Mixed Geopolitical Signals Keep Oil Prices Stable Near $77

Mixed geopolitical signals keep oil prices stable near $77. Explore how complex dynamics impact market stability and traders' vigilance in monitoring global developments.

Author:Dexter CookeReviewer:Darren McphersonFeb 13, 20246.3K Shares154.9K Views

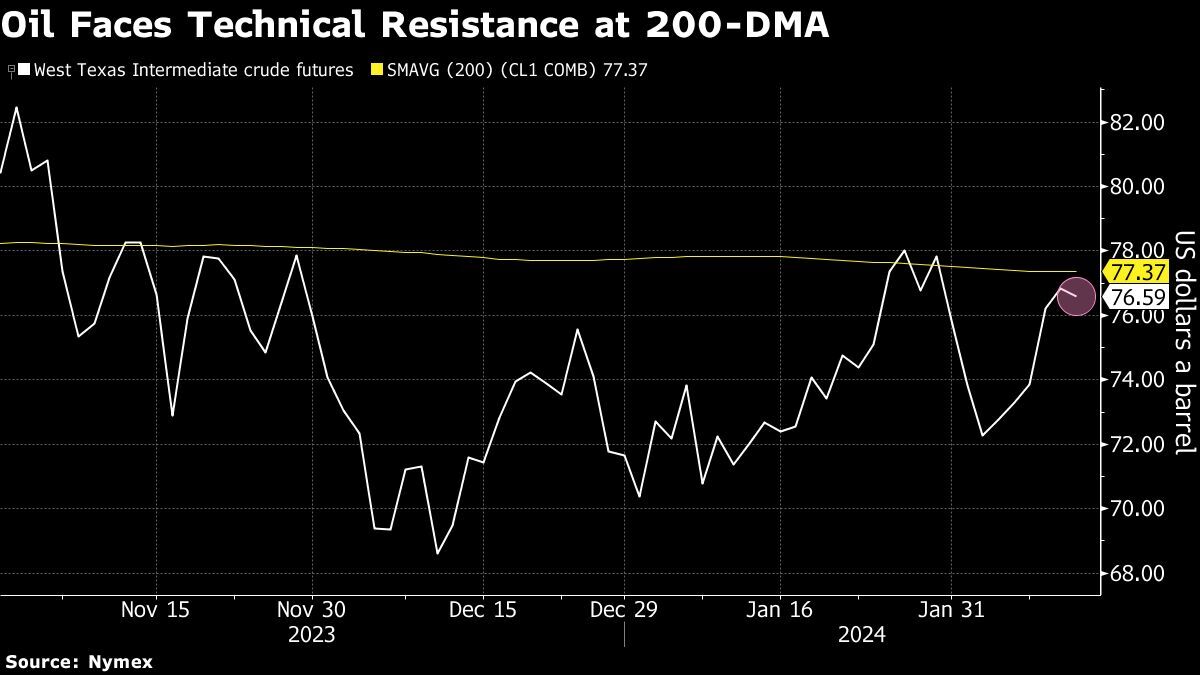

Mixed geopolitical signals keep oil prices stable near $77. The oil markets experienced a day of little change as traders grappled with conflicting geopolitical signals, ultimately settling near $77 a barrel for West Texas Intermediate (WTI). The region's tumultuous dynamics were underscored by heightened military activity in the Middle East, yet offset by diplomatic efforts aimed at de-escalating tensions.

Israel's military conducted strikes in Gaza, specifically in the southern city of Rafah, as a response to ongoing conflicts. The situation in Rafah, where more than a million people have sought refuge, remains dire amidst escalating violence. Meanwhile, Yemen's Houthi rebels reported yet another attack on a ship in the Red Sea, emphasizing the persistent threats to vessels in the region.

In addition to these concerning developments, there were also factors supporting crude prices. Notably, Iraq, the second-largest producer within the OPEC+ alliance, reported declining crude production, contributing to an overall tightening of supply. Furthermore, the better-than-expected compliance by OPEC members to supply cuts prompted Morgan Stanley to raise its price forecast for Brent to $82.50 a barrel for the first quarter, up from $80.

However, amid the turmoil, there were signs of progress toward diplomatic resolutions to the conflicts. Iran's Foreign Minister, Hossein Amirabdollahian, engaged in discussions over the potential release of Israeli hostages held by Hamas, indicating a potential thaw in relations between opposing factions.

The stability of oil prices amid geopolitical tensions reflects a delicate balance. Oil has remained within a relatively narrow band of around $10 this year, influenced by a combination of regional conflicts and broader market fundamentals. The ongoing conflict in the Middle East poses a persistent risk to global oil supply, yet this has been partially offset by factors such as ample global supplies and uncertain demand projections, particularly in key markets like China.

Goldman Sachs analysts highlighted additional downside risks to demand forecasts for China, citing factors such as a surge in electric vehicle sales and shifting consumer preferences.

Traders are eagerly awaiting monthly reports from both OPEC and the International Energy Agency (IEA) for further insights into supply and demand dynamics. These reports will provide critical information that could influence market sentiment and pricing in the coming weeks.

Looking ahead, the outlook for oil prices remains uncertain, with various factors at play. While geopolitical tensions in the Middle East continue to pose risks to supply, diplomatic efforts and evolving market dynamics could offer some relief. However, the delicate balance between these factors underscores the volatility and unpredictability inherent in the oil market.

Oil futures closed the day with minimal change, reflecting the market's cautious stance amidst a complex geopolitical landscape. As tensions persist and diplomatic efforts unfold, traders will continue to monitor developments closely for any indications of future price movements. The delicate balance between supply disruptions and diplomatic resolutions adds uncertainty to market dynamics.

Dexter Cooke

Author

Dexter Cooke is an economist, marketing strategist, and orthopedic surgeon with over 20 years of experience crafting compelling narratives that resonate worldwide.

He holds a Journalism degree from Columbia University, an Economics background from Yale University, and a medical degree with a postdoctoral fellowship in orthopedic medicine from the Medical University of South Carolina.

Dexter’s insights into media, economics, and marketing shine through his prolific contributions to respected publications and advisory roles for influential organizations.

As an orthopedic surgeon specializing in minimally invasive knee replacement surgery and laparoscopic procedures, Dexter prioritizes patient care above all.

Outside his professional pursuits, Dexter enjoys collecting vintage watches, studying ancient civilizations, learning about astronomy, and participating in charity runs.

Darren Mcpherson

Reviewer

Darren Mcpherson brings over 9 years of experience in politics, business, investing, and banking to his writing. He holds degrees in Economics from Harvard University and Political Science from Stanford University, with certifications in Financial Management.

Renowned for his insightful analyses and strategic awareness, Darren has contributed to reputable publications and served in advisory roles for influential entities.

Outside the boardroom, Darren enjoys playing chess, collecting rare books, attending technology conferences, and mentoring young professionals.

His dedication to excellence and understanding of global finance and governance make him a trusted and authoritative voice in his field.

Latest Articles

Popular Articles