Stock Market News Today - Stocks Up As Inflation Data Approaches

Stock market news today, Stocks up as investors await inflation data. Get the latest updates on the market and what to expect in the coming weeks.

Author:James PierceReviewer:Alberto ThompsonOct 24, 20234.3K Shares399.3K Views

Stock market news todayis any information that can impact the price of stocks and other securities. This includes news about company earnings, mergers and acquisitions, economic data, and government policy changes. Stock market news can be found in a variety of sources, including financial websites, newspapers, and television channels.

Stock markets around the world rose on October 14, 2023, as investors awaited inflation data. The Dow Jones Industrial Average gained 0.2%, while the S&P 500 gained 0.4%. The tech-heavy Nasdaq Composite put on roughly 0.7%.

There are a few reasons why the stock market was up on October 14, 2023. First, investors were cautiously optimistic that the upcoming inflation data would show a moderation in price increases. This would be a positive sign for the economy and could lead to further gains in the stock market.

Second, investors were also encouraged by the recent earnings reports from major corporations. Many companies have reported better-than-expected earnings, which suggests that the corporate sector is still healthy.

Finally, investors may have been buying stocks ahead of the upcoming midterm elections in the United States. Historically, the stock market has performed well in the years following midterm elections.

The stock market is likely to remain volatile in the coming weeks, as investors continue to monitor inflation data and economic indicators. However, if the inflation data shows a moderation in price increases, it could lead to further gains in the stock market.

Investors should also keep an eye on the upcoming midterm elections in the United States. If the Democrats lose control of either house of Congress, it could lead to uncertainty in the markets.

Overall, the stock market is likely to remain mixed in the coming weeks. However, there are some positive factors that could lead to further gains, such as a moderation in inflation and strong corporate earnings.

What Is Stock Market News?

Stock market news is any information that can impact the price of stocks and other securities. This includes news about company earnings, mergers and acquisitions, economic data, and government policy changes. Stock market news can be found in a variety of sources, including financial websites, newspapers, and television channels.

Importance Of Stock Market News To Investors

Stock market news is important to investors because it can help them make informed investment decisions. By staying up-to-date on the latest news, investors can identify potential opportunities and risks. For example, if a company reports strong earnings, it may be a signal that the stock is undervalued and could be a good investment. On the other hand, if a company announces a merger or acquisition, it could impact the performance of the stock in the short term.

Different Types Of Stock Market News

There are many different types of stock market news, but some of the most common include:

- Company earnings -Company earnings reports are released quarterly and provide insights into a company's financial performance. Investors closely watch earnings reports to see how companies are doing and to identify potential investment opportunities.

- Mergers and acquisitions (M&A) -When two companies merge or one company acquires another, it can have a significant impact on the stock prices of both companies. Investors should be aware of upcoming M&A activity to make informed investment decisions.

- Economic data -Economic data, such as the GDP growth rate, unemployment rate, and inflation rate, can also impact the stock market. Investors use economic data to assess the overall health of the economy and identify potential risks and opportunities.

- Government policy changes -Government policy changes, such as tax cuts or interest rate hikes, can also impact the stock market. Investors should be aware of upcoming policy changes to make informed investment decisions.

Where To Find Stock Market News

There are many different places to find stock market news. Some popular sources include:

- Financial websites -Financial websites such as Yahoo! Finance, MarketWatch, and CNBC provide a variety of stock market news and information.

- Newspapers -Major newspapers such as The Wall Street Journal and The New York Times also publish stock market news.

- Television channels -Television channels such as CNBC and Bloomberg TV provide 24/7 coverage of the stock market.

In addition to these general sources, there are also many specialized sources of stock market news. For example, there are websites and newsletters that focus on specific industries or sectors.

Investors should choose the sources of stock market news that they find most reliable and informative. It is also important to diversify your sources so that you have a well-rounded view of the market.

What Is Inflation Data?

