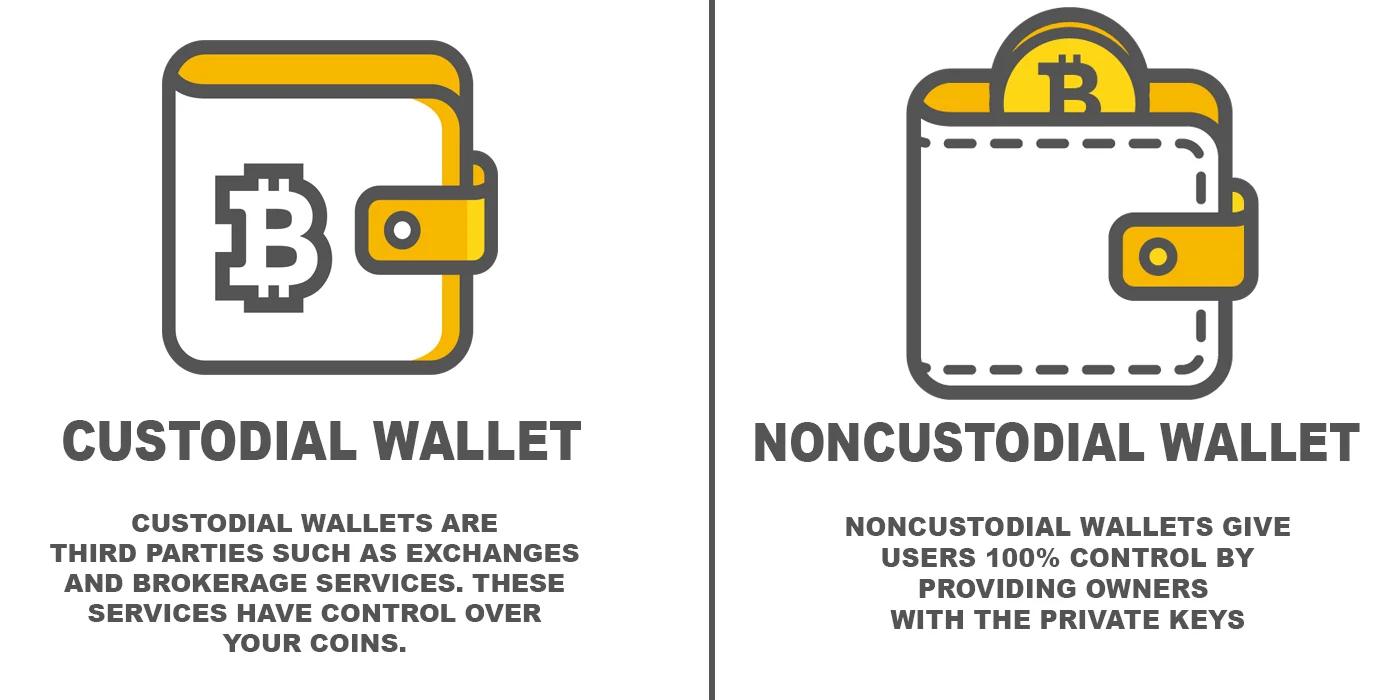

Custodial Wallets And Non-Custodial Wallets

When it comes to cryptocurrency storage, two main types of wallets dominate the landscape - custodial and non-custodial. Choosing between them involves understanding their unique advantages and disadvantages, considering your priorities, and finding the best fit for your crypto needs.

Custodial Wallets

Think of custodial wallets as banks for your crypto. They are managed by third-party platforms like cryptocurrency exchanges (e.g., Coinbase, Binance). Here's the gist:

Pros

- Convenience -Easy to use and set up, with user-friendly interfaces and integration with trading platforms.

- Recovery options -Many offer account recovery features in case you lose your password or access key.

- Insurance -Some custodians provide insurance against security breaches or theft.

- Staking and earning -Some platforms offer staking services, allowing you to earn passive income with your holdings.

Cons

- Less control -You don't own your private keys, giving the custodian control over your funds.

- Vulnerability to third-party risks -Security depends on the custodian's platform and practices.

- Potential fees -Platforms may charge transaction fees or custodial fees.

- Limited functionality -Features might be restricted compared to non-custodial wallets.

Non-Custodial Wallets

These are like self-directed crypto banks. You are in full control of your private keys, making you solely responsible for managing your assets. Here's the deal:

Pros

- Security -You hold your private keys, putting you in ultimate control and minimizing the risk of third-party breaches.

- Privacy -No third party has access to your private information or transaction history.

- Decentralization -You are not reliant on any centralized platform, promoting the core values of cryptocurrency.

- Wider functionality -Many non-custodial wallets offer advanced features like staking, DeFi integration, and dapp interaction.

Cons

- Higher responsibility -Losing your private keys means losing access to your funds permanently.

