A quantitative approach to a subjective question about Bitcoin's energy consumption

Do you think Bitcoin's energy use is okay? It has been argued about since the network's inception. Nevertheless, despite all of the research papers and studies, the topic re-emerges every time Bitcoin appreciates.

Author:James PierceReviewer:Gordon DickersonJun 21, 202121.2K Shares1.2M Views

Do you think Bitcoin's energy use is okay? It has been argued about since the network's inception. Nevertheless, despite all of the research papers and studies, the topic re-emerges every time Bitcoin appreciates.

It is a completely new technology, with a number of inherent flaws, that cannot accurately replicate legacy systems. Bitcoin is a settlement layer, a store of wealth, and a means of exchange, but it is not primarily any of these things. Bitcoin does use a lot of energy, but this is what allows it to be so resilient and safe.

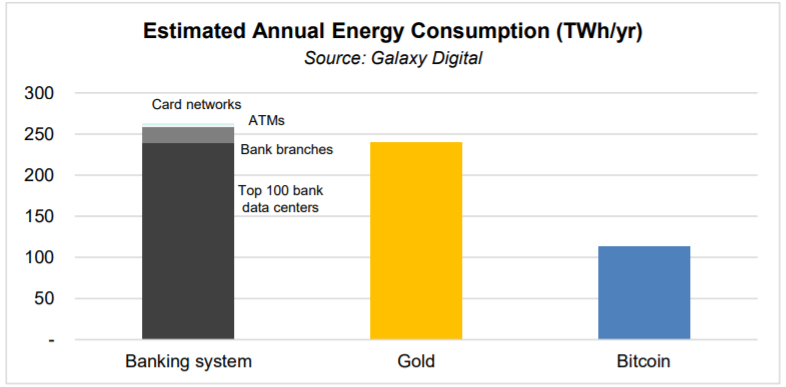

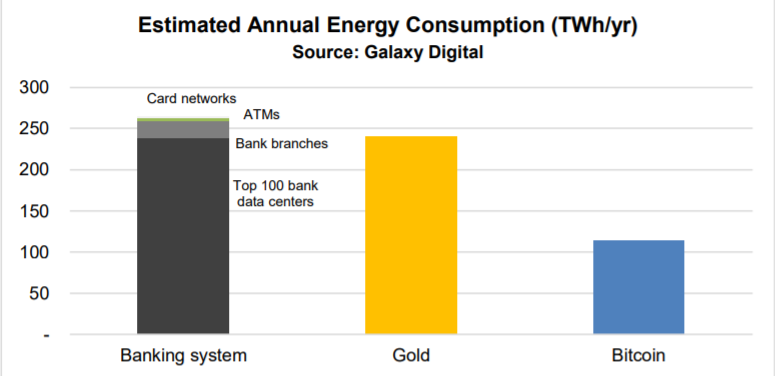

Because of Bitcoin's openness, it is simple to estimate the amount of energy used by Bitcoin. Because this tends to lead to a lot of criticism for Bitcoin, other conventional sectors seldom receive these kinds of criticisms. With respect to payments, savings, and settlement, Bitcoin is often likened to the traditional banking system (as a non-sovereign store of value). However, given many industries do not publicly publish their energy footprints, it is impossible to estimate their total energy use. It seems like a good idea to use Bitcoin's energy usage as a benchmark when discussing it, as it is commonly compared to other industries.

Bitcoin's energy footprint is reviewed in this article, followed by a comparison to the gold and banking industries. Despite this intriguing contrast, the comparisons themselves are just useful approximations.

While it is possible to quantify and compare the amount of energy consumed by different businesses, the topic remains essentially subjective. Despite people's varying viewpoints on the overall significance of the Bitcoin network, its features are unlikely to change. Anyone may join the Bitcoin revolution. It is possible for anybody to keep bitcoins for themselves. Due to Bitcoin's feature of providing probabilistically final settlement within an hour, 24 hours a day, 365 days per year, it is perfectly able to handle numerous transactions over time.

Individuals who do not have the benefit of a solid and accessible financial infrastructure can benefit from these qualities, which provide financial independence to people worldwide. A great use for intermittent and surplus energy is created by the network since these new use cases greatly increase efficiency. Network scalability will only continue to increase as the network adoption merits it.

