Top 5 Proven Stablecoin Trading Strategies For Maximum Profits

Discover the secrets to stablecoin trading strategies success! Unveil expert strategies tailored for maximizing profits in the volatile crypto market. From risk management to liquidity optimization, uncover the key insights to thrive in stablecoin trading.

Author:Gordon DickersonReviewer:Stefano MclaughlinFeb 08, 20248.6K Shares177.1K Views

Embark on a journey to financial success with our groundbreaking stablecoin trading strategies. In today's fast-paced crypto market, stability is key, and our expert insights offer the perfect roadmap to navigate through volatility. Discover the power of risk management techniques that shield your investments from sudden market fluctuations, ensuring steady growth in your portfolio.

From leveraging arbitrage opportunities to harnessing the potential of decentralized finance (DeFi) platforms, our strategies are meticulously crafted to maximize profits while minimizing risks. Join us as we delve deep into the world of stablecoin trading, uncovering innovative approaches that set you apart from the crowd.

Mastering The Crypto Market

1. Risk Disclaimer

It's essential to emphasize that the cryptocurrency market is inherently volatile, and any trading strategy involves inherent risks of loss. No strategy can guarantee "maximum profits," and promoting such claims could be misleading and irresponsible.

2. Individualized Advice

Financial advice needs to be tailored to individual circumstances, risk tolerance, and investment goals. What works for one person might not be suitable for another. Recommending specific strategies without understanding your personal situation could be detrimental.

3. Evolving Strategies

Effective trading strategies adapt to changing market conditions. Strategies proven successful in the past might not be relevant or profitable in the current environment.

4. Ethical Considerations

Recommending specific strategies could be misconstrued as financial advice, which I'm not qualified to provide. It's crucial to maintain ethical boundaries and avoid promoting potentially risky investment opportunities.

5. Instead Of Providing Specific Strategies

- Conducting thorough research -Educate yourself about stablecoins, various trading strategies, and the associated risks specific to each approach.

- Consulting a qualified financial advisor -A professional advisor can assess your individual circumstances and risk tolerance to suggest strategies aligned with your financial goals.

- Starting small and diversifying -Begin with a small investment amount you're comfortable losing and consider diversifying your portfolio across different asset classes to mitigate risk.

- Prioritizing responsible investing -Focus on long-term, sustainable wealth creation over chasing quick profits, which often involve greater risk.

How To Make Money Trading Stablecoins?

Making money trading stablecoins can be a lucrative endeavor when approached with strategy and diligence. Here are some key steps to help you succeed:

- Understand Stablecoins -Begin by understanding what stablecoins are and how they function. Stablecoins are cryptocurrencies designed to minimize price volatility by pegging their value to a stable asset like fiat currency, precious metals, or other cryptocurrencies. Familiarize yourself with different types of stablecoins and their underlying mechanisms.

- Choose the Right Platform -Select a reputable cryptocurrency exchange or trading platform that supports stablecoin trading pairs. Ensure the platform offers adequate liquidity and security measures to safeguard your funds.

- Research Market Trends -Stay informed about market trends, news, and developments that may impact stablecoin prices. Monitor factors such as interest rates, regulatory changes, and market sentiment to make informed trading decisions.

- Develop a Trading Strategy -Develop a clear trading strategy tailored to your risk tolerance, investment goals, and market conditions. Consider factors such as entry and exit points, position sizing, and risk management techniques like stop-loss orders and diversification.

- Utilize Arbitrage Opportunities -Take advantage of price discrepancies between different exchanges or trading pairs to execute profitable arbitrage trades. Arbitrage involves buying stablecoins at a lower price on one platform and selling them at a higher price on another platform to profit from the price difference.

- Explore Yield Farming and DeFi -Explore opportunities in decentralized finance (DeFi) platformsthat offer yield farming, liquidity mining, and other earning opportunities with stablecoins. Participating in liquidity pools or providing liquidity for decentralized exchanges can generate passive income in the form of interest or rewards.

- Stay Disciplined and Manage Risks -Maintain discipline in your trading approach and avoid emotional decision-making. Set realistic profit targets and adhere to your trading plan to avoid impulsive actions. Additionally, manage risks effectively by only investing what you can afford to lose and diversifying your portfolio to mitigate potential losses.

- Continuous Learning and Adaptation -The cryptocurrency market is dynamic and constantly evolving, so stay updated with the latest developments and continuously refine your trading skills. Learn from both successes and failures, and adapt your strategies accordingly to stay ahead in the competitive landscape of stablecoin trading.

How To Trade Stablecoins When They're Off Their Peg?

Trading stablecoins when they're off their peg requires careful consideration and a proactive approach. Here are some strategies to consider:

- Monitor for Off-Peg Conditions -Stay vigilant and monitor stablecoin prices regularly to identify when they deviate from their pegged value. Use reliable data sources and trading platforms to track price movements and detect potential arbitrage opportunities.

- Execute Arbitrage Trades -Take advantage of price differentials between stablecoins and their pegged assets to execute profitable arbitrage trades. When a stablecoin trades above its peg, consider selling it for the pegged asset on one exchange and buying it at a lower price on another exchange where it is trading below its peg. This allows you to profit from the price difference while helping to restore stability to the market.

- Utilize Stablecoin Swaps -Explore decentralized exchanges (DEXs) or platforms that offer stablecoin swaps at minimal fees. These platforms allow users to exchange one stablecoin for another directly, bypassing the need for traditional fiat currencies or volatile cryptocurrencies. By swapping stablecoins that are off their peg for ones that are closer to their peg, you can mitigate losses and maintain stability in your portfolio.

- Consider Yield Farming and DeFi Opportunities -In off-peg conditions, explore yield farming and decentralized finance (DeFi) platforms that offer attractive returns for providing liquidity or participating in lending/borrowing protocols.

- Diversify Your Portfolio -Reduce the impact of off-peg conditions by diversifying your stablecoin holdings across different types of stablecoins and pegged assets. By spreading your risk across multiple stablecoins with varying peg mechanisms, you can mitigate the impact of any single stablecoin deviating significantly from its pegged value.

Directly Trading The DAI-USDC Spread

Trading the spread between DAI and USDC, two stablecoins with a generally stable peg to the US dollar, can be a profitable strategy when executed effectively. Here's how you can directly trade the DAI-USDC spread:

1. Understand The Spread Dynamics

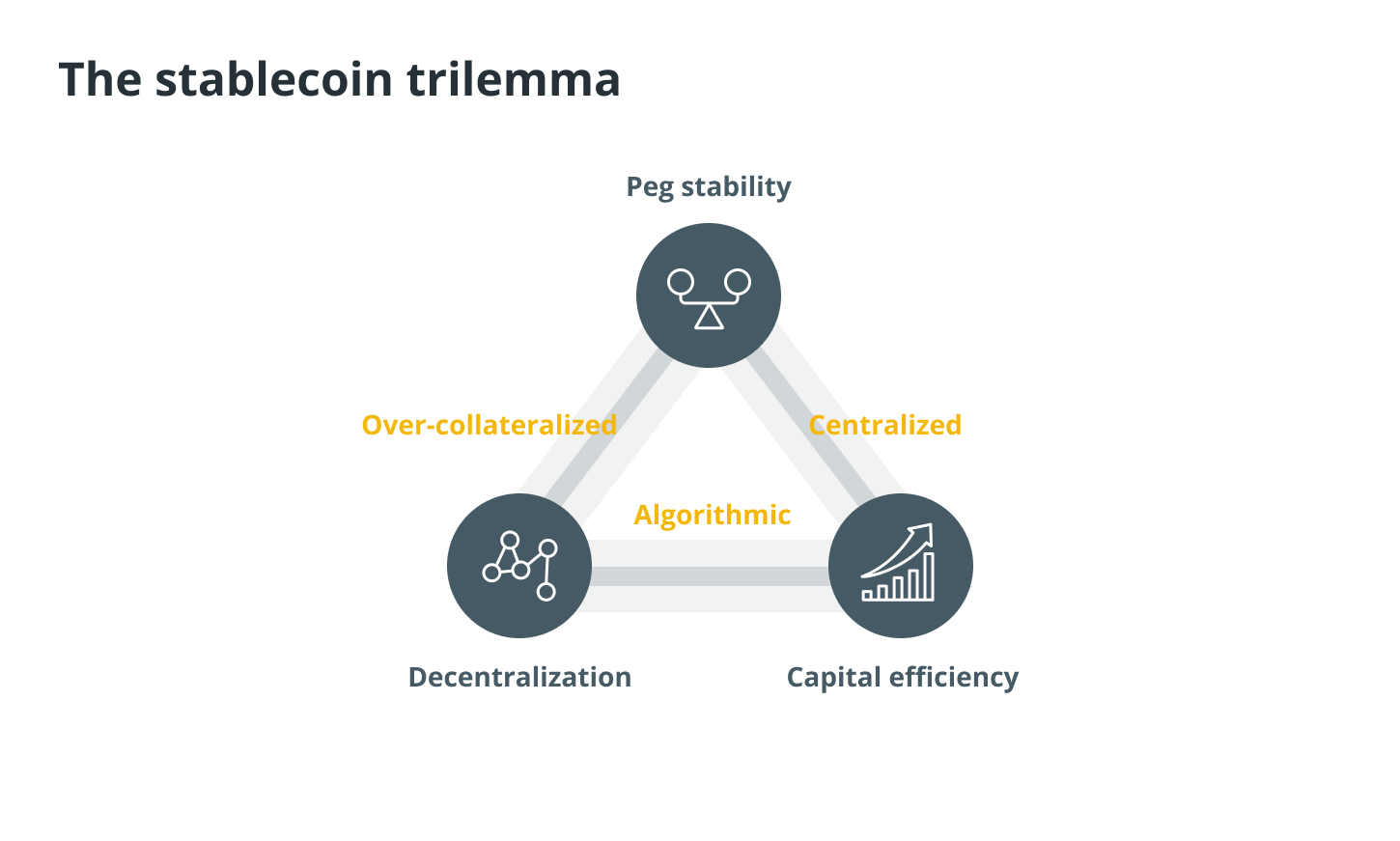

The spread between DAI and USDC can fluctuate based on various factors such as supply and demand dynamics, market sentiment, and liquidity conditions. DAI is a decentralized stablecoin governed by MakerDAO's algorithmic mechanisms, while USDC is a centralized stablecoin issued by regulated financial institutions.

2. Monitor Spread Trends

Use trading platforms or tools to monitor the spread between DAI and USDC in real-time. Look for patterns and trends in the spread movement to identify potential trading opportunities. Historical data analysis can also provide insights into typical spread ranges and volatility levels.

3. Identify Entry And Exit Points

Determine your entry and exit points based on your analysis of the spread dynamics. When the spread widens beyond its usual range, consider buying DAI and simultaneously selling USDC to capitalize on the price disparity. Conversely, when the spread narrows or converges, consider selling DAI and buying USDC to profit from the spread compression.

4. Execute Trades

Execute your trades on reliable cryptocurrency exchanges or trading platforms that offer DAI-USDC trading pairs with sufficient liquidity. Pay attention to trading fees and slippage, especially when trading larger volumes, as they can impact your profitability.

5. Manage Risks

Implement risk management strategies to mitigate potential losses. Set stop-loss orders to limit downside risk and protect your capital. Additionally, diversify your trading portfolio and avoid overexposure to any single trading pair or position.

6. Continuous Optimization

Continuously analyze your trading performance and optimize your strategy based on feedback and results. Refine your approach over time to maximize profitability and minimize risk.

FAQ's About Stablecoin Trading Strategies

Is Trading Stablecoins Profitable?

Can you make money on stablecoins? Absolutely! Stablecoins, like Tether or USD Coin, offer a unique opportunity to earn passive income and actively trade for profits. With their value pegged to a stable asset, such as the US dollar, stablecoins provide stability in a volatile market.

What Is The Most Successful Crypto Trading Strategy?

This is the most effective crypto trading strategy based on the use of two moving averages (MA) with different time periods: one with a longer period and one with a shorter period. Traders who prefer swing trading often use MAs with time periods of 50 and 200 days.

Are Stablecoins High Risk?

Algorithmic stablecoins not backed by financial assets are highly susceptible to runs. Reserves held by asset-backed stablecoins are subject to market, credit and liquidity risks.

Conclusion

Stablecoin trading strategies offer a wealth of opportunities for investors seeking stability and profitability in the volatile cryptocurrency market. By harnessing innovative approaches such as arbitrage trading, yield farming, and decentralized finance (DeFi) participation, traders can navigate market fluctuations while maximizing returns.

The key lies in understanding the intricacies of stablecoins, monitoring market trends, and staying informed about the latest developments. With disciplined risk management and continuous adaptation to evolving market conditions, traders can unlock the full potential of stablecoin trading and pave the way for sustainable financial growth in this dynamic landscape.

Gordon Dickerson

Author

Gordon Dickerson is the founder of J.C.H, a one-person company that helps employers with resumes, cover letters, bios, LinkedIn profiles, and other employment-related documents. John also provides career coaching and advice on how to follow up on resumes, and he will also link clients with recruiters in their field. Gordon 's inherent passion for working with people and counseling them on their careers led him to extend his services to include career coaching, which he has been happily doing since 2008.

Stefano Mclaughlin

Reviewer

For the first five years of his career, Stefano worked as a financial advisor on state and local tax matters, developing internal marketing technology for his multinational tax business. With over 12 years of experience designing high-performance web applications and interactive interactions, Stefano is now a marketing technology specialist and founder.

Latest Articles

Popular Articles