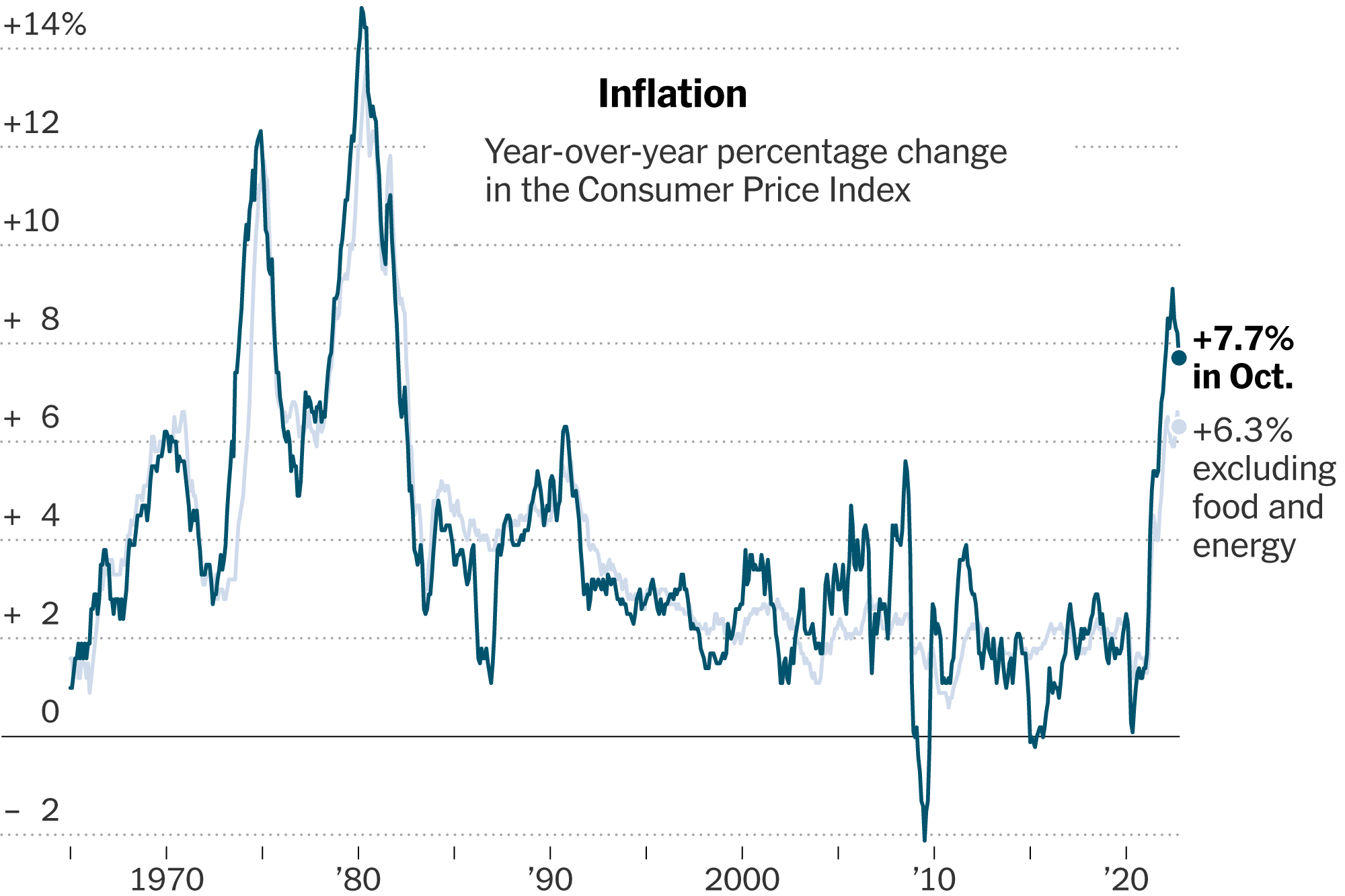

Inflation data is a measure of how much prices for goods and services are increasing over time. It is typically measured using the Consumer Price Index (CPI), which tracks the prices of a basket of goods and services that are typically purchased by consumers. Inflation data is also reported for specific categories of goods and services, such as food, energy, and housing.

Importance Of Inflation Data To The Economy

Inflation data is important to the economy because it can impact a variety of factors, including economic growth, interest rates, and the purchasing power of consumers.

- Economic growth -Inflation can have a negative impact on economic growth if it becomes too high. This is because high inflation can lead to uncertainty and make it difficult for businesses to plan for the future.

- Interest rates -Central banks use inflation data to set interest rates. If inflation is too high, central banks will typically raise interest rates in an effort to slow down inflation.

- Purchasing power of consumers -Inflation can erode the purchasing power of consumers, meaning that they can buy less with the same amount of money. This can lead to a decrease in consumer spending, which can have a negative impact on the economy.

