Credit Union Vs Bank - Understanding The Contrast

Explore the nuances of credit union vs bank. From ownership structures to fees, discover the key differences shaping your financial choices.

Author:Dexter CookeReviewer:Darren McphersonFeb 01, 202412.2K Shares207.5K Views

Credit unions and banks are two distinct financial institutions that play crucial roles in the economic landscape. While both serve as repositories for individuals' money and offer a variety of financial services, they differ in their structures, purposes, and operations. Let's discusscredit union vs bankin detail.

You don't just have to choose from the many local and national banks that want your business when you need a new checking or savings account, a loan, or a line of credit. Credit unions are another choice for these kinds of products that people don't always think of. They offer many of the same financial products and services that banks do.

A credit union is not the same as a regular bank. What is a credit union? There are some important differences between banks and credit unions, even though they offer some of the same services.

There are two types of financial institutions: banks and credit unions. Both offer checking and savings accounts, mortgages, car loans, and personal loans. Both banks are safe, and they both offer online banking and consulting services: When you put money in a bank or credit union, the FDICor NCUA will protect it up to $250,000 per account owner. But the way banks and credit unions work is different.

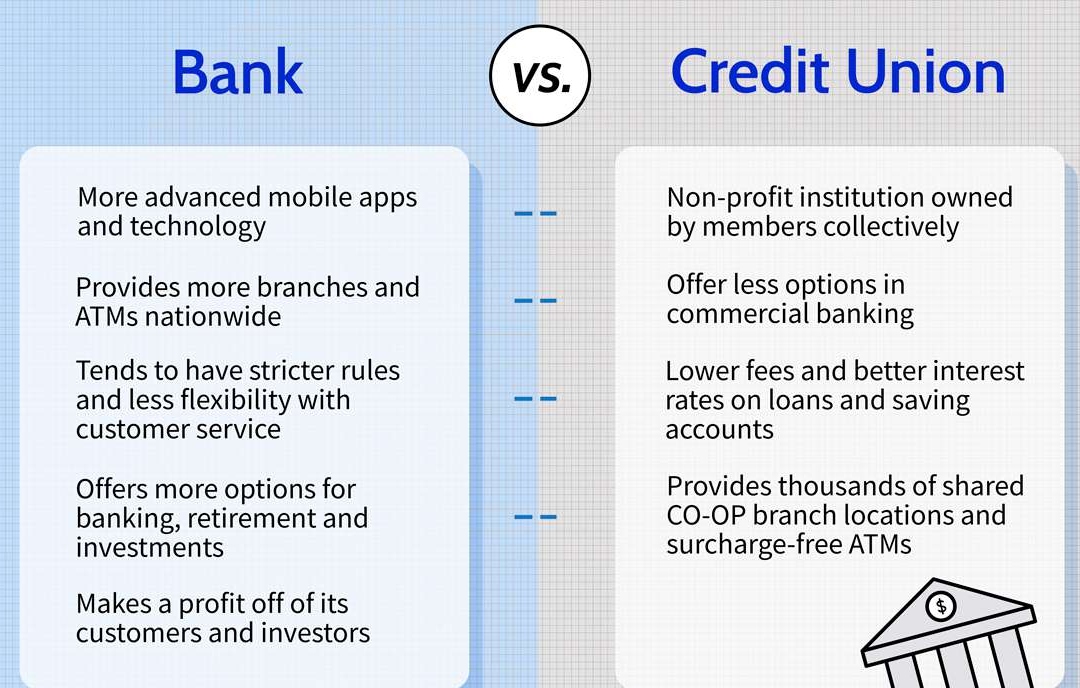

Each financial intuition is different, so fees, interest rates, product offers, ease of use, and customer service will all be different. It is more likely that credit unions will give you better service and lower rates and fees. On the other hand, banks may have a wider range of loans and other financial products, as well as bigger networks that make banking easier.

Most banks are for-profit businesses, but credit unions are not-for-profit businesses that serve the community. This means that their gains are shared among their members. Credit unions will sometimes have better rates and fees than big national banks because of this, but they can't help as many people.

Since credit unions are owned by their members, you must meet certain requirements in order to join and start an account. For example, you must live in a certain state, work for a certain company, be a member of a certain group, etc. But many of the best credit unions let anyone join as long as they donate a small fee to a group that is part of the credit union.

In this detailed comparison, we will explore the credit union vs bank in detail:

Ownership And Structure

Credit unions and banks differ significantly in their ownership and organizational structures, which fundamentally shape their operations and priorities.

Credit Unions

Credit unions operate as member-owned financial cooperatives. The ownership structure is unique, as each member is a shareholder, holding a stake in the institution. Members typically share a common bond, such as living in the same community, working for the same employer, or being part of a specific organization.

The democratic principle is at the core, with members having a direct say in decision-making processes. Members elect a volunteer board of directors to oversee the credit union's operations, ensuring that the institution aligns with the interests and needs of its members.