The Infrastructure And Energy Demands Of The Bitcoin Network

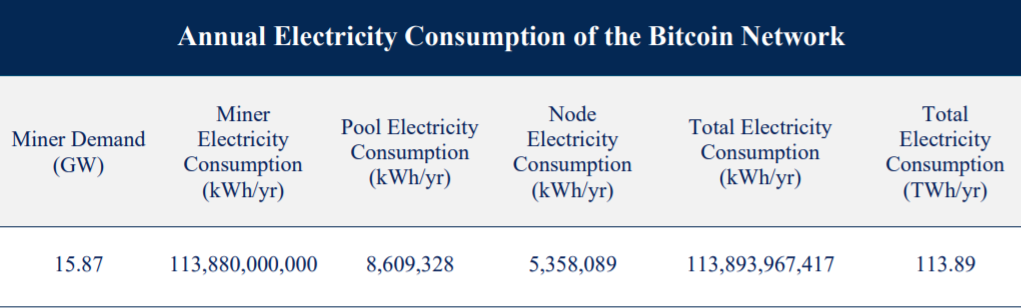

According to estimates, the whole electricity usage of the Bitcoin network comes from three main sources: validating and relaying transactions, pool coordination, and mining hardware. It is estimated that 99.8% of Bitcoin's energy usage is related to mining. The devices are termed ASICs because they contain integrated circuits tailored to certain applications.

The ASICs were built to handle the Proof of Work (PoW) that is needed to keep the blockchain up-to-date and secure. By necessitating the consumption of energy, PoW cryptographically connects the virtual asset to the physical world. One of the most innovative elements of Bitcoin is the new PoW algorithm (PoW stands for Proof of Work). Energy consumption is an inherent characteristic of the Bitcoin network, yet it is what makes the network so safe and stable.

The current Bitcoin network consumes around ~113.89 terawatt-hours (TWh) each year. Here are a few comparisons to put this figure in context:

- The global yearly energy supply is around 166,071 TeraWatt-hours per year, which is 1,458.2 times as much as the energy use of the Bitcoin network.

- Global annual power output is about 26,730 TWh per year, which is 234.7 times more than the number of bitcoins in circulation.

- The “always-on” electrical gadgets in American households generate 1,375 TWh per year, 12.1x that of the Bitcoin network

A key insight in these comparisons is that if fundamental assumptions are applied, it is simple to calculate Bitcoin's real-time energy usage. Many people criticize Bitcoin's energy use since it is easy to point out. Bitcoin is, however, criticized for using "a lot" of energy.

The traditional banking system is most commonly contrasted to Bitcoin (for making payments, storing money, and making a financial transaction) and gold (a non-sovereign store of value). However, Bitcoin is a new technology with little overlap with existing systems. Bitcoin is a settlement layer, a store of wealth, and a means of exchange, but it is not primarily any of these things. These industries use different forms of energy, and the energy footprints are unknown.

Similar incumbent companies in the gold business and the banking system make an accurate comparison for Bitcoin's energy consumption. Unfortunately, auditing the energy use of these two businesses is more difficult than accurately measuring the energy use of Bitcoin.

In order to arrive at an approximate assessment of the energy footprint of the gold mining and banking industries, we will do our best.

Conducting An Audit Of The Gold Industry's Energy Use

to determine the industry's overall GHG emissions, we utilize a World Gold Council study that predicts total emissions in 2018 for the sector. Using this GHG calculation, we get an aggregate yearly energy consumption, as well as an average world carbon intensity.

