5 Reasons Why Staking Cryptocurrencies Is The Key To Success

Dive into the future of finance with our comprehensive guide to staking cryptocurrencies! Discover the top staking projects, maximize your returns, and unlock the potential of your digital assets.

Author:James PierceReviewer:Gordon DickersonFeb 05, 202486 Shares21.5K Views

Unleash the power of your Staking cryptocurrencies with our ground breaking guide to staking! Imagine turning your idle digital assets into a steady stream of passive income that's the magic of cryptocurrency staking. Take control of your financial future as we walk you through the ins and outs of staking, from choosing the right projects to maximizing your returns.

It's time to let your crypto work for you! Embark on a journey of financial freedom as we unravel the secrets of staking cryptocurrencies. Our expert insights and actionable tips will empower you to navigate this exciting terrain, whether you're a seasoned investor or just dipping your toes into the crypto waters.

Top 5 Reasons

Staking cryptocurrencies can offer certain benefits, claiming it as the "key to success" is an oversimplification and requires careful consideration. Here are some reasons why staking might be interesting, along with important points to remember:

1. Earn Rewards

Staking allows you to passively earn rewards on your cryptocurrency holdings. These rewards can come in the form of additional tokens of the same cryptocurrency you staked, or even other tokens associated with the project.

2. Contribute To Network Security

By staking your tokens, you help validate transactions on the blockchain, securing the network and contributing to its overall health. This can be seen as a way to actively participate in the cryptocurrency ecosystem.

3. Increased Liquidity

Some staking platforms offer flexible staking options where you can withdraw your staked tokens with some restrictions. This can provide some degree of liquidity compared to locking your tokens away for extended periods.

4. Governance Rights

Depending on the project, staking might entitle you to voting rights on future developments or proposals within the cryptocurrency's ecosystem. This allows you to have a say in the direction of the project.

5. Potential Price Appreciation

If the staked cryptocurrency appreciates in value, your overall holdings increase along with the rewards earned. However, remember that the cryptocurrency market is inherently volatile, and price appreciation is not guaranteed.

Potential Risks

1. Scams and Phishing -Be wary of scams and phishing attempts promising high staking returns.

2. Regulatory Uncertainty -The regulatory landscape surrounding staking is still evolving, and potential future regulations could impact its profitability or legality in certain jurisdictions.

3. Technical Risks -Staking can involve interacting with complex smart contracts and decentralized platforms, which carry inherent technical risks like bugs, exploits, and hacks.

4. Locking Periods -Staking often involves locking your crypto for a specific period, reducing liquidity and preventing you from selling when desired.

5. Volatility and Impermanent Loss -Cryptocurrencies are inherently volatile, and staking rewards can fluctuate significantly.

How Staking In Crypto Works?

Staking in crypto involves "locking" your digital assets into a blockchain network to earn rewards, similar to how a savings account might pay interest. However, instead of a bank, the rewards come from validating transactions on the blockchain. Here's a breakdown of how it works:

Basic Process

- Choose a Staking Platform -You can stake on cryptocurrency exchanges, dedicated staking platforms, or directly within wallets that support staking for specific coins.

- Select a Stakeable Cryptocurrency -Not all cryptocurrencies allow staking. Look for ones that use a Proof-of-Stake (PoS)consensus mechanism.

- Transfer Your Coins -Move your chosen coins to the chosen platform or wallet.

- Start Staking -Commit your coins to the staking process. Lock-up periods may apply, limiting access to your funds during that time.

- Earn Rewards -As the network processes transactions, you contribute by "validating" them, earning rewards in return. These rewards are typically paid out in the same cryptocurrency you staked.

Key Points

- Earning Rewards -Rewards are often calculated based on the amount you stake and the length of your commitment. Rates can vary greatly between different coins and platforms.

- Security and Validation -By staking, you essentially become a "validator" on the network, helping to secure it and confirm the legitimacy of transactions.

Types Of Staking

- Solo Staking -You run your own validator node, requiring technical expertise and significant capital.

- Delegated Staking -You delegate your stake to a validator, earning rewards without needing to run a node. This is the most common approach for individual investors.

Transfer Your Crypto To A Blockchain Wallet

These are the steps transfer your crypto to a blockchain wallet:

1. Choose A Blockchain Wallet

- Custodial vs. Non-custodial -Decide if you prefer a custodial wallet (managed by a third party) or a non-custodial wallet (you control your private keys). Popular options include MetaMask, Coinbase Wallet, Ledger Nano S(hardware wallet), etc.

- Supported Coins -Ensure the wallet supports the specific cryptocurrency you want to transfer.

