Netflix Inc. Investors Are Worried As Stock Plunges This 2022

Netflix investors have been worried that the company isn't adding new customers quickly enough. Today, they started to panic because they didn't believe the company was adding new customers quickly enough. Netflix's stock fell almost 20% after it said that it didn't add enough new subscribers in the last three months of 2021.

Author:Frazer PughReviewer:Emmanuella SheaJan 21, 2022123.4K Shares2.2M Views

Netflix investors have been worried that the company isn't adding new customers quickly enough. Today, they started to panic because they didn't believe the company was adding new customers relative to their forecasts. As a result, Netflix's stock fell almost 20% after it said that it didn't add enough new subscribers in the last three months of 2021.

What Happens When Stock Plunges?

An abrupt drop in the value of stocks is called a stock market crash. It can happen when there is a big disaster, an economic crisis, or when a long-term speculative bubble comes to an end. It can also be caused by people panicking about a stock market crash, which causes people to panic sell, which drives down prices even more.

Netflix's Missing Expectations

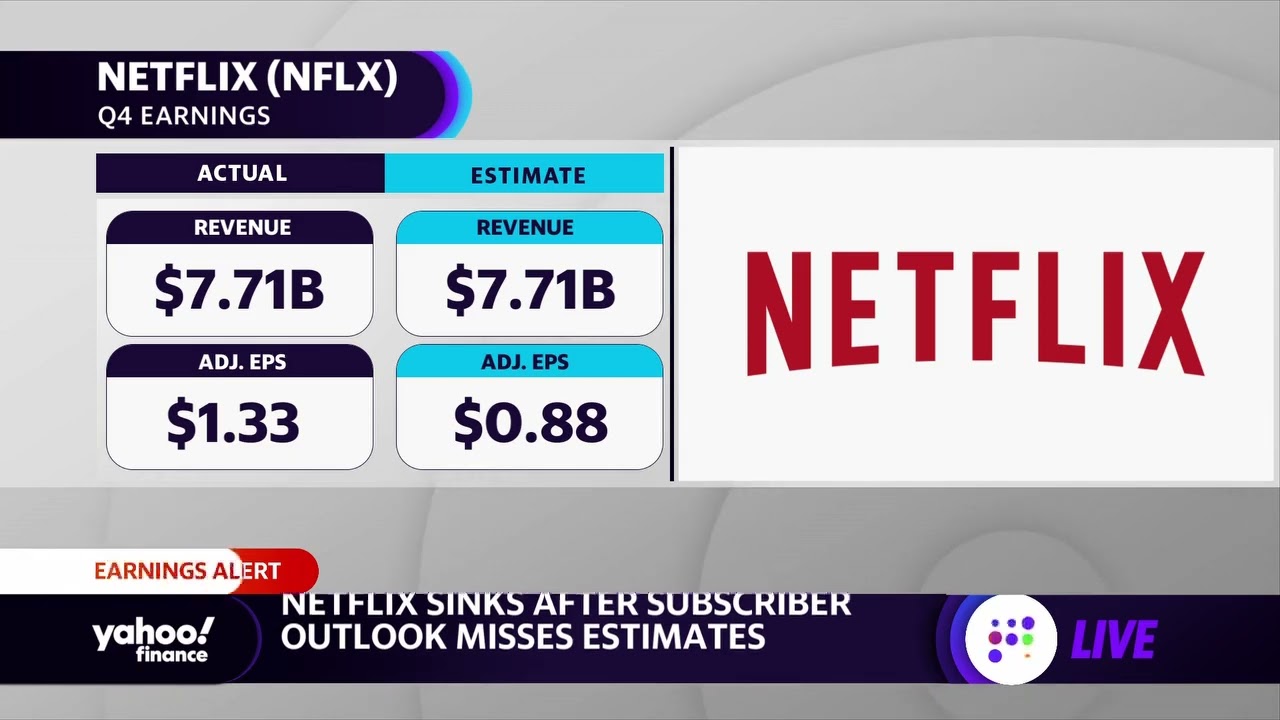

Netflix stock sinks after subscriber outlook misses expectations

CNBC said that the stock had dropped the least since June of 2020. Last quarter, Netflix thought it would have 222.06 million paid subscribers by the end of last year. It didn't meet that goal. Instead, the company said this Thursday, January 20, that it had 221.84 paid members at the end of the fourth quarter.

Since Netflix is already one of the biggest streaming companies out there and can't seem to come up with ways to keep growing, investors have been worried that they won't be able to find new ways to grow. As Netflix says, subscriber growth is going to be low next quarter as well; that's what they say.

The company thought it would get 2.5 million new customers in the first quarter of 2022, down from 4 million in the same time last year. There are still a lot of people who go to Netflix and pay for it, though. Revenue rose 16% over the last year, and paid memberships rose 9% over the last year.

But even though Netflix is still growing, it's doing so very slowly. Investors are worried about both subscriber and revenue growth, especially in the United States, which is their main market.

Netflix Growth Strategy Challenges In The Last Quarters

Netflix didn't say much about its recent price rise in the United States, which was a little bizarre. When it didn't, it said that its new Play Something feature was one example of how the company adds value for its users. Before its call, the company also seemed to wave away any concerns that investors might have about how much competition the company has faced in the last two years.

During this quarter, Netflix premiered two of its most popular films ever, Red Notice and Don't Look Up. But Netflix's growth and new subscribers are slowing even though these two films were watched the most. It is important for Netflix to start taking into account its slow growth, or at least come up with new ways to justify it in the future.

Netflix also gained 8.3 million new subscribers in its most recent financial quarter, which was less than the streaming company had hoped for. There may be more competition from other companies with streaming services, but Netflix says it hasn't stopped growing in areas where these other companies have started to show up. This is what the company wrote to its shareholders on Thursday.

Conclusion

To this day, Netflix hasn't been able to hold on to the market as tightly as it used to, according to one research firm. It was also the first time Netflix executives also said in a letter to shareholders that competition was negatively impacting growth.

A senior analyst at Parrot Analytics told MarketWatch that from the second quarter of 2020 to the fourth quarter of 2021, Apple TV+, Disney+, and HBO Max all flourished their global interest from 10.6% to 20.6%. On the other hand, Netflix dropped from 55% to 45.4%.

Frazer Pugh

Author

Frazer Pugh is a distinguished expert in finance and business, boasting over 6 years of experience. Holding an MBA in Finance from Stanford University, Frazer's credentials underscore his authority and expertise in the field.

With a successful track record in executive roles and as a published author of influential articles on financial strategy, his insights are both deep and practical.

Beyond his professional life, Frazer is an avid traveler and culinary enthusiast, drawing inspiration from diverse cultures and cuisines.

His commitment in delivering trustworthy analysis and actionable advice reflects his dedication to shaping the world of finance and business, making a significant impact through his work.

Emmanuella Shea

Reviewer

Emmanuella Shea is a distinguished finance and economics expert with over a decade of experience. She holds a Master's degree in Finance and Economics from Harvard University, specializing in financial analysis, investment management, and economic forecasting.

Her authoritative insights and trustworthy advice have made her a highly sought-after advisor in the business world.

Outside of her professional life, she enjoys exploring diverse cuisines, reading non-fiction literature, and embarking on invigorating hikes.

Her passion for insightful analysis and reliable guidance is matched by her dedication to continuous learning and personal growth.

Latest Articles

Popular Articles