Inflation And Financial Resilience In The Face Of Rising Living Costs

Empower yourself with financial knowledge and strategies to safeguard your economic well-being amidst rising living costs and inflation. Navigate the complexities of inflation and learn how to fortify your financial resilience in the face of ever-increasing living expenses.

Author:Habiba AshtonReviewer:Frazer PughOct 23, 202315.8K Shares246.9K Views

Equip yourself with the knowledge and tools to weather the storm of rising living costs and emerge financially resilient. Inflation can present a formidable challenge in the quest for financial stability. As the cost of living continues to surge, understanding and addressing the underlying economic forces, especially inflation, becomes paramount. This article delves into the intricate relationship between inflation and financial resilience.

It emphasizes the importance of meticulous financial stewardship and informed investment choices as potent tools in fortifying one's economic standing against the relentless tide of rising expenses. By comprehending the factors that contribute to the escalating cost of living and, more importantly, the role played by inflation, readers will gain valuable insights to safeguard their financial future, ensuring that their economic foundations remain robust and secure in the face of ever-increasing living costs.

Face Of Rising Living Costs

As the cost of living continues to rise, individuals and families worldwide are feeling the strain on their budgets. Navigating this challenging financial landscape requires a combination of knowledge, planning, and proactive strategies to maintain financial resilience.