This cooperative structure contributes to a sense of community and shared responsibility among members. Surplus income generated by the credit union is often returned to members through lower interest rates on loans, higher interest rates on savings, or other financial benefits. This emphasis on member well-being rather than external shareholder profits distinguishes credit unions from traditional banks.

Banks

In contrast, banks operate as for-profit entities owned by shareholders. These shareholders can be individuals, institutional investors, or other corporations. The ownership structure is hierarchical, with a board of directors appointed by the shareholders to oversee the bank's operations. Unlike credit unions, where the focus is on the well-being of members, banks prioritize maximizing profits for their shareholders.

The profit motive drives decision-making in banks, influencing everything from interest rates on loans to fees for services. While this structure allows banks to pursue a broader range of financial activities and innovations, it can sometimes lead to a perception that their priorities may not always align with the best interests of individual account holders.

Membership And Accessibility

The membership criteria and accessibility of credit unions and banks play a crucial role in determining who can become a part of these financial institutions.

Credit Unions

Credit unions often have membership restrictions based on a common bond among members. This common bond could be geographic, such as residing in the same community, or based on employment, where members work for the same employer or industry. Additionally, membership might be centered around a specific organization, association, or affinity group. While these restrictions can limit the accessibility of credit unions, they foster a strong sense of community and shared values among members.

To become a member of a credit union, individuals must meet the specified eligibility criteria. Once a member, they gain voting rights and the opportunity to participate in the credit union's decision-making processes. This member-focused approach ensures that the institution remains closely connected to the needs of its clientele.

Banks

Banks, in contrast, are generally open to the public. They do not have the same membership restrictions as credit unions, allowing anyone to become an account holder. This openness enhances the accessibility of banks, making them widely available to individuals from diverse backgrounds and locations.

The lack of restrictive membership criteria allows banks to serve a broad and varied customer base. This inclusivity, combined with the extensive network of branches and online services, makes banks a convenient choice for those seeking accessibility and a wide range of financial products and services.

Profit Motive:

The profit motive is a central factor that differentiates credit unions and banks. Understanding how these financial institutions approach profitability sheds light on their decision-making processes and the overall financial landscape.

Credit Unions

Credit unions operate as not-for-profit entities, emphasizing the cooperative model. Unlike banks, credit unions do not aim to maximize profits for external shareholders. Instead, their primary focus is on providing affordable financial services to their members. The surplus income generated by credit unions is often reinvested into the institution or returned to members in the form of better interest rates on loans, higher interest rates on savings accounts, or lower fees.

The absence of a profit-driven motive allows credit unions to prioritize the financial well-being of their members. This member-centric approach fosters a sense of community and shared responsibility. Credit unions often highlight their commitment to delivering value to members rather than pursuing maximum profits, making them an attractive option for individuals seeking a more community-oriented and customer-friendly banking experience.

Banks

Banks, on the other hand, operate with a clear profit motive. As for-profit entities, the primary goal is to generate returns for shareholders. Banks engage in various financial activities, from lending and investment to fee-based services, with the aim of maximizing profitability. This profit-driven model can lead to higher fees for certain services and competitive interest rates designed to enhance the bank's overall financial performance.

While banks provide a broad spectrum of financial products and services, the profit motive can sometimes be perceived as prioritizing the interests of shareholders over individual account holders. This distinction in motives influences how banks set interest rates, structure fees, and allocate resources, ultimately shaping the overall banking experience for customers.

Products And Services

Credit unions and banks offer similar financial products and services, but differences exist in terms of scale, variety, and sometimes, the overall approach to customer service.

Credit Unions

Credit unions provide a range of financial products and services that mirror those offered by banks. This includes savings and checking accounts, loans, credit cards, and investment products. The scale and variety of offerings may vary based on the size of the credit union. While larger credit unions may compete with banks in terms of the breadth of services offered, smaller credit unions might have a more focused set of offerings.

One notable aspect of credit union services is their emphasis on favorable terms for members. Credit unions often provide competitive interest rates on loans and higher interest rates on savings accounts, reflecting their commitment to delivering financial benefits directly to their members. This member-centric approach extends to personalized customer service, as credit unions strive to build strong relationships with their members.

Banks

Banks typically offer an extensive array of financial products and services. In addition to basic savings and checking accounts, banks provide a wide range of loans, credit cards, investment options, and specialized financial products. The scale of operations, especially in the case of large national or international banks, allows for a broader and more diverse set of offerings compared to most credit unions.

Banks are often at the forefront of adopting innovative financial technologies, providing customers with digital banking platforms, mobile apps, and online services. The competitive nature of the banking industry drives constant innovation, offering customers convenient and efficient ways to manage their finances.

Interest Rates And Fees

Interest rates and fees are crucial considerations for individuals when choosing between credit unions and banks. These factors impact the overall cost of borrowing and the profitability of savings and investment accounts.

Credit Unions

Credit unions are often known for offering competitive interest rates on loans and higher interest rates on savings accounts. The not-for-profit model of credit unions, combined with their focus on serving members rather than maximizing profits for external shareholders, allows them to provide more favorable terms.

