Bitcoin's Network Effect - Driving Adoption And Value In The Digital Economy

Discover Bitcoin's network effect: driving adoption, value, and innovation in cryptocurrency.

Author:James PierceReviewer:Gordon DickersonFeb 12, 202443 Shares21.7K Views

Bitcoin's network effectis a powerful phenomenon that drives its adoption, utility, and value in the cryptocurrency ecosystem. As the first decentralized digital currency, Bitcoin has established a robust network effect, characterized by a growing user base, increasing liquidity, and widespread acceptance.

In this comprehensive discussion, we explore the concept of Bitcoin's network effect, its key components, and its implications for the broader cryptocurrency landscape.

What Is A Network Effect?

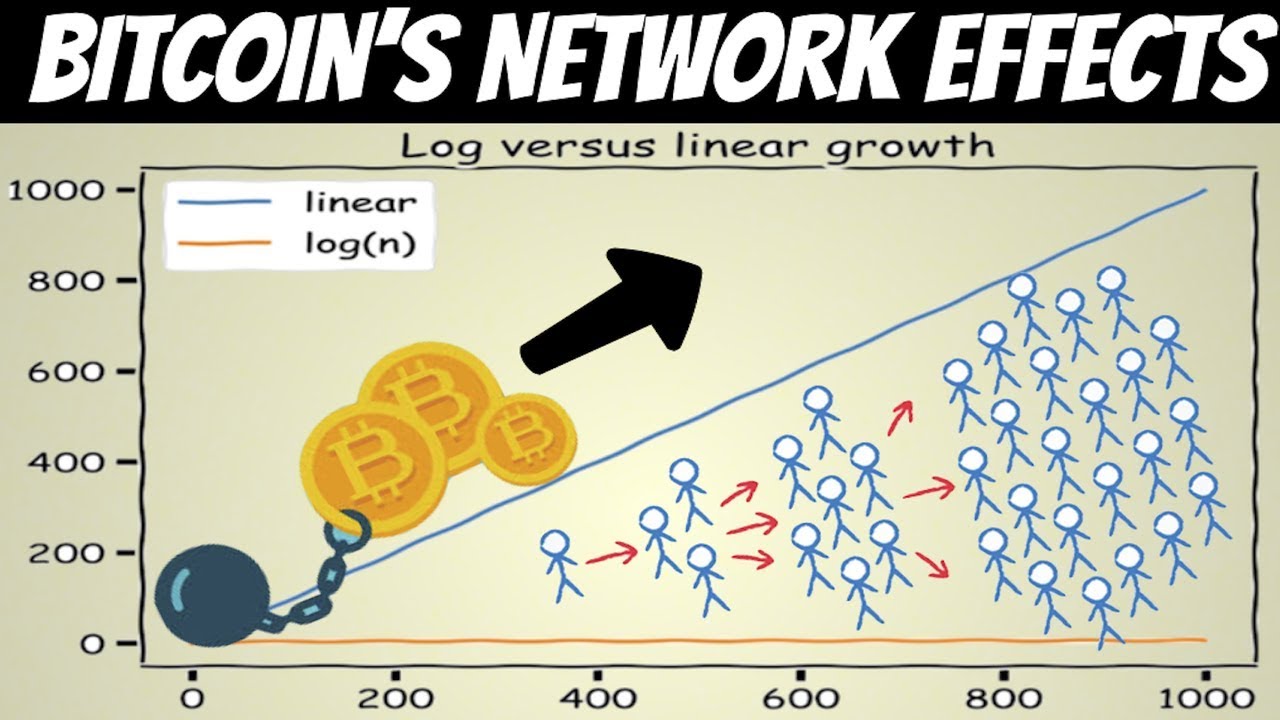

The phenomenon known as a "network effect" occurs when a new user joins a network and alters its value for existing users. For instance, when more users sign up for a particular messaging platform, the number of persons with whom they can communicate increases, making the platform more beneficial.

A network effect is the property of a business or other system that causes the value of the network to increase exponentially for each user as more people utilize it. It's among the most potent economic moats a system may have to keep out rivals.

When a new user joins a network, it becomes more valuable for other members, which is known as a positive network effect. Furthermore, the presence of new members draws in more potential users to the network.

What Is Bitcoin's Network Effect?

Bitcoin's network effect refers to the phenomenon where the value and utility of the cryptocurrency increase as more users adopt and use it. In other words, the more people who use Bitcoin, the more valuable and useful it becomes. This positive feedback loop creates a virtuous cycle of adoption, liquidity, and network security, reinforcing Bitcoin's position as the leading cryptocurrency.

Components Of Bitcoin's Network Effect

- User Adoption -As more individuals and institutions adopt Bitcoin for various use cases, such as payments, remittances, store of value, and investment, the network effect strengthens. Increased user adoption leads to greater network participation, transaction volume, and demand for Bitcoin.

- Merchant Acceptance- The acceptance of Bitcoin as a form of payment by merchants, businesses, and service providers is crucial for its network effect. When more merchants accept Bitcoin, it enhances its utility and accessibility, encouraging further adoption by consumers and investors.

- Infrastructure Development- The development of supporting infrastructure, including wallets, exchanges, payment processors, and regulatory frameworks, plays a vital role in Bitcoin's network effect. Robust infrastructure enhances usability, security, and interoperability, facilitating broader adoption and usage.

- Network Security- Bitcoin's network effect also extends to its security and resilience against attacks and censorship. As the network grows and attracts more miners, nodes, and developers, it becomes increasingly decentralized, distributed, and resistant to manipulation or disruption.

How Bitcoin Is Affected By Network Effects?

Network effects have a significant impact on the value and utility of Bitcoin as a medium of exchange. Like all major currencies, the value of Bitcoin is contingent upon the willingness of a third party to either purchase it as an investment or accept it as payment. The value of Bitcoin increases for those wishing to spend it as more people accept it.

But network effects also apply to all other currencies. Regardless of the product's inherent utility, this strong phenomena rewards the product with the greatest user base. This indicates that well-established currencies with substantial user bases have potent lock-in effects that encourage users to stick with them.

With millions of users, Bitcoin aims to challenge fiat currencies. More specifically, a lot of people anticipate that Bitcoin will mostly replace gold, which is one of the oldest currencies still in use and a global store of value. Bitcoin needs to get past the lock-in effect that keeps them ahead of more established currencies. This is the reason why, despite having far superior monetary properties to those of its current rivals, Bitcoin adoption has been slow.

The Growing Network Effect Of Bitcoin

The expanding network impact of Bitcoin may be quantified using a number of metrics:

- The estimated number of Bitcoin wallet users at this time is 100 million.

- The average daily transaction volume is 300,000.

- The number of Bitcoin miners worldwide is tens of thousands.

- There are approximately 15,000 active public listening nodes.

- The number of businesses accepting Bitcoin is over 100,000 and increasing.

Users' utility both now and in the future is increased by each new business that takes Bitcoin. The incentives for new members to join rise as the network expands. According to Metcalfe's Law, the network effect power of Bitcoin appears to be increasing with time.

Early adopters aid in the network's bootstrapping process in a typical network effect. Periodic hype cycles have helped Bitcoin by attracting new users. Currently, more than 100 million people, or more than 1% of the world's population, own Bitcoin.

Reaching the milestone of 100 million users enhances the network effect of Bitcoin and raises the entry hurdles for rival cryptocurrencies. In contrast, the great majority of cryptocurrencies display other network effects and are not as powerful.

Strategies For Leveraging Bitcoin's Network Effect

- Education and Awareness- Educating individuals, businesses, and institutions about the benefits and potential of Bitcoin is essential for driving adoption and increasing its network effect. Awareness campaigns, educational resources, and outreach initiatives can help demystify Bitcoin and dispel misconceptions.

- User Experience Improvement- Improving the user experience of Bitcoin wallets, exchanges, and payment platforms enhances usability and accessibility, attracting new users and retaining existing ones. Simplifying the process of buying, storing, and using Bitcoin encourages broader adoption and usage.

- Merchant Integration- Encouraging merchants to accept Bitcoin as a form of payment through incentives, partnerships, and support services expands its utility and acceptance. Seamless integration with existing payment systems and e-commerce platforms facilitates frictionless transactions for consumers and merchants alike.