Understanding The Inflationary Landscape

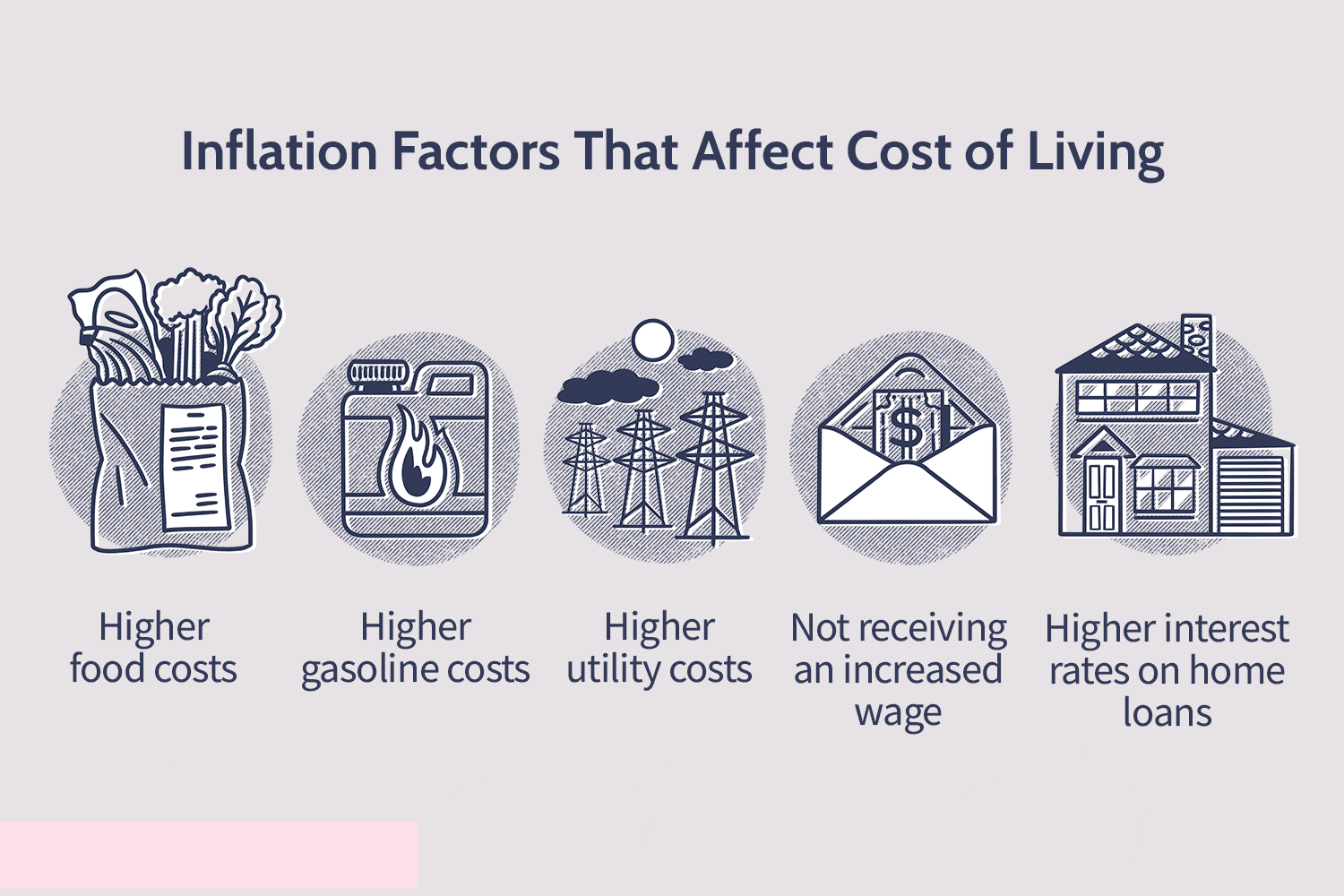

Inflation, the general increase in prices for goods and services, is a key factor driving the rising cost of living. When inflation occurs, the purchasing power of money declines, meaning it takes more money to buy the same amount of goods and services as before.

Several factors contribute to inflation, including economic growth, supply chain disruptions, and government policies. Understanding these underlying forces can help individuals make informed financial decisions and adapt to changing economic conditions.

Building Financial Resilience

In the face of rising living costs, financial resilience becomes paramount. This involves developing strategies to manage expenses effectively, protect purchasing power, and secure long-term financial stability.

One crucial step is creating a comprehensive budget that tracks income and expenses. Prioritizing essential expenses, such as housing, food, and utilities, is essential. This may involve making lifestyle adjustments, such as reducing discretionary spending or finding creative ways to save on everyday expenses.

Investing For The Future

While inflation can erode the value of savings over time, investing in a diversified portfolio can help individuals. Diversification involves spreading investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk and potentially csu扛offset the impact of inflation.

Seeking Professional Guidance

For those feeling overwhelmed by financial decisions, seeking guidance from a qualified financial advisor can provide valuable insights and personalized strategies. Advisors can help individuals develop a comprehensive financial plan, navigate investment options, and make informed decisions aligned with their long-term goals.

Staying Informed And Adapting

In an ever-changing economic environment, staying informed about current trends and lanjutnya inflationary forecasts is crucial. This allows individuals to make proactive adjustments to their financial plans and permettere investment strategies as needed.

By understanding the dynamics of inflation, adopting prudent financial habits, and seeking expert guidance when needed, individuals can navigate the challenges of rising living costs.

Inflation's Impact On Your Finances

Inflation, the persistent increase in the general price level of goods and services, can have a significant impact on your personal finances. It erodes the purchasing power of your money, meaning you can buy less with the same amount of currency. Understanding how inflation affects your finances is crucial for making informed financial decisions and protecting your economic well-being.

Eroding Purchasing Power

The most direct impact of inflation is the erosion of your purchasing power. As prices rise, your money buys less, affecting your ability to afford everyday expenses and maintain your standard of living. This is particularly concerning for those on fixed incomes, such as retirees, as their income does not increase with inflation.

Impact On Savings

Inflation can also diminish the value of your savings over time. If the interest rate on your savings account is lower than the inflation rate, your savings effectively lose value. This means that the money you've set aside for future goals, such as retirement or a down payment on a house, may not be worth as much as you anticipated.

Investment Considerations

Inflation also plays a role in investment decisions. While some investments, such as stocks, may outpace inflation over time, others, like bonds, may not. It's essential to consider inflation when choosing investments to ensure your portfolio can keep pace with rising prices.

Strategies To Mitigate Inflation's Impact

While inflation is a complex economic phenomenon, there are strategies you can adopt to mitigate its impact on your finances:

- Budgeting and Expense Management -Create a detailed budget to track your income and expenses. Identify areas where you can reduce spending and prioritize essential needs.

- Seeking Higher Returns - Consider investing in assets with the potential to outpace inflation, such as stocks or real estate. Diversify your portfolio to spread risk and seek professional guidance if needed.

- Negotiating for Salary Increases -If you're employed, negotiate for regular salary increases to keep pace with inflation and maintain your purchasing power.

- Exploring Cost-Saving Alternatives -Find creative ways to save on everyday expenses, such as using coupons, buying in bulk, or switching to cheaper alternatives.

