Harness Elliott Wave Theory For Crypto Success - 8 Proven Strategies

Unlock the secrets of crypto trading with elliott wave theory in crypto! Learn how to ride the waves of market trends and maximize profits.

Author:James PierceReviewer:Gordon DickersonFeb 19, 2024122 Shares40.7K Views

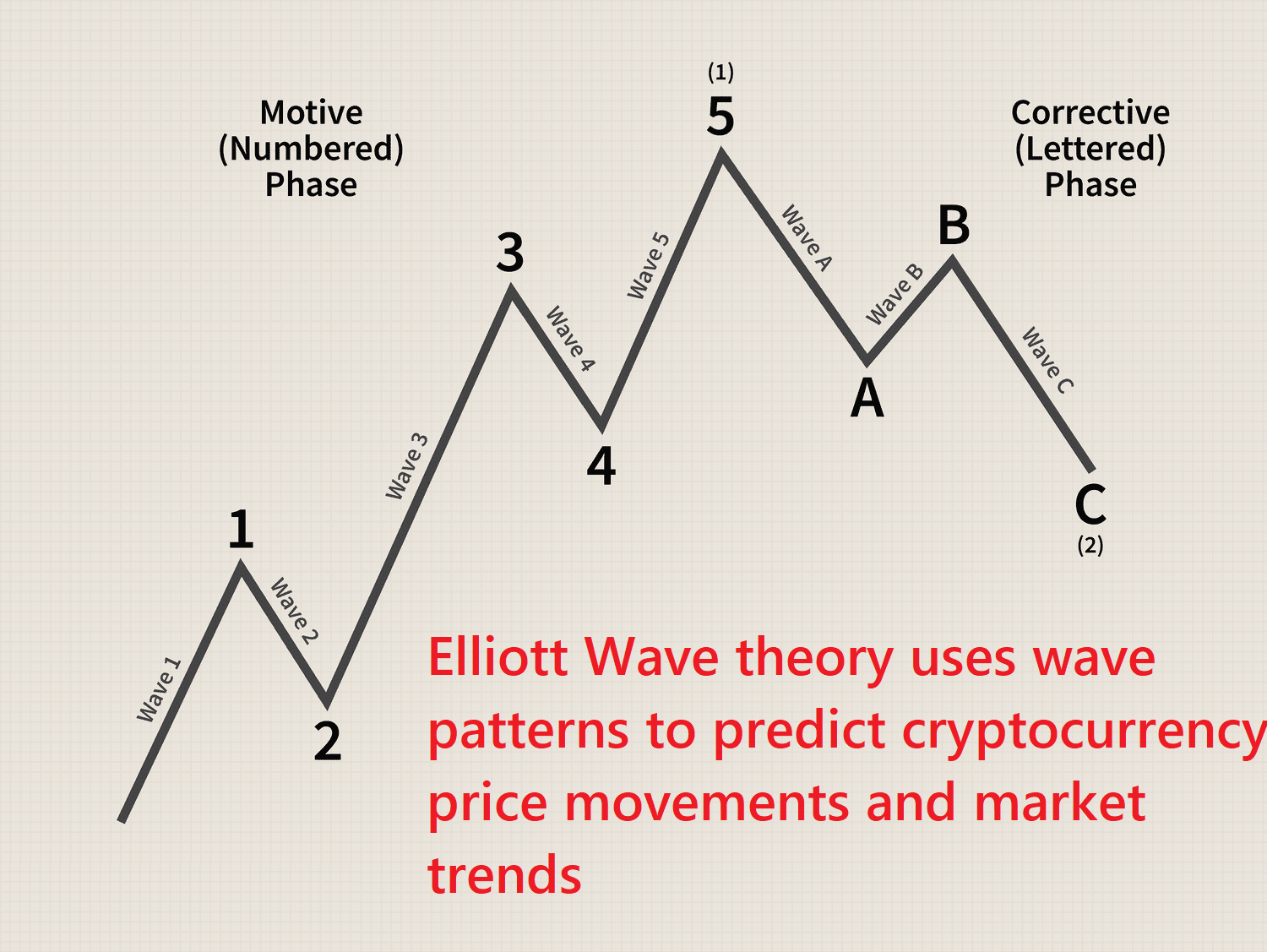

In the fast-paced world of cryptocurrency trading, mastering the Elliott Wave Theory in cryptocan be your ticket to navigating the unpredictable waves of market trends with precision and confidence. Originating from the field of technical analysis, Elliott Wave Theory offers a powerful framework for understanding market psychology and identifying potential price movements.