Inflation Data Is Collected And Reported

Inflation data is collected by government agencies, such as the Bureau of Labor Statistics (BLS) in the United States. The BLS collects price data for a basket of goods and services that are typically purchased by consumers. This data is then used to calculate the CPI, which is the most common measure of inflation.

Inflation data is typically reported on a monthly basis. The BLS releases the CPI for the previous month on the 13th of each month.

Interpret Inflation Data

When interpreting inflation data, it is important to keep in mind the following factors:

- The target inflation rate -Central banks typically have a target inflation rate, which is the rate of inflation that they consider to be optimal for the economy. The target inflation rate in the United States is 2%.

- The direction of inflation -If inflation is rising, it is a sign that prices are increasing. If inflation is falling, it is a sign that prices are decreasing.

- The rate of inflation -The rate of inflation is also important to consider. If inflation is rising at a rapid pace, it is a sign that the economy may be overheating. If inflation is falling at a rapid pace, it is a sign that the economy may be slowing down.

Investors and businesses can use inflation data to make informed decisions. For example, investors may choose to invest in assets that are expected to hold their value or appreciate in value during times of high inflation. Businesses may also use inflation data to set prices and to make other strategic decisions.

Inflation Data Impact On The Stock Market

Relationship Between Inflation And Stock Prices

Inflation can have a significant impact on stock prices. In general, high inflation is negative for stock prices, while low inflation is positive for stock prices.

There are a few reasons why inflation can impact stock prices. First, high inflation can lead to uncertainty and make it difficult for businesses to plan for the future. This can lead to lower corporate profits and lower stock prices.

Second, high inflation can lead to higher interest rates. Central banks typically raise interest rates in an effort to slow down inflation. Higher interest rates can make it more expensive for companies to borrow money and invest, which can lead to lower corporate profits and lower stock prices.

Third, high inflation can erode the purchasing power of consumers. This means that consumers have less money to spend on goods and services. This can lead to lower sales for companies and lower stock prices.

Investors Use Inflation Data To Make Investment Decisions

Investors use inflation data to make a variety of investment decisions. For example, investors may choose to invest in assets that are expected to hold their value or appreciate in value during times of high inflation. Some examples of assets that are typically considered to be good inflation hedges include real estate, commodities, and TIPS (Treasury Inflation-Protected Securities).

Investors may also use inflation data to adjust their investment portfolios. For example, if investors believe that inflation is likely to rise in the future, they may choose to increase their allocation to assets that are expected to perform well in times of high inflation.

Here are some specific examples of how investors might use inflation data to make investment decisions:

- An investor who believes that inflation is likely to rise in the future might invest in TIPS, which are bonds that are indexed to inflation. This means that the principal and interest payments on TIPS will increase as inflation rises, protecting the investor's purchasing power.

- An investor who believes that inflation is likely to rise in the future might also invest in real estate. Real estate prices tend to rise with inflation, so investing in real estate can be a good way to protect against the erosive effects of inflation.

- An investor who believes that inflation is likely to rise in the future might also invest in commodities. Commodities, such as oil and gold, are often seen as good inflation hedges because their prices tend to rise with inflation.

It is important to note that there is no one-size-fits-all approach to investing based on inflation data. Investors should consider their own individual circumstances and risk tolerance when making investment decisions.

Stocks Up As Inflation Data Approaches

On October 14, 2023, stocks around the world rose as investors awaited inflation data. The Dow Jones Industrial Average gained 0.2%, while the S&P 500 gained 0.4%. The tech-heavy Nasdaq Composite put on roughly 0.7%.

The upcoming inflation data release is one of the most important economic events of the week. Investors are hoping that the data will show a moderation in price increases, which would be a positive sign for the economy and could lead to further gains in the stock market.

The Stock Market Is Being Impacted By Upcoming Inflation Data

The upcoming inflation data release is having a mixed impact on the stock market. On the one hand, some investors are buying stocks in anticipation of a moderation in inflation. On the other hand, other investors are selling stocks due to concerns that inflation could remain high, which could lead to higher interest rates and slower economic growth.

Specific Stocks And Sectors That Are Likely To Be Affected By The Inflation Data Release

Some of the specific stocks and sectors that are likely to be affected by the inflation data release include:

- Consumer staples -Consumer staples companies, such as food and beverage companies, tend to do well in times of high inflation because consumers still need to buy these products even when prices are rising.

