How Much Does A Bank Manager Make?

Unlock the Secrets of Bank Manager Salaries - Discover the lucrative world of banking careers! Dive into the details of how much does a bank manager make, salary insights, and career growth.

Author:James PierceReviewer:Alberto ThompsonJan 19, 2024700 Shares233.4K Views

Embark on a journey into the realm of financial success as we unveil the captivating details of how much does a bank manager make?Picture a career where leadership meets financial prowess – a bank manager's role is not only about managing operations but also about earning a substantial income. On average, bank managers enjoy a rewarding salary, often reflecting their expertise in navigating the intricate landscape of finance.

In today's competitive world, financial institutions understand the value of top-tier talent, compensating bank managers generously for their strategic insights and managerial finesse. Delve into the figures and discover the earning potential that awaits those who take the helm in the dynamic world of banking. It's not just a career; it's a pathway to financial empowerment.

What Is A Bank Manager Salary?

Determining the exact salary of a bank manager depends on several factors, including:

1. Location -Salaries for bank managers can vary significantly depending on the region and cost of living. For example, bank managers in big cities like New York or London typically earn more than those in smaller towns.

2. Experience -Like most careers, bank managers earn more with experience. Those with more years under their belt can command higher salaries and bonuses.

3. Bank type -The type of bank can also impact salary. Generally, commercial banks and investment banks pay higher than smaller community banks.

4. Specific role -Bank managers oversee different areas, with specialized positions like branch managers or wealth management directors typically earning more than general bank managers.

But it can fall into the general range:

