Investing For Retirement - Secure Your Future!

The importance of investing for retirement cannot be overstated. As you embark on this path of financial wisdom, we'll unravel the key factors to consider when making investment decisions, explore the dynamic world of stocks, and equip you with the knowledge needed to navigate the exciting realm of retirement investing.

Author:Dexter CookeReviewer:Darren McphersonJul 03, 202338.8K Shares636.3K Views

The importance of investing for retirementcannot be overstated. As you embark on this path of financial wisdom, we'll unravel the key factors to consider when making investment decisions, explore the dynamic world of stocks, and equip you with the knowledge needed to navigate the exciting realm of retirement investing.

No matter the size of your paycheck or the industry you're in, we believe that everyone deserves a shot at financial freedom. Let's embark on this exciting adventure together, as we unlock the path to financial security and unlock the potential of investing for retirement. Your future self will thank you!

How To Invest For Retirement

Investing for retirement is a critical undertaking that requires careful planning and strategic decision-making. If you've ever wondered how to start saving for retirement and make your money work for you, you're in the right place.

Here, we'll outline essential strategies to guide you on your retirement investing journey, highlighting potential pitfalls and providing useful resources to expand your knowledge.

Tax-Advantaged Accounts

Explore the advantages of tax-advantaged retirement accounts like 401(k)s and IRAs. These accounts offer unique benefits that can enhance your retirement savings. Traditional accounts provide tax-deferred growth, allowing you to deduct contributions from your taxes now and defer taxes until retirement.

Roth accounts, on the other hand, enable you to invest with after-tax money, and qualified withdrawals in retirement are tax-free. Be aware of contribution limits and consider maximizing your tax-advantaged contributions over time.

Asset Allocation

Grasp the concept of asset allocation and its importance in retirement investing. Asset allocation involves determining how to distribute your investment funds among different asset classes, such as stocks, bonds, and cash. By striking a balance between these assets, you can manage risk and potentially increase returns.

| Age Group | Recommended Asset Allocation |

| 20s & 30s | 90% to 100% stocks, 0% to 10% bonds |

| 40s | 80% to 100% stocks, 0% to 20% bonds |

| 50s | 65% to 85% stocks, 15% to 35% bonds |

| 60s | 45% to 65% stocks, 30% to 50% bonds, 0% to 10% cash/cash-equivalents |

| 70+ | 30% to 50% stocks, 40% to 60% bonds, 0% to 20% cash/cash-equivalents |

Consider utilizing mutual funds and ETFs for easy diversification. Customize your asset allocation based on your age and risk tolerance, ensuring your portfolio aligns with your long-term goals.

Robo-Advisors Or Target Date Funds

Simplify your retirement investing with the help of robo-advisors or target date funds. Robo-advisors are automated investment platforms that provide professional management and rebalancing of your portfolio. They typically charge an annual fee based on the assets they manage for you.

Target date funds are mutual funds designed to automatically adjust their asset allocation as you approach your target retirement date. Although these services involve extra fees, they can save you time and effort in managing your investments effectively.

Dividend-Paying Stocks

Explore the potential of dividend-paying stocks for consistent income in retirement. Dividend stocks are shares of companies that distribute a portion of their profits to shareholders as dividends. These dividends can be paid out regularly in the form of cash or additional stock.

Dividend investing aims to build a portfolio of stocks that offer reliable and high dividend payments. However, it's important to maintain a diversified portfolio to mitigate risks and avoid overexposure to dividend stocks.

Rental Property Investments

Consider the benefits and challenges of investing in rental properties for retirement income. Rental properties can provide regular cash flow, but they also come with responsibilities such as mortgage payments, property maintenance, and tenant management. If you prefer a more hands-off approach, you can explore real estate investment trusts (REITs).

REITs are investment vehicles that own and manage income-generating real estate properties. They offer the advantage of higher dividends compared to stocks and bonds.

Annuities

Annuities are insurance contracts designed to provide long-term income stability in retirement. While they offer the benefit of guaranteed income, it's crucial to understand the complexities and potential costs involved.

Fixed annuitiesare often recommended for their guaranteed repayments and lower fees.

Variable annuities and index annuitiescome with additional risks and higher fees, requiring careful evaluation.

Comparing different annuity options and understanding the contract terms is essential before making any investment decisions.

Qualified Longevity Annuity Contracts (QLACs)

What Is a QLAC? | Qualified Longevity Annuity Contract

Mitigate the fear of outliving retirement savings with qualified longevity annuity contracts (QLACs). QLACs are annuity contracts specifically designed to provide regular income payments in the later stages of life. They allow you to extend the deadlines for required minimum distributions (RMDs) from your retirement accounts.

