How To Edit Bank Statement - 5 Easy And Effective Solutions

Unlock financial freedom with our expert guide on how to edit bank statement! Discover the essential steps and tools you need to modify your bank statement safely and legally.

Author:Camilo WoodReviewer:Emmanuella SheaJan 22, 2024366 Shares30.5K Views

Embark on a journey of financial empowerment with our comprehensive guide on how to edit a bank statement?Are you tired of feeling restricted by the numbers on your financial records? Our step-by-step instructions will unveil the secrets to editing your bank statement with precision and ease, providing you the freedom to shape your financial narrative according to your needs.

Discover the power to navigate your financial journey confidently, armed with the knowledge to edit your bank statement effectively. We demystify the process, ensuring you understand the ins and outs while emphasizing the importance of ethical and legal considerations. Unleash the potential to present your financial story in the way that suits you best – because your financial freedom begins with the ability to edit and mold your bank statement to reflect your unique financial aspirations.

5 Easy And Effective Solutions - How To Edit Bank Statement

Unlock financial flexibility with these five easy and effective solutions on how to edit your bank statement.

1. Digital Editing Tools

Leverage user-friendly digital editing toolsthat simplify the process of modifying your bank statement. From adjusting transaction amounts to tweaking dates, these tools offer intuitive interfaces, making it a breeze to tailor your financial records with precision.

2. Spreadsheets Mastery

Excel and other spreadsheet applications are powerful allies in your quest for edited bank statements. Learn the art of spreadsheet manipulation to modify figures seamlessly. Our guide provides detailed instructions on harnessing the spreadsheet's potential to edit and customize your financial data effortlessly.