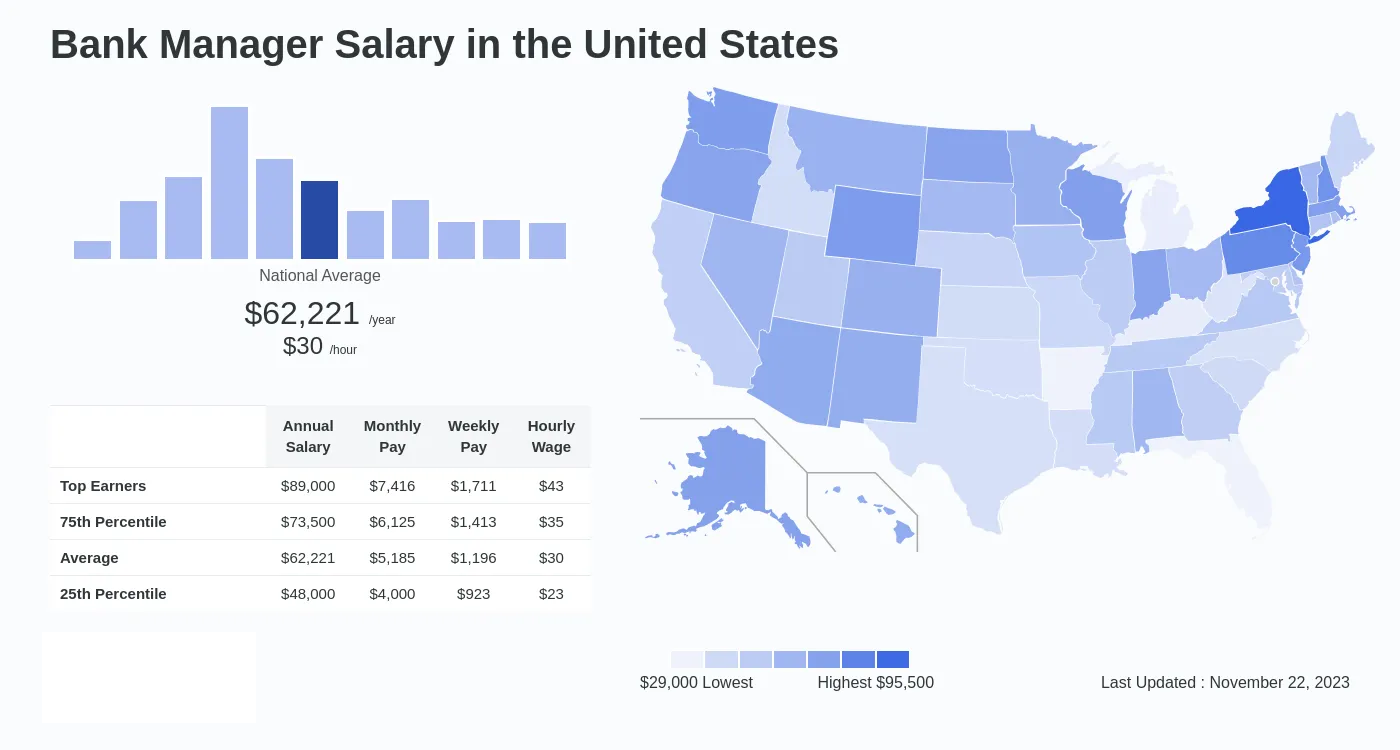

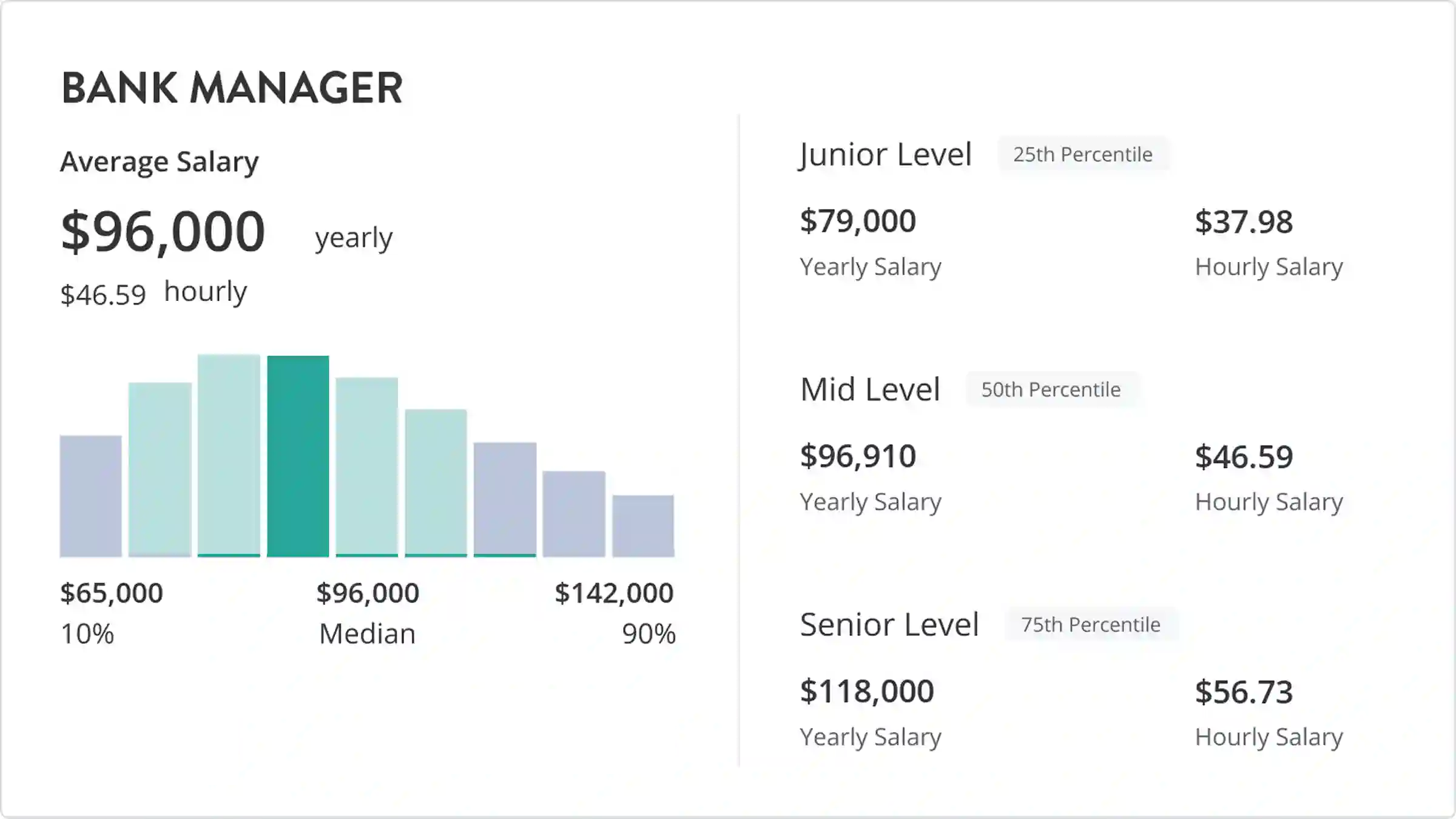

- In the United States -The average annual salary for a bank manager is between $46,000 and $93,000. This includes base salary, bonuses, profit sharing, and commissions.