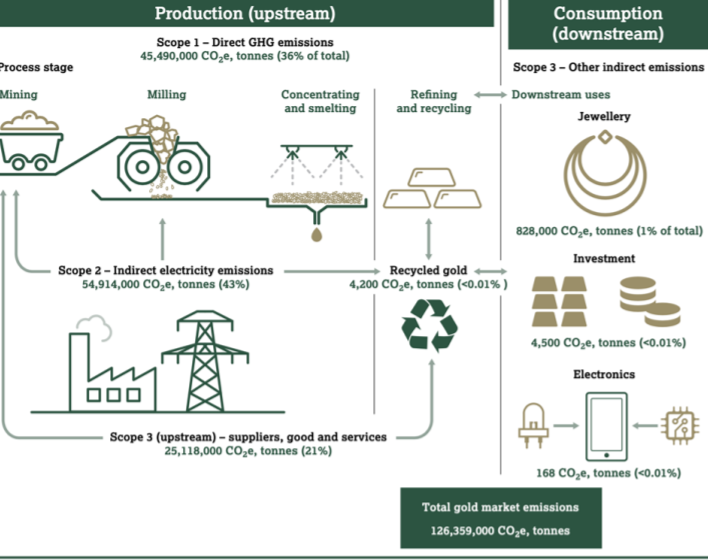

Gold mining emissions and gold consumption emissions are examined in the paper. Most of the GHG emissions are emitted upstream, during upstream processing (mine and refining), and not downstream, during downstream processing (such as manufacturing jewelry, distributing investments, and making electronic components). The World Gold Council, an organization that includes 33 gold industry groups and corporations, should be aware of a possible conflict of interest when reporting on gold mining emissions.

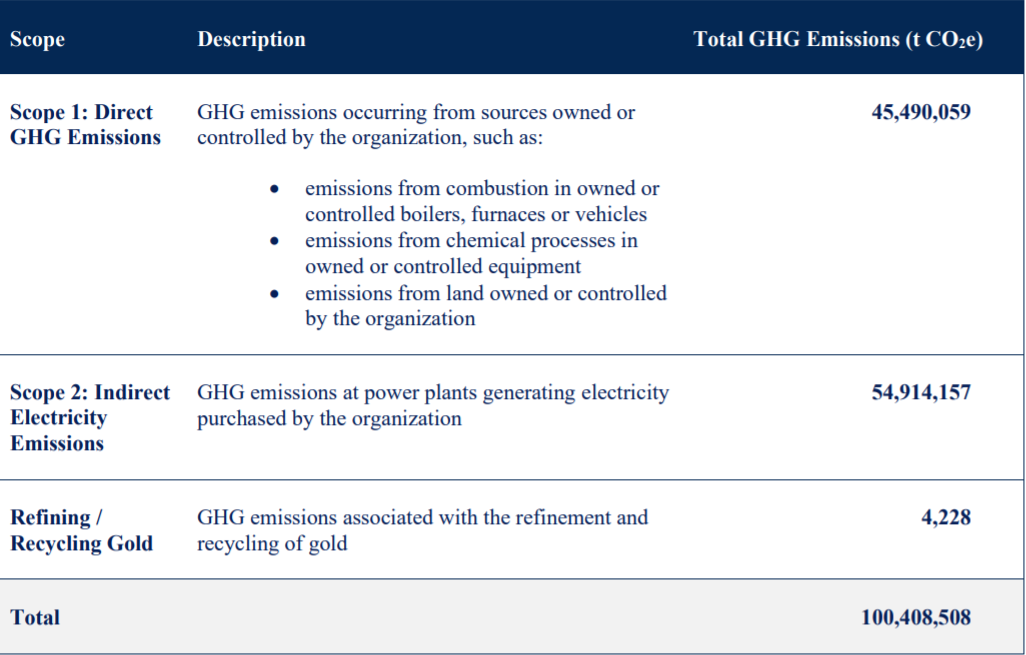

Direct GHG emissions, indirect electricity emissions, and other indirect emissions are split down into three separate scopes: (1) direct GHG emissions, (2) indirect electricity emissions, and (3) other indirect emissions. Take a look at Figure 3 to get further information about these scopes. The total yearly greenhouse gas emissions for all three world gold council scopes are 126 million tons of carbon dioxide.

We only examined direct GHG emissions (scope 1), indirect energy emissions (scope 2), and any emissions-related to gold refining and recycling in comparison to Bitcoin's electrical usage. these segments emitted 100,408,508 tCO2 Using a worldwide IEA carbon intensity multiplier of 0.92 lb CO2/kWh16, we translated the GHG emissions figure to kWh/yr. The premise is that the gold We estimate that with this multiplier, these parts of the gold industry use 240.61 TWh per year. These estimations may ignore certain sources of energy such as usage and emissions that are derived from other sources in the system, and these secondary impacts would have a second-order influence on the gold industry such as the energy and carbon intensity of the tires.

