Overview Of Financial Statements - Getting A Clear Picture

An overview of financial statements is an essential topic for anyone who wants to gain a basic understanding of accounting and finance. Financial statements are documents that show a company's financial position and how it has done financially over a certain time period.

Author:Habiba AshtonReviewer:Frazer PughMar 20, 202377.9K Shares1.1M Views

An overview of financial statementsis an essential topic for anyone who wants to gain a basic understanding of accounting and finance. Financial statements are documents that provide information about a company's financial performance and position over a specific period.

The three primary financial statements are the income statement, balance sheet, and cash flow statement. These statements provide crucial information for investors, creditors, and other stakeholders in evaluating a company's financial health.

In this article, we will provide an overview of financial statements and their importance in understanding a company's financial performance.

Overview Of Financial Statements

As businesses grow and become more complex, it becomes necessary to keep track of their financial transactions and operations. One way to do this is by using financial statements, which provide a snapshot of a company's financial health at a given point in time.

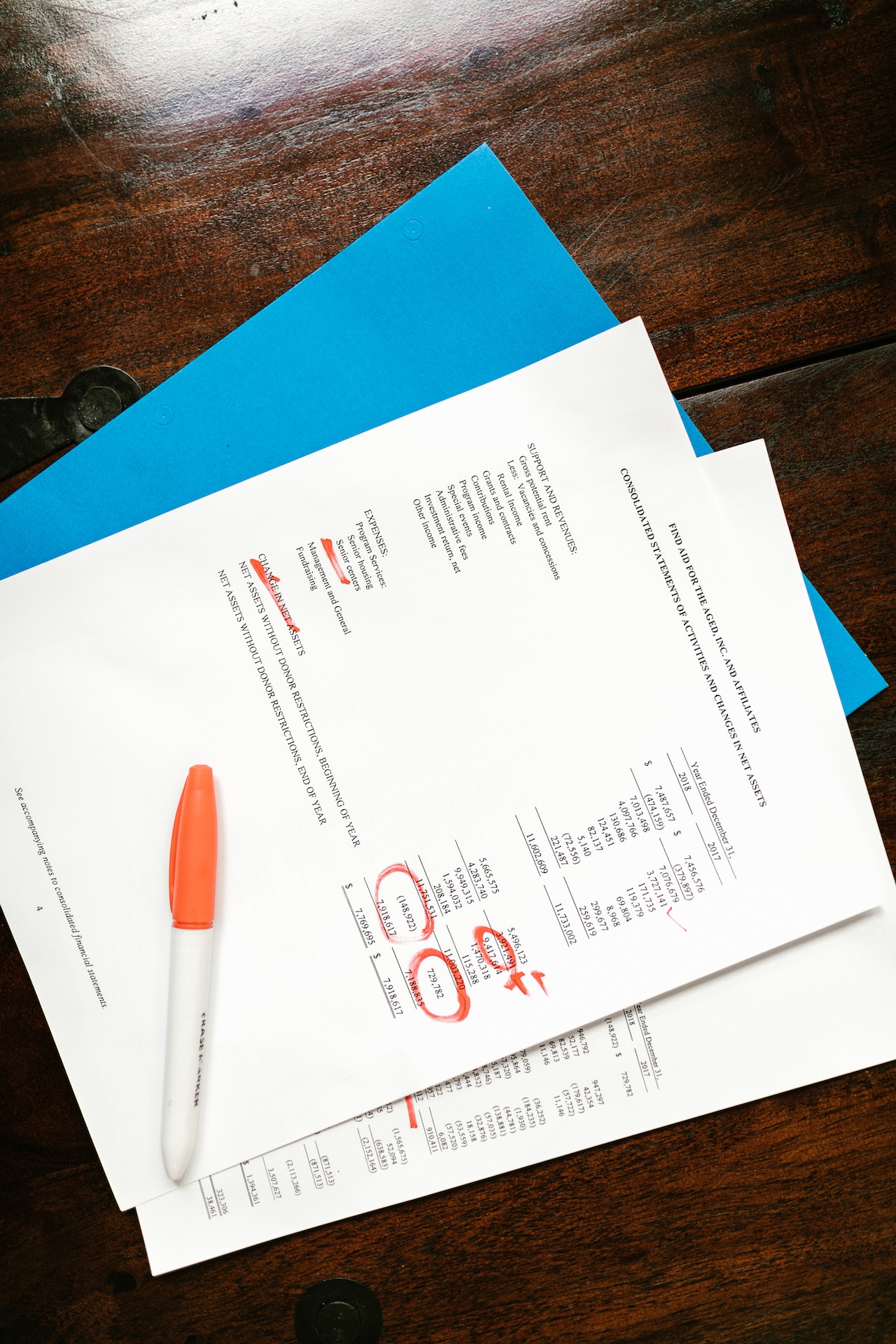

One important aspect of financial statements is that they should be accurate and transparent. This means that all information should be recorded and presented in a clear and understandable way.

Financial statements can be audited by a third-party accounting firm to ensure their accuracy and reliability.

Another important aspect of financial statements is that they can be used to evaluate a company's financial performance over time.

By analyzing trends in the financial statements, investors and analysts can get a better understanding of a company's financial health and make informed decisions about investing in the company.

Financial statements can also be used to compare the financial performance of different companies. For example, investors might compare the financial statements of two companies in the same industry to determine which one is performing better financially.

In addition to the three main financial statements, there are other financial reports that companies may produce.

These include management reports, which provide detailed information about a company's operations and performance, and tax returns, which provide information about a company's tax liabilities.

Overall, financial statements are an essential tool for understanding a company's financial performance and making informed investment decisions.

By familiarizing yourself with the different types of financial statements and how they are used, you can become a more knowledgeable and successful investor.

FINANCIAL STATEMENTS: all the basics in 8 MINS!