This delay not only ensures the longevity of your retirement investments but can also help decrease your tax liability and keep Medicare premiums lower. However, it's important to weigh the benefits against the potential risks and limitations associated with QLACs.

As you plan your retirement, consider consulting with a financial advisor who can provide personalized guidance and help you make the most of your retirement investing strategy. By implementing these strategies and staying informed, you can set yourself on the path toward a financially secure future.

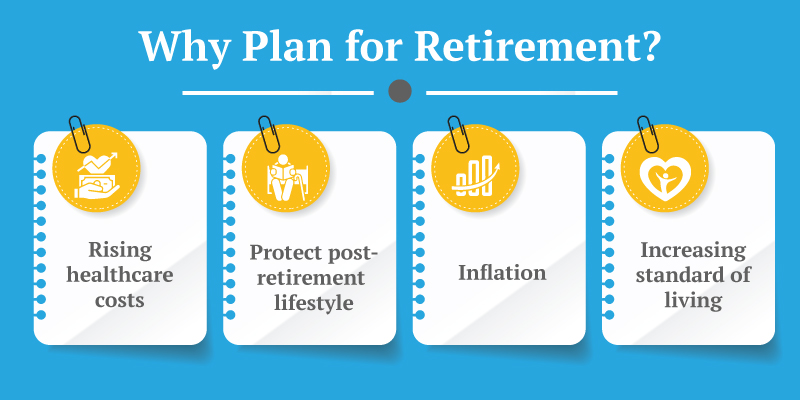

Factors To Consider When Investing For Retirement

When it comes to retirement planning, there are several factors within your control that can significantly impact your financial future. By understanding and managing these factors, you can work towards a more secure retirement. Here are some key considerations:

Factors Within Your Control

Several factors within your control include:

- Income during your working years- Your earnings and the changes in income over time can influence your retirement savings potential.

- Allocation and timing of investments- How you distribute and time your investments can affect your portfolio's growth and risk.

- Use of tax-advantaged accounts- Leveraging tax-advantaged retirement accounts can maximize your savings through tax benefits.

- Use of insurance- Proper insurance coverage can protect your assets and provide a safety net in case of unforeseen events.

- Geographical location- Where you choose to live can impact your cost of living and access to healthcare services.

- Life milestones- Decisions regarding merging finances with a long-term partner, having children, and supporting family members can influence your financial obligations and planning.

- Spending, saving, and investing habits- The choices you make regarding your spending, saving, and investment behaviors can shape your retirement readiness.

Factors Outside Your Control

Factors over which you have little or no control include:

- Asset class returns- The performance of stocks and bonds, which is influenced by market conditions, is beyond your control.

- Inflation rates- The rate at which prices rise over time can erode the purchasing power of your savings.

- Interest rates- Changes in interest rates can impact the returns on your fixed-income investments.

- Federal tax rates- Tax policies set by the government can affect your tax obligations in retirement.

- Government benefits- Social Security and Medicare benefits may be subject to changes in eligibility criteria or funding.

While some factors may be beyond your control, it's essential to focus on the aspects you can manage and adapt your retirement plan accordingly. Reflecting on your values, goals, and desired lifestyle can provide clarity as you strive for financial independence and a fulfilling retirement journey.

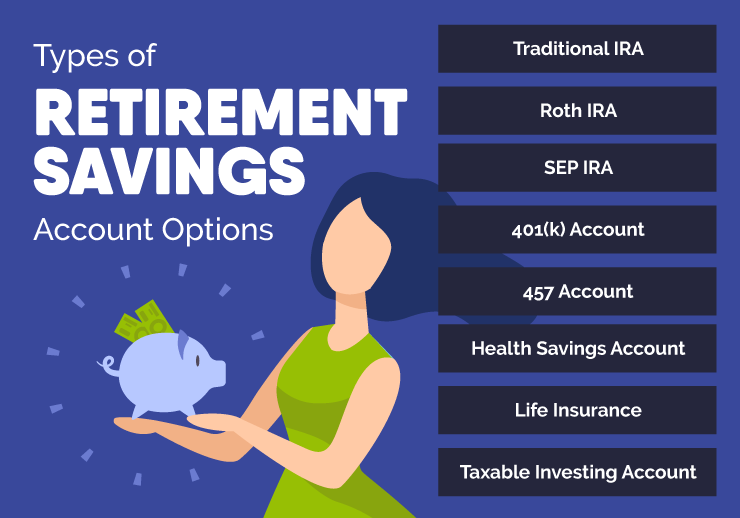

Understanding Retirement Account Options

Choosing the right retirement account is crucial for effective retirement planning. With a wide array of options available, such as 401(k)s, IRAs, Roth IRAs, and more, it's essential to understand the differences and select the account that aligns with your needs. Let's explore the main account options based on different employment scenarios.