3. PDF Editing Software

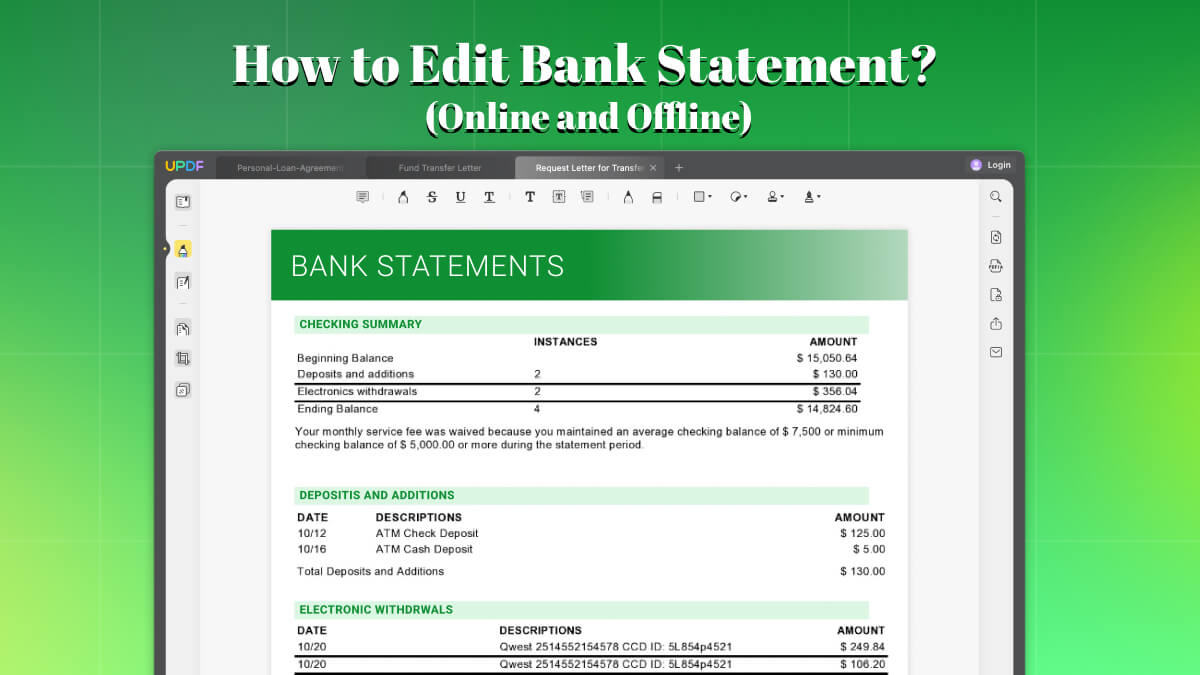

Dive into the world of PDF editing softwaredesigned to enhance and modify bank statements. These tools allow you to add, remove, or alter information within your statements, ensuring a polished and refined result. Our step-by-step tutorial ensures you make the most of these programs with ease.

4. Data Entry Expertise

Develop precise data entry skills to manually edit your bank statement. This solution requires careful attention to detail, but with our expert tips, you'll be able to navigate through your financial records, correcting discrepancies and ensuring accuracy in your edited statements.

5. Consulting Professional

When in doubt, seek guidance from financial professionals experienced in statement editing. Our guide outlines how to approach and collaborate with experts who can provide legitimate advice and ensure that any modifications made align with legal and ethical standards.

Embark on your journey to financial empowerment with these easy and effective solutions, mastering the art of editing your bank statement with confidence and precision.

Can I Remove Transactions From My Bank Statement?

No, you cannot directly remove transactions from your official bank statement issued by your bank. These statements are a chronological record of all financial activities on your account and serve as legal documents for both you and the bank.

However, there are some situations where transactions might appear differently on your statement:

- Pending transactions -These haven't been processed yet and may disappear or change once finalized.

- Temporary holds -Some merchants might place temporary holds that later disappear from your statement without any action needed.

- Refunds -If you return an item or have a transaction reversed, the original transaction might be reversed or replaced with a refund, showing a different final amount.

If you see an incorrect or unauthorized transaction on your statement, you should not attempt to remove it yourself, instead, follow these steps:

1. Contact your bank immediately -Report the discrepancy and follow their instructions to investigate the issue.

2. Gather evidence -Keep any relevant documentation like receipts, emails, or screenshots to support your claim.

3. File a dispute -The bank will initiate a dispute investigation to determine the source of the error.

4. Monitor the progress -Stay informed about the investigation and follow up with your bank if needed.

How To Edit A Bank Statement PDF Online?

Altering or manipulating bank statements is illegal and can have serious consequences. Always rely on legitimate communication and collaboration with your bank to resolve any discrepancies in your statements. Here are some alternative suggestions for working with bank statements:

1. Contact Your Bank Directly

If you need to change or update information on your bank statement, the best course of action is to contact your bank directly. They can help you make any necessary changes to your account or provide you with a corrected statement.

2. Use Authorized Financial Tools

Many banks offer online banking platforms and mobile apps that allow you to download and manage your statements electronically. These tools provide a safe and secure way to access and manipulate your financial information within the framework of authorized options.

3. Invest In Financial Planning Tools

Consider using budgeting or finance tracking software to categorize your transactions and analyze your spending habits. These tools can provide valuable insights into your financial situation without requiring any edits to your official bank statements.

Can I Edit My Bank Statement For Personal Use?

No, you should not edit your bank statement for any reason, even for personal use. Editing, modifying, or falsifying official bank documents is illegal and can have serious consequences, regardless of your intent.

1. Fraudulent Activity -Tampering with your bank statement constitutes fraud, a serious crime punishable by fines and even imprisonment.

2. Financial Reputational Damage -Altered documents can be easily detected by banks and credit bureaus, jeopardizing your financial reputation and impacting your ability to secure loans or credit in the future.

3. Employment Issues -Using an edited bank statement for employment purposes (e.g., proof of income) can lead to job termination or legal action.

4. Personal Consequences -Even if you're not caught, manipulating your bank statement can create financial instability and lead to other problems down the line.

Instead of editing your statement, consider these alternative solutions for addressing your personal needs:

- Reconcile your accounts -Review your statement for any discrepancies and contact your bank if there are errors.

