Disney Rejects Peltz's Nominees, Supports Own Board; Iger Gets $31.6M

Explore the latest developments as Disney rejects Peltz's nominees for its board, affirming its commitment to strategic growth and long-term performance amid an intense activist investor battle. Get insights on the company's firm stance and future direction.

Author:Habiba AshtonReviewer:Emmanuella SheaJan 18, 202472.7K Shares970.4K Views

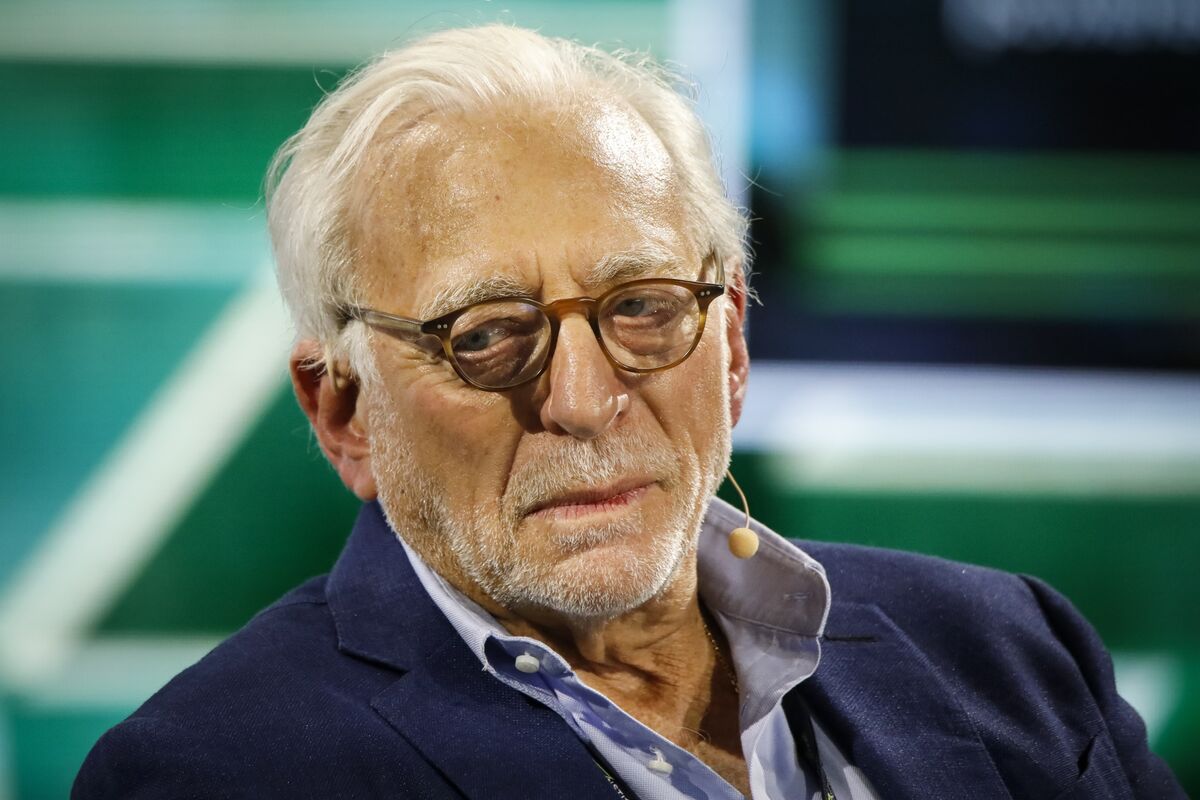

Disney rejects Peltz's nominees. Amid a high-profile activist investor battle, The Walt Disney Company, led by CEO Bob Iger, has firmly rejected board nominations from Nelson Peltz and his Trian fund, instead endorsing its own set of nominees.

The company's preliminary proxy statement details this decision, emphasizing a focus on long-term performance and strategic growth. Disney's board, including names like Mary T. Barra and Safra A. Catz, reflects the company's commitment to these goals.

