Sponsors Can Save SPACs If They Want To - FAQs About Blank Check Companies

So, what exactly is a Special Purpose Acquisition Company (SPAC), and why should you be familiar with this type of organization? There are many of us who are not familiar with SPAC or how it operates. As a result, the author of this article has compiled a list of essential questions and reliable answers concerning the well-known company known as SPACS.

Author:James PierceReviewer:Alberto ThompsonFeb 10, 20223.3K Shares558.6K Views

So, what exactly is a Special Purpose Acquisition Company (SPAC), and why should you be familiar with this type of organization? There are many of us who are not familiar with SPAC or how it operates. As a result, the author of this article has compiled a list of essential questions and reliable answers concerning the well-known company known as SPACS.

What Is SPAC Stock Mean

"Blank check" companies, also known as special purpose acquisition companies (SPACs), are entities that have no commercial operations but have successfully completed an initial public offering (IPO). So that they can avoid a lot of complex paperwork that is done during the IPO Process. In practice, the SPAC is to bring a promising private company to the attention of the public investment community.

These blank-check companies primarily by or merge with a private company and make it public without going through the traditional process of an initial public offering. It is important to know that they look for underwriters and institutional investors before going public.

Are SPACs Good Investments

SPACs Explained | Basic Summary

Individual investors have found SPAC investing to be less profitable than other types of investing. Many small-cap companies underperform the stock market and eventually fall below their IPO price. Given SPAC's dismal track record, most investors should be wary of putting their money into their company.

What Do SPACs Do

The SPAC raises funds by pricing its shares at a reasonable price, usually $10 per share, and offering other incentives to entice investors to participate. Afterwards, it has a set amount of time like around two years to put the investors' funds to work by identifying an appropriate target such as a private company either to merge with or acquire the target company.

How Long Have SPACs Been Around

SPACs were founded by David Nussbaum in 1993, at a time when blank check companies were not permitted in the United States, according to Wikipedia. Dr. Panton explained that "these were born as an exemption of listing blank check companies."

Since the 1990s, more than 500 SPACs have gone public, raising more than $100 billion in total.

