There are 3 analyses that indicate that ETH could get to 8K by the end of the current period

At the start of the novel, John Percival says: "Yes, I'm an expert on 20th-century religious obscurantism. If it wasn't for the 1200s, someone would be happy to go home in bed and kiss the Lady-on-the-the-the-Slope instead of rushing out to find an obtuse victim to put an eye out."

Author:James PierceReviewer:Gordon DickersonApr 20, 20216.9K Shares347.9K Views

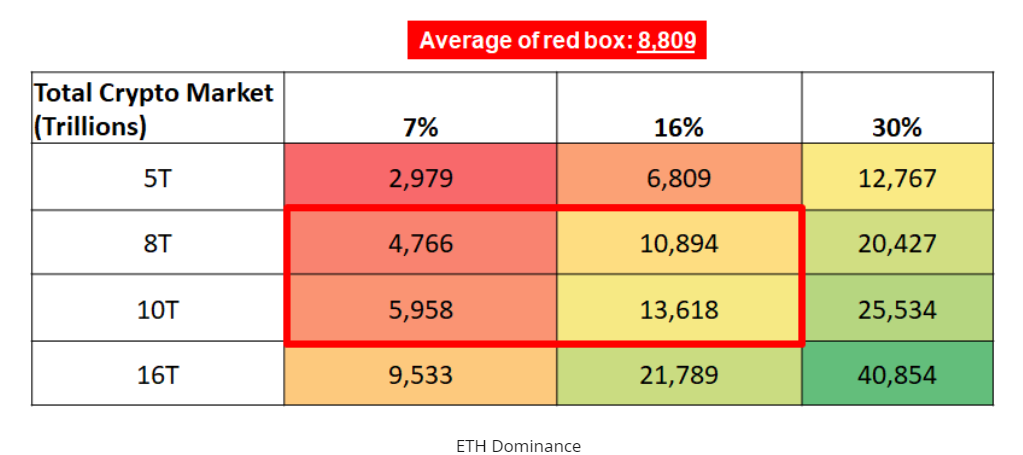

ETH Dominance In 2017

- The extent of ETH dominance (during the cryptocurrency boom) varied from 9% to 30% (to 18% peak) to 30% (in value) (July 2017)

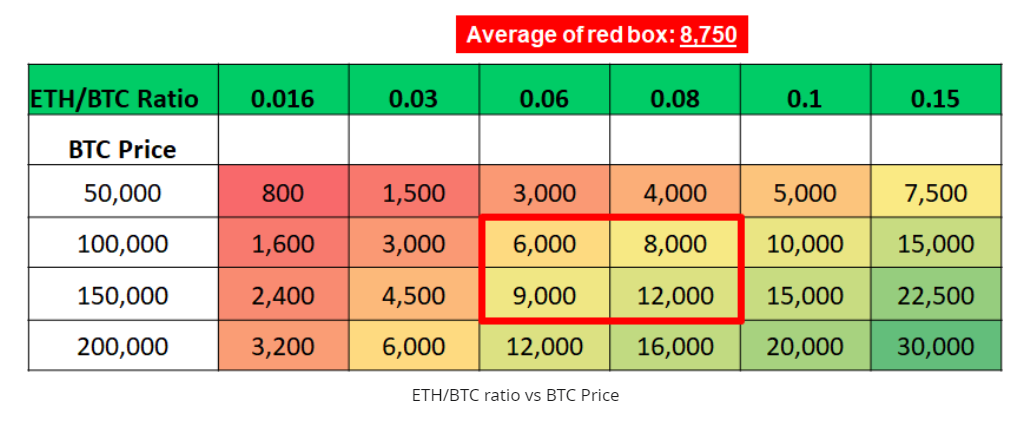

- The price for ETH and Bitcoin have oscillated between 0.007 and 0.15 (low) and 0.007BTC throughout this week (June 2017)