In a 2018 analysis released by Money Metals, "the majority of a tire's production cost comes from burning energy at all forms and in all phases," as one author put it. Tires are 25,000 tons used by Barrick Gold each year. A study by the Rubber Manufacturers Association claims that the manufacture of a typical vehicle tire requires seven gallons of oil. Used for heavy equipment, these tires have a diameter of 13 feet and weigh up to 11,860 pounds.

Examining How Much Energy Banks Are Using

A lot of people say that the banking system is very different from Bitcoin. In order to do all the settlements for the retail and commercial banking sector, several settlement layers are required. Bitcoin, however, has a final settlement layer. Given that the historical banking system is a near-analog, we estimate their energy usage based on the assumptions below.

Electricity usage data are not collected by the banking industry. Within the larger banking system, there are four major areas of power consumption that are accurate enough to create reasonable estimates:

- Data centers for the banking sector

- Branches for the banking sector

- ATMs

- Card network data centers.

Banks' power usage, worldwide, is projected to be 238.92 terawatt-hours (TWh) each year.

Data Centers Where Banking Is Conducted

Information on energy use is not provided by the banking sector since their data centers require this data to operate. In order to arrive at this estimate, several assumptions were made.

No other financial institution reports on the number of private data centers they have.

The data centers' demand, location, and area are not made known. The estimated area of 75,000 ft2and a 400 W/ft2 of demand are used to calculate the power usage of these data centers. The bank's banking data center is in use around the clock, seven days a week, for a total of eight thousand hours a year. Electricity usage is expected to be 6.04 Terawatt-hours (TWh) each year.

A linear connection between BofA's projected data center power usage and total deposits is assumed to estimate worldwide data center demand for the top 100 global banks as reported by S&P Capital IQ. A worldwide top 100 banking association deposits $70,972.10 billion, while a Bank of America deposit account has $1,795.48 billion. When considering total deposits for the top 100 worldwide banks and an estimate of 238.92 TWh per year, it's projected that the whole banking system's data centers consume almost the same amount of energy as Bank of America.

Bank Branches

To run bank branches, the banking system does not provide electricity usage statistics. We calculate this statistic by multiplying the entire number of bank branches, the power consumption of a small business on a worldwide scale, and the total number of hours the firm is open each year. A branch of a bank is defined as operating for 2,250 hours each year, 50 weeks per year, or 9 hours each day, 5 days each week, for a total of 2,250 hours in a year. A branch of a commercial bank is often regarded as a small business.

Publicly available data about the total number of bank branches are available. In all, our model predicts the worldwide average small company energy consumption is estimated to be equal to the sum of four countries: the United States, the United Kingdom, Mexico, and China. It is difficult to come by specific statistics on the small company usage of energy in Mexico and China, therefore we use the information on residential consumption to approximate it. In the report, further information about this computation is provided.

Estimation:Based on worldwide estimates, we estimate that the yearly power usage for bank branches throughout the world is around 19.71 TW.

This assessment overlooks the amount of gas used by banks for heating, as well as the gas and electricity used by all other financial office buildings.

ATMs

Banks do not disclose how much power is used by ATMs. This estimate is generated by multiplying the total number of ATMs, the number of customers that use each ATM, and the hours that ATMs are open. An ATM is continuously operating, with service available 24 hours a day, 7 days a week, for a total of 8,760 hours during the year. The usual number of watts requested by an ATM is calculated to be 145.

This estimate suggests that the worldwide annual energy usage of ATMs is around 3.09 TW, or 0.0003% of global power consumption.

Network Of Cards

To provide energy to the facility, card networks do not disclose electricity usage data that is necessary to operate their infrastructure. The only data center network that makes some of its data centers publicly available is VISA, which acknowledges running five centers throughout the world. VISA reports the total square footage of each data center, but does not break out the power use for each. With this in mind, we have estimated the total amount of data centers at VISA using their total square footage. For the total estimated power consumption, we utilize this demand, the number of transactions that VISA completed in 2019, and VISA's market share by transaction count. When estimating data center energy usage, this model assumes a linear connection between transaction count and projected consumption.