- In the United Kingdom -The average annual salary for a bank manager is around £35,997.

Salary Structure And Pay Scale Comparison

Understanding salary structure and pay scale comparisons is crucial for both employees and employers. Here's a breakdown of both terms.

Salary Structure

It's a system used by organizations to determine employee compensation based on various factors. Common factors include:

- Job level -Jobs are grouped into tiers (pay grades) based on their complexity, responsibility, and required skills. Each grade has a salary range.

- Experience -Employees typically earn more as they gain experience within their role or field.

- Performance -Bonuses or merit increases may be awarded for exceeding expectations.

- Location -Compensation may vary depending on cost of living differences across regions.

- Education and qualifications -Some roles require specific qualifications or education levels, which can influence salary.

Types Of Salary Structures

- Traditional -A hierarchical system with multiple pay grades and narrow ranges within each grade.

- Broadband -Fewer pay grades with wider salary ranges within each, offering more flexibility.

- Hybrid -Combines elements of both traditional and broadband structures.

Pay Scale Comparison

It's the process of analyzing and comparing salaries for similar jobs across different organizations, industries, or locations. This helps individuals assess their current compensation and employers to set competitive salaries.

Resources for pay scale comparison include:

- Salary survey websites -PayScale, Glassdoor, Indeed

- Government data -Bureau of Labor Statistics (BLS)

- Industry associations -Trade groups often publish salary data for their members.

Benefits Of Understanding Salary Structures And Pay Scale Comparisons

For employees

- Negotiate fair compensation during job offers or salary reviews.

- Identify career paths with higher earning potential.

- Evaluate job offers based on salary competitiveness.

For employers

- Attract and retain top talent by offering competitive salaries.

- Ensure internal pay equity among employees in similar roles.

- Benchmark against industry standards for salary competitiveness.

Do The Specific Responsibilities Impact Salary?

Absolutely, specific responsibilities can significantly impact a bank manager's salary. Here's how:

1. Branch Size and Complexity

- Managing a large, complex branch with numerous employees and high transaction volume typically commands a higher salary than overseeing a smaller, simpler branch.

- Responsibilities like handling larger deposits, complex financial products, and high-net-worth clients can increase the pay scale.

2. Risk and Performance Targets

- Managing riskier portfolios or loan accounts, achieving ambitious sales targets, or exceeding profitability goals can lead to performance-based bonuses or higher base salaries.

- Taking on additional responsibilities like compliance oversight or regulatory reporting can also be reflected in compensation.

3. Specialization and Expertise

- Managing a specialized branch, like wealth management or investment banking, often demands unique expertise and carries a higher salary potential compared to a general retail bank manager.

- Specific knowledge of niche financial products or markets can be a valuable asset and command a premium.

4. Leadership and Management Skill

- Effectively leading and motivating teams, fostering a positive work environment, and demonstrating strong decision-making skills are crucial for success.

- Managers with exceptional leadership qualities and proven track records in team development can command higher salaries.

What Are Top 10 Highest Paying Cities For Bank Manager Jobs

Determining the exact top 10 highest-paying cities for bank manager jobs can vary slightly depending on the data source and specific criteria used. However, based on recent information from reputable sources, here are some contenders:

United States

- San Jose, CA -With a median bank manager salary exceeding $108,000, San Jose takes the top spot, likely due to the high cost of living and presence of tech giants influencing overall salaries.

- San Francisco, CA -Following closely behind with a median salary topping $107,000, San Francisco's financial hub and high living costs contribute to its high paying rank.

- New York, NY -The Big Apple is a constant presence in high-paying job lists, and bank managers are no exception. With a median salary above $100,000, New York's competitive financial scene drives up compensation.

- Seattle, WA -The growing tech and finance sector in Seattle has boosted bank manager salaries, pushing the median towards $100,000.

- Boston, MA -Home to several financial institutions and a high cost of living, Boston offers bank managers a median salary around $98,000.

- Oakland, CA -The Bay Area presence extends to Oakland, where bank managers earn a median salary close to $96,000.