2. Obtain The Wallet Address

Locate the receive address within your chosen wallet. It's a long string of alphanumeric characters, often with a QR code for scanning.

3. Initiate The Transfer

- Log in to the platform where your crypto is currently held (exchange, another wallet).

- Navigate to the "Withdraw" or "Transfer" section.

- Select the cryptocurrency and enter the amount you want to transfer.

- Paste or scan the wallet address you obtained in step 2.

- Double-check all details before confirming the transaction.

4. Network Confirmation

- The transaction will be submitted to the blockchain network for verification. This can take minutes or even hours depending on the network traffic and fees.

- You can usually track the transaction progress using the blockchain explorer or within your wallet app.

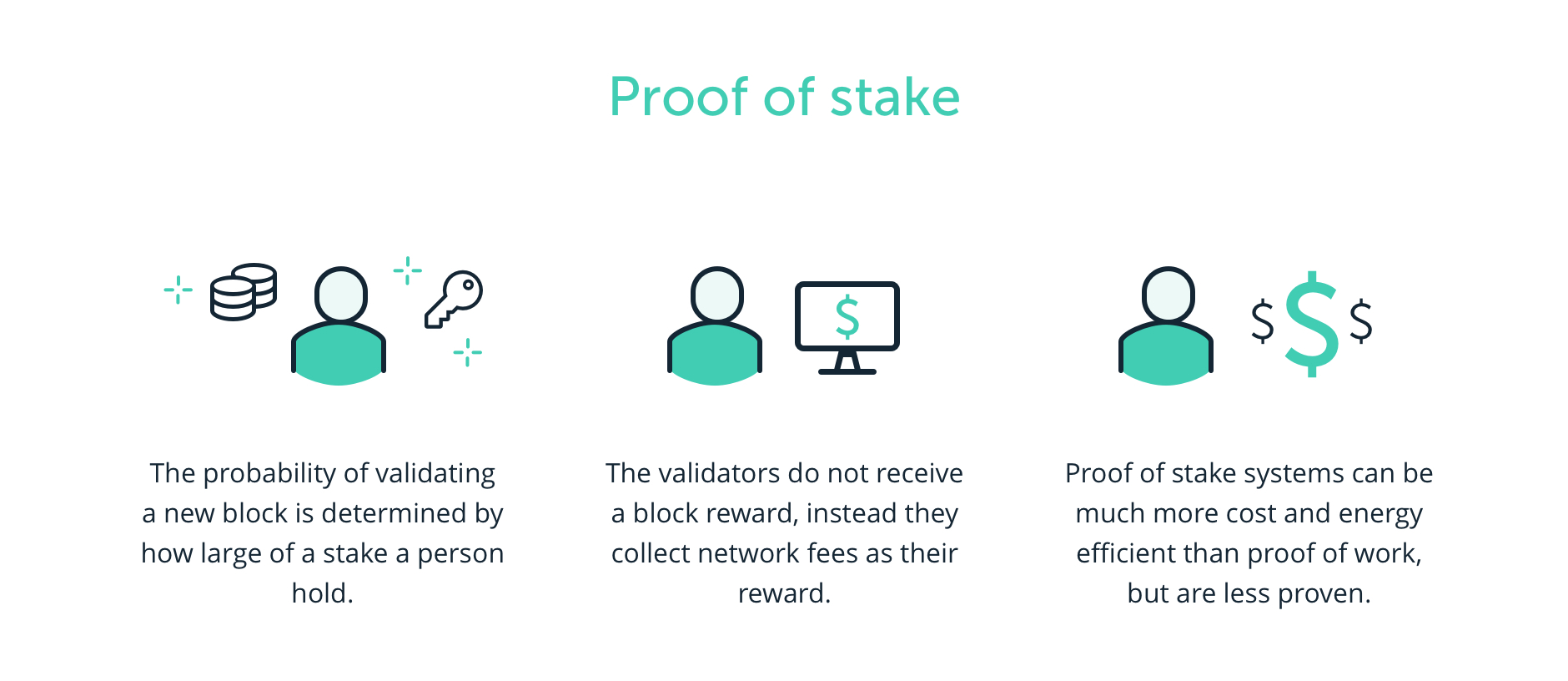

What Is Proof Of Stake?

Proof of stake (PoS) is a mechanism used to validate transactions and secure blockchains in cryptocurrencies. It's an alternative to the more commonly known proof of work (PoW) used in Bitcoin and other early cryptocurrencies. Here's a breakdown of the key points:

What It Does?

- Secures the network -Similar to PoW, PoS ensures the accuracy and security of blockchain transactions by preventing double-spending and other malicious activities.

- Validates transactions -Instead of using computational power like PoW, PoS relies on participants who "stake" their own cryptocurrency.