On average, a data center requires around 400 Watts per square foot. To estimate VISA's electricity usage, we take the total area of all of VISA's data centers, the amount of electricity used per square foot, and the amount of time each data center is powered on. The VISA data centers are estimated to run for a total of 8,760 hours per year, every year, 24 hours a day, 7 days a week, and 365 days a year.

We anticipate the VISA network will use 0.84 terawatt-hours of power each year. In 2019, VISA handled about 185.5 billion transactions in total. Card network operators would need 2.00 terawatt-hours (TWh) of power per year, the equivalent of 0.2% of world electricity usage.

Incorrect:This study does not account for the power use of all of the office buildings on the card network.

Energy Usage Summary Of The Banking System

It is difficult to get data about the electricity used by the banking business. We estimate that the financial sector utilizes 263.72 terawatt-hours of energy per year. A complete calculation of this sector's energy usage will require each financial institution to report on its own numbers.

Even when all the individual comparisons are taken into account, a comparison between Bitcoin and the many levels of the financial system is incorrect. Traditional financial stacks, which include financial institutions, financial service providers, and intermediaries, can be difficult to understand because of their many levels of intermediaries. Credit card networks are ideal for transferring quick payments and IOUs, but they are dependent on the banking system for settlement.

Our approach has been to focus on major institutions that make a significant impact on the global financial system and keep other institutions out from our coverage, such as central banks, clearinghouses (such the DTCC), and other components of the conventional financial system. Because this audit only examines a portion of the overall energy use of the banking system, the amount of energy used by the banking system is unclear and externalities have not been included.

Overlooking the benefits of moving huge amounts of money is being reductive in describing the value of the financial system. In this example, Bitcoin has distinct scalability qualities compared to the banking system. As the number of transactions increases, the financial system must provide extra infrastructure. Bitcoin's energy usage is proportional to network economics, not transaction volume.

So What?

It is a really fascinating perspective on the Bitcoin network's energy consumption, but can it help us answer the question: Is the Bitcoin network's electricity usage an acceptable use of energy?

However, we are still left to make the value judgment regarding the magnitudes of the various industries' energy use. Depending on their ideas regarding the usefulness of bitcoin, an individual's answer will be one of several.

The Value Of Something Is Dependent On The Eye Of The Beholder

There is a broad range of views on bitcoin's value. While some Bitcoin aficionados believe that Bitcoin's energy usage is completely reasonable, others believe it is completely wasteful. the disturbing history of illegal activities.

Galaxy has a very clear belief in Bitcoin and the larger ecosystem; our whole firm has been developed around it. That being said,

Of course, not everyone will agree with our views on this.

Instead of proactively applying labels to every potential opinion on Bitcoin, we instead evaluate several different perspectives. A range of diverse perspectives from extremes.

- The future of Bitcoin does not include a significant role in the global economy. This group holds that no effort is acceptable.

- Instead than disrupting the existing financial system, Bitcoin will function alongside it (similar to gold). Though markets and legislation will help decide the proper degree of Bitcoin energy usage, one organization feels it's justified. While this group of individuals agrees that the usage of energy is not intrinsically evil, they insist on using it in the most environmentally friendly way possible.

- It will be the worldwide currency. This group believes that the market will drive Bitcoin's energy expenditure.

Group 1: Bitcoin Will Not Be Part Of The Global Economy

They feel that the idea of bitcoin having any value has long been rendered obsolete.

Many Who Assume Bitcoin Is Just For The Well-off Are Growing Richer

People in industrialized countries take the security of the financial system for granted. Concerns regarding ATM withdrawals or money confiscation by the government are unlikely due to recent strong monetary growth. This applies only to a small portion of the global population.