For-Profit Employer

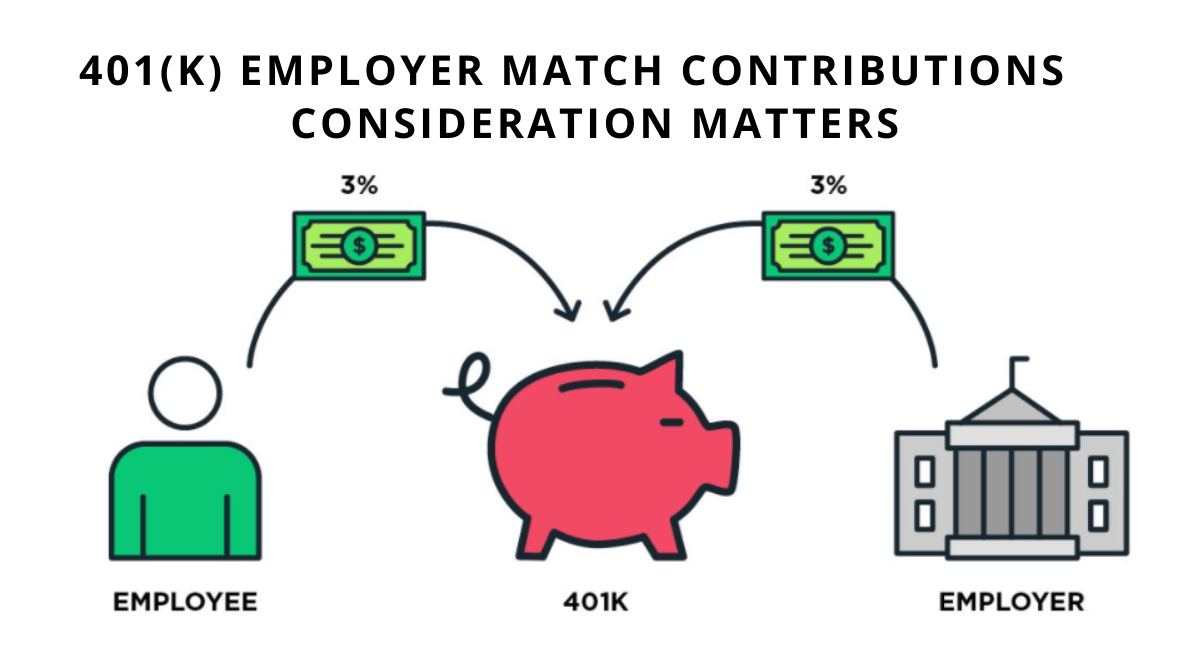

For employees working at for-profit companies, the primary retirement account option is the 401(k) plan. Here are the key considerations:

- Take advantage of potential employer matching contributions. Some employers match a portion of your savings, providing an instant boost to your retirement funds.

- Be aware of annual contribution caps regulated by the government. These limits may vary from year to year, so it's important to stay updated with the latest figures.

- Contributions to a 401(k) are tax-deferred until withdrawal. This means you won't pay taxes on the money you contribute, but you will be taxed when you withdraw funds in retirement.

Nonprofit Employer

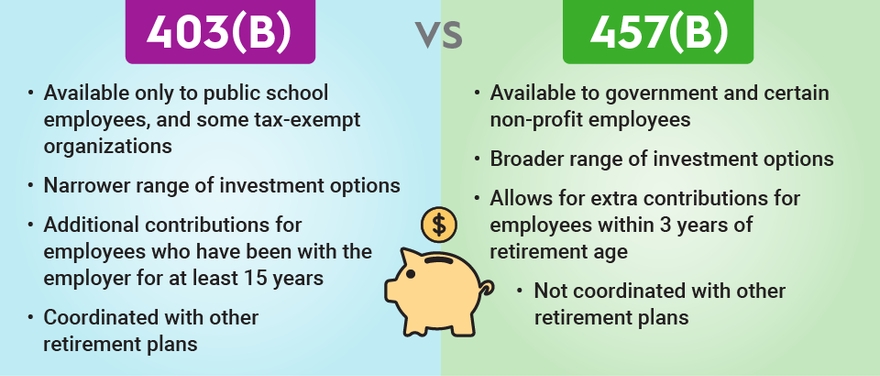

Employees of nonprofit organizations, government entities, schools, or religious institutions have specific retirement account options. Consider the following:

- 457 plans function similarly to 401(k)s and are available for eligible employees of state and local governments and certain nonprofit organizations.

- 403(b) plans are common in nonprofit settings and offer retirement savings options, though they may be more complex and expensive. Some 403(b) plans may require investing in annuities with high fees.

- Evaluate investment options and fees carefully, as they can vary between providers and affect your long-term earnings.