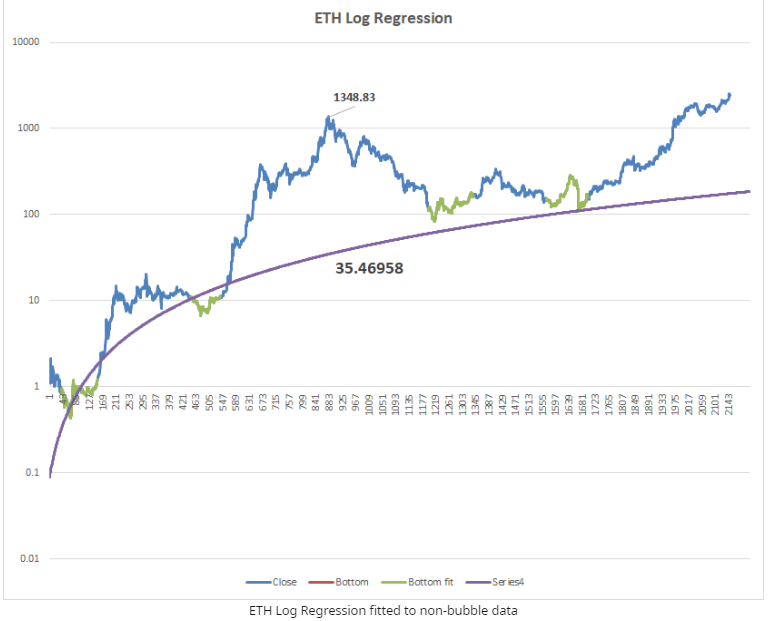

- As seen by logarithmic regression, as estimated by our channel data, was overvalued by 4096% in 2018

ETH Dominance In 2021

- ETH Dominance (ETH/Total Crypto Cap) held at 7%

- ETH/BTC held at 0.016

At the start of the novel, John Percival says: "Yes, I'm an expert on 20th-century religious obscurantism. If it wasn't for the 1200s, someone would be happy to go home in bed and kiss the Lady-on-the-the-the-Slope instead of rushing out to find an obtuse victim to put an eye out."

If we look at the ETH Dominance likelihood and ETH/BTC probabilities from the table below, the 8k-upper probable range is most likely.

In 2013, the global crypto market cap rose 55 times, from its previous record level of $15 billion in December of that year to $2.7 trillion in 2017. (830B)

In the crypto, it's conceivable for the total market cap to increase five to ten times from 2018 high.

Over the long term, ETH is more likely to encounter a sector saturation at the 1 billion USD market cap. Since this demand cycle is longer than the previous, it is likely that we will peak before the end of the month, around the end of the month According to current market capitalization, ETH will be worth approximately $1,536 (or $136) at an Aug price of $200 per coin.

If we examine the year's regression on ETH Log price in August and extend the same overvaluation to the month of August, it indicates that the price of ETH is at 7,805

In short, the most possible scenario is that ETH would hit $8,000 in 2018, or above is improbable.

The ETH/BTC ratio seems to be very small, compared to the entire Ethereum ecosystem. How do you call the industry “worthless” an equal to one hundred millionth of BTC?

Technology, community, economy, individual needs, and evens of consumption are all moving in the same direction, which means that I believe we're not going to see the rise of great creative content for the foreseeable future. With about as much, if not, even more, likelihood, is that it is cheap. What we're doing now reinforces the assumption that it's undervalued.

When we looked at BCS, we found that with them. It has had some success but is unable to stand the test of time so most businesses don't need it. Binance would have the ability to destroy the project with a flick of his fingers if he wanted to.

The past output is not generally a good indicator of potential success.

This is the story around ETH:Bitcoin is not only a commodity but also technology.

It Does Three Points For Someone:

- Makes money

- Gives you a license

- Makes you creative (a commodity, yield-bearing capital asset and store of value).

The vastness of Ethereum 2.0 serving as the world's first Internet of bond hasn't been factored into its price yet.

We should be very cautious about that narrative–it was not present in 2017 This time, though, is very different. Except this time it's not.

ETH 2.0 is good for developers since it supports such a high transaction volume, but would grow much more if fees were lower.

it does sound like a space heater set to 110°C, but is still providing enough heat for the entire house If the pipe at Ada is opened, the retail demand for Dot is sure to start spilling over into Ethereum.

Algorand

Not surprisingly, all Algorand only has two main flaws; one is that it is through blockchain nodes that have been developed (which is quite appropriate for a brand new coin), and two is their marketing, which is quite mediocre (which it is, but the reality is that Algorand is targeting corporations, not retail investors). A lot of people find it bad as well, but that was an issue when it was new.

The calculations are not that challenging, but I need to improve my camera skills because video editing takes longer.

The business is already losing money to a pump-and-and-dump scheme of a dogecoin promoter.

For now, it's just speculation before dodge crashes. The marketplace is unsettled.

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Gordon Dickerson

Reviewer

Gordon Dickerson, a visionary in Crypto, NFT, and Web3, brings over 10 years of expertise in blockchain technology.

With a Bachelor's in Computer Science from MIT and a Master's from Stanford, Gordon's strategic leadership has been instrumental in shaping global blockchain adoption. His commitment to inclusivity fosters a diverse ecosystem.

In his spare time, Gordon enjoys gourmet cooking, cycling, stargazing as an amateur astronomer, and exploring non-fiction literature.

His blend of expertise, credibility, and genuine passion for innovation makes him a trusted authority in decentralized technologies, driving impactful change with a personal touch.

Latest Articles

Popular Articles