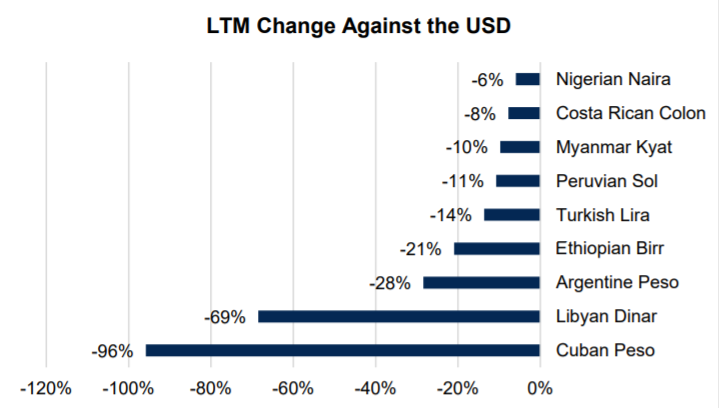

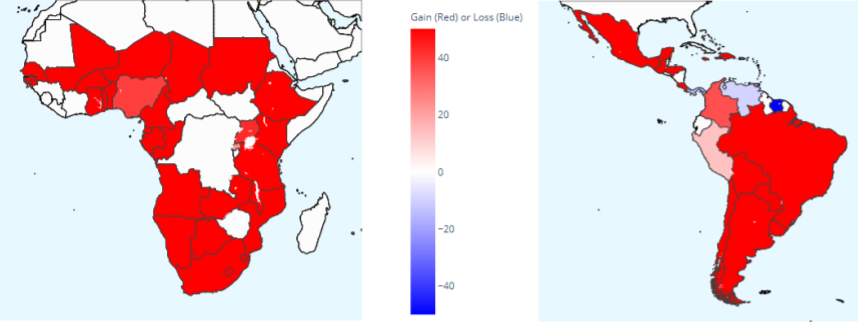

As a result of inflation, residents of Zimbabwe, Venezuela, Myanmar, Argentina, and many other nations have suffered significant material damage. Victims are compelled to look for an alternate form of payment.

In the nations where this movement is occurring, there is increasing peer-to-peer (P2P) trade volume on platforms like Paxful and LocalBitcoins.

For these individuals, bitcoin is more than a means to get rich quickly. It is a lifesaving mechanism that allows these families to maintain their financial resources while the nation's currency is fast declining in value.

Although the primary benefit of bitcoin is to safeguard capital, it also opens the gates for oppressed populations to earn money. the total population living under authoritarian regimes that utilize money as a weapon for surveillance and state control amounts to 4.2 billion people. The majority of the population is excluded from the global financial system due to the debasement of their currency. Following this, Gladstein says:

Belarusian activists have recently bypassed the country's authoritarian government by using bitcoin to send money to striking employees, who in turn, transfer it into the local currency via peer-to-peer markets to feed their families while protesting the government.

In October, an activist group in Nigeria collected $50,000 worth of bitcoin to buy gas masks and protest equipment due to the discovery that the bank accounts that fund their activism had been closed.

As Putin tightly regulates the traditional banking system, opposition figure Alexei Navalny has amassed millions of dollars in bitcoin. The conclusion that Putin cannot freeze a Bitcoin account applies to many things he can't do, but it specifically applies to his inability to do so.

While almost everyone is included in the traditional banking system, in some countries, a portion of the population, the "unbanked," is not. There are about 7 million unbanked families in the United States, according to the 2019 FDIC report.

This group has a heavy proportion of lower-income, less-educated, Black, Hispanic, and American Indian and Native homes, as well as a number of working-age handicapped and low-income households. 48.9% of respondents reported that they did not have enough money to fulfill minimal bank standards when asked why they were unable to obtain financial services. This equates to 3.5 million families in the United States that have no way of obtaining a bank account. In terms of comparison, Connecticut's population is about the same as all the households in the state.

Bitcoin allows anybody to store their worth, independent of their social-economic standing or their income. There are no minimum account balances necessary.

Group 2: The Development Of Bitcoin Would Be Accompanied By The Current Financial System

A majority of members in this category predict that bitcoin will have a significant impact on the global economy, but are concerned about its energy use. Due to the overlooked value that Bitcoin mining brings to the energy industry, this perspective ignores Bitcoin mining.

The Bitcoin Mining Process Can Serve As A Useful Tool For The Energy Sector

Miners may carry out their tasks anywhere as long as they have access to energy and an internet connection. The results of this assist the energy industry by creating a great use for intermittently or superfluously available energy.

