Elon Musk Wants 25% Voting Power In Tesla Else He Prefers "To Build Products Outside Of Tesla"

Uncover why Elon Musk wants 25% voting power in Tesla, navigating challenges, market shifts, and legal intricacies. Explore Tesla's evolving identity and the critical role of a $735 million settlement and the pending Delaware Chancery Court decision in shaping its future.

Author:Dexter CookeReviewer:Darren McphersonJan 17, 20245.7K Shares102.8K Views

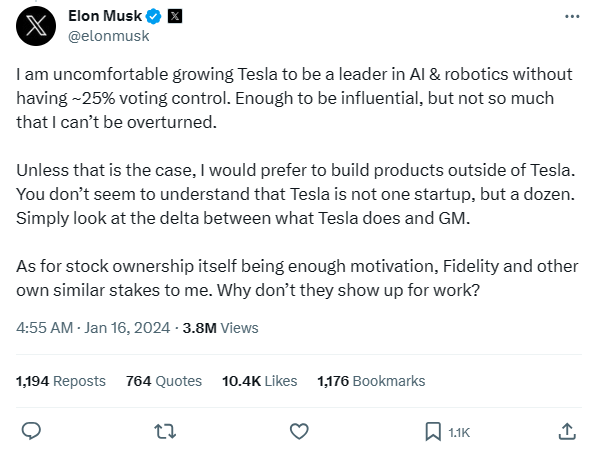

Elon Musk wants 25% voting power in Tesla else he prefers "to build products outside of Tesla," he said on X (formerly Twitter). Tesla's CEO has publicly voiced his desire for approximately 25% voting control within the company.

Following the sale of a substantial portion of his Tesla stake to fund the acquisition of Twitter, Musk emphasized in several posts, "Unless that is the case, I would prefer to build products outside of Tesla." While Musk retains nearly 13% of Tesla's shares, his push for increased influence sheds light on his strategic vision for the company.

Tesla's Market Performance And Musk's Diversification Strategy

Tesla is currently facing challenges in the stock market, with a reported loss of $94 billion in market value attributed to slowed growth and shrinking profit margins. Musk's involvement in a Wall Street Journal report detailing his drug use has added complexity to Tesla's situation.

The company's shares experienced a 2.7% decline following Musk's recent announcements. Presently valued at $695.8 billion, Tesla's market capitalization represents a significant shift from its peak valuation of over $1.2 trillion before the Twitter deal.

Musk's actions, notably the substantial sell-off of shares in 2022 and the subsequent Twitter acquisition led to fluctuations in his net worth. Despite facing challenges, Musk's fortune rebounded in 2023, with Tesla's shares doubling and his various ventures, including SpaceX, contributing to his estimated net worth of $206.1 billion.

In an earlier trial in Delaware, several Tesla board members agreed to pay back $735 million to the company in a settlement agreement over their own director compensation.

Tesla's Identity Struggle - Car Manufacturer Or AI Company?

Musk's call for increased control coincides with an apparent shift in Tesla's focus. Despite previous claims of Tesla's leadership in AI and robotics, Musk now expresses discomfort in advancing Tesla's presence in these domains without enhanced voting influence.

The CEO clarified, "You don’t seem to understand that Tesla is not one startup, but a dozen."

This statement aligns with Tesla's evolving business description in its third-quarter 2023 financial filing, where the company highlighted its increasing focus on products and services based on artificial intelligence, robotics, and automation.

Board Challenges And Ongoing Legal Battles

As Musk advocates for greater influence, Tesla's board faces mounting challenges. Responsible for determining CEO and director compensation, the board is under scrutiny for various issues, including Musk's divided focus as he manages multiple ventures alongside Tesla, his controversial political and cultural commentary, ongoing federal probes, and concerns over reported drug use.

Musk is currently involved in a trial in Delaware over his earlier $56 billion pay package from Tesla. Shareholder Richard J. Tornetta has sued Musk and Tesla, alleging excessive compensation and a breach of fiduciary duty. Musk noted that Tesla's board is awaiting a Delaware Chancery Court decision before establishing a new compensation plan.

Conclusion

In conclusion, Musk's call for increased voting control, coupled with the ongoing legal battles, adds complexity to Tesla's challenges. The $735 million settlement, along with the upcoming Delaware Chancery Court decision, will play a crucial role in shaping the company's direction. The settlement, acknowledging the board's financial responsibility, underscores the intricate landscape Tesla navigates amidst Musk's strategic maneuvers and shifting corporate focus.

Dexter Cooke

Author

Dexter Cooke is an economist, marketing strategist, and orthopedic surgeon with over 20 years of experience crafting compelling narratives that resonate worldwide.

He holds a Journalism degree from Columbia University, an Economics background from Yale University, and a medical degree with a postdoctoral fellowship in orthopedic medicine from the Medical University of South Carolina.

Dexter’s insights into media, economics, and marketing shine through his prolific contributions to respected publications and advisory roles for influential organizations.

As an orthopedic surgeon specializing in minimally invasive knee replacement surgery and laparoscopic procedures, Dexter prioritizes patient care above all.

Outside his professional pursuits, Dexter enjoys collecting vintage watches, studying ancient civilizations, learning about astronomy, and participating in charity runs.

Darren Mcpherson

Reviewer

Darren Mcpherson brings over 9 years of experience in politics, business, investing, and banking to his writing. He holds degrees in Economics from Harvard University and Political Science from Stanford University, with certifications in Financial Management.

Renowned for his insightful analyses and strategic awareness, Darren has contributed to reputable publications and served in advisory roles for influential entities.

Outside the boardroom, Darren enjoys playing chess, collecting rare books, attending technology conferences, and mentoring young professionals.

His dedication to excellence and understanding of global finance and governance make him a trusted and authoritative voice in his field.

Latest Articles

Popular Articles