- Regulatory Clarity and Compliance- Establishing clear and supportive regulatory frameworks for Bitcoin fosters confidence, trust, and legitimacy in its usage. Regulatory clarity reduces uncertainty and risk for businesses, investors, and users, encouraging greater adoption and investment in Bitcoin.

What Does The Network Effect Mean For Bitcoin’s Future?

It's actually very positive news for Bitcoin that the lock-in effect of other currencies is impeding adoption. The network effect's influence and the currency's inherent utility are the two primary drivers of its adoption. Since its inception in 2009, the use of bitcoin has steadily increased. The incentive for the next individual to join the network is increased with each new adopter.

Early adoption is the most difficult and becomes simpler with each new person who accepts Bitcoin. Given that Bitcoin has already survived the most challenging phases of the adoption curve, one would assume that things will only become simpler from this point on. Many Fortune 500 firms, billionaire investors, and regular consumers already use Bitcoin extensively.

It is challenging to determine where Bitcoin is on the adoption curve right now for a variety of reasons. The network allows a large number of users to interact anonymously. On the other hand, they can openly endorse Bitcoin without really possessing it or confirming transactions. More crucially, these findings rely on your prediction of Bitcoin's ultimate equilibrium after it has been completely included into the world economy.

We are aware, nevertheless, that each individual who follows the current adopters initiates a positive feedback loop that encourages other followers. These users will eventually accumulate to a critical mass that will cause Bitcoin to surpass a tipping point. Theoretically, this moment will have a strong enough network effect to quickly prompt everyone, including those who haven't made the switch, to accept the currency.

Bitcoin's Network Effect - FAQs

How Does Bitcoin's Network Effect Drive Adoption?

Bitcoin's network effect drives adoption by increasing its usability, liquidity, and security as more individuals, businesses, and institutions use and accept it.

What Are The Key Components Of Bitcoin's Network Effect?

The key components of Bitcoin's network effect include user adoption, merchant acceptance, infrastructure development, and network security.

What Are The Implications Of Bitcoin's Network Effect For Its Price?

Bitcoin's network effect contributes to its price appreciation over time, as increasing demand and adoption drive up its value.

How Does Bitcoin's Network Effect Impact Its Market Dominance?

Bitcoin's strong network effect has cemented its position as the dominant cryptocurrency, accounting for the majority of market capitalization and trading volume.

What Strategies Can Be Used To Leverage Bitcoin's Network Effect?

Strategies for leveraging Bitcoin's network effect include education and awareness, improving user experience, merchant integration, and regulatory clarity.

Conclusion

Bitcoin's network effect is a fundamental driver of its adoption, utility, and value in the cryptocurrency ecosystem. As more individuals, businesses, and institutions recognize and embrace Bitcoin's potential, its network effect strengthens, reinforcing its position as the leading cryptocurrency. By understanding the components and implications of Bitcoin's network effect and implementing strategies to leverage it effectively, stakeholders can contribute to the continued growth and success of Bitcoin in the digital economy.

Jump to

What Is A Network Effect?

What Is Bitcoin's Network Effect?

Components Of Bitcoin's Network Effect

How Bitcoin Is Affected By Network Effects?

The Growing Network Effect Of Bitcoin

Strategies For Leveraging Bitcoin's Network Effect

What Does The Network Effect Mean For Bitcoin’s Future?

Bitcoin's Network Effect - FAQs

Conclusion

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Gordon Dickerson

Reviewer

Gordon Dickerson, a visionary in Crypto, NFT, and Web3, brings over 10 years of expertise in blockchain technology.

With a Bachelor's in Computer Science from MIT and a Master's from Stanford, Gordon's strategic leadership has been instrumental in shaping global blockchain adoption. His commitment to inclusivity fosters a diverse ecosystem.

In his spare time, Gordon enjoys gourmet cooking, cycling, stargazing as an amateur astronomer, and exploring non-fiction literature.

His blend of expertise, credibility, and genuine passion for innovation makes him a trusted authority in decentralized technologies, driving impactful change with a personal touch.

Latest Articles

Popular Articles