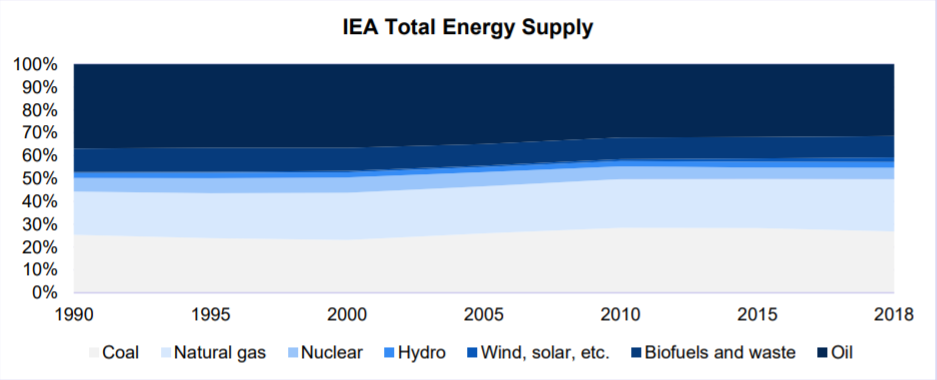

A report by the World Bank puts the figure at around 8.25% of global power consumption is lost in transmission. To obtain an annual worldwide power transmission loss of 2,205.23 TWh/yr, apply this number to the 2018 International Energy Agency (IEA) global electricity production estimate of 26,730.07 TWh/yr. The $19.36 loss suffered by the network today is equivalent to Bitcoin's whole yearly energy usage. Even if it could not be recovered entirely, the fact that much energy is lost each year owing to inefficiency emphasizes both present losses as well as the reality that energy is not fungible.

Often, critics think that miners' energy use either reduces the amount of energy that may be put to better use or results in more energy consumption. While using non-rivalrous energy may be the most cost-effective option, due to inefficiencies in the energy market, bitcoin miners are motivated to utilize discarded or underutilized energy as this energy tends to be the cheapest.

Even though money generated by mining is somewhat unstable, miners have the liberty to choose when and if to use the equipment. Mining is the ultimate energy sink for anybody, wherever, since it allows anyone to earn money from unused energy.

Mining For Bitcoin And Combating Fire Are Two Unrelated Things

One notable place where Bitcoin mining results in a significant decrease in greenhouse gas emissions is in oil fields, thereby resulting in a reduction of methane emissions. About 40% of the present global energy supply is derived from oil. As energy firms strive to find ways to refine oil, the resource is abundant in many parts of the world.

Methane is also produced in large quantities during the oil extraction process. Methane can be delivered through the pipeline, but not as a functioning fuel. When it comes to methane, most of it is either vented or flared at the wellhead. Neither approach is optimal.

Methane has 25 times the impact on the environment than carbon dioxide when it comes to the greenhouse effect. Methane and carbon dioxide are produced as a byproduct when the methane is burned, theoretically lowering the amount of CO2 produced by 24 times. When we consider the various kinds of natural gas flaring, however, the amount of methane that may be lost by flaring varies. Sometimes, up to 70% of the natural gas is lost in flaring.

The blockchain mining process offers a solution. Many firms, like Great American Mining, Upstream Data, and Crusoe Energy Systems, are now developing pipelines to carry the gas that's normally flared off to catch the gas and utilize it for mining bitcoins. Unlike flaring, which may burn methane with less than 3 percent efficiency, gas generators are capable of burning methane with 99 percent efficiency, thereby decreasing the danger of leaking into the atmosphere. A 24 times decrease in emissions is possible for oil producers, since they can avoid releasing methane into the environment. Oil and gas released around 82 Mt of CO2 equivalent in 2019, according to the IEA. To put it in context, this is about comparable to around 8% of the worldwide 33.2 Gt of CO2 emissions that year. This is another way in which Bitcoin mining may be done using surplus electricity.

Bitcoin Is Related To Intermittent Energy

One way to mitigate the intermittent generation of wind and solar power is to ensure flexible generation is ready to take up the slack (such as using natural gas). Curtailment has occurred due to the greater amount of wind and solar output than can be compensated for.

Various estimates imply that it would represent a substantial percentage of the Bitcoin network. An up-to-date estimate puts 6.5 terawatt-hours of solar output curtailed in Chile, China, Germany, and major U.S. areas in 2018, while another places 21.5 terawatt-hours of wind curtailment worldwide in 2013. Meanwhile, some experts estimate that China alone cut 57 TWh of wind and solar power output in 2016.