- Technical complexity -Requires a higher level of technical understanding and may be less user-friendly for beginners.

- No recovery options -If you lose your password or access key, there's no way to recover your funds.

- Potential security risks -Managing your own keys exposes you to vulnerabilities like malware and phishing attacks.

So, Custodial Or Non-Custodial?

The choice depends on your priorities and crypto experience:

- For beginners or those prioritizing convenience and ease of use, custodial wallets offer a smooth entry point.

- For security-conscious users or those wanting full control over their assets, non-custodial wallets provide higher autonomy and decentralization.

Is Binance A Bitcoin Wallet?

While Binance can store Bitcoin and other cryptocurrencies, it wouldn't be entirely accurate to call it simply a "Bitcoin wallet." Here's why:

Binance Is A Cryptocurrency Exchange

- Its primary function is facilitating the buying, selling, and trading of various cryptocurrencies, including Bitcoin.

- You can deposit your Bitcoin into your Binance account to trade or use it for other purposes on the platform.

- Unlike a standalone wallet, Binance holds your crypto assets like Bitcoin under its control, similar to a custodial wallet.

Some argue Binance can act as a Bitcoin wallet:

- Binanceprovides a unique Bitcoin address where you can receive Bitcoin from other users.

- You can send Bitcoin from your Binance account to other addresses, including personal wallets.

- Binance offers certain wallet features like transaction history and balance tracking.

Other Considerations When Choosing A Bitcoin Wallet

Choosing the right Bitcoin wallet goes beyond just basic types, security, and convenience. Beyond the big picture, several smaller yet crucial details can significantly impact your crypto experience. Here are some additional considerations worth pondering:

1. Supported currencies -Do you plan to store only Bitcoin, or do you intend to diversify into other cryptocurrencies? Choose a wallet that supports the specific coins you're interested in.

2. Transaction fees -Some wallets charge fees for sending and receiving Bitcoin. Compare fees across different options to find the most cost-effective solution.

3. Privacy features -Certain wallets offer enhanced privacy features, such as coin mixing or stealth addresses. Consider if this aligns with your priorities.

4. User interface and ease of use -Especially for beginners, a user-friendly interface with clear instructions can be invaluable.

5. Multi-signature support -For added security, some wallets allow multi-signature transactions, requiring multiple private keys to authorize spending.

6. Mobile accessibility -Do you need to access your Bitcoin on the go? Choose a wallet with a reliable mobile app.

7. Customer support -Responsive and helpful customer support can be crucial if you encounter technical difficulties or have questions.

8. Reputation and track record -Opt for wallets with a solid reputation and a proven track record of security and reliability.

9. Compatibility -Ensure your chosen wallet is compatible with the devices and operating systems you use.

10. Community and development -A vibrant community and active development team can indicate a healthy and growing project.

FAQ's About Bitcoin Wallet Types

What Are The Classification Of Bitcoin Wallets?

There are three major types of crypto wallets - hardware, software, and paper wallets. These wallets can be further categorized as hot or cold based on their internet connectivity.

What File Type Is Bitcoin Wallet?

The original Bitcoin client stores private key information in a file named wallet. dat following the so called "bitkeys" format. The wallet. dat file contains your private keys, public keys, scripts (which correspond to addresses), key metadata (e.g. labels), and the transactions related to your wallet.

What Type Of Wallet Is Trust Wallet?

Trust Wallet is a decentralized crypto wallet, meaning users take self-custody of their cryptocurrencies and private keys. Crucially, Trust Wallet does not collect any personal information from users enabling them to store cryptocurrencies anonymously.

Conclusion

The world of Bitcoin wallet types is as diverse as the investors who navigate it. As we close the chapters on our exploration, one resounding truth remains: the key to a successful and secure cryptocurrency journey lies in informed decision-making. Embrace the knowledge gained here, and let it be the compass guiding you through the ever-shifting currents of the blockchain.

Whether you opt for the impenetrable fortress of a hardware wallet or the accessibility of a mobile wallet, understanding the nuances of each type empowers you to wield control over your digital assets with confidence.As the crypto landscape continues to evolve, staying vigilant and adaptable becomes paramount.

Gordon Dickerson

Author

Gordon Dickerson, a visionary in Crypto, NFT, and Web3, brings over 10 years of expertise in blockchain technology.

With a Bachelor's in Computer Science from MIT and a Master's from Stanford, Gordon's strategic leadership has been instrumental in shaping global blockchain adoption. His commitment to inclusivity fosters a diverse ecosystem.

In his spare time, Gordon enjoys gourmet cooking, cycling, stargazing as an amateur astronomer, and exploring non-fiction literature.

His blend of expertise, credibility, and genuine passion for innovation makes him a trusted authority in decentralized technologies, driving impactful change with a personal touch.

James Pierce

Reviewer

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Latest Articles

Popular Articles