By recognizing repetitive patterns and wave structures, traders can gain invaluable insights into where the market might be headed next, empowering them to make informed decisions and capitalize on opportunities. Whether you're a seasoned trader or just dipping your toes into the world of crypto, embracing the principles of Elliott Wave Theory can elevate your trading game to new heights.

Mastering Crypto Trading

Here are 8 Proven Strategies To Harness Elliott Wave Theory For Crypto Success:

1. Identify The Trend

The first step to using Elliott Wave Theory for crypto success is to identify the overall trend of the market. This can be done by looking at the longer-term charts and identifying the direction of the most recent five-wave impulse pattern. Once you have identified the trend, you can start to look for opportunities to trade in line with it.

2. Use Fibonacci Retracements

Fibonacci retracements can be used to identify potential support and resistance levels. These levels can be used to enter and exit trades, as well as to take profits. To use Fibonacci retracements, simply draw a Fibonacci retracement tool from the high of the most recent five-wave impulse pattern to the low. The Fibonacci retracement levels will then appear on the chart.

3. Look For Elliott Wave Patterns

Once you have identified the trend and the Fibonacci retracement levels, you can start to look for Elliott wave patterns. These patterns can be used to identify potential trading opportunities. Some of the most common Elliott wave patterns include triangles, wedges, and flags.

4. Use Elliott Wave Indicators

There are a number of Elliott wave indicators available that can help you to identify Elliott wave patterns. These indicators can be helpful, but it is important to remember that they are not perfect and should not be used as the sole basis for your trading decisions.

5. Manage Your Risk

It is important to manage your risk when trading cryptocurrencies, regardless of whether you are using Elliott Wave Theory or not. This means using stop-loss orders to limit your losses and taking profits when you are in a winning trade.

6. Be Patient

Elliott Wave Theory is not a get-rich-quick scheme. It takes time and practice to learn how to use it effectively. Be patient and don't expect to become a successful trader overnight.

7. Do Your Own Research

Elliott Wave Theory is a complex topic. It is important to do your own research and understand how it works before you start using it to trade cryptocurrencies.

8. Stay Up-to-Date

The cryptocurrency market is constantly changing. It is important to stay up-to-date on the latest news and developments so that you can adjust your trading strategies accordingly.

