How To Write A Financial Summary - Mastering Financial Reports

When it comes to managing finances, one important skill to have is the ability how to write a financial summary. A financial summary is a brief overview of a company's revenue, expenses, profits, and losses, as well as its overall financial performance.

Author:James PierceReviewer:Camilo WoodMar 21, 20235 Shares318 Views

When it comes to managing finances, one important skill to have is the ability how to write a financial summary. A financial summary is a concise overview of a company's financial performance, including revenue, expenses, profits, and losses.

It is often used to provide key stakeholders, such as investors and board members, with a quick snapshot of the company's financial health.

Writing an effective financial summary requires a clear understanding of the company's financial statements and the ability to distill complex financial information into easy-to-understand language.

In this article, we will discuss how to write a financial summary that effectively communicates a company's financial performance.

How To Write A Financial Summary

Understand The Purpose Of The Financial Summary

The first step in writing a financial summary is to understand the purpose of the document. The financial summary is not meant to provide a detailed analysis of the company's financial statements, but rather to provide a high-level overview of the company's financial performance.

The financial summary should answer key questions such as:

- What is the company's revenue?

- What are the company's expenses?

- What is the company's net income?

- What are the company's key financial metrics, such as earnings per share or return on equity?

Gather Financial Information

To write an effective financial summary, you will need to gather financial information from the company's financial statements.

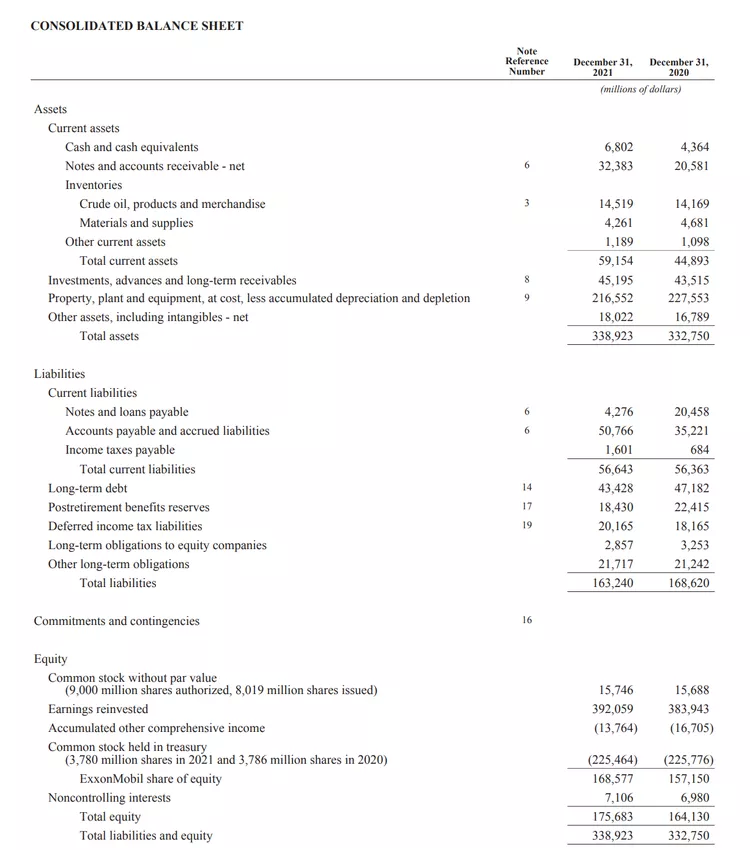

The financial statements you will need to review include the income statement, balance sheet, and cash flow statement.

These statements will provide you with the key financial information you need to include in your financial summary.

Determine The Key Financial Metrics

Once you have reviewed the company's financial statements, you will need to determine the key financial metrics that you will include in your financial summary.

These metrics may vary depending on the industry and the company's specific goals and objectives.

Some common financial metrics to include in a financial summary include revenue growth, gross profit margin, net income, and return on equity.

Write The Financial Summary

Once you have gathered the necessary financial information and determined the key financial metrics, you can begin writing the financial summary.

The financial summary should be concise and easy to understand. Use bullet points and short sentences to highlight the key financial metrics and provide a brief explanation of what each metric means.

Edit And Review The Financial Summary

Once you have written the financial summary, it is important to edit and review the document to ensure that it is accurate and effectively communicates the company's financial performance.

Make sure that the financial summary is free of errors and that it includes all of the key financial metrics that are important for stakeholders to know.

Basic Financial Statements

Financial Summary Example

A financial summary is a concise overview of a company's financial performance over a specific period. It provides important insights into the company's revenue, expenses, and overall profitability. Here's an example of a financial summary for a hypothetical company:

XYZ Corporation Financial Summary

The financial summary shows that the company had a revenue of $500,000 and incurred expenses of $350,000, resulting in a net income of $150,000.