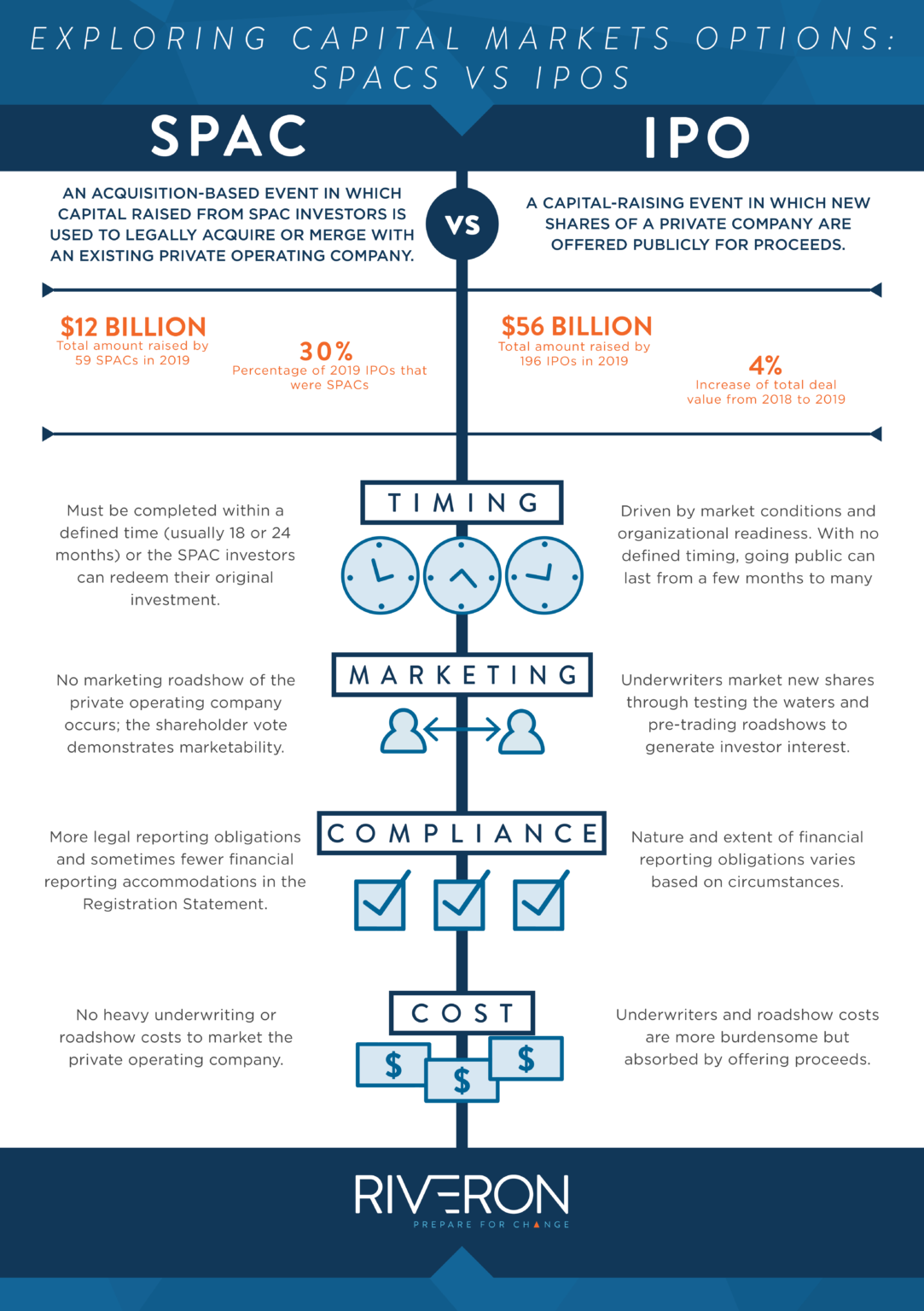

What Is A SPAC Vs IPO

An Initial Public Offering (IPO) is when a private company issues new shares and, with the assistance of an underwriter, sells them on a public stock exchange. SPAC transactions allow a private company to become publicly traded by merging with a publicly traded shell company—the special-purpose acquisition company—that is already publicly traded (SPAC).

Is SPAC Cheaper Than IPO

It isn't very expensive or difficult to make a company that buys other businesses public. Not with IPOs: One study found that investment banks can take as much as 7% of the gross proceeds from an IPO in fees. This also means that the SPAC doesn't need as much money to go public as a traditional company.

How Can I Invest In SPAC

You can purchase SPACs through an online brokerage account if that is something you are interested in doing for your investment portfolio. Among the internet platforms that provide SPACs to investors are Fidelity and Robinhood, to name a couple. You can also look for SPAC ETFs using an online brokerage account if you like.

How Much Does It Cost To Start A SPAC

The costs of establishing the SPAC and conducting the first roadshow (pre-IPO) will be approximately $800,000 USD, with 5.1 percent of the anticipated IPO proceeds serving as sponsor capital being added to that total. Approximately two-thirds of the setup costs must be paid prior to the IPO, with the remaining one-third being covered by the proceeds of the offering.

SPACs Examples

There are six prominent SPAC equities that investors should be aware of.

- Soaring Eagle Acquisition Corp.

- CM Life Sciences III Inc.

- Altimar Acquisition Corp.

- TPG Pace Solutions Corp.

- First Reserve Sustainable Growth Corp.

- Merida Merger Corp.

What Are Some Well-Known Companies That Have Gone Public Through A SPAC

SPAC mergers have resulted in the public listing of some of the world's most well-known companies, including digital sports entertainment and gaming company DraftKings, aerospace, and space travel company Virgin Galactic, energy storage innovator QuantumScape, and real estate platform Opendoor Technologies, among others.

Exploring Capital Markets Options - SPACs Vs IPOs

Companies that are planning to access the capital markets might choose from a variety of various possibilities. The formation of Special Purpose Acquisition Companies, often known as SPACs, is becoming increasingly popular as a viable alternative to the standard initial public offering (IPO).

Conclusion

The article provides comprehensive solutions to all of the major queries that have been brought across the online community. The author hopes that these key responses will assist you in determining whether or not a SPAC merger is good for your industry.

Sponsors, founders, or other stakeholders may be considering a SPAC merger or a standard IPO. Whichever path is chosen, management teams must be aware of the steps necessary to prepare for the capital market, and the consequences it may partake.

Jump to

What Is SPAC Stock Mean

Are SPACs Good Investments

What Do SPACs Do

How Long Have SPACs Been Around

What Is A SPAC Vs IPO

Is SPAC Cheaper Than IPO

How Can I Invest In SPAC

How Much Does It Cost To Start A SPAC

SPACs Examples

What Are Some Well-Known Companies That Have Gone Public Through A SPAC

Exploring Capital Markets Options - SPACs Vs IPOs

Conclusion

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Alberto Thompson

Reviewer

Alberto Thompson is an acclaimed journalist, sports enthusiast, and economics aficionado renowned for his expertise and trustworthiness. Holding a Bachelor's degree in Journalism and Economics from Columbia University, Alberto brings over 15 years of media experience to his work, delivering insights that are both deep and accurate.

Outside of his professional pursuits, Alberto enjoys exploring the outdoors, indulging in sports, and immersing himself in literature. His dedication to providing informed perspectives and fostering meaningful discourse underscores his passion for journalism, sports, and economics. Alberto Thompson continues to make a significant impact in these fields, leaving an indelible mark through his commitment and expertise.

Latest Articles

Popular Articles