Stockchoker - The Secret Weapon That Can Help You Beat The Market

Use Stockchoker to compare stock performance, identify investment opportunities, and make smarter investment decisions.

Author:Anderson PattersonReviewer:Elisa MuellerOct 11, 202371 Shares71.2K Views

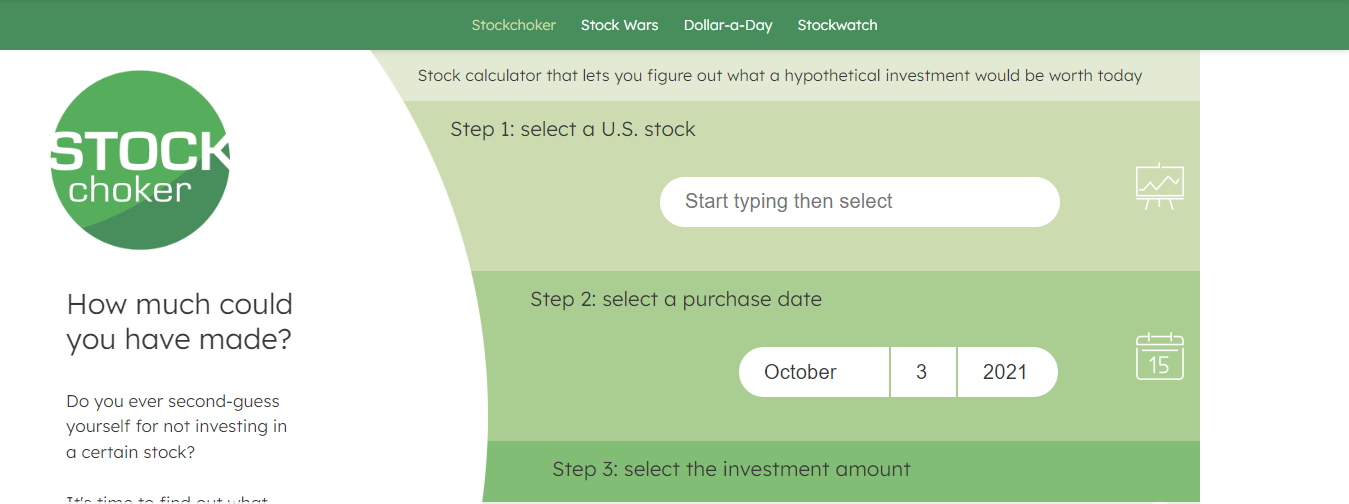

Stockchokeris a website that provides a free historical investment calculator. This calculator allows users to input a stock symbol and a purchase date, and then calculates how much that investment would be worth today. The calculator also takes into account splits and dividends.

Stockchoker is a free online stock calculator that allows users to track the performance of their investments over time. It also provides a variety of tools for researching potential investments and comparing the performance of different stocks.

Stockchoker also has a feature called "Stock Wars", which allows users to compare the performance of different stocks over time. This feature can be used to see how a particular stock has performed against the S&P 500 or other benchmark indices.

Stockchoker is a secret weapon for investors because it provides them with a powerful suite of tools for making smarter investment decisions. Stockchoker can help you beat the market by providing you with the information and tools you need to make smarter investment decisions.

Stockchoker is a useful tool for investors of all levels of experience. It can be used to research potential investments, track the performance of existing investments, and compare the performance of different stocks.

Stockchoker is a valuable tool for investors of all levels of experience. It can help you make smarter investment decisions and beat the market.

Stockchoker To Research Potential Investments

To use Stockchoker to research potential investments, you can follow these steps,

Input A Stock Symbol And Purchase Date

To use Stockchoker to research potential investments, simply input the stock symbol and purchase date into the calculator. You can also specify a start and end date to see how the stock has performed over a certain time period.

See How Much Your Investment Would Be Worth Today

Once you have input the stock symbol and purchase date, Stockchoker will calculate how much your investment would be worth today. This takes into account splits and dividends, as well as the current price of the stock.

Take Into Account Splits And Dividends

Splits and dividends can have a significant impact on the value of your investment. Stockchoker automatically takes these into account when calculating the value of your investment.

Example

Let's say that you are considering investing in the stock of Apple Inc. (AAPL). You can use Stockchoker to research the stock and see how it has performed in the past.

To do this, simply input the stock symbol AAPL and a purchase date into the calculator. You can also specify a start and end date to see how the stock has performed over a certain time period.

Let's say that you input a purchase date of January 1, 2023. Stockchoker will then calculate how much your investment would be worth today, taking into account splits and dividends.

As of August 4, 2023, AAPL stock is trading at $176.77 per share. Stockchoker will calculate that your investment would be worth $210.14 per share today, taking into account splits and dividends.

This information can help you make an informed decision about whether or not to invest in AAPL stock.