Using Bitcoin mining as an energy sink might help monetize this energy at the source or smooth out grid-level instability.

Using surplus and intermittent energy in addition to oil drilling and geothermal resources are two examples of the network's capacity to utilize excess and irregular energy. Some say finding ways to capture surplus hydroelectricity from dams and improving plant efficiency.

Group 3: Bitcoin Will One Day Become The Global Monetary Standard

At this camp, network security is related to the amount of energy used. Miners are economically reasonable, and hence the network only consumes as much electricity as the market requires.

Features And Functionality Are Not Mistakes

Greater energy use directly correlates to increased security and resilience under Bitcoin's Proof-of-Work consensus process. As the hash rate rises, 51% of attack risks become less likely.

As the threat of geographic centralization recedes, it becomes less dangerous. In North America, public mining firms have said they will add about 40 exahashes, or an increase of 28% in the current network hash rate, by the end of 2021.

The chance of an assault succeeding decreases as the network grows. Assuming the attacker has gained control of enough mining machines to mine 51% of the network's blocks, an attack would need controlling over 8GW of mining capacity or 16GW of new mining equipment. Due to the fact that the devices have to be powered with energy, an attack would be a very large endeavor. The objective is not static; the hash rate of the network would have risen by the time substantial capacity could be assembled.

A Rational Actor: Bitcoin Miner

Mining is fundamentally a business. Bitcoin miners are always seeking to optimize their profits by seeking out cheap power. Miners have an incentive to keep their operational costs low, even if this means moving from one energy-rich location to another. It means that miners will look for the lowest-cost sources of energy.

Miners will only choose to invest in a mining operation with the prospect of profit, even if they are positive about bitcoin. The lucrative miner will shut down their mine when it is not in use. Decreased income caused the hash rate to decline by 23% following the most recent halving in May 2020. A smaller number of mining enterprises had lucrative operations and gained as competition dropped.

Conclusion

People have different ideas about how important the Bitcoin network is, but Bitcoin's characteristics have not changed. Anyone can become involved with Bitcoin. Anyone can store their own bitcoins. The random chance of the final settlement occurs within an hour, 24 hours a day, 365 days per year, no matter when you made the transaction.

This list of characteristics offers financial independence to individuals worldwide while providing them with enough financial infrastructure that is reliable and accessible. The network might provide more valuable service to the energy sector by enabling ideal instances for periods of intermittent and excessive energy usage. The growth of the network will only continue if network use calls for it.

Even while energy usage might be negative, it doesn't have to be. Conversely, energy is the only universal money, according to Smil. As humanity uncovers new technologies that need more energy, they will have a greater impact on the status quo. As another example, Bitcoin is.

As we were returning to the topic of whether Bitcoin's energy consumption is an acceptable use of energy, the question then becomes: Is the Bitcoin network's electricity usage justifiable? To sum up, our response is a resounding yes.

Jump to

The Infrastructure And Energy Demands Of The Bitcoin Network

Conducting An Audit Of The Gold Industry's Energy Use

Examining How Much Energy Banks Are Using

Energy Usage Summary Of The Banking System

So What?

The Value Of Something Is Dependent On The Eye Of The Beholder

Group 1: Bitcoin Will Not Be Part Of The Global Economy

Group 2: The Development Of Bitcoin Would Be Accompanied By The Current Financial System

Group 3: Bitcoin Will One Day Become The Global Monetary Standard

Conclusion

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Gordon Dickerson

Reviewer

Gordon Dickerson, a visionary in Crypto, NFT, and Web3, brings over 10 years of expertise in blockchain technology.

With a Bachelor's in Computer Science from MIT and a Master's from Stanford, Gordon's strategic leadership has been instrumental in shaping global blockchain adoption. His commitment to inclusivity fosters a diverse ecosystem.

In his spare time, Gordon enjoys gourmet cooking, cycling, stargazing as an amateur astronomer, and exploring non-fiction literature.

His blend of expertise, credibility, and genuine passion for innovation makes him a trusted authority in decentralized technologies, driving impactful change with a personal touch.

Latest Articles

Popular Articles