Is Real Estate Investment Trusts A Good Career Path?

Thinking "Is Real Estate Investment Trusts a good career path"? Unpack the pros & cons, salary expectations, & future prospects. Make an informed decision about your next move.

Author:Darren McphersonReviewer:Habiba AshtonJan 16, 202418.7K Shares280.1K Views

Do you have a desire to embark on a rewarding venture in the real estate sector? If you do, let's explore the dynamic realm of "Is Real Estate Investment TrustsA Good Career Path". These organizations provide an appealing opportunity for individuals seeking varied prospects in real estate investment.

Whether your interest lies in becoming a real estate agent or aspiring to be an investment analyst, the realm of REITs presents numerous paths to investigate. In this detailed blog, we will guide you through a range of career opportunities, advantages, and possible challenges associated with choosing a career in real estate investmentthrough REITs.

What Exactly Are Real Estate Investment Trusts (REITs)?

Picture a landscape where companies own, manage, and finance income-generating real estate properties. This encapsulates the essence of Real Estate Investment Trusts (REITs). For individuals aspiring to become real estate investors and seeking a share of the commercial real estate market without the complexities of direct ownership, REITs present an appealing option.

As integral components of the real estate sector, REITs afford professionals the opportunity to invest in real estate without the responsibilities associated with owning a specific property.

A notable characteristic of REITs is their commitment to distributing a significant portion of their taxable income to shareholders in the form of dividends, typically on a quarterly basis. This distinctive feature makes REITs an attractive choice for investors looking for a consistent income stream derived from rental income generated by the underlying real estate assets.

Fundamentally, the purpose of REITs is to provide investors with the ability to capitalize on the growth and income potential of real estate while ensuring liquidity and diversification.

Through the pooling of resources from diverse investors, REITs assemble a varied property portfolio, effectively mitigating individual risks and capitalizing on the advantages of economies of scale.

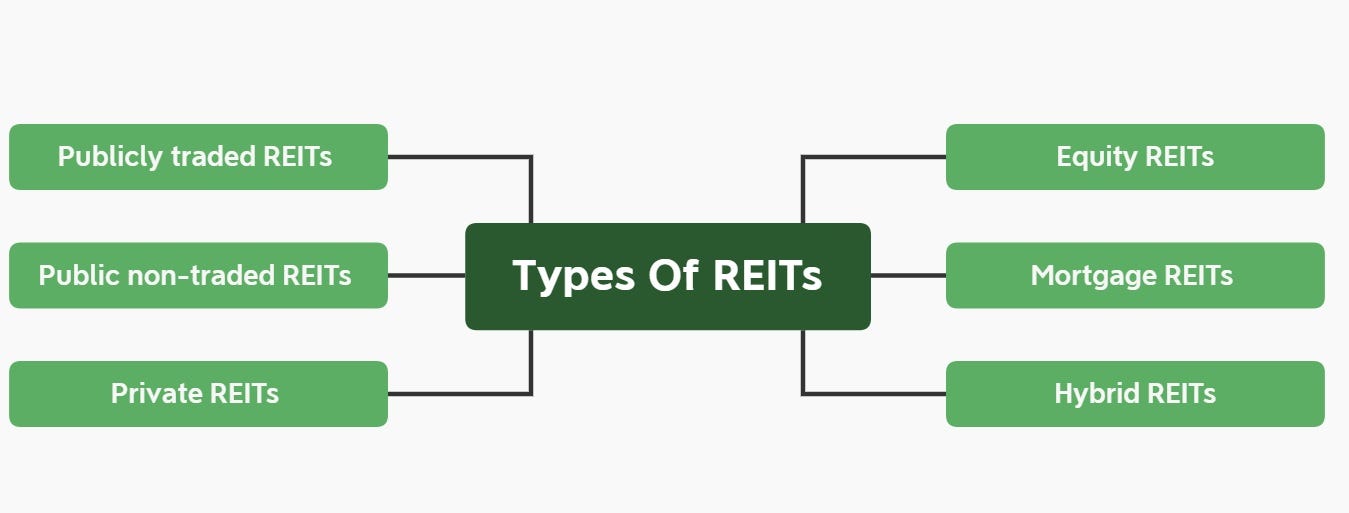

Kinds Of REITs Exist

Real Estate Investment Trusts (REITs) come in various types, each defined by their investments and the characteristics of the managed real estate assets. Here are the primary categories of REITs:

Equity Real Estate Investment Trusts

This is the most prevalent type of REIT. These entities primarily possess and manage income-generating real estate properties such as office buildings, shopping centers, hotels, apartment complexes, healthcare facilities, and industrial warehouses. Profits are generated through leasing these properties to tenants, and a significant portion is distributed to shareholders in the form of dividends.