Tips for using Stockchoker to research potential investments,

- Use the "Stock Wars" feature to compare the performance of different stocks.

- Create custom filters to narrow down your search.

- Export your data to a spreadsheet for further analysis.

By following these tips, you can use Stockchoker to research potential investments and make smarter investment decisions.

Stockchoker Track The Performance Of Existing Investments

Create A Portfolio Of Stocks

To track the performance of your existing investments, you can create a portfolio of stocks in Stockchoker. This will allow you to track the performance of your portfolio over time and compare it to the S&P 500 or other benchmark indices.

To create a portfolio, simply click on the "Portfolios" tab and click on the "Create New Portfolio" button. You will then be able to add stocks to your portfolio by entering the stock symbol and the number of shares you own.

Track The Performance Of Your Portfolio Over Time

Once you have created a portfolio, you can track its performance over time by clicking on the "Performance" tab. This tab will show you the current value of your portfolio, as well as its performance over the past day, week, month, year, and since inception.

You can also use the "Performance" tab to compare your portfolio to the S&P 500 or other benchmark indices. This will help you to see how your portfolio is performing relative to the overall stock market.

Compare Your Portfolio To The S&P 500 Or Other Benchmark Indices

To compare your portfolio to the S&P 500 or other benchmark indices, simply click on the "Compare" button on the "Performance" tab. You can then select the benchmark index that you want to compare your portfolio to.

Stockchoker will then show you a chart that compares the performance of your portfolio to the benchmark index. This chart will show you how your portfolio has performed relative to the benchmark index over the past day, week, month, year, and since inception.

Example

Let's say that you have a portfolio of stocks that includes Apple Inc. (AAPL), Microsoft Corp. (MSFT), and Alphabet Inc. (GOOGL). You can use Stockchoker to track the performance of your portfolio over time and compare it to the S&P 500.

To do this, simply create a portfolio in Stockchoker and add the stocks AAPL, MSFT, and GOOGL to it. Once you have created your portfolio, you can click on the "Performance" tab to track its performance over time.

You can also use the "Compare" button to compare your portfolio to the S&P 500. This will show you how your portfolio has performed relative to the S&P 500 over the past day, week, month, year, and since inception.

By using Stockchoker to track the performance of your portfolio, you can make sure that your investments are on track to meet your financial goals.

Tips for using Stockchoker to track the performance of existing investments,

- Set up alerts to be notified when your portfolio reaches certain price targets.

- Use the "Dividend Tracker" to track your dividend income.

- Export your data to a spreadsheet for further analysis.

By following these tips, you can use Stockchoker to track the performance of your existing investments and make smarter investment decisions.

Stockchoker To Compare The Performance Of Different Stocks

Compare Different Stocks Side-by-side

To compare the performance of different stocks, simply enter the stock symbols of the stocks you want to compare into the Stockchoker calculator. You can also specify a start and end date to see how the stocks have performed over a certain time period.

Stockchoker will then show you a chart that compares the performance of the stocks you selected. This chart will show you how the stocks have performed relative to each other over the past day, week, month, year, and since inception.

See How Different Stocks Have Performed Over Different Time Periods

You can also use Stockchoker to see how different stocks have performed over different time periods. To do this, simply click on the "Timeframe" button on the chart and select the time period you want to view.

Stockchoker will then show you a chart that compares the performance of the stocks you selected over the selected time period. This can be helpful for identifying stocks that are trending up or down over certain time periods.

Identify Trading Opportunities

Stockchoker can also be used to identify trading opportunities. To do this, simply look for stocks that are outperforming or underperforming the market or other stocks in their sector. You can also look for stocks that are breaking out of technical patterns.

Once you have identified a stock that you think has trading potential, you can use Stockchoker to research the stock and develop a trading plan.

Example

Let's say that you are considering investing in the stock of Apple Inc. (AAPL) and Microsoft Corp. (MSFT). You can use Stockchoker to compare the performance of these two stocks to see which one is a better investment.

To do this, simply enter the stock symbols AAPL and MSFT into the Stockchoker calculator. You can also specify a start and end date to see how the stocks have performed over a certain time period.

Stockchoker will then show you a chart that compares the performance of AAPL and MSFT over the selected time period. This chart will show you how the stocks have performed relative to each other over the past day, week, month, year, and since inception.

You can also use the "Timeframe" button to see how AAPL and MSFT have performed over different time periods. This can be helpful for identifying stocks that are trending up or down over certain time periods.

Once you have compared the performance of AAPL and MSFT, you can make an informed decision about which stock is a better investment for you.

Tips for using Stockchoker to compare the performance of different stocks,

- Use the "Stock Wars" feature to compare the performance of different stocks side-by-side.

- Use the "Timeframe" button to see how different stocks have performed over different time periods.