Elliott Wave Theory, Explained

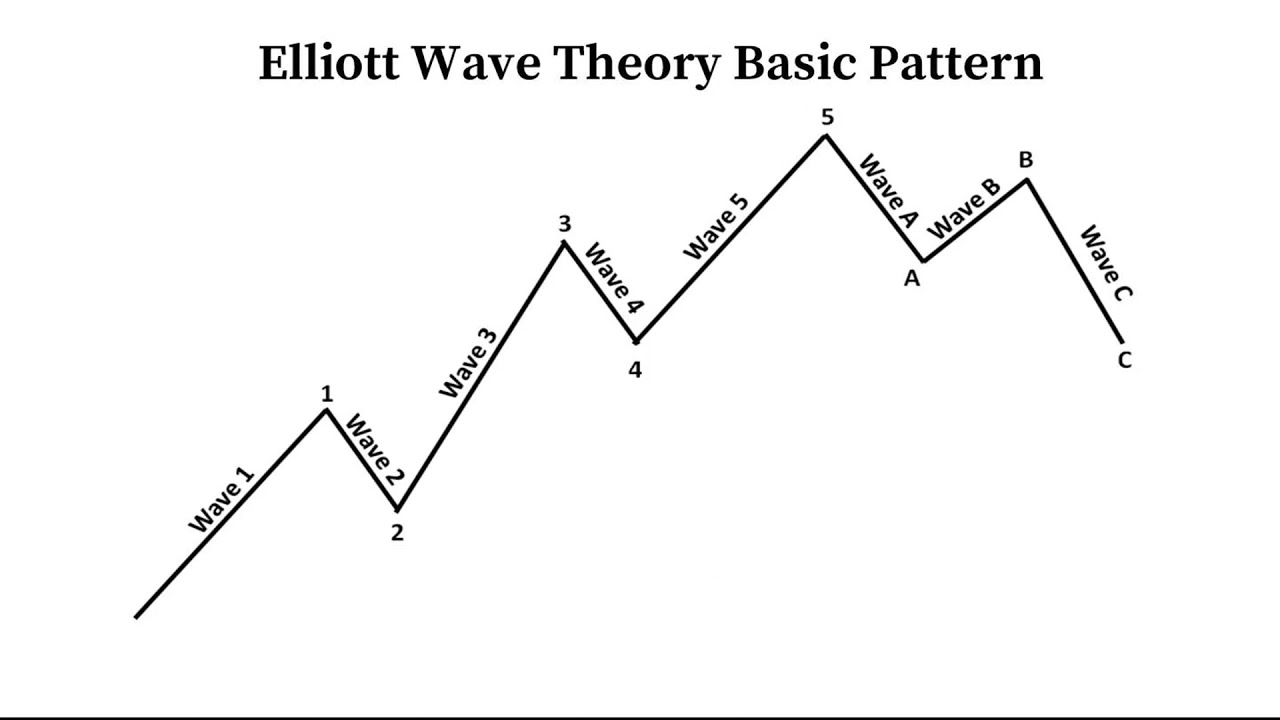

Elliott Wave Theory, developed by Ralph Nelson Elliott, is a technical analysis tool used to predict future price movements by identifying recurring patterns in market behavior. This theory proposes that market psychology drives these patterns, forming "waves" that reveal the overall trend and potential turning points. Here's a breakdown:

Key Concepts

- Waves -Elliott identified five impulse waves (1, 3, 5) following the trend and three corrective waves (2, 4) against the trend. These waves repeat at different timeframes, creating a fractal-like structure.

- Impulse Waves -These waves propel the market in the dominant direction (uptrend or downtrend). Wave 3 is usually the strongest and longest, while waves 1 and 5 subdivide into smaller impulse waves.

- Corrective Waves -These waves retrace a portion of the previous impulse wave, representing periods of consolidation or counter-trend movement. Wave A retraces most of wave 1, wave B goes against the trend, and wave C completes the correction.

- Degrees of Waves -Elliott recognized waves occurring at different timeframes, from Grand Supercycle (decades) to Subminuette (minutes). Identifying the relevant degree is crucial for accurate analysis.

The Role Of Elliott Wave Patterns In Cryptocurrency

Like in traditional markets, Elliott Wave Theory (EWT) plays a role in cryptocurrency trading by offering a framework for understanding price movements and predicting potential trends. However, due to the inherent volatility and unique characteristics of the crypto market, it's crucial to be mindful of both the potential benefits and limitations of using EWT in this context.

Benefits

- Identifying Trends -EWT helps recognize the overall market trend, aiding in aligning trades with its direction.

- Uncovering Sentiment -Corrective wave patterns can signal shifts in investor sentiment, suggesting potential trend reversals.

- Setting Entry/Exit Points -Fibonacci retracements, often used with EWT, offer potential support and resistance levels for entering and exiting trades.

- Trading Opportunities -Identifying different wave patterns within the overall trend can pinpoint potential entry and exit points for short-term trades.

Limitations

- Volatility -The high volatility of cryptocurrencies can make identifying clear wave patterns more challenging compared to slower-moving traditional markets.

- Limited History -Crypto markets have a relatively short history compared to traditional assets, making backtesting EWT strategies less reliable.

- Self-Fulfilling Prophecy -Due to its popularity, some argue that EWT becomes a self-fulfilling prophecy, influencing trader behavior and potentially invalidating its predictive power.

Elliot Wave Theory Vs. Other Indicators

Both Elliott Wave Theory (EWT) and other technical indicators aim to help traders and investors anticipate future price movements. However, they differ significantly in their approach and have distinct advantages and disadvantages. Here's a comparison:

Elliott Wave Theory

Pros

- Identifies potential trend reversals -Recognizing specific wave patterns can warn of upcoming shifts in the overall market direction.

- Captures long-term trends -EWT focuses on analyzing trends across various timeframes, offering insights into broader market cycles.