The Purpose Of Financial Statement

The primary purpose of financial statements is to provide relevant and useful information about a company's financial performance to various stakeholders, including investors, creditors, and management.

Financial statements help stakeholders evaluate the company's profitability, liquidity, and solvency, and make informed decisions about investing or lending money to the company.

Financial statements can also be used to assess a company's financial health and identify areas for improvement. For example, if a company's income statement shows that it is consistently losing money, management may need to evaluate its pricing strategies, reduce expenses, or restructure its operations.

Another important use of financial statements is to comply with legal and regulatory requirements. Publicly traded companies are required to file financial statements with regulatory bodies such as the Securities and Exchange Commission (SEC), and companies of all sizes must prepare financial statements for tax purposes.

In summary, financial statements are critical tools for evaluating a company's financial performance, making informed decisions, and complying with legal and regulatory requirements.

Interpreting Financial Statements

Interpreting financial statements is a crucial skill for anyone who wants to gain a comprehensive understanding of a company's financial health. Financial statements provide a wealth of information about a company's financial performance, including its revenues, expenses, assets, and liabilities.

There are several key metrics and ratios that analysts use to interpret financial statements. One of the most important is the profit and loss statement, which provides an overview of a company's revenues and expenses. This statement is also known as an income statement and shows the company's net income or loss for a specific period.

Another important financial statement is the balance sheet, which provides a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and equity, and is used to determine the company's liquidity and solvency.

The cash flow statement is also an important financial statement. It shows the company's cash inflows and outflows over a specific period, which is crucial for determining its ability to pay its debts and finance its operations.

Analysts also use a range of financial ratios to interpret financial statements, including the debt-to-equity ratio, the return on equity, and the current ratio. These ratios can provide valuable insights into a company's financial position and help analysts make informed investment decisions.

Overall, interpreting financial statements is a complex process that requires a thorough understanding of accounting principles and financial analysis techniques. However, by mastering this skill, investors and analysts can gain valuable insights into a company's financial health and make informed decisions about their investments.