- Washington, D.C. -The nation's capital attracts high-level salaries across various sectors, and bank managers benefit with a median around $95,000.

- Los Angeles, CA -Another major city with a high cost of living and a significant financial sector, Los Angeles offers bank managers a median salary about $94,000.

- Miami, FL -The growing financial scene in Miami combined with a high cost of living pushes the median bank manager salary towards $94,000.

- Denver, CO -Denver's booming economy and growing financial sector offer bank managers a median salary exceeding $92,000.

Which Bank Pays The Most For Managers?

| JPMorgan Chase & Co | $114,1932 |

| Chase | $112,6773 |

| Citizens | $106,4894 |

| Wells Fargo | $104,9455 |

| Bank of America | $102,778 |

What Is The Lowest Salary Of Bank Manager?

Determining the absolute "lowest" salary for a bank manager in the UK is difficult due to various factors influencing individual cases. However, here's an overview:

General Range

- The average bank manager salary in the UK is around £47,011 per year or £24.11 per hour, according to Talent.com.

- Entry-level positions can start as low as £33,417 per year.

Minimum Wage Considerations

- The UK National Living Wage for people aged 25 and over is currently £9.50 per hour.

- Bank managers should generally earn above the minimum wage, but specific situations might exist where entry-level roles in certain locations, particularly smaller towns, could be close to the minimum wage.

Typical Salary Progress For Most Careers

Understanding typical salary progress for most careers is crucial for career planning and financial stability. Here's a breakdown of what to expect.

General Trends

- Early Career (20s-30s) -This is usually the period of the fastest salary growth due to factors like gaining experience, acquiring new skills, and promotions. Average annual increases of 5-10% are common.

- Mid-Career (30s-40s) -Salary growth usually continues, but at a slower pace compared to early career. Increases of 2-5% per year are common. Focus shifts towards specialized skills and leadership roles for higher jumps.

- Late Career (40s-50s) -Salary growth tends to plateau or even slow down further. Increased responsibility and expertise can still lead to significant raises, but they might be less frequent.

- Pre-Retirement (50s-60s) -Salary may remain stable or even decrease depending on job type, industry, and retirement planning strategies.

Factors Influencing Salary Progression

- Education and Qualifications -Higher education or specialized certifications can significantly boost starting salaries and long-term earning potential.

- Experience and Skillset -Gaining experience and refining skills leads to promotions, increased responsibilities, and higher pay.

- Industry and Job Type -Certain industries like tech or finance offer higher average salaries. Specialized jobs within any field can command higher pay compared to generalist roles.

- Location -Cost of living differences across regions can impact salaries. High-cost cities often offer higher overall compensation.

- Company Size and Reputation -Larger, well-established companies typically offer higher salaries and better benefits compared to smaller firms.

- Negotiation Skills -Effective negotiation during job offers and salary reviews can significantly impact earning potential.

Which Degree Is Best For Bank Manager?

There's no single "best" degree for a bank manager, as the ideal qualifications can vary depending on specific career goals, bank type, and location. However, several degrees provide a strong foundation for becoming a bank manager, and here are some popular options:

Bachelor's Degrees

- Business Administration -Offers a broad understanding of business principles, including finance, management, marketing, and accounting. Excellent for entry-level positions and progressing to supervisory roles.

- Finance - Provides in-depth knowledge of financial concepts, analysis, and risk management. Ideal for positions focused on investments, lending, or financial planning.

- Economics -Develops analytical skills and understanding of economic trends and market forces. Valuable for roles requiring strategic analysis and decision-making.

- Accounting -Offers strong numeracy skills and knowledge of financial reporting and regulations. Crucial for positions involving risk management, compliance, and internal controls.

Master's Degrees

- Master of Business Administration (MBA) -Enhances leadership, communication, and strategic management skills. Highly valued for senior management positions.

- Master of Finance (M.Fin.) -Deepens financial knowledge and expertise in areas like quantitative analysis, portfolio management, and financial modeling. Beneficial for specialized financial roles.

Bonus And Incentive Rates - Bank Branch Manager

The specific bonus and incentive rates for bank branch managers can vary significantly depending on several factors, including.

1. Bank Size And Type

- Large national banks -Often offer higher base salaries but potentially lower bonuses and incentives due to standardized structures.