"The nominees reflect Disney’s ongoing commitment to a strong board focused on the long-term performance of the company, strategic growth initiatives, the succession planning process, and increasing shareholder value,” Disney stated.

This move comes amidst a backdrop of executive pay disclosures, with Iger’s fiscal 2023 pay totaling $31.6 million, largely composed of stock and option awards.

Executive Decisions And Shareholder Dynamics

Disney's stance against Peltz and former Disney CFO Jay Rasulo, who has joined Trian in its board fight, is clear in its proxy statement. The company outlines a comprehensive rationale for its decision, citing a lack of strategic ideas from Peltz and Rasulo's outdated perspective on the business. Disney underscores the importance of experience in media and technology sectors, and the need for fresh, relevant insights in an evolving industry.

“In deciding not to recommend Mr. Peltz, the directors considered a number of factors, including that in a two year quest for a seat on the Disney Board, Mr. Peltz had not actually presented a single strategic idea for Disney; that his assessment of Disney seemed oblivious to the ongoing secular change in the media industry; that Mr. Peltz’s experience was primarily in commodity consumer packaged goods businesses and not the media or technology sector, that Mr. Peltz had no experience in a business that is primarily driven by creative talent and focused on delivering uniquely memorable customer experiences; and that Mr. Peltz’s partnership with Mr. Perlmutter, who owns the lion’s share of the equity claimed by the Trian Group, and the complexity of Mr. Perlmutter’s history with Disney and Mr. Iger and other senior executives, created significant concern regarding how that partnership would impact Mr. Peltz’s agenda as a director,” the proxy explained.

Disney also addresses the re-hiring of Brian Chapek at Marvel Studios and the company's approach to generative artificial intelligence, suggesting a broad spectrum of strategic considerations. The company's preparations for a potential proxy battle at the upcoming annual meeting are evident, as it seeks to fortify support for its board nominees against activist investors like Peltz, Rasulo, and others proposed by Blackwells.

“It’s not like we’ve got a number of empty seats — ‘Come on in join the Disney board. Have fun’,” Iger expressed at a conference, reflecting a strategic focus over mere board expansion. The shareholder vote will ultimately decide the outcome, but Disney has already secured backing from ValueAct Capital Management, another activist investor, for its board nominees.

Conclusion

Disney's clear-cut stance against the nominations put forth by Trian Fund Management, as well as the other activist fund Blackwells, is a decisive move in a complex corporate governance scenario.

The company's leadership under Iger and its board's strategic decisions reflect a deep commitment to steering Disney through a rapidly evolving media landscape and emerging technological challenges.

Habiba Ashton

Author

Habiba Ashton, an esteemed professional in Digital Marketing and Business, brings over 10 years of experience to the table. She holds a Master's degree in Marketing Management from Stanford University and is a certified Digital Marketing strategist.

Habiba has authored numerous articles on SEO, Social Media Marketing, and Branding, published across reputable platforms.

Her impactful projects have consistently driven growth and visibility for businesses, earning her accolades from clients and industry peers alike. One notable achievement includes leading a digital marketing campaign that resulted in a 30% increase in online sales for a major retail client.

Looking ahead, Habiba is committed to pioneering ethical digital marketing practices that prioritize customer trust and engagement. Her vision is to lead initiatives that foster a transparent and sustainable digital ecosystem for businesses and consumers alike.

In her free time, she enjoys cycling, stargazing, and staying updated on digital entertainment trends.

Emmanuella Shea

Reviewer

Emmanuella Shea is a distinguished finance and economics expert with over a decade of experience. She holds a Master's degree in Finance and Economics from Harvard University, specializing in financial analysis, investment management, and economic forecasting.

Her authoritative insights and trustworthy advice have made her a highly sought-after advisor in the business world.

Outside of her professional life, she enjoys exploring diverse cuisines, reading non-fiction literature, and embarking on invigorating hikes.

Her passion for insightful analysis and reliable guidance is matched by her dedication to continuous learning and personal growth.

Latest Articles

Popular Articles