- Rewards contributors -Stakers who validate transactions correctly are rewarded with new cryptocurrency.

How It Works?

- Stake your coins -You lock up a certain amount of your cryptocurrency in a staking pool.

- Become a validator -Based on your stake size and other factors, you might be randomly chosen to validate a block of transactions.

- Validate the block -You verify the legitimacy of the transactions in the block.

- Earn rewards:If you validate the block correctly, you earn new cryptocurrency as a reward.

Benefits Of PoS

- More energy-efficient -Compared to PoW's intense mining process, PoS consumes significantly less energy.

- Faster transaction speeds -PoS networks can handle more transactions per second than PoW networks.

- Increased accessibility -Anyone with enough staked coins can participate in validation, unlike PoW's specialized mining equipment.

Potential Drawbacks

- Centralization concerns -With large stakers having more influence, concerns about potential centralization exist.

- Technical complexity -Understanding and participating in PoS can be more technically challenging than PoW.

- Relatively new -PoS is still under development compared to the established PoW system.

Examples Of PoS Cryptocurrencies

- Ethereum (ETH)

- Cardano (ADA)

- Solana (SOL)

- Binance Coin (BNB)

- Polkadot (DOT)

When You Should Or Shouldn't Stake Crypto

Whether or not you should stake crypto depends on a variety of factors related to your personal circumstances, risk tolerance, and investment goals. Here's a breakdown of the key considerations:

When You Should Consider Staking Crypto

- You have a long-term investment horizon -Staking often involves locking up your crypto for a period, so it's best suited for assets you don't plan to sell in the near future.

- You're comfortable with volatility -Cryptocurrency prices can fluctuate significantly, and staking rewards can also vary. Ensure you can handle potential price swings.

- You understand the technical risks -Staking often involves interacting with complex smart contracts and platforms, which carry risks like bugs, exploits, and hacks. Do your research and choose reputable platforms.

- You seek passive income -Staking can offer returns higher than traditional savings accounts, though with greater associated risk.

- You believe in the project and its future -Staking often implies supporting the project's development and governance. Ensure you align with the project's goals and value proposition.

- You have a well-diversified portfolio -Staking should be just one part of a diversified investment strategy. Don't put all your eggs in one basket.

When You Shouldn't Consider Staking Crypto

- You need immediate access to your funds -As mentioned, staking often involves lock-up periods, limiting your ability to sell quickly.

- You have a low risk tolerance -If you're uncomfortable with potential price drops or technical risks, staking might not be suitable for you.

- You don't fully understand the technology or project -Before staking, thoroughly research the specific cryptocurrency, its staking process, and the associated risks.

- You have short-term investment goals -Staking is better suited for holding long-term, as the value of your staked assets and rewards can fluctuate significantly.

- Regulations in your jurisdiction are unclear -Stay informed about potential regulatory changes impacting staking in your region.

FAQ's About Staking Cryptocurrencies

How Do I Start Staking Crypto?

The simplest way to start staking as a beginner is via an online crypto exchange or platform. These resources provide users with tools and interfaces that make staking crypto straightforward. On Coinbase you can easily stake ETH right from your homepage.

Is Staking Crypto Legal?

staking is one of the most common practices in the DeFi market, but from a US legal perspective, it is almost certainly equivalent to issuing debt securities. This is especially true for projects that issue yields in well-known cryptocurrencies.

What Is The Safest Coin To Stake?

What is the safest coin to stake? Ethereum is considered by many to be one of the 'safest' coins to stake. As a well-established project with a large market capitalization, it's a popular choice for investors looking to get started with staking.

Conclusion

The world of cryptocurrency staking is a dynamic frontier where digital assets come alive, transforming from dormant holdings into powerful sources of passive income. As we've explored the intricacies of staking, it's evident that this innovative financial strategy offers investors a unique opportunity to participate actively in blockchain networks while earning rewards. The potential for long-term wealth creation through staking is undeniable, providing a bridge between the traditional finance realm and the decentralized future of currencies.

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Gordon Dickerson

Reviewer

Gordon Dickerson, a visionary in Crypto, NFT, and Web3, brings over 10 years of expertise in blockchain technology.

With a Bachelor's in Computer Science from MIT and a Master's from Stanford, Gordon's strategic leadership has been instrumental in shaping global blockchain adoption. His commitment to inclusivity fosters a diverse ecosystem.

In his spare time, Gordon enjoys gourmet cooking, cycling, stargazing as an amateur astronomer, and exploring non-fiction literature.

His blend of expertise, credibility, and genuine passion for innovation makes him a trusted authority in decentralized technologies, driving impactful change with a personal touch.

Latest Articles

Popular Articles