Locate Your Insight Credit Union Routing Number - 7 Quick Steps

Locate your insight credit union routing number. Find your financial footing effortlessly using our routing number. Join us for secure transactions and unrivaled customer support today.

Author:Dexter CookeReviewer:Darren McphersonJan 11, 202456.6K Shares1M Views

Unlocking seamless banking experiences begins with understanding the crucial details, and at Insight Credit Union Routing Number, our routing numbers are the key to effortless financial transactions. As the backbone of secure transfers, our routing numbers empower you to navigate the intricacies of modern banking with ease.

Discover the power of precision and security as you delve into the world of Insight Credit Union's routing numbers. Navigate financial avenues confidently, knowing that you hold the key to efficient money management. Our routing numbers serve as the linchpin for secure transfers, embodying our pledge to facilitate smooth transactions while prioritizing your financial well-being.

What Is A Routing Number?

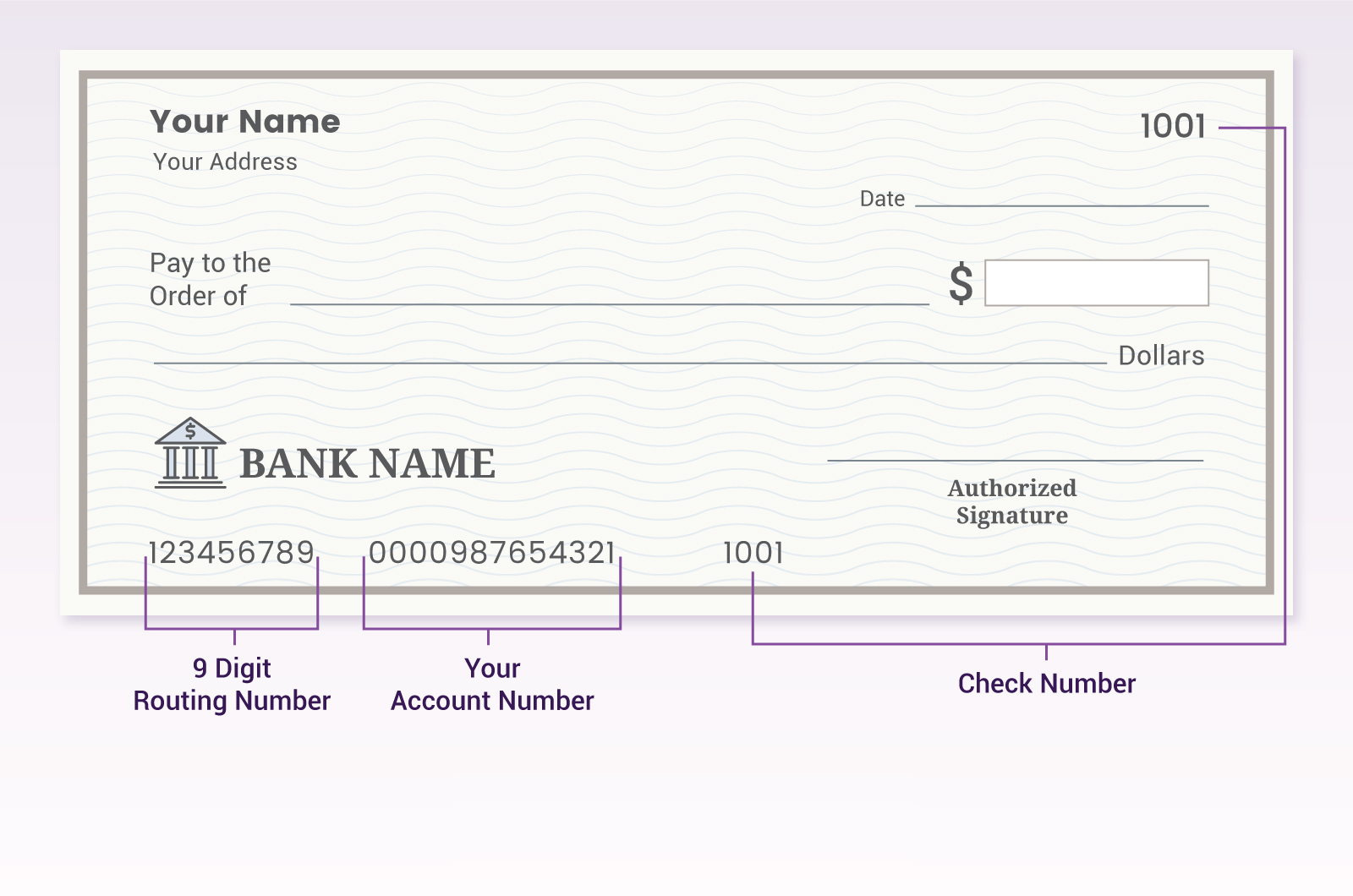

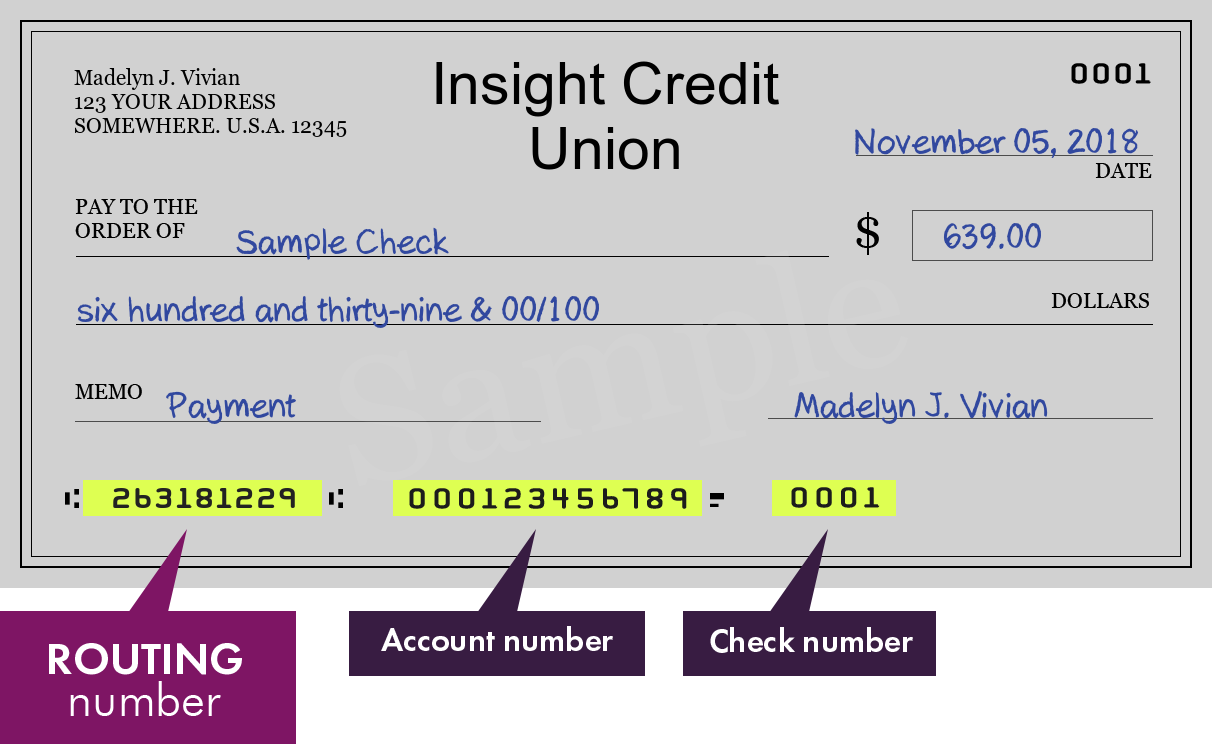

A routing number, also known as an ABA routing transit number, is a nine-digit code that identifies a specific financial institution in the United States. It's like a bank's address in the financial system, ensuring that your money gets routed to the right place when you make electronic transactions.

Think of it like a zip code for your bank. Just like a zip code directs mail to the correct address, a routing number directs electronic funds transfers to the correct financial institution.

Here are some of the things a routing number is used for:

- Direct deposit -When your employer or payroll company sends your paycheck electronically, they use your routing number to send the money to your bank account.

- ACH transfers -When you transfer money between your bank accounts or to someone else's bank account, you'll need to provide both your routing number and your account number.

- Bill pay -When you set up online bill pay, you'll need to enter your routing number so that your payments can be sent electronically.

- Checks -While less common with the rise of electronic payments, the routing number printed on your checks is used by the recipient's bank to route the funds to your account.

Here's where you can find your routing number:

- Checks -The routing number is usually printed in the bottom left corner of your checks, along with your account number.

- Online banking -You can usually find your routing number on your online banking account details page.

- Bank statements -Your routing number may also be printed on your bank statements.

