Tax-Advantaged Accounts - Maximizing Wealth Growth

In today's complex financial landscape, individuals are constantly seeking ways to optimize their wealth growth and minimize their tax liabilities. One effective strategy that can help achieve these goals is the utilization of tax-advantaged accounts. These accounts offer a range of benefits, from tax deferral to tax-free growth, enabling individuals to make the most of their investments while potentially reducing their overall tax burden.

Author:James PierceReviewer:Alberto ThompsonJul 10, 2023287 Shares71.8K Views

In today's complex financial landscape, individuals are constantly seeking ways to optimize their wealth growth and minimize their tax liabilities. One effective strategy that can help achieve these goals is the utilization of tax-advantaged accounts. These accounts offer a range of benefits, from tax deferral to tax-free growth, enabling individuals to make the most of their investments while potentially reducing their overall tax burden.

Understanding Tax-Advantaged Accounts

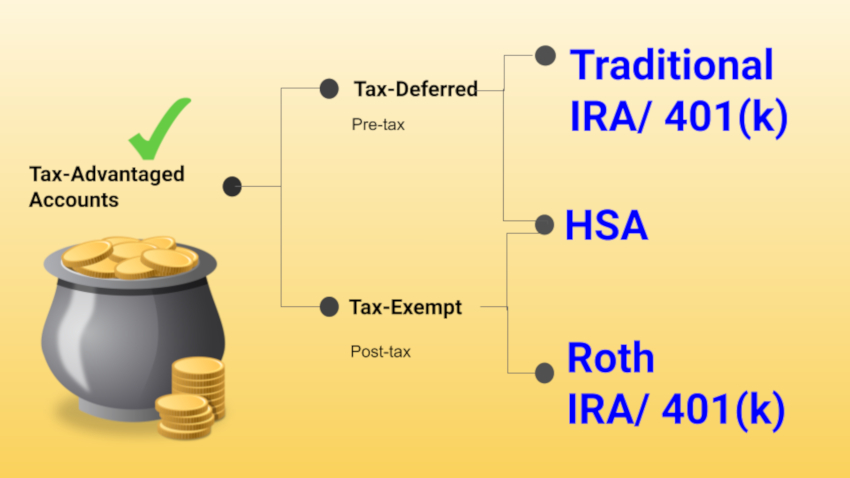

Tax-advantaged accounts are financial accounts that offer tax benefits to the account holder. These benefits can come in various forms, such as tax deductions, tax exemptions, or tax deferrals. The primary purpose of these accounts is to encourage and incentivize savings for significant life expenses like retirement, education, and health.

What Are Tax-Advantaged Accounts?

Tax-advantaged accounts, as defined by Investopedia, refer to investment accounts that provide specific tax benefits to individuals. These accounts are designed to incentivize saving and investing by offering favorable tax treatment on contributions, earnings, or withdrawals. By taking advantage of these accounts, investors can potentially increase their after-tax returns and accelerate their wealth accumulation.

Types Of Tax-Advantaged Accounts

There are various types of tax-advantaged accounts available, each with its own set of rules and benefits. Let's explore some of the most common ones:

- Retirement Accounts - Retirement accounts, such as 401(k)s and Individual Retirement Accounts (IRAs), are widely recognized tax-advantaged accounts. Contributions made to these accounts are often tax-deductible, and the earnings within the accounts grow tax-deferred until withdrawal. Traditional IRAs and 401(k)s offer tax-deferred growth, while Roth IRAs provide tax-free growth potential, as qualified withdrawals are tax-free. These accounts are designed to help individuals save for retirement and enjoy tax advantages while doing so.

- Health Savings Accounts (HSAs) - HSAs are specialized accounts that allow individuals with high-deductible health insurance plans to save for qualified medical expenses. Contributions made to HSAs are tax-deductible, and the earnings grow tax-free. Moreover, withdrawals used for eligible medical expenses are also tax-free. HSAs offer a unique triple-tax advantage, providing tax deductions on contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

- 529 College Savings Plans -These plans are designed to help families save for future education expenses. Contributions made to 529 plans are not tax-deductible, but the earnings grow tax-free. Withdrawals used for qualified educational expenses are also tax-free. 529 plans provide a tax-efficient way to save for education, whether it's for a child, grandchild, or even yourself.

- Flexible Spending Accounts (FSAs) -FSAs are employer-sponsored accounts that allow employees to set aside pre-tax dollars to cover certain out-of-pocket medical expenses or dependent care costs. Contributions made to FSAs are not subject to income tax, resulting in potential tax savings. FSAs provide individuals with an opportunity to pay for eligible expenses with pre-tax dollars, reducing their overall taxable income.

These are just a few examples of tax-advantaged accounts available to individuals. Each account type has specific rules and limitations, so it's important to understand the details and eligibility requirements associated with each.

The Benefits Of Tax-Advantaged Accounts

Tax-advantaged accounts offer individuals a range of benefits that can significantly impact their financial well-being. These accounts provide advantages such as tax deferral, tax-free growth, potential tax savings, and alignment with specific financial goals. By understanding and leveraging these benefits, individuals can maximize their wealth growth and potentially reduce their overall tax burden.

What Are Tax Advantaged Accounts? (Do They Make Sense For You!?)

Let's explore in detail the various advantages that tax-advantaged accounts have to offer.

Tax Deferral And Compound Growth

One of the primary benefits of tax-advantaged accounts is tax deferral. In accounts like traditional IRAs and 401(k)s, contributions are made with pre-tax dollars, reducing your taxable income for the year. The earnings within these accounts grow tax-deferred until withdrawal, allowing your investments to compound over time without the drag of annual taxes. This compounding effect can significantly enhance your overall investment returns.

Consider an individual who contributes $10,000 per year to a traditional IRA for 30 years, with an average annual return of 7%. Assuming a 25% tax rate, their investment would grow to approximately $761,225. In contrast, if they had invested the same amount in a taxable account, assuming the same return and tax rate, the investment would grow to only around $570,920. The tax-advantaged account provides a substantial advantage, demonstrating the power of tax deferral and compound growth.

Potential Tax-Free Growth And Withdrawals

Certain tax-advantaged accounts, such as Roth IRAs and HSAs, offer the potential for tax-free growth and withdrawals. With a Roth IRA, contributions are made with after-tax dollars, but qualified withdrawals in retirement are entirely tax-free. This can be highly advantageous, as it allows you to potentially enjoy years of tax-free growth on your investments.

Suppose an individual contributes $5,000 per year to a Roth IRA for 30 years, with an average annual return of 7%. At the end of the period, the account balance would be approximately $467,328. The best part is that all qualified withdrawals from the account, including the contributions and earnings, would be tax-free.

Similarly, HSAs provide the opportunity for tax-free growth and withdrawals when used for qualified medical expenses. This can serve as a powerful tool for covering healthcare costs, both in the short term and during retirement.

Tax Savings And Lowered Tax Burden

By utilizing tax-advantaged accounts, individuals can potentially reduce their overall tax burden. Contributions to these accounts often qualify for deductions, lowering your taxable income. Additionally, the tax advantages within these accounts can result in significant savings, especially over an extended period. The money saved on taxes can be reinvested or used for other financial goals.

For example, let's consider an individual in a 25% tax bracket who contributes $10,000 per year to a traditional 401(k) for 30 years. The total amount of contributions over the period would be $300,000. Assuming a 7% average annual return, the account balance would be approximately $2,283,351. Without considering taxes, the growth of the account would be substantial.

However, when accounting for taxes, assuming a 25% tax rate at the time of withdrawal, the individual would save $570,837 in taxes, allowing them to keep more of their investment returns.

Tailored To Specific Financial Goals

Tax-advantaged accounts are designed to meet specific financial objectives. For example, retirement accounts cater to long-term savings needs, while 529 plans focus on educational expenses. By leveraging these specialized accounts, individuals can align their investment strategies with their financial goals, ensuring a more targeted and efficient approach.

For retirement planning, tax-advantaged accounts such as traditional IRAs and 401(k)s provide individuals with the opportunity to save for their future while enjoying potential tax savings. These accounts are designed to incentivize long-term savings by offering tax deductions on contributions and tax-deferred growth.

When it comes to education expenses, 529 college savings plans offer tax advantages tailored specifically for this purpose. Contributions to 529 plans are not tax-deductible, but the earnings grow tax-free. Withdrawals used for qualified educational expenses are also tax-free. This makes 529 plans an attractive option for parents or guardians who want to save for their children's education without incurring tax liabilities on the growth of their investments.