Types Of Financial Statements

There are three main types of financial statements that companies typically prepare:

1. Income Statement

The income statement, also known as the profit and loss statement, provides a summary of a company's revenue and expenses over a specific period. The purpose of the income statement is to show whether the company is generating a profit or a loss.

2. Balance Sheet

The balance sheet provides a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and equity. The purpose of the balance sheet is to provide a summary of the company's financial position, including how much it owns and how much it owes.

3. Cash Flow Statement

The cash flow statement provides a summary of a company's cash inflows and outflows over a specific period. It shows where the company's cash is coming from and where it's going. The purpose of the cash flow statement is to provide information about the company's liquidity and its ability to generate cash.

How Financial Statements Are Used

Financial statements are used by a variety of stakeholders for different purposes:

1. Investors

Investors use financial statements to evaluate the financial health of a company and make investment decisions. They look at a company's financial statements to determine its profitability, liquidity, and solvency.

2. Creditors

Creditors use financial statements to evaluate a company's ability to pay back loans. They look at a company's financial statements to determine its creditworthiness and the amount of risk involved in lending money to the company.

3. Regulators

Regulators use financial statements to monitor and regulate companies in the public interest. They use financial statements to ensure that companies are complying with relevant laws and regulations.

People Also Ask

What Are The Four Basic Financial Statements?

The four basic financial statements are the income statement, balance sheet, statement of cash flows, and statement of stockholders' equity.

How Do You Analyze Financial Statements?

Financial statements can be analyzed by calculating various ratios such as liquidity ratios, profitability ratios, and solvency ratios.

What Is The Purpose Of A Balance Sheet?

The purpose of a balance sheet is to show a company's financial position at a specific point in time by presenting the company's assets, liabilities, and equity.

What Is The Purpose Of An Income Statement?

The purpose of an income statement is to show a company's financial performance over a specific period of time by presenting the company's revenues, expenses, and net income or loss.

What Is The Purpose Of A Statement Of Cash Flows?

The purpose of a statement of cash flows is to show the inflows and outflows of cash for a company over a specific period of time, organized into operating, investing, and financing activities.

Final Words

An overview of financial statements is essential for businesses and individuals alike. It provides a clear picture of the financial health of a company or organization and helps in making informed decisions.

By understanding the different financial statements, one can analyze the financial performance and stability of a business. Financial statements also aid in measuring a company's profitability, liquidity, and solvency.

It is crucial to review financial statements periodically to identify areas of improvement and make necessary changes to achieve financial goals.

Overall, understanding financial statements is an important skill for anyone involved in financial management.

Habiba Ashton

Author

Habiba Ashton, an esteemed professional in Digital Marketing and Business, brings over 10 years of experience to the table. She holds a Master's degree in Marketing Management from Stanford University and is a certified Digital Marketing strategist.

Habiba has authored numerous articles on SEO, Social Media Marketing, and Branding, published across reputable platforms.

Her impactful projects have consistently driven growth and visibility for businesses, earning her accolades from clients and industry peers alike. One notable achievement includes leading a digital marketing campaign that resulted in a 30% increase in online sales for a major retail client.

Looking ahead, Habiba is committed to pioneering ethical digital marketing practices that prioritize customer trust and engagement. Her vision is to lead initiatives that foster a transparent and sustainable digital ecosystem for businesses and consumers alike.

In her free time, she enjoys cycling, stargazing, and staying updated on digital entertainment trends.

Frazer Pugh

Reviewer

Frazer Pugh is a distinguished expert in finance and business, boasting over 6 years of experience. Holding an MBA in Finance from Stanford University, Frazer's credentials underscore his authority and expertise in the field.

With a successful track record in executive roles and as a published author of influential articles on financial strategy, his insights are both deep and practical.

Beyond his professional life, Frazer is an avid traveler and culinary enthusiast, drawing inspiration from diverse cultures and cuisines.

His commitment in delivering trustworthy analysis and actionable advice reflects his dedication to shaping the world of finance and business, making a significant impact through his work.

Latest Articles

Popular Articles