- If your employer doesn't offer matching contributions or has limited investment options, consider using IRAs (Individual Retirement Accounts) for additional retirement savings.

No Employer Plan Or Self-Employed

IRA for Self Employed (EVEN BETTER THAN A 401K!)

Individuals who don't have access to employer-sponsored retirement plans or are self-employed can explore these options:

- Individual Retirement Accounts (IRAs) are available at financial institutions and offer tax advantages for retirement savings.

- When selecting an IRA provider, compare fees, investment options, and account maintenance charges. Consider the long-term impact of fees on your investment returns.

- Contribution limits for IRAs may vary based on income and other factors. The federal government adjusts these limits periodically, so it's essential to stay informed.

- Traditional IRAs offer tax-deductible contributions, but withdrawals are taxed during retirement. Roth IRAs involve after-tax contributions, but qualified withdrawals are tax-free.

- Self-employed individuals may consider SEP (Simplified Employee Pension) or Solo 401(k) plans, which offer higher contribution limits compared to traditional IRAs.

Comparison of Traditional and Roth IRAs:

| Traditional IRA | Roth IRA |

| Taxed upon withdrawal | No upfront tax deduction |

| Taxed upon withdrawal | Tax-free withdrawals if rules are followed |

| Subject to required minimum distributions (RMDs) | No RMDs during the original owner's lifetime |

Changing Jobs

When changing jobs, consider these steps for managing your retirement accounts effectively:

- Evaluate whether rolling over old 401(k) or 403(b) accounts into an IRA is suitable. Rolling over funds can consolidate your retirement savings and provide greater control over investment choices.

- Assess investment options and fees when deciding whether to retain accounts with former employers or transfer them to new employers' plans. Some employer plans may offer limited investment options, while IRAs provide more flexibility.

- Consolidate retirement accounts into an IRA for ease of management. By combining multiple accounts, you can simplify tracking and monitoring your retirement savings.

By understanding the various retirement account options and aligning them with your employment situation, you can make informed decisions that optimize your retirement savings and help you achieve your long-term financial goals.

Beginner's Guide to Retirement Plans (401k, IRA, Roth IRA / 401k, SEP IRA, 403b)

People Also Ask

What Kind Of Investment Is Best For Retirement?

One of the top options for generating retirement income is balanced funds, which consist of a mix of stocks and fixed income, prioritizing dividends and interest earnings. Retirees also often consider fixed-income funds that exclusively invest in bonds as a favorable investment choice for their retirement portfolios.

What Is The Best Way To Start Investing For Retirement?

The most effective strategy is to start by utilizing a retirement savings account. We're not being facetious, just straightforward. Various investment accounts exist, but retirement accounts such as IRAs and 401(k)s were designed specifically to encourage individuals to save for retirement.

Is It Worth Investing For Retirement?

It offers the advantage of reducing the amount of taxes owed on annual income. Additionally, it enables the deferral or potential avoidance of taxes on investment earnings. Moreover, it generates earnings on earnings, leveraging the compounding effect that is not achievable with a regular savings account.

Conclusion

In conclusion, investing for retirement requires thoughtful consideration of various factors. By choosing the right retirement account based on your employment situation and considering factors like employer contributions, tax advantages, fees, and investment options, you can pave the way toward a secure future.

Take control of your retirement investing and set yourself up for a financially sound retirement. Start investing for retirement today!

Dexter Cooke

Author

Dexter Cooke is an economist, marketing strategist, and orthopedic surgeon with over 20 years of experience crafting compelling narratives that resonate worldwide.

He holds a Journalism degree from Columbia University, an Economics background from Yale University, and a medical degree with a postdoctoral fellowship in orthopedic medicine from the Medical University of South Carolina.

Dexter’s insights into media, economics, and marketing shine through his prolific contributions to respected publications and advisory roles for influential organizations.

As an orthopedic surgeon specializing in minimally invasive knee replacement surgery and laparoscopic procedures, Dexter prioritizes patient care above all.

Outside his professional pursuits, Dexter enjoys collecting vintage watches, studying ancient civilizations, learning about astronomy, and participating in charity runs.

Darren Mcpherson

Reviewer

Darren Mcpherson brings over 9 years of experience in politics, business, investing, and banking to his writing. He holds degrees in Economics from Harvard University and Political Science from Stanford University, with certifications in Financial Management.

Renowned for his insightful analyses and strategic awareness, Darren has contributed to reputable publications and served in advisory roles for influential entities.

Outside the boardroom, Darren enjoys playing chess, collecting rare books, attending technology conferences, and mentoring young professionals.

His dedication to excellence and understanding of global finance and governance make him a trusted and authoritative voice in his field.

Latest Articles

Popular Articles