Consumer Price Index For All Urban Consumers - Examining Expenditures

The adage “nothing is permanent in this world except change” rings truer when the topic of conversation is prices. We’re referring to the up-down-up-down prices of goods and services. The Consumer Price Index for All Urban Consumers confirms how the spending habits of consumers change periodically.

Author:James PierceReviewer:Camilo WoodAug 03, 2023598 Shares149.5K Views

The Consumer Price Index for All Urban Consumers(CPI-U) is one of the two indexes used to measure consumer inflation for the said types of consumers.

The other one is the Chained Consumer Price Index for All Urban Consumers (C-CPI-U), according to the U.S. Bureau of Labor Statistics (BLS).

From the total population of America, the BLS estimated that 93 percent of it make up the country’s group of all urban consumers - the consumers based in metropolitan or urban areas.

Similarly, the aforementioned percentage represents the group’s expenditures. These expenditures, in turn, reflect the CPI.

The Consumer Price Index for All Urban Consumers therefore counts as a significant factor in determining the CPI.

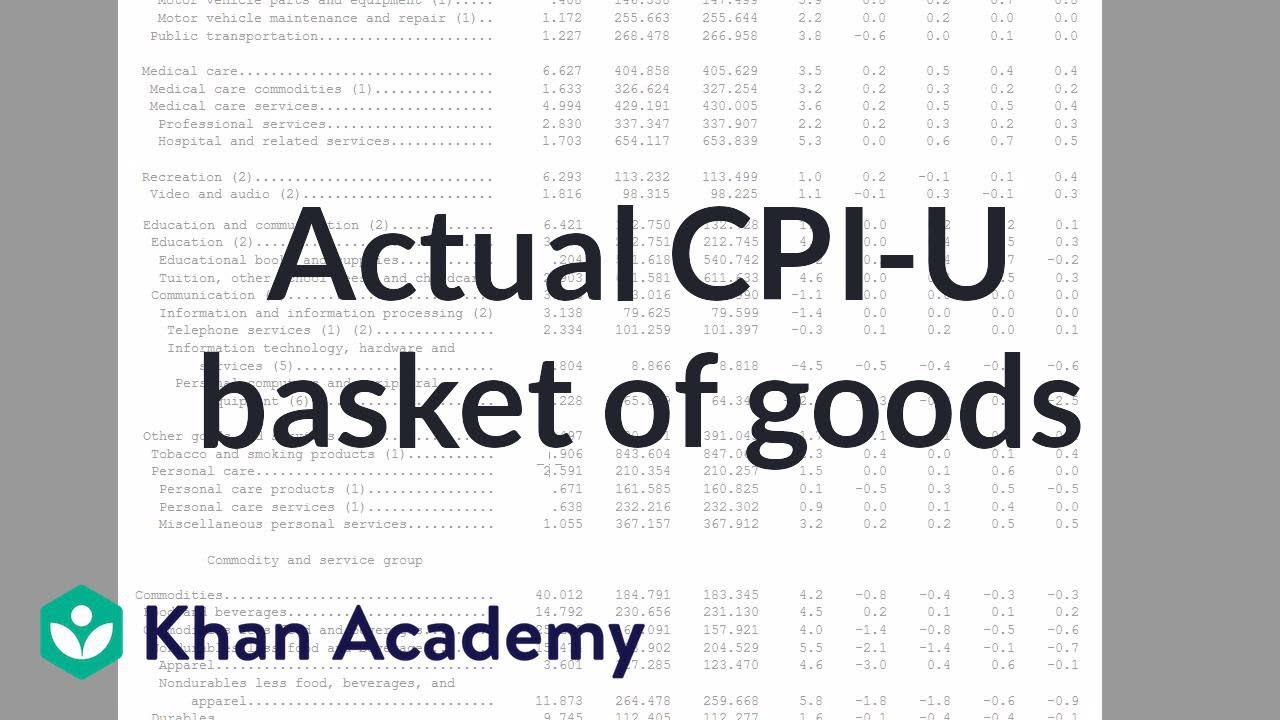

Actual CPI-U Basket of Goods

Consumer Price Index

Prices of goods and services go up and down.

They change periodically and when they do, the way consumers spend change, too. It influences what they buy and how much they will spend for purchases.