- Healthcare -Healthcare companies also tend to do well in times of high inflation because people still need to get medical care even when prices are rising.

- Technology -Technology companies may be negatively impacted by high inflation if it leads to higher interest rates and slower economic growth.

- Financials -Financial companies may also be negatively impacted by high inflation if it leads to higher interest rates, which can make it more difficult for borrowers to repay their loans.

Investors should carefully consider their own investment objectives and risk tolerance before making any investment decisions.

What To Expect In The Coming Weeks

The stock market is likely to remain volatile in the coming weeks, as investors continue to monitor inflation data and economic indicators. However, if the inflation data shows a moderation in price increases, it could lead to further gains in the stock market.

Here are some specific predictions for the stock market in the coming weeks:

- Consumer staples and healthcare stocks are likely to continue to outperform the broader market -These sectors are typically seen as defensive sectors, meaning that they tend to do well even in times of economic uncertainty.

- Technology and financial stocks may be more volatile in the coming weeks -These sectors are more sensitive to interest rates and economic growth.

- The overall stock market is likely to remain mixed in the coming weeks -However, if the inflation data shows a moderation in price increases, it could lead to further gains in the stock market.

It is important to note that these are just predictions and the stock market can be unpredictable. Investors should always do their own research before making any investment decisions.

Here are some additional factors that investors may want to consider when making investment decisions in the coming weeks:

- The upcoming midterm elections in the United States -Historically, the stock market has performed well in the years following midterm elections. However, there is some uncertainty about the outcome of the upcoming elections and how they could impact the market.

- The Federal Reserve's monetary policy -The Fed is expected to continue raising interest rates in an effort to combat inflation. However, there is some concern that the Fed could raise rates too aggressively and cause a recession.

- The global economy -The global economy is facing a number of challenges, including the war in Ukraine and rising inflation. These challenges could have a negative impact on the stock market.

Investors should carefully consider all of these factors before making any investment decisions.

FAQs About Stock Market News Today

Why Are Stock Markets Rising?

The law of supply and demand holds true as in any market. Some factors, such as the rate of inflation, have the power to move the market as a whole higher or lower. Other factors, such as corporate earnings, may move a single company or an industry sector.

When Should You Buy A Stock?

The best time to buy any stock is when the price is low. However, what you consider to be a low price will depend on how long you plan to hold the stock. If you're investing for the long term, the timing of your trade will likely matter much less because, historically, the market has risen consistently over time.

Is It Wise To Invest In Share Market Now?

The best time to buy a stock is when you think it's undervalued by the market. There are always opportunities to find good long-term investments. Waiting for an undervalued stock to pull back in price because you think the overall stock market is overvalued is unlikely to produce positive results for investors.

Conclusion

Stock market news today, The stock market is likely to remain volatile in the coming weeks, as investors continue to monitor inflation data and economic indicators. However, if the inflation data shows a moderation in price increases, it could lead to further gains in the stock market.

Investors should focus on investing in assets that are expected to hold their value or appreciate in value during times of high inflation. Some examples of assets that are typically considered to be good inflation hedges include real estate, commodities, and TIPS (Treasury Inflation-Protected Securities).

Investors should also consider adjusting their investment portfolios to account for the potential for higher interest rates in the future. For example, investors may want to increase their allocation to assets that are typically less sensitive to interest rates, such as growth stocks and small-cap stocks.

Overall, investors should carefully consider their own individual circumstances and risk tolerance when making investment decisions. There is no one-size-fits-all approach to investing, and investors should always do their own research before making any investment decisions.

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Alberto Thompson

Reviewer

Alberto Thompson is an acclaimed journalist, sports enthusiast, and economics aficionado renowned for his expertise and trustworthiness. Holding a Bachelor's degree in Journalism and Economics from Columbia University, Alberto brings over 15 years of media experience to his work, delivering insights that are both deep and accurate.

Outside of his professional pursuits, Alberto enjoys exploring the outdoors, indulging in sports, and immersing himself in literature. His dedication to providing informed perspectives and fostering meaningful discourse underscores his passion for journalism, sports, and economics. Alberto Thompson continues to make a significant impact in these fields, leaving an indelible mark through his commitment and expertise.

Latest Articles

Popular Articles