Bitcoin Whales - Understanding Their Impact On The Cryptocurrency Market

Explore Bitcoin whales: behaviors, impact, and implications in cryptocurrency markets.

Author:James PierceReviewer:Gordon DickersonFeb 11, 20247.4K Shares233.9K Views

Bitcoin whales, a term often used to describe individuals or entities holding large amounts of Bitcoin, wield significant influence in the cryptocurrency market. These whales, with their substantial holdings, can impact market dynamics, liquidity, and investor sentiment.

In this comprehensive discussion, we delve into the phenomenon of Bitcoin whales, examining their behavior, motivations, and implications for the broader cryptocurrency ecosystem.

Understanding Bitcoin Whales

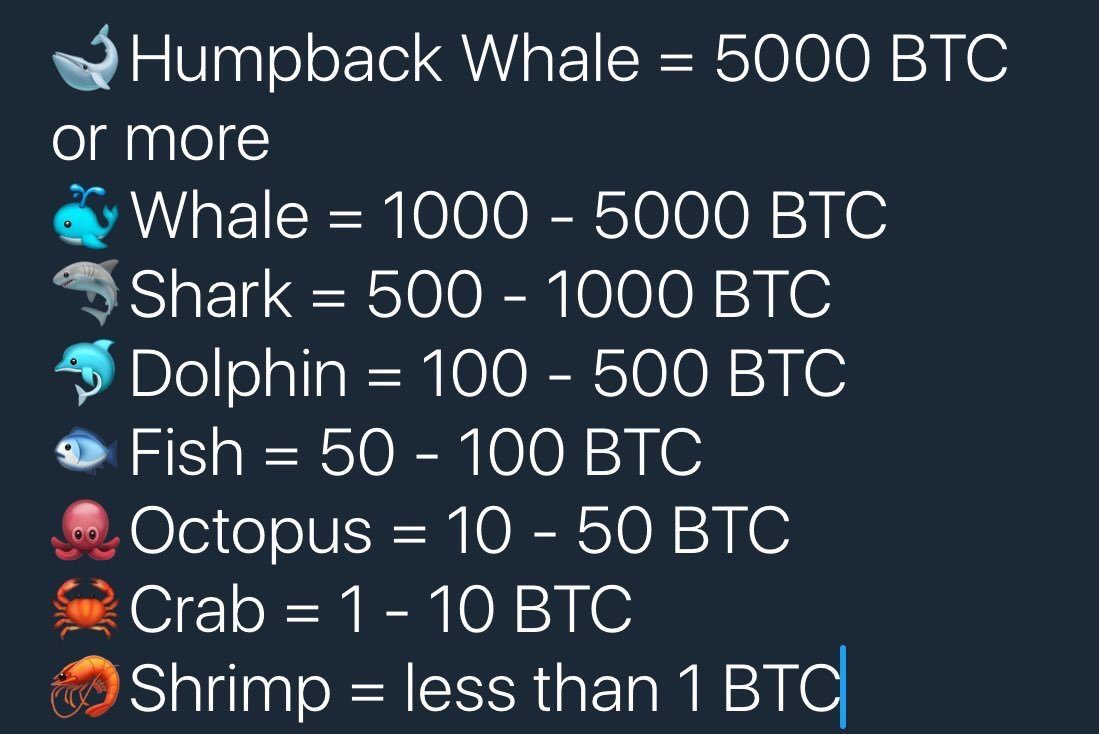

Bitcoin whales are entities that hold a substantial quantity of Bitcoin, often measured in thousands or even tens of thousands of bitcoins. While the term "whale" is borrowed from traditional finance, where it refers to large institutional investors, in the context of Bitcoin, whales can include early adopters, institutional investors, cryptocurrency exchanges, investment funds, and mining pools.

Three Ways To Spot A Bitcoin Whale

Given its capacity to influence the market with a straightforward buy or sell order, understanding how to identify a Bitcoin whale might be a useful addition to your trading toolkit.

Let's examine three indicators that point to a Bitcoin whale.

- Employ Blockchain Explorers -You may view every transaction on the public ledger of Bitcoin. By using a blockchain explorer, like blockchain.com, you can see big bitcoin transfers.

- Examine Trade Trends - Large trades made by whales frequently cause abrupt drops or increases in price. Unusual patterns in trade could indicate a Bitcoin whale entering the market if you watch closely at trading patterns.

- Social media - A few of the bitcoin whales are present on social media, where they share their thoughts on investing methods and the state of the bitcoin market. You can utilize information and acquire some understanding of their possible trading activity.

Behavior And Motivations

Bitcoin whales exhibit various behaviors and motivations, driven by factors such as profit-taking, long-term investment strategies, market manipulation, and portfolio diversification. Some whales accumulate bitcoins as a store of value or hedge against inflation, while others engage in active trading or speculation to capitalize on short-term price movements.

Influence Of Bitcoin Whales On Evolving Market Trends

For a some time now, bitcoin whales have shaped the course of the market. But there is a discernible change when comparing market habits in 2017–2018 and 2020–2021.

The Number of Entities With Balance ≥ 1k measure below confirms that whales' holdings of Bitcoin decreased throughout the 2017 bull run. The then-maturing market environment, which offered plenty of chances for whale distribution, along with new market entrants and sharp price swings may have contributed to this decreasing tendency.

This measure, which identifies distinct firms with at least 1,000 BTC, provides detailed information about the dynamics of market dominance. In this context, "entities" are defined as groups of addresses that are under the control of a single network node, as ascertained using Glassnode's sophisticated clustering algorithms and heuristics.