- Contact your bank -If you can't find your routing number anywhere else, you can always contact your bank and ask them for it.

It's important to keep your routing number safe and not share it with anyone you don't trust. Sharing your routing number is like giving someone the key to your bank account, so be careful!

7 Quick Steps To Locate Your Insight Credit Union Routing Number

Have trouble finding your Insight Credit Unionrouting number? Don't fret! Routing numbers are essential for various banking tasks, but they can sometimes be elusive. This guide will equip you with seven simple steps to locate your routing number quickly and effortlessly.

Step 1 - Check Your Cheques

The most straightforward way to find your routing number is to look at your Insight Credit Union cheques. The routing number, typically a nine-digit code, is printed alongside your account number in the bottom left corner.

Step 2 - Online Banking Portal

Log in to your Insight Credit Union online banking portal. Your routing number is often displayed prominently on your account dashboard or within account details.

Step 3 - Mobile Banking App

Open your Insight Credit Union mobile banking app and navigate to your account settings or information section. The routing number is usually displayed there for easy access.

Step 4 - Contact Insight Credit Union

If the above methods fail, don't hesitate to contact Insight Credit Union directly. A customer service representative can assist you in retrieving your routing number over the phone or through secure messaging.

Step 5 - Banking Statements

Your routing number can also be found on your Insight Credit Union bank statements. Look for the top section where your account information is listed.

Step 6 - Deposit Slips

If you have any Insight Credit Union deposit slips handy, the routing number might be printed in the designated area for bank information.

Step 7 - Routing Number Lookup Websites

Several online resources allow you to search for routing numbers based on bank names or locations. While not always recommended due to potential security concerns, these websites can be a last resort if other methods fail.

Remember:

- Never share your routing number with anyone unless you are initiating a legitimate financial transaction.

- Be cautious when using online routing number lookup tools, as some might be fraudulent.

- If you have concerns about the legitimacy of a website or request for your routing number, contact Insight Credit Union directly for verification.

By following these simple steps, you should be able to locate your Insight Credit Union routing number quickly and securely.

What Are The Differences Between FedACH & FedWire Credit Transfers?

Both FedACH and FedWire are electronic funds transfer systems in the US, but they have key differences to consider when choosing which one to use:

Speed

- FedWire -Real-time transfers, funds settle as soon as they're sent. Ideal for urgent payments like closing costs on a house or settling a margin call.

- FedACH -Next-day settlement, meaning funds typically arrive in the recipient's account by the next business day. Not as fast as FedWire, but still significantly faster than traditional paper checks.

Cost

- FedWire -Higher transaction fees, typically ranging from $25 to $45 per transfer. These fees can be higher for international transfers.

- FedACH -Generally lower fees, often free or just a few dollars per transfer. This makes them a more affordable option for smaller or recurring payments.

Transaction Limits

- FedWire -No limit on transaction size.

- FedACH -Daily limit of $25,000 per account, though some higher limits may be available with prior approval from your bank.

Reversals

- FedWire -Once initiated, FedWire transfers are irrevocable. This means they cannot be canceled or reversed once sent.

- FedACH -Some ACH transfers can be reversed up to one business day before the scheduled settlement date. This provides more flexibility and reduces risk for certain types of payments.

Availability

- FedWire -Available 24/7/365.

- FedACH -Typically processed during business hours, not available on weekends or holidays.

Security

Both FedWire and FedACH -Utilize secure protocols to protect against fraud and unauthorized access.

Summary

- Choose FedWire -When you need the fastest possible transfer, have large-value transactions, or require guaranteed settlement.

- Choose FedACH -When cost is a primary concern, your transfer is not time-critical, or you want the flexibility of possible reversals.

Ultimately, the best choice between FedACH and FedWire depends on your specific needs and priorities. Consider factors like speed, cost, transaction size, and desired flexibility when making your decision.

How Are SWIFT / BIC Codes, IBANs, Sort Codes, And Routing Numbers Different?

Here's a breakdown of the differences between SWIFT/BIC codes, IBANs, sort codes, and routing numbers:

SWIFT/BIC Codes

- Purpose -Identify specific banks worldwide for international transfers.

- Structure -8-11 characters, comprising bank code, country code, location code, and optional branch code.

- Example -CHASUS33XXX (JPMorgan Chase in the US)

IBANs (International Bank Account Numbers)

- Purpose -Identify individual bank accounts in countries that use IBANs (primarily Europe, Middle East, North Africa, and the Caribbean).

- Structure -Up to 34 characters, including country code, check digits, and bank account number.

