Stock Trak - The Best Way To Learn About Investing

StockTrak - The all-in-one portfolio simulation tool that teaches you everything you need to know about investing. Sign up today and start your journey to financial success!

Author:Emmanuella SheaReviewer:Frazer PughNov 27, 20232.1K Shares99.1K Views

In the ever-evolving financial landscape, mastering the art of investing is essential for both personal and professional success. StockTrak, a unique and interactive platform, demystifies the complexities of financial markets, bridging the gap between theoretical knowledge and practical financial skills.

With its realistic simulation of market conditions and diverse investment options, StockTrak provides an invaluable experience for aspiring investors at all levels. Whether you are a student seeking to understand market dynamics or a professional looking to refine your investment strategies, StockTrak's comprehensive and user-friendly environment enables you to learn, practice, and excel in the art of investing.

StockTrak's significance lies in its ability to replicate real-world trading experiences without financial risk. This immersive environment fosters experimentation with a wide range of investment strategies, from conservative to aggressive, across a broad spectrum of assets, including stocks, bonds, mutual funds, and even cryptocurrencies. StockTrak's detailed performance tracking and analytical tools empower users to make informed decisions and develop a keen understanding of market trends and behaviors. This hands-on approach not only educates but also instills confidence, making StockTrak an essential stepping stone for anyone serious about mastering the world of investing.

Understanding StockTrak - An Overview

StockTrak is a portfolio simulation tool that allows users to practice investing in the stock market without risking any real money. It is a popular tool for students, investors, and financial professionals alike. StockTrak provides users with a realistic simulation of market conditions and a wide range of investment options, including stocks, bonds, mutual funds, and even cryptocurrencies.

StockTrak is a valuable tool for anyone who wants to learn more about investing or improve their investment skills. It is also a useful tool for financial professionals who want to test new investment strategies or research different assets.

What Is StockTrak? Exploring The Platform

StockTrak is a web-based platform that is accessed through a computer or mobile device. When users create a StockTrak account, they receive a virtual portfolio with a set amount of money. Users can then use this money to buy and sell securities, just as they would in the real world.

StockTrak provides users with a variety of tools to help them make informed investment decisions. These tools include

- Real-time market data -StockTrak uses real-time market data to provide users with accurate prices and information for all securities.

- Investment news and analysis -StockTrak provides users with access to investment news, analysis, and research from leading financial institutions.

- Performance tracking -StockTrak tracks the performance of users' portfolios and provides them with detailed reports.

Key Features Of StockTrak - Simulation And Tools

StockTrak offers a variety of key features that make it a valuable tool for investors of all levels. These features include:

- Realistic simulation -StockTrak provides a realistic simulation of market conditions, including price fluctuations, dividends, and splits. This allows users to experience the real-world challenges and rewards of investing without risking any real money.

- Wide range of investment options -StockTrak offers many investment options, including stocks, bonds, mutual funds, and even cryptocurrencies. This allows users to build a diversified portfolio that meets their individual investment goals.

- Educational resources -StockTrak provides users with access to a variety of educational resources, including articles, videos, and tutorials. This allows users to learn more about investing and improve their investment skills.

- Competitive environment -StockTrak offers users the opportunity to compete against other investors in simulated competitions. This can be a fun and motivating way to learn and improve investment skills.

The Educational Value Of StockTrak

StockTrak is a portfolio simulation tool that provides users with a realistic experience of investing in the stock market without risking any real money. This makes it a valuable educational resource for students, beginners, and experienced investors alike.

StockTrak bridges the gap between theoretical knowledge and practical financial skills by allowing users to experiment with different investment strategies in a simulated environment. This hands-on learning experience helps users to develop a deeper understanding of the stock market and how to make informed investment decisions.

StockTrak also enhances financial literacy by teaching users about the different types of investments available, how to read financial statements, and how to manage risk. This knowledge is essential for anyone who wants to be a successful investor.

Bridging Theory And Practice In Investing

StockTrak provides users with a realistic simulation of the stock market, including real-time market data and access to a wide range of investment options. This allows users to experiment with different investment strategies and see how they perform in real-world conditions.

For example, a student using StockTrak could test out different portfolio allocation strategies or try to time the market. An experienced investor could use StockTrak to backtest new investment ideas or to practice trading new asset classes.

By allowing users to practice investing in a risk-free environment, StockTrak helps to bridge the gap between theoretical knowledge and practical financial skills. This is essential for anyone who wants to be a successful investor in the long term.

How StockTrak Enhances Financial Literacy

StockTrak also enhances financial literacy by teaching users about the different types of investments available, how to read financial statements, and how to manage risk.

StockTrak provides users with access to a wide range of investment options, including stocks, bonds, mutual funds, and ETFs. Users can also learn about more complex investment vehicles, such as options and futures contracts.

In addition, StockTrak provides users with access to detailed financial data for all of the securities that they can trade. This data includes historical price charts, financial statements, and analyst ratings. Users can use this data to learn how to analyze investments and make informed investment decisions.

Finally, StockTrak teaches users about the importance of risk management. Users can learn about different risk management strategies and how to implement them in their own portfolios. This knowledge is essential for protecting your capital and minimizing losses.

Overall, StockTrak is a valuable educational resource for anyone who wants to learn about investing and enhance their financial literacy. By providing users with a realistic simulation of the stock market and access to a wide range of investment tools, StockTrak helps users develop the skills and knowledge they need to be successful investors.

Navigating The StockTrak Platform

StockTrak is a powerful portfolio simulation tool that allows users to learn about investing in the stock market without risking any real money. With its realistic simulation of market conditions and diverse range of investment options, StockTrak provides an invaluable experience for aspiring investors of all levels.

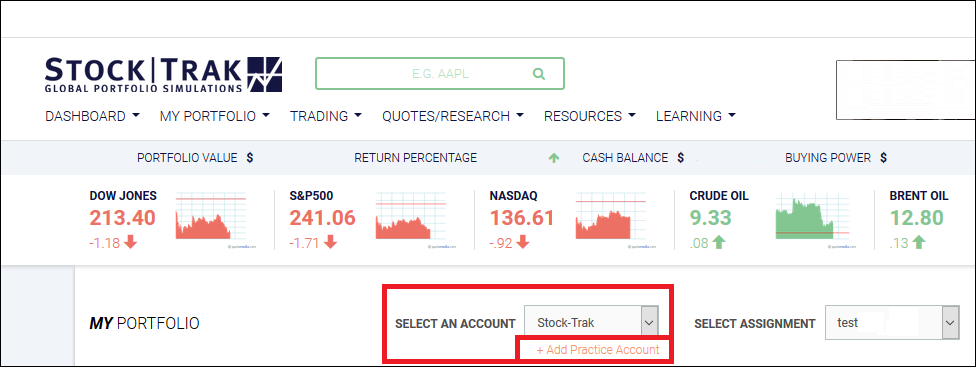

Getting Started - Setting Up Your Account

To get started with StockTrak, simply create an account on the StockTrak website. Once you have created an account, you will be able to choose your starting cash balance and investment options. StockTrak offers a variety of different investment options, including stocks, bonds, mutual funds, and even cryptocurrencies.

Once you have chosen your investment options, you can start building your portfolio. To buy or sell an investment, simply enter the ticker symbol and quantity of shares you wish to trade. StockTrak will display the current bid and ask prices for the investment. You can then place a market order to buy the investment at the current ask price or sell the investment at the current bid price.

Exploring Different Investment Options

StockTrak offers a wide range of investment options to choose from. This allows users to experiment with different investment strategies and learn about the different types of investments available.

One of the best ways to explore different investment options on StockTrak is to use the "Market Scanner" tool. The Market Scanner allows users to search for investments based on a variety of criteria, such as industry sector, market capitalization, and price-to-earnings ratio. This can be a helpful way to find undervalued or overvalued stocks, as well as stocks that are in line with your investment goals.

Another way to explore different investment options on StockTrak is to read the research reports that are available on the platform. StockTrak partners with a variety of investment research firms to provide users with access to professional-grade research reports. These reports can help you learn more about specific companies and industries.

Investment Strategies On StockTrak

StockTrak is a portfolio simulation tool that allows users to trade stocks, bonds, mutual funds, and other securities in a virtual environment. It is a popular tool for students and investors of all levels to learn about investing and practice their trading skills without risking any real money.

There are many different investment strategies that can be used on StockTrak. Two of the most common strategies are conservative investing and aggressive investing.

Conservative investors -focus on minimizing risk and preserving capital. They typically invest in a mix of stocks and bonds, with a larger allocation to bonds. Conservative investors may also choose to invest in dividend-paying stocks, which can provide a steady stream of income.

Aggressive investors -are willing to take on more risk in order to achieve higher returns. They typically invest in a larger percentage of stocks and may also choose to invest in smaller, more volatile stocks. Aggressive investors may also use leverage, such as margin trading, to amplify their returns.

Which investment strategy is right for you depends on your risk tolerance and investment goals. If you are new to investing, it is generally recommended to start with a conservative approach. As you gain more experience and knowledge, you can gradually shift to a more aggressive approach if you wish.

Diversification- is another important investment principle. Diversification means spreading your investments across different asset classes, sectors, and regions. This helps to reduce your risk, if one asset class or sector underperforms, the others may help to offset the losses.

There are many different ways to diversify your portfolio. For example, you can invest in a mix of stocks, bonds, and mutual funds. You can also invest in different sectors of the economy, such as technology, healthcare, and consumer staples. And you can also invest in different countries and regions.

Risk management- is also an important part of investing. Risk management involves taking steps to reduce your risk of loss. Some common risk management techniques include:

- Setting stop-loss orders - A stop-loss order is an order to sell a security when it reaches a certain price. This can help to limit your losses if the security price declines.

- Using margin sparingly - Margin trading can amplify your gains, but it can also amplify your losses. It is important to use margin sparingly and to understand the risks involved.

- Rebalancing your portfolio regularly - Rebalancing your portfolio involves adjusting the allocation of your assets to ensure that it remains aligned with your risk tolerance and investment goals.

Tracking And Analyzing Performance

Tracking and analyzing performance is essential for any investor, regardless of experience level. By regularly monitoring your portfolio performance, you can identify areas where you need to improve your investment strategy and make informed decisions about future trades. StockTrak provides a variety of analytical tools to help you track and analyze your performance, including:

- Portfolio performance reports -These reports provide a comprehensive overview of your portfolio performance, including total return, annualized return, risk metrics, and asset allocation. You can also compare your portfolio performance to a benchmark, such as a specific market index.

- Trade history -This tool allows you to view a detailed history of all your trades, including the date, price, quantity, and symbol of each trade. You can also filter your trade history by date range, symbol, or trade type.

- Charting tools -StockTrak provides a variety of charting tools to help you visualize your portfolio performance and market data. You can create charts that show price movement, volume, technical indicators, and other data.

To effectively track and analyze your performance, it is important to use StockTrak's analytical tools on a regular basis. This will help you identify trends in your portfolio performance and make informed decisions about future trades.

Utilizing StockTrak’s Analytical Tools

StockTrak's analytical tools can be used in a variety of ways to track and analyze your performance. Here are a few examples

- Identify underperforming assets -By reviewing your portfolio performance reports, you can identify any assets that are underperforming the benchmark. This may indicate that you need to rebalance your portfolio or sell the underperforming assets.

- Analyze your trading strategy -By reviewing your trade history, you can analyze your trading strategy and identify areas where you need to improve. For example, you may need to adjust your risk tolerance or develop a more disciplined trading plan.

- Backtest investment strategies -You can use StockTrak's charting tools to backtest investment strategies on historical data. This can help you identify which strategies are likely to be successful in the future.

Learning From Trading Decisions And Outcomes

One of the best ways to improve your investing skills is to learn from your trading decisions and outcomes. When you make a trade, take the time to reflect on your decision-making process and identify the factors that influenced your decision. Once the trade has closed, analyze the outcome and identify what you can learn from it.