When it comes to loans, credit unions may offer lower interest rates compared to banks, especially on products like auto loans, personal loans, and credit cards. Additionally, members may benefit from reduced fees or more flexible repayment terms. On the savings side, credit unions often provide higher yields on savings accounts, certificates of deposit (CDs), and other deposit products.

Regarding fees, credit unions generally have a reputation for keeping fees lower than those of banks. This includes account maintenance fees, ATM fees, and transaction fees. The member-centric approach of credit unions prioritizes affordability for their members.

Banks

Banks offer a wide range of interest rates and fees, and these can vary widely depending on the institution's size, location, and overall business strategy. Interest rates on loans and credit cards from banks may be competitive, particularly for customers with strong credit histories. However, the profit-driven motive of banks may lead to higher fees for certain services, such as overdraft fees, ATM fees, and account maintenance fees.

In terms of savings accounts, banks may provide competitive interest rates, although they might not always match the higher rates offered by credit unions. The focus on profitability can influence the balance between offering attractive rates to customers and ensuring the bank's financial success.

Regulation And Insurance

Regulation and insurance play a critical role in providing stability and security for both credit unions and banks. Understanding the regulatory environment and deposit insurance mechanisms helps consumers make informed decisions about where to entrust their money.

Credit Unions

Credit unions in the United States are regulated by the National Credit Union Administration (NCUA). This federal agency supervises and insures federal credit unions and most state-chartered credit unions. The NCUA ensures that credit unions adhere to federal regulations and maintain financial stability.

Deposits in credit unions are typically insured up to $250,000 per individual by the National Credit Union Share Insurance Fund (NCUSIF). This insurance provides a level of protection for members' deposits, ensuring that even if the credit union faces financial difficulties, members can recover their insured funds.

Banks

Banks in the United States are subject to a regulatory framework overseen by multiple entities, including the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC). The regulatory landscape ensures that banks adhere to federal guidelines, maintain capital adequacy, and operate in a manner that safeguards the financial system.

Deposits in banks are typically insured by the FDIC, providing insurance coverage of up to $250,000 per depositor per bank. This insurance adds a layer of security for bank customers, assuring them that even if the bank encounters financial challenges, their insured deposits are protected.

Considerations For Consumers

When deciding between credit unions and banks, consumers should carefully evaluate their individual financial needs and preferences. Credit unions may appeal to those who prioritize member-centric services, competitive interest rates, and lower fees. On the other hand, banks may be a better fit for individuals seeking a broader range of financial products, advanced technological features, and the convenience of widespread accessibility.

Credit Union Vs Bank - FAQs

What Is The Main Difference Between A Credit Union And A Bank?

The primary difference lies in ownership and structure. Credit unions are member-owned cooperatives, while banks are typically for-profit entities owned by shareholders.

Do Credit Unions And Banks Offer The Same Range Of Financial Products?

Yes, both credit unions and banks offer similar financial products, including savings and checking accounts, loans, credit cards, and investment options.

Which Institution Has Broader Accessibility - Credit Unions Or Banks?

Banks generally have broader accessibility as they are open to the public, while credit union membership is often restricted based on common bonds.

Is A Credit Union Safer Than A Bank?

Yes. In general, when banks fail, credit unions are better than banks. This is because credit unions don't take as many chances because they serve people and small businesses instead of big investors like banks do.

Conclusion

Credit unions and banks serve as vital components of the financial services sector, each with its unique characteristics. The credit union vs bank choice depends on individual preferences, financial needs, and the importance placed on factors like community focus, ownership structure, and accessibility. Whether one opts for the member-driven ethos of a credit union or the extensive services of a bank, both institutions contribute to the diverse and dynamic landscape of the financial industry.

Dexter Cooke

Author

Dexter Cooke is an economist, marketing strategist, and orthopedic surgeon with over 20 years of experience crafting compelling narratives that resonate worldwide.

He holds a Journalism degree from Columbia University, an Economics background from Yale University, and a medical degree with a postdoctoral fellowship in orthopedic medicine from the Medical University of South Carolina.

Dexter’s insights into media, economics, and marketing shine through his prolific contributions to respected publications and advisory roles for influential organizations.

As an orthopedic surgeon specializing in minimally invasive knee replacement surgery and laparoscopic procedures, Dexter prioritizes patient care above all.

Outside his professional pursuits, Dexter enjoys collecting vintage watches, studying ancient civilizations, learning about astronomy, and participating in charity runs.

Darren Mcpherson

Reviewer

Darren Mcpherson brings over 9 years of experience in politics, business, investing, and banking to his writing. He holds degrees in Economics from Harvard University and Political Science from Stanford University, with certifications in Financial Management.

Renowned for his insightful analyses and strategic awareness, Darren has contributed to reputable publications and served in advisory roles for influential entities.

Outside the boardroom, Darren enjoys playing chess, collecting rare books, attending technology conferences, and mentoring young professionals.

His dedication to excellence and understanding of global finance and governance make him a trusted and authoritative voice in his field.

Latest Articles

Popular Articles