- Example -DE89 3704 0044 0532 0130 00 (an account in Germany)

Sort Codes

- Purpose -Identify specific bank branches in the UK for domestic payments.

- Structure -6 digits, usually formatted as two sets of three digits (e.g., 12-34-56).

- Example -20-00-00 (Barclays Bank, London)

Routing Numbers

- Purpose -Identify specific financial institutions in the US for domestic transfers.

- Structure -9 digits, assigned by the American Bankers Association (ABA).

- Example -021000021 (Bank of America)

Key Differences

- Geographic Scope -SWIFT/BIC codes are global, IBANs are regional, sort codes are UK-specific, and routing numbers are US-specific.

- Level of Identification -SWIFT/BIC codes identify banks, IBANs identify individual accounts, sort codes identify bank branches, and routing numbers identify financial institutions.

- Use Cases -SWIFT/BIC codes are used for international transfers, IBANs for transfers within IBAN-using countries, sort codes for domestic UK payments, and routing numbers for domestic US payments.

- When making a payment -always use the correct code for the country and system you're sending money to This ensures that your funds reach the intended recipient accurately and efficiently.

What Is The Automated Clearing House (ACH) Number?

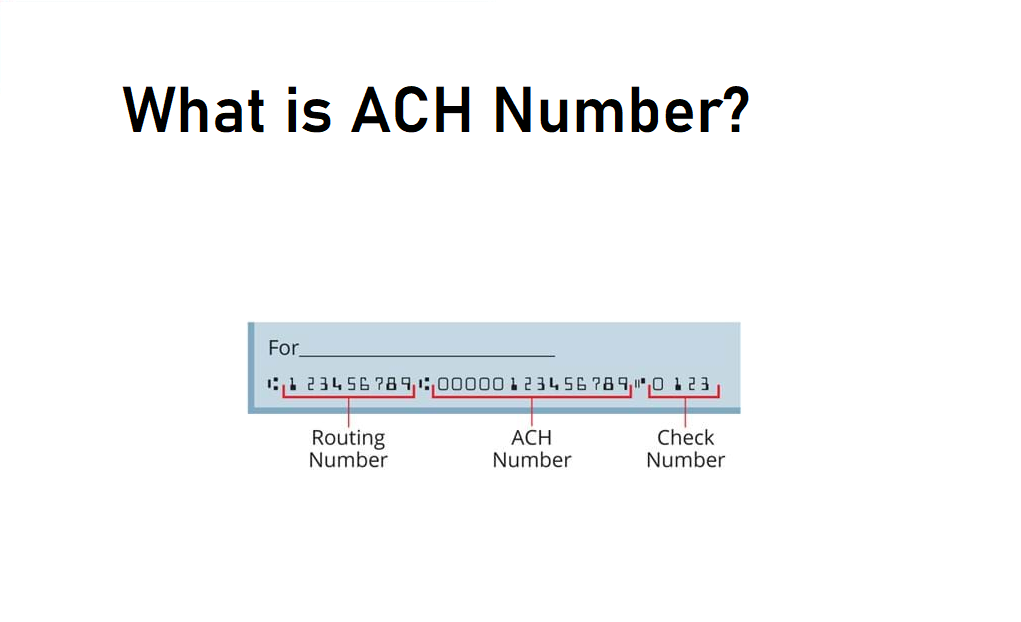

The Automated Clearing House (ACH) itself doesn't have a single "number." It's a network, not a specific bank or financial institution. Therefore, the "ACH number" you need actually depends on what you're trying to do with it.

Here's a breakdown of what you might be looking for:

- Routing number -If you need to initiate an ACH transfer from your bank account to another account, you'll need the routing number of the receiving bank. This is a 9-digit code that identifies the specific financial institution where the recipient's account is held. You can find this on your recipient's checks, online banking portal, or bank statements.

- Originator ID -If you're a business or organization receiving ACH payments, you might have an originator ID assigned by your bank or payment processor. This unique identifier helps track your incoming ACH transactions.

- Network identifier -The ACH network itself has a network identifier, but this is only relevant for technical purposes in specific situations. It's not something you'll typically need for everyday transactions.

Security And Reliability Of Insight Credit Union Routing Numbers

Insight Credit Union, like all financial institutions, takes the security and reliability of its routing numbers very seriously. Here's a breakdown of the measures they utilize:

Security Of Insight Credit Union Routing Numbers

- Data encryption -Routing numbers and other sensitive information are stored and transmitted using strong encryption protocols, making it difficult for unauthorized individuals to access.