Mortgage Real Estate Investment Trusts

Diverging from direct property ownership, these REITs concentrate on real estate debt. They invest in and own mortgages or mortgage-backed securities, furnishing financial support for real estate projects. Their revenue is derived from the interest generated by these mortgage investments. Mortgage REITs are typically more sensitive to fluctuations in interest rates and exhibit distinct risk profiles in comparison to equity REITs.

Hybrid Real Estate Investment Trusts

Combining the features of both equity and mortgage REITs, hybrids feature a diverse portfolio encompassing real estate properties and debt securities. This amalgamation allows for the accumulation of rental income and interest revenue, presenting a well-balanced approach to real estate investment.

Residential Real Estate Investment Trusts

Specializing in the ownership and operation of residential properties, including apartment buildings, student housing, and single-family homes, these REITs cater to the rental market. They generate income by leasing residential units to tenants.

Commercial Real Estate Investment Trusts

With a focus on commercial real estate, these REITs concentrate on owning and managing properties such as office buildings, retail centers, hotels, and industrial facilities. Their revenue is derived from leasing these spaces to businesses and retailers.

Retail Real Estate Investment Trusts

Dedicated to retail properties, this category revolves around owning and operating shopping malls, standalone retail spaces, outlet centers, and strip malls. Revenue is generated through rental agreements with retailers and businesses.

Industrial Real Estate Investment Trusts

Dominating the landscape of industrial properties, which encompass warehouses, manufacturing plants, distribution centers, and logistics facilities, these REITs generate income by leasing these properties to businesses engaged in manufacturing, logistics, and distribution.

Healthcare Real Estate Investment Trusts

Specializing in properties related to healthcare, these REITs oversee assets like medical office buildings, assisted living facilities, senior housing, and skilled nursing homes. Income is generated through leasing these properties to healthcare providers.

Lodging Real Estate Investment Trusts

Taking charge in the hospitality sector, these REITs own and operate properties such as resorts, motels, and hotels. Their revenue is bolstered through room rentals and various guest services.

Data Center Real Estate Investment Trusts

In the era of technology, these REITs serve as guardians of data centers—central hubs that house servers and IT equipment for businesses and cloud service providers. Their revenue is derived from leasing data center space to corporate entities.

This compilation highlights some of the key types of REITs, each specializing in a specific niche within the real estate landscape.

Whether you're an investor exploring your options or a professional considering a career in the REIT industry, familiarizing yourself with these REIT subcategories can assist in making well-informed investment decisions or mapping out a career path aligned with your expertise and interests.

Is Real Estate Investment Trust A Good Career Path

Embarking on a career in Real Estate Investment Trusts (REITs) can be gratifying and satisfying for individuals intrigued by the realms of real estate and finance. Determining whether a career in REITs is a suitable choice hinges on your ambitions and is influenced by personal preferences, career goals, and skill sets.

As you contemplate the possibility of a REIT career, here are some aspects to consider:

Understanding Real Estate Trends And Market Insights

Professionals in the REIT domain stay attuned to shifts in industry trends, economic indicators, and regulatory changes that impact real estate investments. Collaborating with experts in real estate investment can provide a wealth of knowledge, aiding in making informed investment decisions and fostering professional advancement.

Networking And Resources

Being part of a REIT opens doors to an extensive network comprising industry insiders, investors, and experts. This interconnected network plays a crucial role in advancing one's career, discovering profitable deals, and securing essential resources.

Specialized Expertise

Within REITs, there are often specialized departments—such as asset management, property management, acquisitions, and investor relations. Immersing oneself in these areas allows professionals to carve out a niche aligned with their interests and skills, leading to expertise and professional fulfillment.

Dynamic And Innovative Atmosphere

REITs thrive in a dynamic and constantly evolving industry. This fast-paced environment compels professionals to adapt to new challenges and seize emerging opportunities. In this vibrant setting, creativity flourishes, and innovative solutions abound.