StockTrak's analytical tools can help you learn from your trading decisions and outcomes in a number of ways. For example, you can use the trade history tool to review all of your trades, including the date, price, quantity, and symbol of each trade. You can also use the charting tools to visualize your portfolio performance and market data.

By regularly reviewing your trading decisions and outcomes, you can identify patterns and develop a better understanding of the market. This knowledge can help you make more informed trading decisions in the future.

Here are some specific tips for learning from your trading decisions and outcomes

- Keep a trading journal -A trading journal is a great way to track your trading decisions and outcomes. In your journal, you should include information such as the date, time, symbol, quantity, price, and entry and exit reasons for each trade. You should also note your emotions and thought process at the time of each trade.

- Review your trading journal regularly -At least once a month, take some time to review your trading journal. Look for patterns in your trading decisions and outcomes. Identify any areas where you need to improve, such as your risk management or trading discipline.

- Analyze your winning and losing trades -It is important to analyze both your winning and losing trades. When you make a winning trade, try to identify the factors that contributed to your success. When you make a losing trade, try to identify the factors that led to your loss. This knowledge can help you make better trading decisions in the future.

StockTrak - A Powerful Tool For Professional Development

StockTrak is a portfolio simulation platform that provides users with the opportunity to learn about investing and managing a virtual portfolio in a real-world market environment. It is a powerful tool for professional development, offering valuable benefits to both individuals preparing for a career in finance and experienced investors and professionals.

Preparing For A Career In Finance

For those aspiring to a career in finance, StockTrak provides a unique opportunity to gain hands-on experience with investing. Users can learn about different investment strategies, practice trading stocks, and build a portfolio without risking any real money. This experience can be invaluable when applying for jobs in the financial industry, as it demonstrates a strong understanding of investing fundamentals and a proven ability to manage a portfolio.

In addition to helping users develop their investment skills, StockTrak can also help them prepare for the realities of working in the financial industry. The platform simulates the real-world market environment, exposing users to the same challenges and opportunities that professional investors face on a daily basis. This exposure can help users develop the confidence and skills necessary to succeed in the competitive financial industry.

StockTrak For Experienced Investors And Professionals

Experienced investors and professionals can also benefit from using StockTrak. The platform provides a safe and risk-free environment to experiment with new investment strategies and test new ideas. This can be especially helpful for investors who are looking to expand their portfolio into new asset classes or who are trying to develop new trading strategies.

StockTrak can also be used by experienced investors and professionals to refine their investment strategies. The platform's detailed performance tracking and analytical tools can help users identify areas for improvement and make more informed investment decisions.

Future Of Investing Education With StockTrak

StockTrak is a leading provider of portfolio simulation tools for students and investors of all levels. Its platform enables users to learn and practice investing in a risk-free environment, exposing them to the complexities of real-world financial markets. With its commitment to innovation and its focus on user experience, StockTrak is poised to play a pivotal role in the future of investing education.

New Features And Updates On The Horizon

StockTrak is constantly developing new features and updates to enhance its platform and provide users with the most comprehensive and immersive learning experience possible. Some of the exciting new features on the horizon include:

- Expanded asset class coverage -StockTrak is expanding its asset class coverage to include cryptocurrencies, options, and futures. This will allow users to learn about and invest in a wider range of financial instruments, preparing them for success in the ever-evolving world of investing.

- Enhanced social learning features -StockTrak is developing new social learning features to connect users with each other and create a more collaborative learning environment. This will allow users to share ideas, learn from each other's successes and failures, and build a community of investors.

- Gamified learning experiences -StockTrak is leveraging gamification elements to make the learning process more engaging and enjoyable. This will help users to stay motivated and learn at their own pace.

The Evolving Landscape Of Financial Education Tools

The landscape of financial education tools is constantly evolving, with new technologies and platforms emerging all the time. StockTrak remains at the forefront of this evolution, continually innovating and adapting to meet the needs of its users.

One of the key trends in financial education is the shift toward personalized learning. StockTrak's platform is uniquely well-suited to this trend, as it offers a high degree of customization and flexibility. Users can tailor their learning experience to their individual needs and interests, focusing on the specific topics that are most important to them.