- Explain your situation -If you need a specific document for a personal reason, talk to your bank about alternative options like providing bank verification letters or recent transaction statements.

- Seek professional help -If you're facing financial difficulties, consult a financial advisor or credit counselor for guidance on managing your finances ethically and constructively.

Alternative Ways To Edit Bank Statements

Editing official bank statements is illegal and highly risky. Any attempt to manipulate these documents can have serious consequences, including fraud charges, financial reputation damage, and even legal action. Therefore, I cannot provide any information or instructions on how to edit bank statements, regardless of the context.

1. Use your online banking portal -Most banks offer online banking platforms where you can download and customize transaction reports based on your preferences. You can filter transactions by date, category, or amount, and export them in different formats like PDF or CSV. This allows you to create an unofficial document tailored to your specific needs without altering the official bank statement.

2. Create a budget spreadsheet -You can manually enter your income and expenses in a spreadsheet program like Excel or Google Sheets. This allows you to categorize your transactions, calculate totals, and analyze your spending habits. This document serves as a personal financial tool and does not affect your actual bank records.

3. Request bank verification letters -Your bank can provide official letters verifying your account balance, income, or transaction history for a specific period. These letters are legitimate documents accepted by many institutions and do not involve modifications to your official statement.

4. Seek professional help -If you need assistance structuring your financial information for a specific purpose, such as applying for a loan or visa, consider consulting a financial advisor or accountant. They can help you prepare official documents and provide guidance on financial planning and management.

Remember, there are always ethical and legal ways to present your financial information in a way that serves your needs. Please prioritize these alternative solutions and avoid any attempts to modify official bank statements, which can lead to serious repercussions.

Can You Change The Name Of Something On A Bank Statement?

While you can't directly change the names on your official bank statement, in some specific situations, there might be ways to achieve a similar outcome.

1. Update your account information -If the merchant name on your statement is inaccurate or outdated, you can contact your bank to request an update. They might be able to adjust the name if they can verify the correct information.

2. Explain your situation -If you need the names on your statement to appear differently for a specific reason (e.g., merging accounts), talk to your bank about alternative options. They might be able to provide separate statements or official letters clarifying the situation.

3. Use unofficial documents -You can create your own document summarizing your financial information, including renaming transactions for your personal understanding. Remember, this wouldn't be an official bank document and shouldn't be used for verification purposes.

4. Seek documentation from other sources -For certain purposes, like applying for a visa, you might be able to use alternative documents to verify your income or transactions. Consider official letters from employers or receipts for specific transactions instead of relying on edited bank statements.

Can Edited Bank Statement PDF Be Detected?

Detecting edited bank statement PDFs depends on the nature and sophistication of the edits, as well as the tools and expertise used for analysis. Here's a breakdown of the possibilities:

1. Detectable Edits

- Obvious Visual Cues -Clumsy edits like mismatched fonts, inconsistent spacing, or pixelation around altered content can be readily spotted with careful visual inspection.

- Metadata Inconsistencies -Changes to the document's metadata, such as creation date, author, or software used, may leave inconsistencies if not meticulously edited.

- Digital Forensics Analysis -Advanced forensic tools can analyze pixel-level changes, hidden text or objects, and digital signatures to uncover manipulated elements.

2. Difficult-to-detect Edits

- Skilled Edits -Professional edits using sophisticated graphic design software might appear seamless to the naked eye, blending perfectly with the original document.

- Data Alteration -Modifying specific text within the PDF, like transaction amounts or dates, can be challenging to detect without comparing it to the original bank statement or using specialized software.

3. Factors Influencing Detection

- Complexity of Edits - The simpler the edit, the higher the chance of detection. Complex edits require greater effort and skill to conceal.

- Tools Used -Basic editing tools leave more traces than professional software designed to mask alterations.

- Expertise of Analyzer - Trained investigators and forensic analysts have a higher chance of spotting sophisticated edits compared to untrained individuals.

How Do You Blur A Bank Statement?