Shaping The Real Estate Landscape

REITs wield significant influence in shaping the real estate scenery through investments and property development. Professionals within REITs find fulfillment in contributing to growth and enhancing communities through real estate endeavors.

Embracing A Variety Of Real Estate Assets

REITs often encompass a diverse array of real estate properties, spanning residential, commercial, industrial, and retail categories. Engaging in the REIT domain provides individuals with a multifaceted experience involving various asset classes, offering a comprehensive and well-rounded exposure to the real estate sector.

Investment Opportunities

Professionals associated with REITs have the opportunity to invest in the company's shares, allowing them to participate in the growth and successes of the REIT. This aligns the goals of employees with those of shareholders and the company itself.

For those passionately captivated by the realms of real estate and finance, REITs present an appealing niche. The landscape is adorned with a spectrum of career possibilities, market insights, stable compensation, and a path toward growth.

Career Options In Real Estate Investment Trust

Real Estate Agent

Within the realm of REITs, there exists a role for real estate agents who facilitate the buying and selling of properties within the REIT's portfolio. This role introduces individuals to the world of real estate transactions without the direct responsibility of ownership.

Investment Analyst

Embedded in the history of real estate investment trusts, investment analysts play a pivotal role in evaluating various investment opportunities. They analyze potential properties, making informed investment decisions on behalf of the REITs.

Property Manager

Guardians of operational harmony within income-generating real estate properties are the property managers. Their responsibilities include managing tenant relationships and ensuring property maintenance to sustain a consistent stream of rental income.

Investor Relations Manager

Situated within the REIT hierarchy, investor relations managers play a crucial role. These individuals navigate the landscape of shareholder communication, articulating the REIT's investment objectives, and fostering positive relationships with investors.

Begin A Career In Real Estate Investment Trusts

Embarking on a career journey within Real Estate Investment Trusts (REITs) requires a combination of education, skills, networking, and relevant experience. Here's a guide to help you navigate the landscape of the REIT domain:

Acquire Appropriate Education

Commence a bachelor's degree program in finance, real estate, business administration, economics, or a related field. While some roles, such as that of a real estate agent, may not necessarily require a formal college degree, in such cases, alternative pathways can be explored. Click here to discover ways to enter the realm of real estate agency without a degree.

Dive Into Financial Understanding

Develop a strong understanding of investment analysis, valuation, risk management, and financial modeling. Familiarize yourself with the vocabulary of real estate financial metrics, including net operating income (NOI) and capitalization rates.

Acquire Real Estate Insights

Absorb knowledge about various property types, property management, lease agreements, and the trajectories of the real estate market. Understand the intricate relationship between economic dynamics and the real estate landscape, including factors like interest rates and demographic shifts.

Cultivate Professional Expertise

Seek out internships or entry-level positions within real estate firms, asset management companies, or financial institutions. Engage in real estate projects or participate in investment analyses to gain hands-on experience and practical insights.

Consider Further Education

Reflect on the possibility of pursuing a master's degree in fields such as real estate, finance, or related disciplines. Advanced degrees can open doors to more specialized roles and higher-level positions within the realm of REITs.

Build Connections

Immerse yourself in real estate events, conferences, and seminars to establish connections with professionals in the REIT industry. Join real estate associations or online forums to interact with industry experts and potential employers.

Explore REIT Realms

Conduct a thorough study of various REITs, exploring their investment strategies, portfolios, and performance. Identify REITs that align with your career goals and areas of interest within the real estate sector.

Seize REIT Opportunities

Regularly check job boards and career platforms for openings within REITs. Tailor your resume and cover letter to highlight relevant experiences and qualifications for each application.

Highlight Your Expertise

During interviews, demonstrate your expertise in real estate investment, financial analysis, and industry trends. Be prepared to discuss how your skill set can contribute to the success of the REIT.

Employment Opportunities Exist In Real Estate Investment Trusts

According to the renowned employment platform indeed.com, there are more than 6,000 job listings in the field of REITs for enthusiasts in the United States. Notable job titles include:

- Analyst -Over 1,500 available positions.

- Property Manager- Over 1,000 available positions.

- Developer- Over 500 available positions.

- Financier- Over 300 available positions.

- Marketing and Sales- Over 200 available positions.