- Reflects investor psychology -The theory argues that wave patterns mirror collective investor sentiment, potentially predicting sentiment shifts.

Cons

- Highly subjective -Identifying waves can be subjective, leading to differing interpretations and potential misidentification.

- Complex and time-consuming -Learning and applying EWT effectively requires considerable dedication and practice.

- Limited historical data -Backtesting EWT strategies for short-term trading might be less reliable due to shorter market histories.

Other Technical Indicators

Pros

- Wide variety and adaptability -Many technical indicators exist, each focusing on different aspects of market behavior and adapting to various trading styles.

- Quantifiable and objective -Most indicators provide numerical outputs, reducing subjectivity and offering clear signals for buy/sell decisions.

- Easier to learn and apply -Understanding and using many indicators requires less time and effort compared to EWT.

Cons

- Short-term focus -Many indicators primarily predict short-term price movements, missing longer-term trends and potentially misleading.

- False signals and overreliance -Indicators can generate false signals, and relying solely on them can be risky.

- Market manipulation -Some indicators might be susceptible to manipulation by large market players.

Which Time Frame Is Best For Elliott Wave?

There is no single "best" timeframe for using Elliott Wave Theory. The most suitable timeframe depends on several factors, including:

Your Trading Style

- Day Trader -For shorter-term trades aiming to capitalize on quick movements, intraday charts (1-minute, 5-minute, 15-minute) might be preferable.

- Swing Trader -Targeting price swings over days or weeks, hourly, daily, or weekly charts could be more relevant.

- Long-Term Investor -Seeking to invest for months or years, monthly or even yearly charts might be more appropriate.

Market Volatility

- Highly Volatile Markets -Shorter timeframes (hourly, daily) might be helpful in identifying smaller wave patterns associated with rapid price swings.

- Less Volatile Markets -Longer timeframes (weekly, monthly) might be better suited for capturing larger wave patterns indicative of more gradual trends.

Your Comfort Level

- New User -Starting with longer timeframes (daily, weekly) can provide a broader context and make identifying waves easier initially.

- Experienced User -As your understanding of EWT matures, you can explore analyzing shorter timeframes for potential trading opportunities.

FAQ's About Elliott Wave Theory In Crypto

IS Elliott Wave Bullish Or Bearish?

The Elliott Wave Theory is based on the idea that market psychology drives the price movements, and that these patterns reflect shifts in market sentiment from bullish to bearish and back again.

What Is The Concept Of Elliott Wave Principle?

The Elliott Wave Theory suggests that stock price movements can be reasonably predicted by studying price history as the markets move in wave-like patterns driven by investor sentiment. Like ocean waves, the movements are repetitive, rhythmic, and timely.

Is Elliott Wave Good For Trading?

The Elliott Wave is coined on the idea that financial markets move in repetitive cycles. Investors can correctly determine where the market will go by identifying these patterns. This is the essence of profitable trading using the Elliott Waves, making the model unique and appealing to traders.

Conclusion

The Elliott Wave Theory serves as a potent tool for crypto traders seeking to navigate the complexities of the market with confidence and precision. By understanding the underlying principles of wave patterns and market psychology, traders can anticipate price movements and make informed decisions that align with market trends. While mastering Elliott Wave Theory requires dedication and practice, the potential rewards are substantial.

Armed with this knowledge, traders can mitigate risk, maximize profits, and ultimately thrive in the dynamic world of cryptocurrency trading. So, whether you're a novice looking to enhance your skills or a seasoned pro seeking a competitive edge, embracing Elliott Wave Theory can pave the way for success in the exciting realm of crypto markets.

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Gordon Dickerson

Reviewer

Gordon Dickerson, a visionary in Crypto, NFT, and Web3, brings over 10 years of expertise in blockchain technology.

With a Bachelor's in Computer Science from MIT and a Master's from Stanford, Gordon's strategic leadership has been instrumental in shaping global blockchain adoption. His commitment to inclusivity fosters a diverse ecosystem.

In his spare time, Gordon enjoys gourmet cooking, cycling, stargazing as an amateur astronomer, and exploring non-fiction literature.

His blend of expertise, credibility, and genuine passion for innovation makes him a trusted authority in decentralized technologies, driving impactful change with a personal touch.

Latest Articles

Popular Articles