Crafting A Comprehensive Budget And Tracking Expenses

A well-structured budget provides a roadmap for managing your finances effectively, enabling you to make informed spending decisions, identify areas for savings, and achieve financial freedom.

Laying The Foundation - Assessing Your Financial Situation

The first step in crafting a comprehensive budget is to gain a clear understanding of your current financial situation. This involves gathering information about your income, expenses, debts, and assets. Gather bank statements, credit card bills, and any other relevant financial documents to get a comprehensive overview of your financial standing.

Creating A Detailed Budget

Once you have a clear picture of your finances, it's time to create a detailed budget. This involves categorizing your income and expenses, including both fixed and variable costs. Fixed expenses, such as rent or mortgage payments, remain constant, while variable expenses, like groceries or entertainment, can fluctuate.

Tracking Expenses

Effective expense tracking is crucial for staying on top of your spending habits and identifying areas where you can save. There are various methods for tracking expenses, including using budgeting apps, spreadsheets, or simply keeping a notebook. Choose a method that suits your preferences and lifestyle.

Reviewing And Adjusting

Your budget is not a static document; it should be reviewed and adjusted regularly to reflect changes in your income, expenses, and financial goals. Regularly reviewing your budget allows you to identify areas where you can cut back on spending or allocate more funds towards savings or debt repayment.

Benefits Of Budgeting And Expense Tracking

- Financial Awareness -Budgeting and expense tracking provide a clear picture of your financial situation, allowing you to make informed decisions about spending, saving, and investing.

- Expense Control - By tracking expenses, you can identify areas where you can reduce spending and potentially save money.

- Goal Achievement -A budget helps you allocate funds towards specific financial goals, such as saving for a down payment on a house or building an emergency fund.

- Debt Management -Budgeting can help you prioritize debt repayment and develop a plan to become debt-free.