- Smaller community banks -Might offer lower base salaries but potentially higher bonuses and incentives tied to local performance and branch profitability.

- Investment banks -Typically offer the highest overall compensation packages, including significant bonuses and incentives based on individual and team performance in revenue generation and deal-making.

2. Location

- High-cost cities -Banks operating in expensive locations (e.g., New York City, London) might offer higher bonuses and incentives to attract and retain talent.

- Rural areas -Smaller communities might have lower bonus and incentive rates due to smaller market size and potential limitations on growth.

3. Performance Metrics

- Profitability -Many banks tie bonuses and incentives to the branch's overall profitability, including factors like net interest income, fee income, and loan originations.

- Individual performance -Some banks also factor in individual performance metrics like customer satisfaction, sales targets achieved, and employee engagement.

- Team performance -In team-oriented environments, bonuses and incentives might be based on the entire branch team's achievements against set goals.

4. Experience And Qualifications

- More experienced and highly qualified branch managers often command higher bonus and incentive rates due to their ability to drive better results.

- Certain specialized certifications or specific industry knowledge might also result in increased bonus eligibility.

5. Market Conditions

- Economic downturns or challenging market conditions can lead to reduced bonus and incentive rates across the banking industry.

- Conversely, strong economic performance and robust market growth can result in increased bonus and incentive payouts.

General Ranges For Bonus And Incentive Rates For Bank Branch Managers

- National banks -10%-20% of base salary, potentially reaching 30% for exceptional performance.

- Community banks -20%-30% of base salary, with potential for higher payouts based on local market conditions and branch performance.

- Investment banks -50%-100% of base salary, with top performers exceeding 100% in bonus payouts.

Additional Resources

- Glassdoor provides salary estimates based on user-submitted data: https://www.glassdoor.co.uk/Job/banking-jobs-SRCH_KE0,7.htm

- PayScale also offers salary information for bank managers: https://uk.talent.com/salary?job=bank+manager

While it's impossible to pinpoint the absolute lowest salary for every bank manager situation, these insights should give you a good understanding of the salary range and the factors that influence it.

Please note

- These figures are based on median salaries, meaning half of bank managers in these cities earn more and half earn less.

- Specific bank type, experience level, and individual skills can significantly impact individual salaries.

- Cost of living and other factors can also influence the perceived "high paying" nature of a city.

FAQ's About How Much Does A Bank Manager Make?

Why Managers Are Usually Highly Paid?

Career advancement and development opportunities: A managerial role can be a significant step toward more senior management positions. Increased pay: Managers tend to be rewarded with a higher salary due to increased responsibility for resources, employees, and projects.

What Is The Lowest Position In A Bank?

Bank tellers are typically entry-level positions at banks that directly interact with and service customers. Most employers require at least a high school diploma, but advancement will often require a bachelors degree.

Which Degree Is Best For Bank Manager?

Graduation while pursuing your bachelor's degree, you will study subjects like financial systems, taxation, accountancy, business management, cost accounting, company law and many more. Post-graduation: it is advisable to pursue an MBA in finance or banking to become a bank manager.

Conclusion

The compensation landscape for bank managers is undeniably enticing, reflecting the crucial role they play in steering financial institutions towards success. As we unravel the mysteries of their earning potential, it becomes evident that a career as a bank manager is not only about overseeing operations but is also a pathway to financial prosperity.

With competitive salaries that acknowledge their expertise and leadership, bank managers stand at the forefront of a lucrative industry, where their financial acumen is not only valued but generously rewarded. So, for those aspiring to carve a rewarding career in finance, the journey begins with understanding the substantial earnings that come with the pivotal role of a bank manager a role where financial success meets professional fulfillment.

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Alberto Thompson

Reviewer

Alberto Thompson is an acclaimed journalist, sports enthusiast, and economics aficionado renowned for his expertise and trustworthiness. Holding a Bachelor's degree in Journalism and Economics from Columbia University, Alberto brings over 15 years of media experience to his work, delivering insights that are both deep and accurate.

Outside of his professional pursuits, Alberto enjoys exploring the outdoors, indulging in sports, and immersing himself in literature. His dedication to providing informed perspectives and fostering meaningful discourse underscores his passion for journalism, sports, and economics. Alberto Thompson continues to make a significant impact in these fields, leaving an indelible mark through his commitment and expertise.

Latest Articles

Popular Articles