- Access controls -Strict access controls limit who can access and view routing numbers within the credit union. Only authorized personnel with a legitimate reason need to know.

- Monitoring and alerts -Systems are in place to monitor for suspicious activity related to routing numbers, and alerts are triggered if anything anomalous is detected.

- Compliance with regulations -Insight Credit Union adheres to all relevant regulations and industry standards regarding data security and privacy.

Reliability

- System redundancy -Multiple backup systems are in place to ensure that routing numbers are accessible even if there are technical issues with the main system.

- Regular testing and maintenance -Routing numbers are regularly tested and validated to ensure their accuracy and functionality.

- Collaboration with the ABA -Insight Credit Union works closely with the American Bankers Association (ABA) to ensure that its routing numbers are up-to-date and accurate.

Additional Tips

- Only share your routing number with trusted entities -Don't share your routing number with anyone unless you are initiating a legitimate financial transaction.

- Be cautious of phishing attempts -Be wary of emails or phone calls requesting your routing number. Verify the sender's identity before providing any sensitive information.

- Monitor your accounts regularly -Regularly review your bank statements and online banking activity to identify any unauthorized transactions.

While no system is foolproof, Insight Credit Union takes significant steps to safeguard the security and reliability of its routing numbers. By remaining vigilant and practicing good security habits, you can further protect yourself from fraudulent activity.

FAQ's About Insight Credit Union Routing Number

How Do I Contact Insight Bank Customer Service?

Get your Insight Account and routing numbers. View the Direct Deposit form received with your card. Call the Insight Customer Service hotline at 1-888-572-8472 and press 3 to hear your direct deposit account and routing numbers.

What Is The Phone Number For Insight Card?

1-888-572-8472 Contact Insight Card Services, LLC by calling 1-888-572-8472, by mail at Insight Card Services, LLC, P.O. Box 190245, Birmingham, AL 35219, or visit www.insightvisa.com.

How Do I Check My Insight Card Balance?

Mobile app with real-time activity alerts. Download the app to manage your account and receive text or email alerts with updates about your account activity, including your account balance.

Conclusion

The Insight Credit Union routing number isn't just a set of digits; it's a gateway to a world of financial convenience and security. By understanding and utilizing this crucial identifier, members gain access to a seamless banking experience. It acts as the linchpin for a multitude of transactions, ensuring the smooth flow of funds with precision and reliability.

As you navigate your financial journey, remember that Insight Credit Union's routing number stands as a symbol of our dedication to facilitating easy, secure, and hassle-free transactions. Embrace the confidence that comes with understanding this pivotal element, empowering yourself to make informed financial decisions and harness the full potential of your banking experience.

Jump to

What Is A Routing Number?

7 Quick Steps To Locate Your Insight Credit Union Routing Number

What Are The Differences Between FedACH & FedWire Credit Transfers?

How Are SWIFT / BIC Codes, IBANs, Sort Codes, And Routing Numbers Different?

What Is The Automated Clearing House (ACH) Number?

Security And Reliability Of Insight Credit Union Routing Numbers

FAQ's About Insight Credit Union Routing Number

Conclusion

Dexter Cooke

Author

Dexter Cooke is an economist, marketing strategist, and orthopedic surgeon with over 20 years of experience crafting compelling narratives that resonate worldwide.

He holds a Journalism degree from Columbia University, an Economics background from Yale University, and a medical degree with a postdoctoral fellowship in orthopedic medicine from the Medical University of South Carolina.

Dexter’s insights into media, economics, and marketing shine through his prolific contributions to respected publications and advisory roles for influential organizations.

As an orthopedic surgeon specializing in minimally invasive knee replacement surgery and laparoscopic procedures, Dexter prioritizes patient care above all.

Outside his professional pursuits, Dexter enjoys collecting vintage watches, studying ancient civilizations, learning about astronomy, and participating in charity runs.

Darren Mcpherson

Reviewer

Darren Mcpherson brings over 9 years of experience in politics, business, investing, and banking to his writing. He holds degrees in Economics from Harvard University and Political Science from Stanford University, with certifications in Financial Management.

Renowned for his insightful analyses and strategic awareness, Darren has contributed to reputable publications and served in advisory roles for influential entities.

Outside the boardroom, Darren enjoys playing chess, collecting rare books, attending technology conferences, and mentoring young professionals.

His dedication to excellence and understanding of global finance and governance make him a trusted and authoritative voice in his field.

Latest Articles

Popular Articles