Another key trend in financial education is the increasing focus on experiential learning. StockTrak's platform provides users with a hands-on learning experience that mimics the real world of investing. This allows users to learn by doing, developing the skills and knowledge they need to be successful investors.

StockTrak's Role In The Future Of Investing Education

StockTrak is poised to play a pivotal role in the future of investing education. With its commitment to innovation, its focus on user experience, and its alignment with the latest trends in financial education, StockTrak is well-positioned to help the next generation of investors achieve their financial goals.

Here are some specific ways in which StockTrak can help shape the future of investing in education.

- Provide students with early exposure to investing -StockTrak can be used in educational institutions at all levels, from elementary school to college. This allows students to learn about investing early on, developing the financial literacy skills they need to make informed financial decisions in the future.

- Prepare investors for the real world -StockTrak's platform simulates the real world of investing, exposing users to the same challenges and opportunities that they will face in the real market. This helps users to develop the skills and knowledge they need to be successful investors.

- Democratize access to investing education -StockTrak's platform is affordable and accessible to everyone, regardless of their socioeconomic background. This helps to democratize access to investing education and create a more inclusive financial system.

Overall, StockTrak is a powerful tool that can be used to improve investing education for people of all ages and backgrounds. With its commitment to innovation and its focus on user experience, StockTrak is poised to play a pivotal role in the future of investing education.

Frequently Ask Questions - StockTrak

How Does Stock-Trak Work?

When your students register, they receive a brokerage account with an imaginary cash balance. Once their accounts are activated, they can visit our web page to make trades or email the support desk if they have questions about their account. Stock-Trak brokers DO NOT give advice.

Is Stock Track Free?

At WallStreetSurvivor and Stock-Trak, you can practice trading online stocks and mutual funds. You can create your own contests and trading rules, practice trading on several portfolios, and best of all – registration is absolutely free!

How Do You Trade In Stocktrak?

If you want to sell a stock, you will receive the “bid” price. Ask price - This is the lowest amount a “seller” in the market is willing to take for their stock. If you want to buy a stock, you will pay the “bid” price. To buy or sell a stock at the current bid/ask prices, you will use a “Market” order type.

Conclusion

StockTrak is a powerful and innovative platform that provides users with a unique and immersive learning experience in the world of investing. With its realistic simulation of market conditions, diverse investment options, and comprehensive performance tracking tools, StockTrak is the perfect tool for anyone who wants to learn about investing without risking any real money.

Whether you are a student, a professional, or simply someone who is interested in learning more about investing, StockTrak has something to offer you. Its platform is scalable and adaptable to meet the needs of users at all levels of experience.

Jump to

Understanding StockTrak - An Overview

The Educational Value Of StockTrak

Navigating The StockTrak Platform

Investment Strategies On StockTrak

Tracking And Analyzing Performance

StockTrak - A Powerful Tool For Professional Development

Future Of Investing Education With StockTrak

Frequently Ask Questions - StockTrak

Conclusion

Emmanuella Shea

Author

Emmanuella Shea is a professional financial analyst with over 9 years of experience in the financial markets. Emmanuella is still concerned about the long-term stability of multimillion-dollar financial portfolios. She is skilled at persuading and manipulating high-ranking individuals in addition to her work as a Financial Analyst. Her decisions are trusted and respected, and her views are highly regarded. Her long-term ambition is to work as a policy advisor at the national level. She wants to use her unwavering dedication and drive to help developing-country people gain more dignity and autonomy.

Frazer Pugh

Reviewer

I work in the investment management sector as a professional. Previously, I advised top financial services companies on balance sheet management, portfolio planning, and valuations as a consultant. I am currently pursuing a part-time MBA at Melbourne University, where I am a lecturer in accounting and hedge fund strategies, as well as a mentor/coach in a part-time equity analysis initiative. I have a bachelor's degree in economics, a master's degree in finance, and am a Chartered Accountant. I enjoy instructing and assisting others in achieving their objectives.

Latest Articles

Popular Articles