This indicates that the company was able to generate a profit of $150,000 during the specified period.

Financial summaries can also include other important metrics such as cash flow, return on investment, and debt-to-equity ratio.

These metrics provide additional insights into a company's financial health and can help investors make informed decisions about investing in the company.

It's important to note that financial summaries should be tailored to the intended audience.

For example, a financial summary for investors may include more detailed information than a summary for internal management.

The goal is to provide a clear, concise overview of the company's financial performance and position.

Tips For Creating A Financial Summary For Investors

Creating a financial summary for investors is an important aspect of business planning. It allows potential investors to get an overview of your company's financial health and performance, which can help them make an informed decision about whether or not to invest in your business.

Here are some tips for creating an effective financial summary for investors:

- Keep it concise: Investors don't have the time or patience to wade through pages and pages of financial data. Keep your financial summary concise and to the point, highlighting the most important information in a clear and easy-to-understand format.

- Use graphs and charts: Graphs and charts can be a great way to visually represent your financial data, making it easier for investors to understand key trends and patterns.

- Highlight key metrics: Be sure to highlight key metrics such as revenue growth, profit margins, and return on investment. These metrics give investors a good indication of your company's financial health and potential for growth.

- Provide context: While it's important to highlight your company's financial performance, it's also important to provide context for that performance. Be sure to explain any external factors that may have impacted your company's financials, such as changes in the market or industry trends.

- Be transparent: Finally, it's important to be transparent with your financial summary. Don't try to hide any negative trends or challenges your company may be facing. Instead, be upfront about any risks or challenges investors should be aware of, as this will build trust and credibility with potential investors.

What To Include In A Financial Summary For A Non-Profit Organization

A financial summary is a critical component of a non-profit organization's annual report, grant proposal, or fundraising campaign.

It provides an overview of the organization's financial health, including revenue, expenses, assets, and liabilities.

Here are some important items to include in a financial summary for a non-profit organization:

Revenue

Detail the sources of income for the organization, including donations, grants, and program fees. It's essential to show the percentage breakdown of each revenue source.

Expenses

Outline the expenses incurred by the organization, including salaries, rent, supplies, and program costs. It's important to show the percentage breakdown of each expense category.

Net Income

Calculate the net income by subtracting total expenses from total revenue. It's crucial to highlight if the organization is running at a surplus or a deficit.

Assets

List the organization's assets, including cash, investments, and property. It's essential to show the value of each asset and its percentage of the organization's total assets.

Liabilities

Outline the organization's liabilities, including loans, accounts payable, and mortgages. It's important to show the value of each liability and its percentage of the organization's total liabilities.

Financial Ratios

Use financial ratios to provide a clearer picture of the organization's financial health. Common financial ratios for non-profit organizations include the program expense ratio, fundraising efficiency ratio, and administrative expense ratio.

By including these key items in a financial summary, non-profit organizations can provide stakeholders with a clear understanding of the organization's financial health and sustainability.

People Also Ask

What Is A Financial Summary Report?

A financial summary report is a document that provides a concise overview of the financial performance of a company or organization. It typically includes key financial metrics such as revenue, expenses, net income, and cash flow.

How Do You Write A Financial Summary For A Business Plan?

To write a financial summary for a business plan, you should first gather financial data for your company, such as income statements, balance sheets, and cash flow statements.

Next, you should identify the key financial metrics that are most important for your business, such as revenue growth, profit margins, and cash reserves.

Finally, you should use this data to create a clear and concise financial summary that highlights the financial health of your company.

What Should Be Included In A Financial Summary?

A financial summary should include key financial metrics such as revenue, expenses, net income, and cash flow, as well as other important information such as profit margins, debt levels, and inventory turnover.

It should also provide a brief overview of the financial health of the company, including any challenges or opportunities that may impact its future performance.

How Do You Present A Financial Summary?

To present a financial summary, you should first organize the data into a clear and concise format, such as a spreadsheet or graph.

Next, you should provide an overview of the financial metrics and highlight any significant trends or patterns that may be relevant to the audience.

Finally, you should be prepared to answer any questions or provide additional detail as needed.

What Are The Benefits Of A Financial Summary?

A financial summary can provide a clear and concise overview of a company's financial performance, which can be useful for investors, lenders, and other stakeholders.

It can also help business owners and managers identify areas where they can improve financial performance and make more informed decisions about the future direction of the company.

Final Words

How to write a financial summary is an essential task for individuals and businesses to keep track of their financial health.

It provides a concise overview of the financial statements and helps in making informed decisions about budgeting, investments, and future plans.

By following the steps mentioned in this article, anyone can learn how to write a financial summary effectively.

However, it is crucial to remember that the financial summary should always be accurate, up-to-date, and reflective of the current financial situation.

With regular practice and attention to detail, anyone can become proficient in writing an informative and well-structured financial summary.

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles