What Is PayTM Postpaid Lite Convenience Fee And What Are The Advantages?

In this essay, we shall explain what Paytm Postpaid Service is. What is the Paytm Postpaid Lite Convenience Fee? And what are the advantages? And how can you make the most of it? Here, we will give in-depth information.

Author:Anderson PattersonReviewer:Elisa MuellerMar 25, 2022715 Shares178.7K Views

PayTM, as we all know, has become a highly popular payment application in India, with practically everyone using it. PayTM has introduced a slew of new offerings to help its burgeoning user base.

Paytm launched a new service called "Paytm Postpaid Service 2021" last year to virtually eliminate the inconvenience of daily payments for its users.

In this essay, we shall explain what Paytm Postpaid Service is And What is the PayTM Postpaid Lite Convenience Fee? And what are the advantages? And how can you make the most of it? Here, we will give in-depth information. As a result, you should read today's article all the way through and make use of Paytm's service.

PayTM Postpaid

PayTM has created three postpaid variants: Lite, Delite, and Elite, which will be supplied based on the evaluation of our partner NBFC. While the Postpaid Lite card has credit limitations of up to Rs. 20,000 and a convenience fee that will be applied to the monthly bill, the Delite and Elite cards have credit limits of Rs. 20,000 to Rs. 1,00,000 in monthly spending and no convenience fees.

PayTM Postpaid Lite Review

Paytm Postpaid Lite was created to allow Paytm users with poor credit ratings to take advantage of the ease and benefits of this service. Paytm Postpaid, on the other hand, is free to activate and keep running.

PayTM Postpaid Lite Convenience Charges

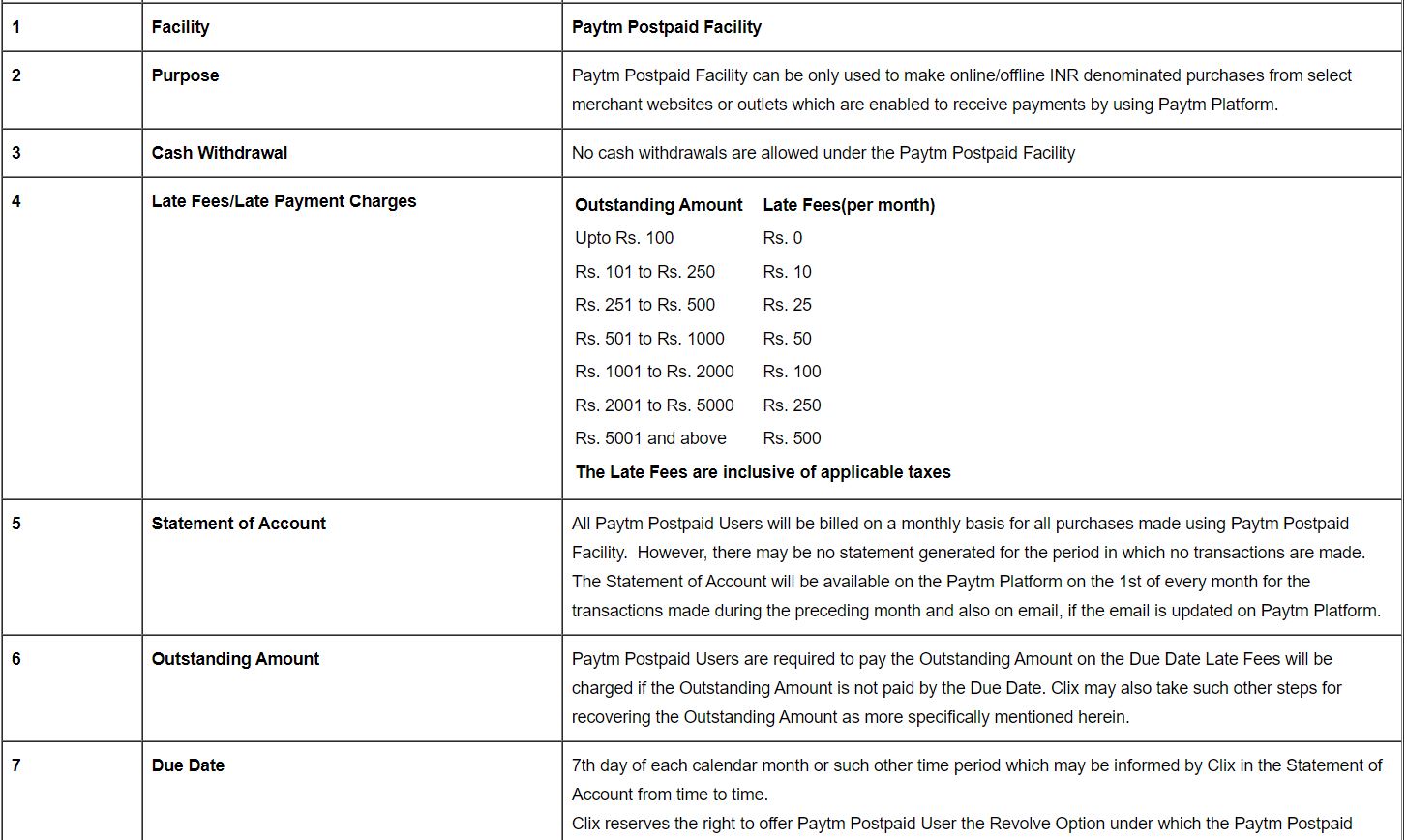

Customers are charged a PayTM postpaid lite convenience fee for the pleasure of paying for a product or service using a payment method that is not common for the firm. A company that typically takes cash or cheques for transactions but also accepts credit cards for convenience may charge a fee for the convenience.

Paytm has partnered with two NBFCs to offer the postpaid service. With the increased credit limit, customers will be able to pay for high-value products such as furniture and consumer electronics.

With a CIBIL score of 0–700, you may obtain a credit limit of 20,000 with Paytm postpaid light. The convenience charge ranges from 0% to 4%. The 7th of each month is the payment due date for all Paytm postpaid services.

PayTM Postpaid Lite Benefits

Paytm Postpaid users may take advantage of some amazing and unique discounts on movies, bill payments, and more.

You can gain extra bonuses and incentives by using this service.

Paytm postpaid services do not require any documents, unlike other banks.

PayTM Postpaid Activate

You can activate postpaid services in your PayTM account by the following procedure.

Your service will be enabled immediately when you complete the KYC, or you will be placed on a waiting list.

Use an OTP to double-check.

To check your credit score, double-check your name, contact information, PAN, and date of birth.

To continue, simply click.

You will be required to check your current credit rating.

Select the Paytm Postpaid symbol from the drop-down menu.

In the search icon on your home screen, type "Paytm Postpaid."

Open the Paytm app and log in.

PayTM Postpaid Lite Eligibility

The NBFC and PayTM determine your eligibility based on your Paytm transaction history. Paytm will look into your transaction history and payment methods. Paytm will verify your CIBIL score when you apply for a credit limit through the app. The aforementioned factors will determine the credit limit and approval. It is important to note that you must be at least 18 years old to receive Paytm Postpaid.

PayTM Postpaid Cancellation

Paytm Postpaid Users may opt to cancel their Paytm Postpaid Service at any time by notifying the Paytm Platform's 24x7 Help Section. However, the Paytm Postpaid Facility will be terminated only after all outstanding payments, late fees, and any other sums owed to the Paytm Postpaid User have been settled.

Is PayTM Postpaid Lite Safe

It's a nice experience using Paytm postpaid since there are no hidden costs other than late payment charges beyond the payment date, and it's as if we simply have to pay for the amount we used from the postpaid credit they give, with no interest or hidden charges. Late payments are also allowed, but only after a tiny late payment charge has been paid, which is computed by them.

For the time being, not all vendor wallets are accepted, but I believe this will change in the near future.

Is PayTM Postpaid Useful?

Paytm Postpaid may only be used to make INR-denominated purchases online or offline from specific merchant websites or locations that accept payments through the Paytm Platform. All purchases made with the Paytm Postpaid Facility will be debited on a monthly basis for all Paytm Postpaid users.

What Is PayTM Postpaid Lite?

Paytm Postpaid allows you to purchase today and pay in one bill the following month or sooner using UPI, debit card, or internet banking. Paytm Postpaid is a service that we provide to our most loyal clients. Paytm Postpaid LITE is a Paytm Postpaid version.

Conclusion

Paytm has launched a new and excellent venture called Paytm Postpaid. You can acquire a credit limit of up to Rs. 1,000,000 after the account is authorized. To recharge your phone and DTH, you can use Paytm postpaid. You can also use it to make travel reservations, buy movie tickets, and shop online.

Anderson Patterson

Author

Anderson Patterson, a tech enthusiast with a degree in Computer Science from Stanford University, has over 5 years of experience in this industry.

Anderson's articles are known for their informative style, providing insights into the latest tech trends, scientific discoveries, and entertainment news.

Anderson Patterson's hobbies include exploring Crypto, photography, hiking, and reading.

Anderson Patterson's hobbies include exploring Crypto, photography, hiking, and reading.

In the Crypto niche, Anderson actively researches and analyzes cryptocurrency trends, writes informative articles about blockchain technology, and engages with different communities to stay updated on the latest developments and opportunities.

Elisa Mueller

Reviewer

Elisa Mueller, a Kansas City native, grew up surrounded by the wonders of books and movies, inspired by her parents' passion for education and film.

She earned bachelor's degrees in English and Journalism from the University of Kansas before moving to New York City, where she spent a decade at Entertainment Weekly, visiting film sets worldwide.

With over 8 years in the entertainment industry, Elisa is a seasoned journalist and media analyst, holding a degree in Journalism from NYU. Her insightful critiques have been featured in prestigious publications, cementing her reputation for accuracy and depth.

Outside of work, she enjoys attending film festivals, painting, writing fiction, and studying numerology.

Latest Articles

Popular Articles