Instead of considering blurring your statement, here are some safe and legal options for achieving your goals.

1. Use unofficial documents -You can create your own document summarizing your financial information, leaving out or obscuring sensitive details for personal use. Remember, this wouldn't be an official bank document and shouldn't be used for verification purposes.

2. Redact specific information -Some PDF editing software offers redaction tools that allow you to black out specific information on the statement while preserving the integrity of the document. However, even this practice can be questionable if used to conceal financial activity.

Please Note

- Never intentionally alter your official bank statement. Doing so is illegal and can have serious consequences.

- Always prioritize transparency and honesty in financial matters.Seek legitimate solutions that accurately represent your financial situation.

- Consult your bank or a financial professional if you're unsure about the best way to present your financial information.

FAQ's About How To Edit Bank Statement?

Is It Possible To Edit A Bank Statement?

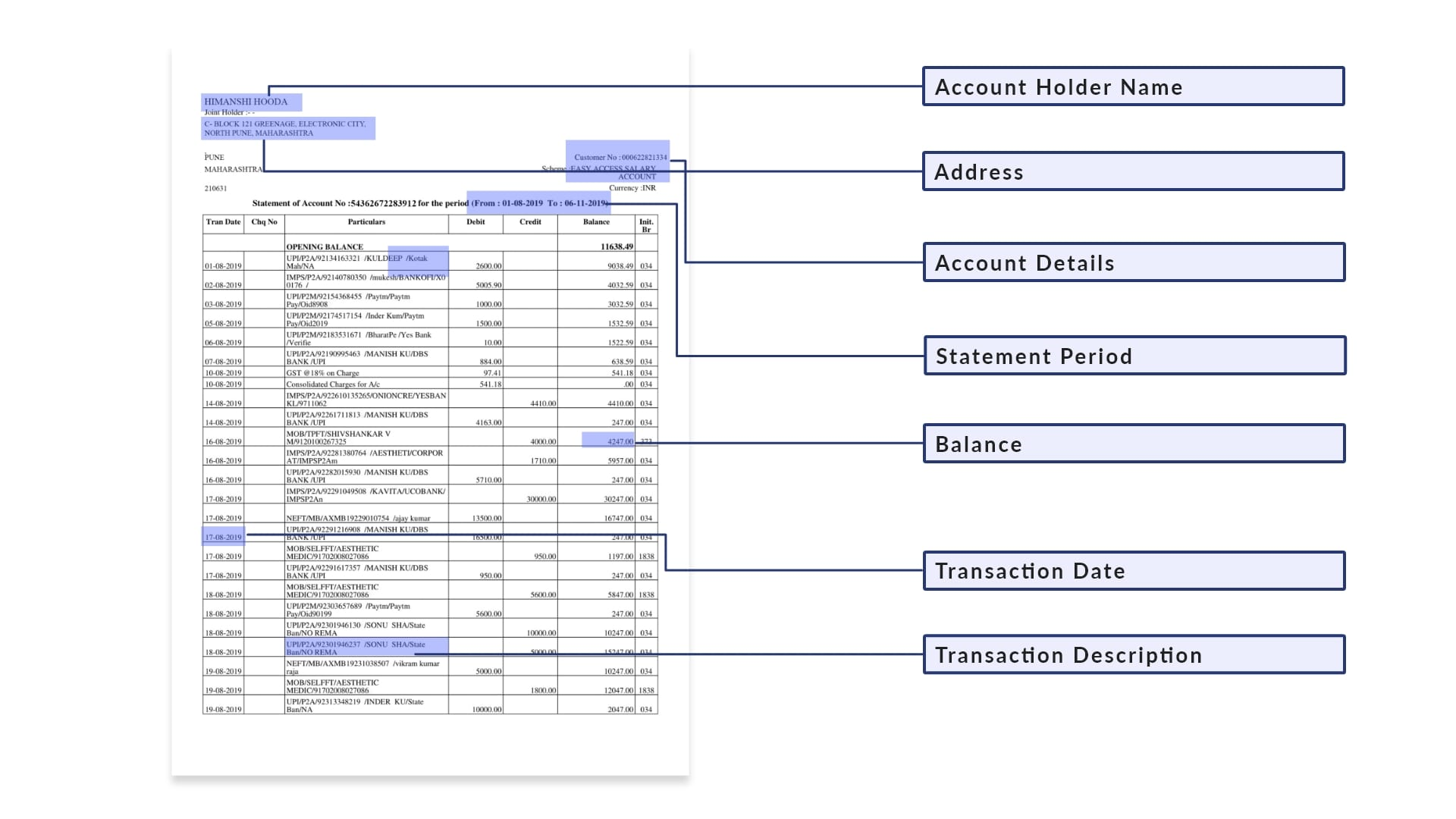

The bank statement template usually has a header & footer, main content on top, and tables that contain transaction information and other details. So, you can open UPDF and click "File" > "Open" and choose your PDF bank statement. Click "Edit PDF" and then double-click on a text to make it editable.

Can PDF Bank Statements Be Altered?

Even PDF files that are not in text format can still be edited through other means. Techniques such as using screen capture software to take an image of the document and then editing and resaving it can be used to change an electronic file.

What Is Bank Statement Correction?

A debit deposit correction means funds are moving from the payable into the deposit to compensate for the exposure and a credit deposit correction implies funds are moving back from the deposit into the payable as the exposure has now been balanced.

Conclusion

Mastering the skill of editing bank statements is a gateway to personal financial empowerment. The array of techniques, from digital tools and spreadsheet proficiency to PDF editing software and meticulous data entry, provides individuals with the flexibility to tailor their financial narratives to better suit their needs. However, it is crucial to approach this process responsibly, ensuring adherence to legal and ethical standards.