- Use the "Compare" button to compare your portfolio to the S&P 500 or other benchmark indices.

By following these tips, you can use Stockchoker to compare the performance of different stocks and identify trading opportunities.

Tips And Tricks For Using Stockchoker

Here are some tips and tricks for using Stockchoker,

Use The "Stock Wars" Feature To Compare The Performance Of Different Stocks

The "Stock Wars" feature allows you to compare the performance of up to 10 stocks side-by-side. This is a great way to identify stocks that are outperforming or underperforming the market or other stocks in their sector.

To use the "Stock Wars" feature, simply click on the "Stock Wars" tab and enter the stock symbols of the stocks you want to compare. You can also specify a start and end date to see how the stocks have performed over a certain time period.

Stockchoker will then show you a chart that compares the performance of the stocks you selected over the selected time period. This chart will show you how the stocks have performed relative to each other and to the market as a whole.

Create Custom Filters To Narrow Down Your Search

Stockchoker also allows you to create custom filters to narrow down your search for potential investments. This can be helpful if you are looking for stocks that meet specific criteria, such as stocks in a particular sector, stocks with a certain market capitalization, or stocks with a certain dividend yield.

To create a custom filter, simply click on the "Filters" tab and click on the "Create New Filter" button. You can then specify the criteria that you want to use to filter your search results.

Stockchoker will then show you a list of stocks that meet your criteria. You can then click on any of the stocks in the list to view more information about them.

Export Your Data To A Spreadsheet For Further Analysis

Stockchoker also allows you to export your data to a spreadsheet for further analysis. This can be helpful if you want to compare your data to other data sources or if you want to use it to create your own charts and graphs.

To export your data to a spreadsheet, simply click on the "Export" button on the "Performance" tab or the "Stock Wars" tab. You can then choose to export your data to a CSV file or an Excel file.

Other Tips And Tricks

Here are some other tips and tricks for using Stockchoker,

- Use the "Dividend Tracker" to track your dividend income.

- Set up alerts to be notified when your portfolio reaches certain price targets.

- Use the "Stock Scanner" to find stocks that meet your criteria.

- Use the "Stock Screener" to find stocks that are undervalued or overvalued.

- Use the "Backtesting" feature to test your trading strategies.

By following these tips and tricks, you can use Stockchoker to make smarter investment decisions and beat the market.

(Stockchoker) _____ FAQs

Is Stockchoker Safe To Use?

Yes, Stockchoker is safe to use. It is a trusted tool that has been used by investors for many years. Stockchoker takes security seriously and uses the latest security measures to protect your data.

What If I Have A Question About Stockchoker?

If you have a question about Stockchoker, you can contact the Stockchoker support team. The support team is available 24/7 and is happy to help you with any questions you have.

Is Stockchoker Accurate?

Stockchoker is accurate to the best of its knowledge. However, it is important to remember that past performance is not indicative of future results.

Conclusion

Stockchoker is a valuable tool for investors of all levels of experience. It can help you make smarter investment decisions and beat the market.

Stockchoker offers a variety of features, including a stock calculator, portfolio tracker, stock screener, backtesting tool, dividend tracker, Stock Wars feature, and custom filters. These features can be used to research potential investments, track the performance of existing investments, compare the performance of different stocks, and identify trading opportunities.

Stockchoker is free to use and easy to sign up for. To learn more about Stockchoker, visit the Stockchoker website or read the Stockchoker blog.

I hope this article has been helpful. If you have any questions about Stockchoker, please feel free to leave a comment below.

Anderson Patterson

Author

Anderson Patterson, a tech enthusiast with a degree in Computer Science from Stanford University, has over 5 years of experience in this industry.

Anderson's articles are known for their informative style, providing insights into the latest tech trends, scientific discoveries, and entertainment news.

Anderson Patterson's hobbies include exploring Crypto, photography, hiking, and reading.

Anderson Patterson's hobbies include exploring Crypto, photography, hiking, and reading.

In the Crypto niche, Anderson actively researches and analyzes cryptocurrency trends, writes informative articles about blockchain technology, and engages with different communities to stay updated on the latest developments and opportunities.

Elisa Mueller

Reviewer

Elisa Mueller, a Kansas City native, grew up surrounded by the wonders of books and movies, inspired by her parents' passion for education and film.

She earned bachelor's degrees in English and Journalism from the University of Kansas before moving to New York City, where she spent a decade at Entertainment Weekly, visiting film sets worldwide.

With over 8 years in the entertainment industry, Elisa is a seasoned journalist and media analyst, holding a degree in Journalism from NYU. Her insightful critiques have been featured in prestigious publications, cementing her reputation for accuracy and depth.

Outside of work, she enjoys attending film festivals, painting, writing fiction, and studying numerology.

Latest Articles

Popular Articles