10 Crypto Market Breakout Signals To Watch In 2024

Discover how to capitalize on the latest crypto market breakout signals! Uncover actionable insights to maximize your profits and navigate the volatile crypto landscape effectively.

Author:James PierceReviewer:Gordon DickersonFeb 26, 2024190 Shares47.5K Views

In the fast-paced world of cryptocurrency trading, staying ahead of the curve is key to maximizing profits. That's where crypto market breakout signalscome into play, offering traders valuable insights into potential price movements before they happen. These signals act as powerful indicators, identifying periods of heightened market activity and signaling the potential for significant price shifts.

By recognizing breakout signals early on, traders can strategically position themselves to capitalize on emerging trends and seize profitable opportunities.Whether you're a seasoned trader or just dipping your toes into the world of crypto, understanding and utilizing breakout signals can make all the difference in your trading success.

10 Key Signals To Watch

Predicting future market movements is notoriously tricky, and even experienced investors can be caught off guard by unexpected events. However, certain signals can indicate potential breakouts in the crypto market. Here are 10 to watch in 2024, with examples:

Technical Analysis

1. Increased Trading Volume - Rising volume often precedes breakouts, suggesting growing interest and potential price action. Example: Bitcoin saw a surge in trading volume before its breakout in November 2021.

2. Breakouts from Key Resistance Levels -When prices consistently surpass previous resistance levels, it can signal a bullish trend. Example: Ethereum breaking above the $4,000 resistance in 2021.

3. Moving Average Crossovers -When a short-term moving average crosses above a long-term one, it can indicate bullish momentum. Example: Bitcoin's 50-day moving average crossing above its 200-day moving average in 2020.

4. Relative Strength Index (RSI) Divergence - When the RSI indicator diverges from the price action, it can signal an impending breakout. Example: Bitcoin's RSI staying low while the price rises, suggesting bullish potential.

Fundamental Analysis

5. Positive News and Developments -Major news like successful product launches or regulatory approvals can trigger breakouts. Example: Ethereum's "Merge" upgrade in September 2022 led to a price surge.

6. Institutional Adoption -Increased investments from large institutions can boost confidence and drive prices up. Example: Grayscale's Bitcoin Trust attracting billions of dollars in 2021.

7. Mainstream Media Coverage -Increased media attention, especially positive coverage, can attract new investors and fuel breakouts. Example: Elon Musk's tweets endorsing Dogecoin in 2021.

Macroeconomic Factors

8. Economic Uncertainty -During times of economic uncertainty, investors may seek alternative assets like crypto, leading to breakouts. Example: Bitcoin's rise in 2020 amid the pandemic-driven economic downturn.

9. Loose Monetary Policy - When central banks implement loose monetary policies, it can increase liquidity and potentially benefit riskier assets like crypto. Example: Bitcoin's bull run in 2021 coincided with the US Federal Reserve's quantitative easing program.

10. Technological Advancements -Breakthroughs in blockchain technology or wider adoption of crypto-related solutions can trigger market excitement and breakouts. Example: The rise of Decentralized Finance (DeFi) projects in 2020.

How To Find Crypto Breakouts And What Makes A Crypto Breakout?

In technical analysis (TA), a breakout signifies a notable shift in the price of an asset, either surpassing a resistance barrier or dipping below a support zone. Such breakouts often suggest that the asset's price will embark on a trending trajectory aligning with the breakout direction. This guide aims to illuminate the methods for identifying crypto breakouts and dissecting the dynamics that characterize them.

Breakouts accompanied by substantial trading volume tend to carry more weight as signals compared to those occurring amidst average volume. Elevated volume levels during breakouts imply a greater likelihood of the price sustaining its momentum in the breakout direction.

Breakouts manifest in various forms, such as range or channel breakouts, or through the emergence of recognizable price patterns like triangles, flags, wedges, or head and shoulders formations. Typically, breakouts emerge following a phase of diminished market volatility.

The duration of pattern development often serves as a harbinger for the breakout's potential explosiveness. Longer-established patterns tend to yield more forceful breakouts. Moreover, if price levels are clearly delineated, many traders might converge on the same price thresholds to set their stop-loss orders.

Consequently, the triggering of these stop orders could catalyze a cascading effect, precipitating rapid price movements. The underlying principle of breakout trading is straightforward: if support and resistance levels confine price within a range, breaching that range could foreshadow a substantial price swing.

Breakout trading is a versatile approach applicable across various timeframes and trading styles. Depending on the breakout direction, a trader might execute either a buy or sell position once the price breaches the predefined support or resistance boundaries. It's worth noting, however, that akin to other TA techniques, interpreting breakouts involves a degree of subjectivity.

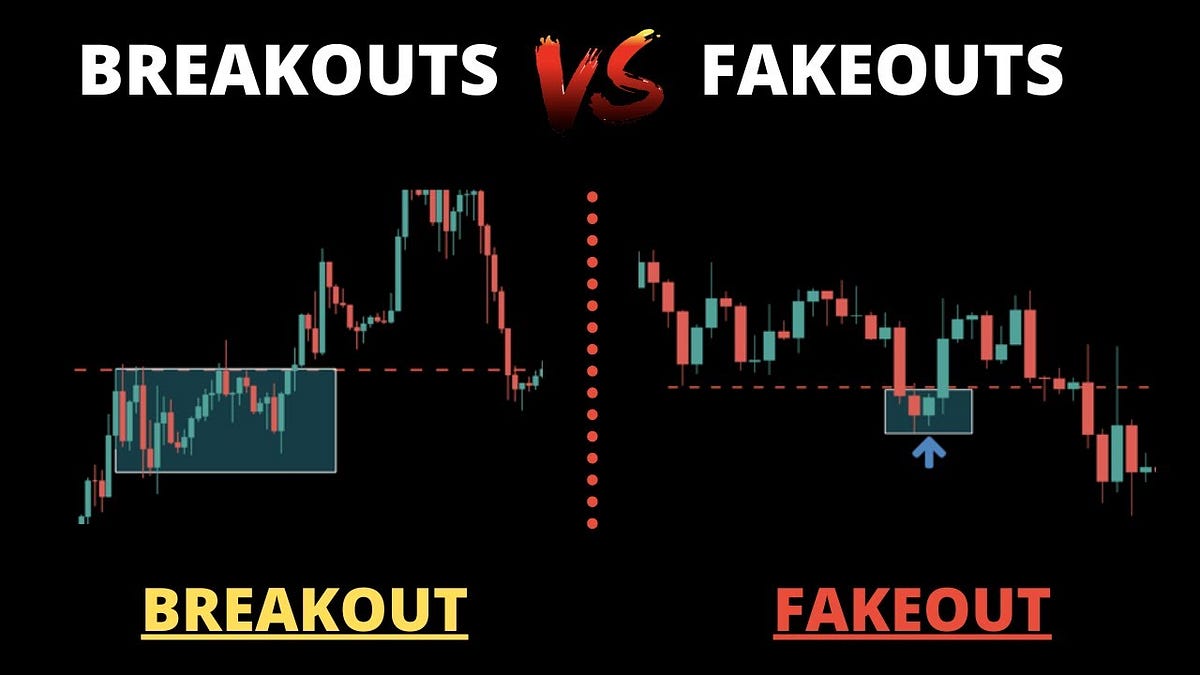

The identification of support and resistance levels, as well as the chart patterns delineating breakouts, can vary among traders. In instances where price breaches a defined range but swiftly retraces its steps, it's labeled a fakeout or false breakout. This scenario occurs when price briefly exits a defined range before reverting back into it.

To mitigate the risks associated with fakeouts, some traders opt to await confirmation of the breakout on higher timeframes before entering a trade. Additionally, they may monitor the breakout level for potential retests, which could establish it as either fresh support or resistance, depending on the breakout's direction, thereby serving as a strategic entry point.

| Technical Analysis | Signal - "Increased Trading Volume", Description - Significant rise in trading activity preceding a price movement |

| Signal - "Breakout from Key Resistance Levels", Description - Price consistently exceeding past resistance points, indicating bullish momentum | |

| Signal - "Moving Average Crossovers", Description - Short-term moving average crossing above long-term, suggesting buying pressure | |

| Signal - "Relative Strength Index (RSI) Divergence", Description - RSI indicator diverges from price action, potentially signaling a breakout | |

| Fundamental Analysis | Signal - "Positive News & Developments", Description - Major news like successful launches or approvals impacting price |

| Signal - 'Institutional Adoption", Description - Large institutions investing, boosting confidence and driving prices up | |

| Signal - 'Mainstream Media Coverage", Description - Increased positive media attention attracting new investors | |

| Macroeconomic Factors | Signal - "Economic Uncertainty", Description - Investors seeking alternative assets like crypto during economic downturns |

| Signal - "Loose Monetary Policy", Description - Increased liquidity potentially benefiting riskier assets like crypto | |

| Signal - "Technological Advancements", Description - Breakthroughs in blockchain technology or wider adoption of crypto solutions |

Technical Indicators

Technical trading strategies rely on utilizing various technical indicators, either individually or in combination, to inform trading decisions. Employing these indicators is essential for any trader navigating the cryptocurrency market, enabling them to forecast price peaks and troughs accurately over specific timeframes.

By incorporating effective risk management tools alongside technical analysis, traders can optimize gains and mitigate losses while gaining deeper insights into price movements.

Moving Averages (MAs) serve as pivotal tools, offering support and resistance levels while providing insights into overall market sentiment through crossovers. At FX Lxleaders, we leverage simple MAs, smoothed MAs, and exponential MAs to gauge market trends.

Candlestick patterns are equally invaluable, revealing intricate price action dynamics and signaling potential reversals. These patterns reflect price fluctuations over a defined period, shedding light on whether buyers or sellers dominate, thus guiding future price movements.

Fibonacci Levels, deeply entrenched in trading strategies, capitalize on the Fibonacci sequence's inherent predictive qualities, offering vital support and resistance zones for trade entry and exit points. Trendlines play a crucial role in identifying optimal buying and selling positions during bullish or bearish trends.

Crypto Trend Signals

As previously mentioned, cryptocurrencies often experience significant trends, whether bullish or bearish, leading to substantial price movements, particularly for smaller coins. Consequently, trading within these trends can be highly lucrative. For instance, in early 2021, we observed a notably bullish trend in the crypto market, presenting numerous opportunities for profitable Bitcoin trades.

In a trending market, our strategy involves patiently waiting for pullbacks to conclude, which are typically indicated by trendlines or moving averages. We prefer to see a reversal candlestick pattern before entering a trade, as exemplified by the hammer candlestick touching both the ascending trendline and the 50-day Simple Moving Average (SMA) on the daily chart in March.

This bullish buying pattern signaled the end of the pullback, with the uptrend resuming shortly after, resulting in significant profits.

Breakouts Vs Fakeouts - Avoid FOMO During A Potential Breakout

- To grasp the significance of breakouts, it's essential to understand support and resistance levels. The support level signifies a price level or zone beneath the current market price, indicating strong buying interest that surpasses selling pressure. Conversely, the resistance level lies above the current market price, showcasing formidable selling pressure that exceeds buying interest.

- Breakouts typically occur following periods of subdued market volatility and frequently signal attempts at trend reversals. Breakouts accompanied by heightened trading volume are typically perceived as robust signals, with higher volumes correlating to increased chances of price continuation in the breakout direction.

- However, if an asset's price momentarily breaches the support or resistance levels before swiftly retracting, it may constitute a fakeout—a deceptive setup resembling a breakout but ultimately failing to materialize.

- It's common for traders to experience fear of missing out (FOMO) when a cryptocurrency nears a breakout point or breaches a resistance level. However, hastily entering trades in such scenarios can be precarious, as not all breakouts prove successful; some may result in fakeouts. Consequently, exercising caution and waiting for confirmation, such as a candle closing outside or above the resistance level, may be a prudent approach.

FAQ's About Crypto Market Breakout Signals

How Do You Predict Crypto Breakouts?

Predicting crypto breakouts involves analyzing various technical indicators and market conditions to anticipate potential shifts in price momentum. Traders often look for patterns such as consolidations, triangles, or flags, combined with factors like volume spikes and trendline validations.

What Are The Signs Of A Breakout In Cryptocurrency?

In cryptocurrency trading, a breakout occurs when the price of a particular cryptocurrency surpasses a predetermined resistance level or falls below a support level. These breakouts are a fundamental aspect of technical analysis, characterized by sudden movements accompanied by heightened trading volumes and greater market volatility.

Are Crypto Signals Accurate?

Crypto trading signals are frequently derived from technical, fundamental analysis, or a blend of both methodologies. Nonetheless, there's no assurance that these signals will consistently prove accurate or yield profitable outcomes. There are several reasons why placing full trust in crypto trading signals may be unwise.

Conclusion

Crypto market breakout signals serve as invaluable tools for traders seeking to navigate the dynamic landscape of cryptocurrency trading. These signals, derived from technical analysis and often accompanied by fundamental insights, offer glimpses into potential price movements beyond predefined support or resistance levels.

However, while breakout signals can provide valuable guidance for trading decisions, it's essential to approach them with caution and supplement them with thorough analysis. Traders should remain mindful of the inherent risks and uncertainties associated with crypto trading, recognizing that no signal is foolproof and that market conditions can swiftly change.

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Gordon Dickerson

Reviewer

Gordon Dickerson, a visionary in Crypto, NFT, and Web3, brings over 10 years of expertise in blockchain technology.

With a Bachelor's in Computer Science from MIT and a Master's from Stanford, Gordon's strategic leadership has been instrumental in shaping global blockchain adoption. His commitment to inclusivity fosters a diverse ecosystem.

In his spare time, Gordon enjoys gourmet cooking, cycling, stargazing as an amateur astronomer, and exploring non-fiction literature.

His blend of expertise, credibility, and genuine passion for innovation makes him a trusted authority in decentralized technologies, driving impactful change with a personal touch.

Latest Articles

Popular Articles