The ability to edit a bank statement is not just about manipulating numbers; it's about taking control of one's financial story. Armed with the knowledge and skills outlined in our guide, individuals can navigate their financial journey with confidence, making informed decisions that align with their unique goals and aspirations. Remember, financial empowerment begins with the ability to shape your narrative – and mastering the art of editing your bank statement is a significant step towards achieving that autonomy.

See Also: How To Read Your Bank Statement?

Jump to

5 Easy And Effective Solutions - How To Edit Bank Statement

Can I Remove Transactions From My Bank Statement?

How To Edit A Bank Statement PDF Online?

Can I Edit My Bank Statement For Personal Use?

Alternative Ways To Edit Bank Statements

Can You Change The Name Of Something On A Bank Statement?

Can Edited Bank Statement PDF Be Detected?

How Do You Blur A Bank Statement?

FAQ's About How To Edit Bank Statement?

Conclusion

Camilo Wood

Author

Camilo Wood has over two decades of experience as a writer and journalist, specializing in finance and economics. With a degree in Economics and a background in financial research and analysis, Camilo brings a wealth of knowledge and expertise to his writing.

Throughout his career, Camilo has contributed to numerous publications, covering a wide range of topics such as global economic trends, investment strategies, and market analysis. His articles are recognized for their insightful analysis and clear explanations, making complex financial concepts accessible to readers.

Camilo's experience includes working in roles related to financial reporting, analysis, and commentary, allowing him to provide readers with accurate and trustworthy information. His dedication to journalistic integrity and commitment to delivering high-quality content make him a trusted voice in the fields of finance and journalism.

Emmanuella Shea

Reviewer

Emmanuella Shea is a professional financial analyst with over 9 years of experience in the financial markets. Emmanuella is still concerned about the long-term stability of multimillion-dollar financial portfolios. She is skilled at persuading and manipulating high-ranking individuals in addition to her work as a Financial Analyst. Her decisions are trusted and respected, and her views are highly regarded. Her long-term ambition is to work as a policy advisor at the national level. She wants to use her unwavering dedication and drive to help developing-country people gain more dignity and autonomy.

Latest Articles

Popular Articles