According to the U.S. Bureau of Labor Statistics (BLS), the CPI “measures” and “reflects” these changes.

The Consumer Price Index for All Urban Consumers is the one that represents the spending patterns of all urban consumers.

Urban consumers are those living in urban or metropolitan areas.

Some examples of urban consumers include those who are jobless at the moment as well as people who are already retired. Metropolitan-based clerical consumers (those with blue-collar jobs) also fall under this category.

Their expenditures matter significantly since they comprise 93 percent (in the U.S., that is) of the population, according to an October 2022 BLS report.

To provide comparison, in the January 2017 issue of “Beyond The Numbers,”which is a BLS publication, the agency stated that urban consumers made up 89 percent of the U.S. population.

So, in the U.S., the number of urban consumers increased by 4 percent in the last five years.

With urban consumers being a major force in terms of economic activities, the reliability of the Consumer Price Index for All Urban Consumers as an inflation indicator.

Consumer Price Index For All Urban Consumers

For the reason that this article focuses on the Consumer Price Index in the U.S. context, it will use the definition provided by an American government agency.

“„The CPI for All Urban Consumers (CPI-U) is a measure of price change for urban consumers that reflects the expenditure patterns of an average consumer living in an urban area.- U.S. Bureau of Labor Statistics (BLS)

Based on that definition, by the BLS, the Consumer Price Index for All Urban Consumers basically shows the expenditures of urban households in the U.S.

The CPI, by the way, shows the spending patterns of two major groups in America:

- urban consumers (CPI-U)

- urban wage earners and clerical workers (Consumer Price Index for Urban Wage Earners and Clerical Workers or CPI-W)

Across the U.S., the BLS gather data for CPI-U from:

- 75 urban areas

- approximately 6,000 housing units

- an estimated 22,000 retail establishments (miscellaneous service establishments, including supermarkets, malls, and hospitals)

The BLS includes all relevant taxes urban consumers paid along with the goods they bought and the services they availed in the Consumer Price Index for All Urban Consumers.

Consumer Price Index Table 2022

The Consumer Price Index for All Urban Consumers provides data specifically those that pertain to price changes.

These price changes are those happening in more than 200 categories. The U.S. Bureau of Labor Statistics grouped these categories into eight major sets.

The table below indicates the Consumer Price Index for All Urban Consumers (expenditure category) based on the CPI - October 2022 report by the BLS released on November 10, 2022:

| Eight Major Groups (Expenditure Category) | Relative Importance - September 2022 |

| a. Food | 13.705 percent |

| a.1 Nonalcoholic Beverages and Beverage Materials | 0.978 percent (included in the 13.705 percent) |

| b. Alcoholic Beverages | 0.868 percent |

| Shelter | 32.622 percent |

| Apparel | 2.482 percent |

| Transportation commodities (less motor fuel) | 8.405 percent |

| Transportation services | 5.946 percent |

| Medical Care commodities | 1.474 percent |

| Medical Care services | 6.894 percent |

| Recreation commodities | 1.877 percent |

| Recreation services | 3.106 percent |

| Education and Communication commodities | 0.751 percent |

| Education and Communication services | 5.276 percent |

| Other Goods | 1.352 percent |

| Other Personal Services | 1.354 percent |

People Ask

What Does All Urban Consumers Mean?

The BLS explains that the term “all urban consumers” refer to “almost all residents of urban or metropolitan areas,” including the following:

- professionals

- the self-employed

- poor people

- the unemployed

- retired people

What Is The Difference Between CPI U And CPI W?

One difference is that the CPI-U shows the CPI for the spending patterns of urban consumers while CPI-W is for urban wage earners and clerical workers.

What Is The Current CPI Rate?

In the U.S., “on a seasonally adjusted basis,” the BLS reported that the Consumer Price Index for All Urban Consumers (CPI-U) increased in October 2022 by 0.4 percent.

Final Thoughts

The Consumer Price Index for All Urban Consumers consistently changesprimarily because the spending patterns of people differ over time.

What consumers may prioritize buying now may become a less priority in a different period of time. It could depend upon the current circumstances they are in.

Some deem the CPI as “controversial,” as based on a 2022 Investopedia article, in terms of its role as an inflation indicator.

Nonetheless, several economists and analysts place their confidence in its reliability, particularly on data concerning the Consumer Price Index for All Urban Consumers.

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles