Crypto Portfolio Diversification Methods - Crafting A Resilient Crypto Portfolio

Diversify your crypto portfolio for resilience. Learn effective crypto portfolio diversification methods, optimize risk, and enhance returns.

Author:James PierceReviewer:Gordon DickersonFeb 02, 20241K Shares41.5K Views

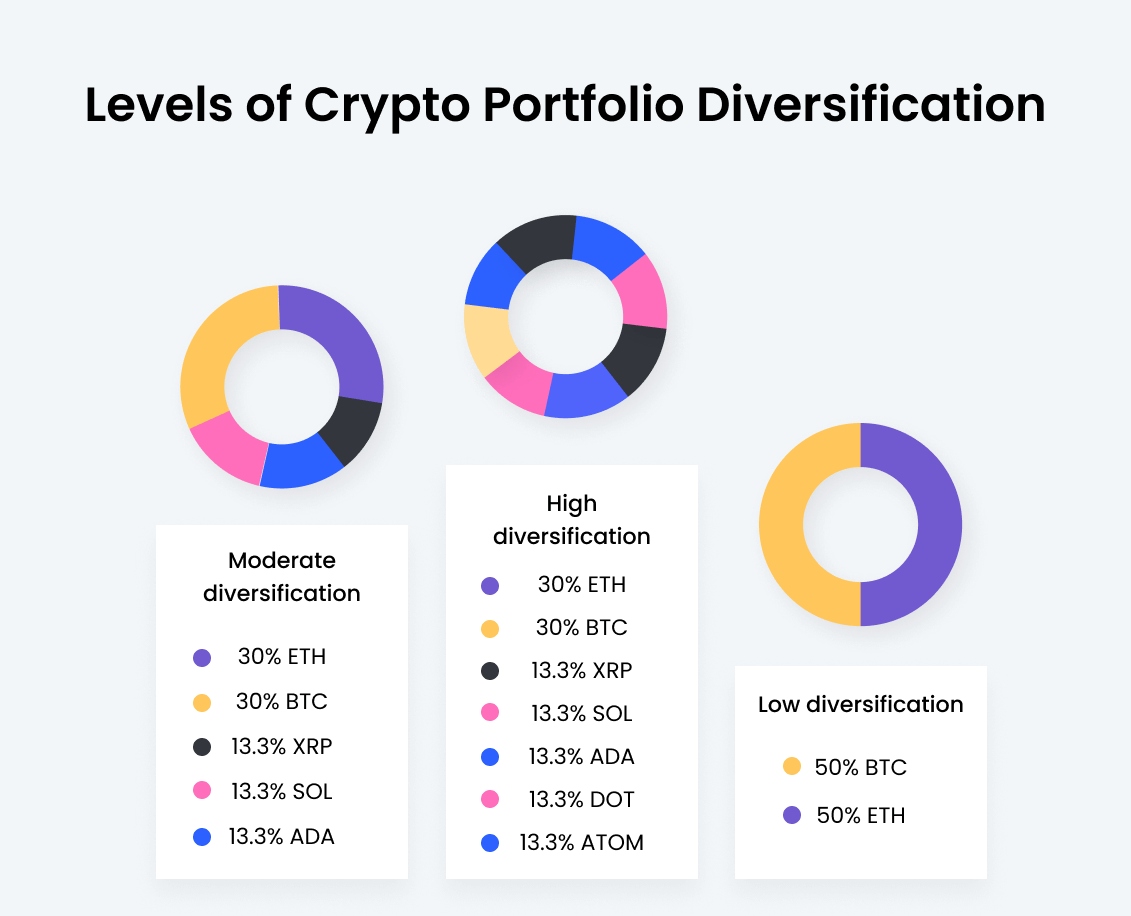

As the cryptocurrency market continues to mature, investors are increasingly recognizing the need for a well-diversified portfolio to navigate the inherent volatility and optimize returns. Diversification involves spreading investments across various assets to minimize risk exposure to any single cryptocurrency. In this article, we'll explore several effective crypto portfolio diversification methods, offering insights into the benefits and challenges associated with each approach.

Let's have a detailed look at some of the best crypto portfolio diversification methods:

Spread Your Bets Among Different Cryptocurrencies.

Adding additional tokens to your current holdings is a simple method of diversifying your cryptocurrency portfolio. It could be difficult to decide which new cryptocurrencies to add, but you can simplify the process by assessing your existing holdings.

What gaps exist in your token portfolio right now? If you can't resist buying additional cryptocurrency, consider diversifying your holdings in these ways:

- Include cryptocurrencies with big or modest caps -Think about investing in new cryptocurrencies if your holdings are primarily Bitcoin. Consider diversifying your portfolio with Bitcoin or another large-cap cryptocurrency if you only own small-cap stocks.

- Purchase several kinds of tokens -Stablecoins, utility tokens, governance tokens, and other currency kinds can be added to your portfolio. Expand your horizons in multiple industries. Tokens from a variety of industries, including gaming, file storage, environmental protection, and finance, can be found in a diversified cryptocurrency portfolio.

- Extend throughout multiple regions -You can expand your cryptocurrency holdings to include tokens that are mostly utilized in particular geographical areas.

- Make investments in various blockchain protocols -Coins that employ various consensus techniques, such as proof-of-work and proof-of-stake, may be included in a diversified cryptocurrency portfolio.

- Encourage DeFi initiatives - Those who are eager to see money become more accessible to all can decide to hold digital tokens linked to one or more decentralized financial initiatives.

- Invest in solutions for blockchain scaling -Those who are aware of the difficulties that can result from overcrowding on cryptocurrency networks can be motivated to purchase the digital tokens of a blockchain scaling solution.

Core Cryptocurrencies Allocation

At the core of any diversified crypto portfolio lies the allocation of funds to well-established cryptocurrencies. Bitcoin and Ethereum, often referred to as the "blue-chip" assets of the crypto space, provide a stable foundation for investment. These core assets not only offer reliability but also act as a hedge against extreme market fluctuations.

Inclusion Of Mid And Small-Cap Coins

While core cryptocurrencies provide stability, introducing mid and small-cap coins to the portfolio adds an element of growth potential. Mid and small-cap coins are often more volatile, presenting both higher risk and higher reward. Striking a careful balance between these categories allows investors to benefit from potential high returns while maintaining a level of stability.

Equal Weight Distribution

An equal weight distribution strategy involves allocating an equal percentage of the portfolio to each selected cryptocurrency. This method ensures that the performance of any single asset does not disproportionately impact the overall portfolio. While straightforward, this approach requires careful consideration of the chosen assets to maintain an optimal balance.

Invest In Initial Coin Offerings

Taking a chance on an initial coin offering (ICO) investment is one way to diversify your cryptocurrency portfolio. By definition, a coin that is going through an ICO is a brand-new cryptocurrency that isn't currently available for purchase.

One approach to diversify your cryptocurrency holdings is to invest in more initial coin offerings (ICOs). Buying a coin at a low price when it is still in its infancy can result in substantial gains, but it also has the potential to lose all of its worth. Before using this method to diversify your cryptocurrency holdings, be aware of the hazards.

Market Capitalization-Based Allocation

Another effective method is allocating funds based on market capitalization. Large-cap cryptocurrencies like Bitcoin and Ethereum provide stability, while mid and small-cap coins offer growth potential. By distributing investments across different market cap categories, investors can achieve a balanced risk-reward profile.

Sector-Based Diversification

Crypto assets serve various purposes, ranging from decentralized finance (DeFi) to non-fungible tokens (NFTs) and blockchain platforms. Sector-based diversification involves allocating funds across different sectors to capture emerging trends and technological advancements. This approach helps investors position themselves strategically in the rapidly evolving crypto landscape.

Geographical Diversification

Diversifying across different geographical regions is crucial, considering the varying regulatory environments in the global cryptocurrency market. Regulatory changes in a specific jurisdiction can significantly impact the value of cryptocurrencies. Spreading investments across different regions helps mitigate the risks associated with regulatory uncertainties.

Balancing Stablecoins And Volatile Assets

Integrating stablecoins into a crypto portfolio can act as a risk management strategy. Stablecoins, pegged to fiat currencies like the US Dollar, provide a stable store of value. Balancing volatile assets with stablecoins helps preserve capital during market downturns while maintaining exposure to potential high-growth assets.

Dynamic Rebalancing

The cryptocurrency market is dynamic, with assets experiencing fluctuations in value over time. Implementing a dynamic rebalancing strategy involves regularly reassessing the portfolio and adjusting allocations to maintain the desired level of diversification. This proactive approach helps investors adapt to changing market conditions and capitalize on emerging opportunities.

Utilizing Index Funds And ETFs

For investors seeking a more hands-off approach, index funds and exchange-traded funds (ETFs) tracking cryptocurrency baskets provide an instant way to diversify. These funds automatically balance and adjust holdings based on the composition of a specific index, offering a passive yet diversified investment strategy.

Risk Tolerance Assessment

Understanding individual risk tolerance is paramount when crafting a diversified crypto portfolio. Investors with a lower risk tolerance may opt for a more conservative approach, emphasizing larger, more stable cryptocurrencies. On the contrary, those comfortable with higher risk may allocate a larger portion to mid and small-cap coins.

Crypto Portfolio Diversification Methods - FAQs

What Is A Good Crypto Portfolio Allocation?

Generally speaking, a 3% allocation to cryptocurrency combined with a monthly rebalancing frequency has doubled the Sharpe ratio at the expense of a very slight increase in overall portfolio volatility (often about one percentage point).

Why Is Crypto Portfolio Diversification Important?

Diversification mitigates risk by spreading investments across various assets, reducing exposure to the volatility of any single cryptocurrency.

What Is The Best Way To Diversify Your Crypto Portfolio?

- Examine your present cryptocurrency holdings.

- It can be compared to the digital economy.

- Determine any holes in your portfolio.

- Divvy up your investments.

- Periodically rebalance your investments.

How Does Including Mid And Small-cap Coins Contribute To Portfolio Diversification?

Mid and small-cap coins offer growth potential, adding diversity and balancing risk within a crypto portfolio.

What Role Do Stablecoins Play In Balancing Risk In A Crypto Portfolio?

Stablecoins provide a stable store of value, balancing the risk of volatile assets in a portfolio and preserving capital during market downturns.

Why Is Risk Tolerance Assessment Crucial In Crafting A Diversified Crypto Portfolio?

Understanding individual risk tolerance helps tailor the portfolio to investor comfort, ensuring an appropriate mix of stable and high-potential assets.

Conclusion

Crafting a resilient crypto portfolio requires a thoughtful combination of these effective crypto portfolio diversification methods.

By carefully selecting core cryptocurrencies, incorporating mid and small-cap coins, maintaining equal weight distribution, considering market capitalization, and diversifying across sectors and regions, investors can navigate the complex and dynamic cryptocurrency market with confidence.

Regular reassessment, dynamic rebalancing, and an awareness of risk tolerance further contribute to the effectiveness of a diversified crypto portfolio strategy.

Jump to

Spread Your Bets Among Different Cryptocurrencies.

Core Cryptocurrencies Allocation

Inclusion Of Mid And Small-Cap Coins

Equal Weight Distribution

Invest In Initial Coin Offerings

Market Capitalization-Based Allocation

Sector-Based Diversification

Geographical Diversification

Balancing Stablecoins And Volatile Assets

Dynamic Rebalancing

Utilizing Index Funds And ETFs

Risk Tolerance Assessment

Crypto Portfolio Diversification Methods - FAQs

Conclusion

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Gordon Dickerson

Reviewer

Gordon Dickerson, a visionary in Crypto, NFT, and Web3, brings over 10 years of expertise in blockchain technology.

With a Bachelor's in Computer Science from MIT and a Master's from Stanford, Gordon's strategic leadership has been instrumental in shaping global blockchain adoption. His commitment to inclusivity fosters a diverse ecosystem.

In his spare time, Gordon enjoys gourmet cooking, cycling, stargazing as an amateur astronomer, and exploring non-fiction literature.

His blend of expertise, credibility, and genuine passion for innovation makes him a trusted authority in decentralized technologies, driving impactful change with a personal touch.

Latest Articles

Popular Articles