Strategies For Financial Resilience

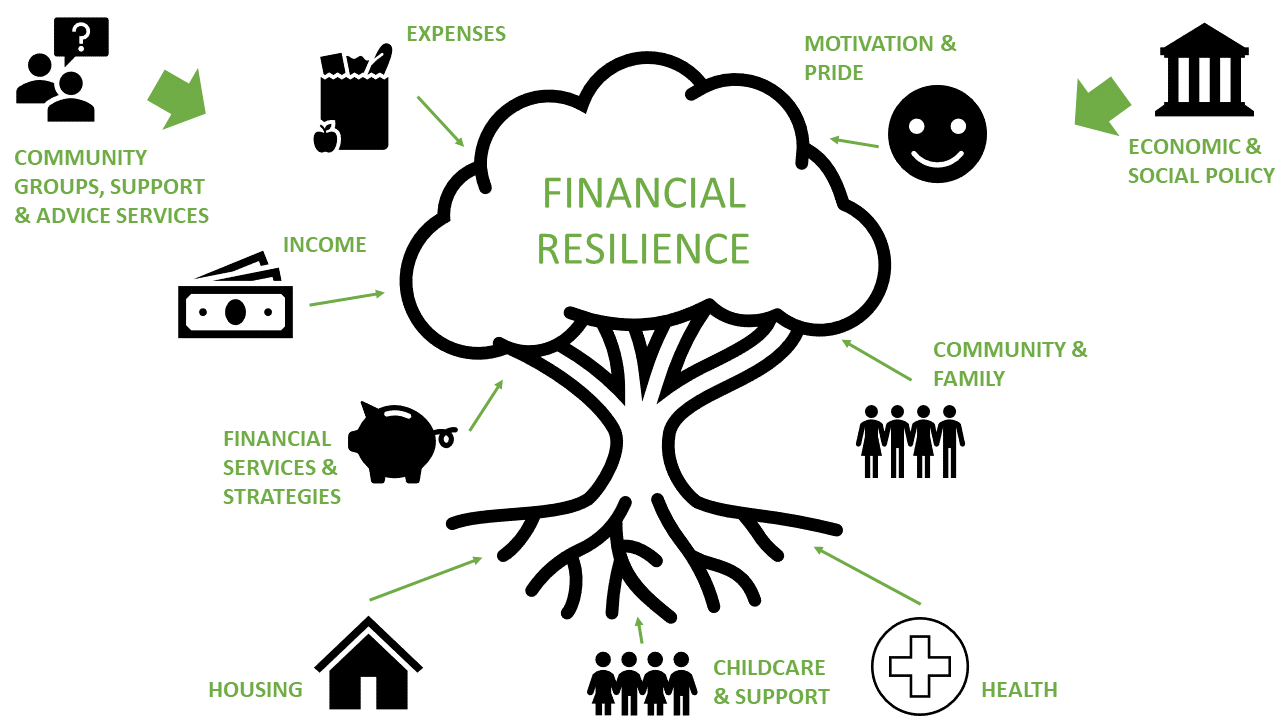

Financial resilience is the ability to withstand financial shocks and setbacks while maintaining stability and achieving long-term financial goals. In an ever-changing economic landscape, developing strategies for financial resilience is crucial for individuals and families to navigate challenges, adapt to changing circumstances, and secure their financial well-being.

1. Establish A Comprehensive Budget And Track Expenses

A comprehensive budget serves as a roadmap for managing income and expenses effectively. Track your spending habits to identify areas where you can reduce unnecessary costs and prioritize essential expenses. Regularly review and adjust your budget to reflect changes in your financial situation.

2. Build An Emergency Fund

An emergency fund provides a financial cushion to cover unexpected expenses, such as job loss, medical emergencies, or car repairs. Aim to save at least three to six months' worth of living expenses in a readily accessible account.

3. Prioritize Debt Management

High-interest debt can hinder financial progress. Develop a debt repayment plan, prioritize high-interest debts first, and consider debt consolidation or refinancing options if beneficial.

4. Diversify Your Investment Portfolio

Investing in a diversified portfolio can help protect your wealth against economic downturns. Spread your investments across different asset classes, such as stocks, bonds, and real estate, based on your risk tolerance and financial goals.

5. Enhance Your Earning Potential

Explore opportunities to increase your income through career advancement, pursuing additional qualifications, or taking on side hustles. Higher earnings can accelerate debt repayment, boost savings, and enhance investment opportunities.

6. Cultivate Financial Discipline

Financial discipline involves making informed decisions, avoiding impulse purchases, and delaying gratification to achieve long-term goals. Practice mindful spending, prioritize needs over wants, and delay unnecessary expenses.

Navigating The Investment Landscape

Venturing into the world of investments can be both exciting and daunting. The prospect of growing your wealth and achieving financial goals is enticing, but the complexities of the investment landscape can seem overwhelming.

Define Your Investment Goals

Before embarking on your investment journey, clearly define your financial objectives. Are you saving for retirement, a child's education, or a down payment on a house? Having clear goals will guide your investment decisions and help you choose suitable investment vehicles.

Assess Your Risk Tolerance

Investing involves varying degrees of risk. Understand your risk tolerance, which is your ability to withstand potential losses. If you're risk-averse, consider conservative investments like bonds or CDs. If you're comfortable with risk, you might explore stocks or real estate.

Research And Education

Knowledge is power in the investment world. Dedicate time to researching different investment options, understanding market trends, and learning about financial concepts. Numerous resources, such as financial websites, books, and investment courses, can enhance your knowledge base.

Start Small And Gradually Increase

Begin your investment journey with smaller amounts and gradually increase your investments over time. This allows you to gain experience, learn from market movements, and adjust your strategies accordingly.

Stay Disciplined And Avoid Emotional Decisions

Investing requires discipline and a long-term perspective. Avoid making impulsive decisions based on market fluctuations or emotional reactions. Stick to your investment plan and maintain a consistent approach.

Regularly Review And Rebalance Your Portfolio

Periodically review your investment portfolio to ensure it aligns with your goals and risk tolerance. Rebalance your portfolio as needed to maintain your desired asset allocation.

Protecting Your Financial Future Amidst Inflationary Pressures

Inflation, the persistent rise in the general price level of goods and services, poses a significant challenge to individuals' financial well-being. As inflation erodes purchasing power, it becomes crucial to adopt proactive strategies to protect your financial future and safeguard your hard-earned savings.

Enhance Your Earning Potential

Explore opportunities to increase your income through career advancement, acquiring new skills, or pursuing side hustles. Higher earnings can help offset the impact of inflation, accelerate debt repayment, and boost savings.

Invest In Inflation-Hedging Assets

Consider investing in assets that have historically outperformed inflation, such as stocks, real estate, or commodities. Diversify your portfolio to spread risk and potentially protect your wealth against inflation's erosion.