When we fast-forward to the 2020-2021 timeframe, institutional investors started to enter the Bitcoin market, causing a shift. This change reduced the market power of Bitcoin whales and indicated a more developed Bitcoin ecosystem with more liquidity, stable prices, and a wider range of market players.

As the market has developed, we have shown that, in line with the Relative Address Supply Distribution measurebelow, the total amount held by Whale companies has been declining over the course of Bitcoin's existence. This measure gives an overview of the amount of Bitcoin in circulation that is held by addresses falling within particular balance ranges.

An obvious picture of this downward trend can be seen in historical peaks:

- Whales accounted for over 76% of the total supply at its peak in 2011.

- By the time of the 2013 peak, this had decreased to roughly 62%.

- By the time it peaked in 2017, the percentage had dropped even more to about 52%.

- Interestingly, Whales held about 53% at the 2021 peak, indicating a minor increase.

- By September 2023, whales made up around 39% of the entire available supply.

The accompanying graphic illustrates this data, which shows a consistent decline in the proportion of Bitcoin held by whales relative to the overall supply. It is imperative to explicate that the term 'Whale entities' encompasses not only individual significant holders but also exchanges, extensive centralized assets such as ETFs, GBTC, and WBTC, and corporate holdings like Microstrategy.

Implications For The Cryptocurrency Ecosystem

- Centralization Concerns- The concentration of wealth among Bitcoin whales raises concerns about centralization and inequality within the cryptocurrency ecosystem. Large holders wield disproportionate influence over market dynamics and governance decisions.

- Market Manipulation Risks- Bitcoin whales' ability to execute large trades and manipulate market prices raises concerns about market manipulation and insider trading. Regulatory oversight and transparency measures are necessary to mitigate these risks and ensure market integrity.

- Investor Confidence and Trust- Whales' actions and behavior can impact investor confidence and trust in the cryptocurrency market. Transparency, fair market practices, and regulatory compliance are essential for fostering trust and promoting broader adoption.

Strategies For Managing Whale Influence

- Transparency and Disclosure- Enhancing transparency and disclosure requirements for large cryptocurrency holders, including whales, can promote market integrity and investor confidence. Publicly disclosing holdings, trading activities, and investment strategies fosters trust and accountability.

- Diversification and Risk Management -Investors can mitigate the impact of whale influence by diversifying their portfolios across different asset classes, including cryptocurrencies, stocks, bonds, and commodities. Implementing risk management strategies, such as stop-loss orders and position sizing, helps protect against sudden price movements.

- Regulatory Oversight- Regulatory authorities play a crucial role in monitoring and regulating the activities of Bitcoin whales to prevent market manipulation, insider trading, and fraud. Robust regulatory frameworks, enforcement mechanisms, and compliance standards promote fair and orderly markets.

Bitcoin Whales - FAQs

What Are Bitcoin Whales?

Bitcoin whales are individuals or entities holding significant amounts of Bitcoin, often measured in thousands or tens of thousands of bitcoins.

How Much Bitcoin Is Owned By Whales?

Whales are bitcoin addresses that have 10,000 or more bitcoin in them.

How Do Bitcoin Whales Impact The Market?

Bitcoin whales can impact market dynamics, liquidity, and investor sentiment through their large buy or sell orders, influencing price volatility and market direction.

What Motivates Bitcoin Whales To Buy Or Sell?

Bitcoin whales' motivations vary and can include profit-taking, long-term investment strategies, market manipulation, and portfolio diversification.

How Do Bitcoin Whales Work?

Large holders of digital currency, known as "Bitcoin whales," have the ability to influence market fluctuations with a single trade. One generally acknowledged cutoff point for a bitcoin whale is 1,000 BTC.

Why Are Bitcoin Whales A Concern For The Cryptocurrency Ecosystem?

Bitcoin whales raise concerns about centralization, market manipulation, and insider trading, posing risks to market integrity and investor confidence.

Who Is The Highest Bitcoin Whale?

The quantity of whale entities that possess between 1,000 and 10,000 BTC reached 1,958 on February 1, which is the biggest amount since November 2022.

Are There Strategies For Detecting And Tracking Bitcoin Whale Activity?

Analysts and researchers use blockchain analytics tools and data analysis techniques to detect and track Bitcoin whale activity, identifying patterns and trends in whale behavior.

What Measures Can Be Taken To Address Concerns About Bitcoin Whale Influence?

Enhancing transparency, implementing regulatory oversight, and promoting fair market practices are essential measures for addressing concerns about Bitcoin whale influence and ensuring market integrity.

Conclusion

Bitcoin whales play a significant role in shaping the dynamics of the cryptocurrency market, influencing prices, liquidity, and investor sentiment. While their actions can introduce volatility and risks, transparency, accountability, and regulatory oversight are essential for mitigating their impact and ensuring market integrity.

By understanding the behavior, motivations, and implications of Bitcoin whales, investors can make informed decisions and navigate the complexities of the evolving cryptocurrency landscape.

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Gordon Dickerson

Reviewer

Gordon Dickerson, a visionary in Crypto, NFT, and Web3, brings over 10 years of expertise in blockchain technology.

With a Bachelor's in Computer Science from MIT and a Master's from Stanford, Gordon's strategic leadership has been instrumental in shaping global blockchain adoption. His commitment to inclusivity fosters a diverse ecosystem.

In his spare time, Gordon enjoys gourmet cooking, cycling, stargazing as an amateur astronomer, and exploring non-fiction literature.

His blend of expertise, credibility, and genuine passion for innovation makes him a trusted authority in decentralized technologies, driving impactful change with a personal touch.

Latest Articles

Popular Articles