Drawbacks Of A Career In REITs

While a profession within Real Estate Investment Trusts (REITs) unfolds numerous benefits, it's crucial to consider potential downsides:

Market Volatility

Despite typically showing lower volatility compared to other investment options, REITs are still susceptible to fluctuations in the real estate market. Economic downturns or changes in interest rates can impact property values and rental income, thereby affecting the performance of REITs and potentially leading to job insecurity for those in the industry.

Dependency On Real Estate Performance

Professionals in REITs may face uncertainty during economic downturns or contractions in the real estate market. Due to the significant reliance on real estate performance, a downturn could result in reduced hiring, layoffs, or salary cuts.

Dividend Obligation

REITs are obligated to maintain substantial dividend payments to shareholders. During economic challenges, REITs may face pressure to uphold these dividend distributions, potentially impacting financial stability and job security for professionals in the sector.

Intense Competition

The increasing popularity of REITs has led to heightened competition in the job market. Securing desirable positions within well-established REITs may become a competitive endeavor, requiring candidates to possess specialized skills and relevant experience.

Frequently Asked Questions - Is Real Estate Investment Trusts A Good Career Path

What Is The Lifespan Of A REIT?

There is no set lifetime for the trust in most cases. Investors who buy publicly traded shares in a REIT can usually buy as much or little as they like and dispose of the shares when they want or need to. However, if an investor buys a non-traded or private REIT, the investment should be considered illiquid.

Which REITs Rank Among The Largest In North America?

Some of the largest REITs in North America include American Tower Corporation, Prologis Inc., and Simon Property Group. These companies are notable for their extensive real estate portfolios and significant market presence.

Which Positions Within Real Estate Investment Trusts Offer The Highest Salaries?

The most lucrative roles in real estate investment trusts often include positions such as Chief Financial Officer (CFO), Portfolio Manager, and Chief Investment Officer (CIO). These roles command higher salaries due to their strategic and leadership responsibilities within the REIT sector.

Conclusion

Is real estate investment trusts a good career path? A profession in Real Estate Investment Trusts (REITs) offers an excellent trajectory for individuals fascinated by real estate and finance. Featuring diverse career options such as real estate agents, investment analysts, property managers, and investor relations managers, these experts can engage in various aspects of the real estate market without direct property ownership. If you seek a fulfilling journey in the realm of real estate investment, the domain of REITs invites you to embark on exploration.

Jump to

What Exactly Are Real Estate Investment Trusts (REITs)?

Kinds Of REITs Exist

Is Real Estate Investment Trust A Good Career Path

Career Options In Real Estate Investment Trust

Begin A Career In Real Estate Investment Trusts

Employment Opportunities Exist In Real Estate Investment Trusts

Drawbacks Of A Career In REITs

Frequently Asked Questions - Is Real Estate Investment Trusts A Good Career Path

Conclusion

Darren Mcpherson

Author

Darren Mcpherson brings over 9 years of experience in politics, business, investing, and banking to his writing. He holds degrees in Economics from Harvard University and Political Science from Stanford University, with certifications in Financial Management.

Renowned for his insightful analyses and strategic awareness, Darren has contributed to reputable publications and served in advisory roles for influential entities.

Outside the boardroom, Darren enjoys playing chess, collecting rare books, attending technology conferences, and mentoring young professionals.

His dedication to excellence and understanding of global finance and governance make him a trusted and authoritative voice in his field.

Habiba Ashton

Reviewer

Habiba Ashton, an esteemed professional in Digital Marketing and Business, brings over 10 years of experience to the table. She holds a Master's degree in Marketing Management from Stanford University and is a certified Digital Marketing strategist.

Habiba has authored numerous articles on SEO, Social Media Marketing, and Branding, published across reputable platforms.

Her impactful projects have consistently driven growth and visibility for businesses, earning her accolades from clients and industry peers alike. One notable achievement includes leading a digital marketing campaign that resulted in a 30% increase in online sales for a major retail client.

Looking ahead, Habiba is committed to pioneering ethical digital marketing practices that prioritize customer trust and engagement. Her vision is to lead initiatives that foster a transparent and sustainable digital ecosystem for businesses and consumers alike.

In her free time, she enjoys cycling, stargazing, and staying updated on digital entertainment trends.

Latest Articles

Popular Articles