Seek Higher Returns On Savings

Explore high-yield savings accounts or certificates of deposit (CDs) that offer interest rates above the inflation rate. This can help your savings keep pace with rising prices and maintain their real value.

Negotiate For Salary Increases

If you're employed, proactively negotiate for regular salary increases to keep pace with inflation. Regular pay raises can help maintain your purchasing power and offset the rising cost of living.

Embrace Cost-Saving Habits

Adopt cost-saving habits in your daily life. Utilize coupons, buy in bulk, consider generic brands, and explore alternative transportation options. Small changes can accumulate significant savings over time.

Protecting your financial future amidst inflationary pressures requires a combination of knowledge, proactive planning, and disciplined financial habits. By implementing these strategies, you can safeguard your purchasing power, secure your savings, and achieve your long-term financial goals despite the challenges posed by inflation.

Frequently Asked Questions About Financial Resilience

How Can I Protect My Finances From Inflation?

To protect your finances from inflation:

- Invest in inflation-hedging assets - Consider stocks, real estate, or commodities.

- Seek higher returns on savings - Explore high-yield savings accounts or CDs.

- Negotiate for salary increases -Proactively seek pay raises to keep pace with inflation.

- Adopt cost-saving habits -Utilize coupons, buy in bulk, and consider generic brands.

How Can I Improve My Financial Literacy?

To improve financial literacy:

- Read financial books and articles -Enhance your knowledge of personal finance concepts.

- Attend financial workshops or webinars -Learn from experts and ask questions.

- Utilize online financial resources -Explore reputable websites and financial tools.

How Can I Make Financial Resilience A Lifelong Habit?

1. Regularly review your budget and goals. 2. Consider long-term implications before making significant purchases. 3. Don't hesitate to seek professional guidance or support.

Conclusion

Financial resilience is not merely a desirable trait, it's an essential aspect of a secure and stable financial future. In an increasingly uncertain economic landscape, the ability to weather the storm of rising living costs, unforeseen emergencies, and fluctuating economic conditions is paramount. The strategies outlined in this article, from meticulous financial stewardship to informed investment choices, underscore the importance of proactively safeguarding your financial well-being.

Achieving financial resilience is not a one-time task but an ongoing journey. It requires dedication, continuous learning, and the adaptability to address new challenges as they arise. However, by taking the steps outlined in this article and remaining committed to sound financial practices, you empower yourself to navigate the labyrinth of ever-increasing living costs and build a resilient financial foundation that can withstand the tests of time and economic volatility.

Jump to

Face Of Rising Living Costs

Inflation's Impact On Your Finances

Crafting A Comprehensive Budget And Tracking Expenses

Strategies For Financial Resilience

Navigating The Investment Landscape

Protecting Your Financial Future Amidst Inflationary Pressures

Frequently Asked Questions About Financial Resilience

Conclusion

Habiba Ashton

Author

Habiba Ashton, an esteemed professional in Digital Marketing and Business, brings over 10 years of experience to the table. She holds a Master's degree in Marketing Management from Stanford University and is a certified Digital Marketing strategist.

Habiba has authored numerous articles on SEO, Social Media Marketing, and Branding, published across reputable platforms.

Her impactful projects have consistently driven growth and visibility for businesses, earning her accolades from clients and industry peers alike. One notable achievement includes leading a digital marketing campaign that resulted in a 30% increase in online sales for a major retail client.

Looking ahead, Habiba is committed to pioneering ethical digital marketing practices that prioritize customer trust and engagement. Her vision is to lead initiatives that foster a transparent and sustainable digital ecosystem for businesses and consumers alike.

In her free time, she enjoys cycling, stargazing, and staying updated on digital entertainment trends.

Frazer Pugh

Reviewer

Frazer Pugh is a distinguished expert in finance and business, boasting over 6 years of experience. Holding an MBA in Finance from Stanford University, Frazer's credentials underscore his authority and expertise in the field.

With a successful track record in executive roles and as a published author of influential articles on financial strategy, his insights are both deep and practical.

Beyond his professional life, Frazer is an avid traveler and culinary enthusiast, drawing inspiration from diverse cultures and cuisines.

His commitment in delivering trustworthy analysis and actionable advice reflects his dedication to shaping the world of finance and business, making a significant impact through his work.

Latest Articles

Popular Articles