Health savings accounts (HSAs) provide individuals with a tax-advantaged way to save for medical expenses. Contributions made to HSAs are tax-deductible, the earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. HSAs offer flexibility and potential tax savings for healthcare expenses, making them a valuable tool for individuals looking to manage their healthcare costs effectively.

Flexible spending accounts (FSAs) also offer tax advantages by allowing employees to contribute pre-tax dollars to cover medical expenses or dependent care costs. By utilizing FSAs, individuals can lower their taxable income, resulting in potential tax savings.

STOP SAVING and Start Investing in a Tax Advantaged Account!

Considerations And Limitations

While tax-advantaged accounts offer numerous benefits, it's important to understand their limitations and consider certain factors:

- Contribution Limits - Each tax-advantaged account type has contribution limits that individuals must adhere to. It's crucial to be aware of these limits and contribute accordingly to maximize the benefits.

- Withdrawal Restrictions - Some tax-advantaged accounts impose restrictions on when and how withdrawals can be made. Understanding these rules is essential to avoid penalties or unintended tax consequences.

- Eligibility and Income Limits -Certain tax-advantaged accounts, such as Roth IRAs and HSAs, have income restrictions for eligibility. High earners may find themselves ineligible for these accounts, limiting their access to certain tax benefits.

- Changing Tax Laws -Tax laws are subject to change, and new legislation can impact the benefits provided by tax-advantaged accounts. Staying informed about any changes and adapting your strategy accordingly is crucial.

It's important to consult with a financial advisor or tax professional to determine the most suitable tax-advantaged accounts for your specific financial situation and goals.

People Also Ask

What Is The Best Tax-advantaged Account?

Consider these top tax-advantaged investments and accounts for wealth accumulation:

- Traditional 401(k) Plans

- 403(b) and 457 Plans

- Traditional IRA

- Roth 401(k), 403(b), and 457 Plans

- 529 Plan

- Health Savings Account (HSA)

- Municipal Bonds

- Charitable Giving

These accounts offer significant tax benefits and are excellent tools for building wealth.

What Is A Tax-Advantaged Mutual Fund?

A tax-advantaged mutual fund, also known as a tax-managed stock fund, is a type of investment fund specifically designed to reduce the tax liability of investors. This is achieved through various strategies such as avoiding dividend-paying stocks, balancing capital gains with losses, and holding onto stocks for longer periods to evade short-term gains.

What Is The Difference Between Tax-advantaged And Taxable Accounts?

Taxable accounts like brokerage accounts are suitable for investments that yield less tax on returns. On the other hand, tax-advantaged accounts like IRA, 401(k), or Roth IRA are typically more beneficial for investments that incur higher taxes on returns.

What Is An Example Of A Taxable Account?

Examples of taxable accounts encompass checking accounts, savings accounts, money market accounts, and brokerage accounts (cash management accounts). These differ from tax-advantaged accounts that come with specific tax guidelines.

Is Tax A Liability Or Asset?

A tax expense represents a financial obligation to federal, state, or city governments over a specific period and is considered a liability.

What Accounts Reduce Taxes?

401(k) accounts are considered pre-tax accounts. The contributions you make to these accounts are deducted from your income before it is subjected to taxes. This process effectively lowers your overall taxable income, leading to a reduced tax liability. Hence, 401(k) accounts serve as a useful tool for minimizing your tax bill.

Conclusion

Tax-advantaged accounts are powerful tools that can help individuals maximize their wealth growth and minimize their tax liabilities. By taking advantage of these accounts, individuals can benefit from tax deferral, tax-free growth, and potential tax savings. Whether it's planning for retirement, education, or healthcare expenses, tax-advantaged accounts offer tailored solutions to meet specific financial goals.

However, it's important to carefully consider the rules, limitations, and eligibility requirements associated with each account type. By staying informed and making informed decisions, individuals can harness the full potential of tax-advantaged accounts and enhance their long-term financial well-being.

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Alberto Thompson

Reviewer

Alberto Thompson is an acclaimed journalist, sports enthusiast, and economics aficionado renowned for his expertise and trustworthiness. Holding a Bachelor's degree in Journalism and Economics from Columbia University, Alberto brings over 15 years of media experience to his work, delivering insights that are both deep and accurate.

Outside of his professional pursuits, Alberto enjoys exploring the outdoors, indulging in sports, and immersing himself in literature. His dedication to providing informed perspectives and fostering meaningful discourse underscores his passion for journalism, sports, and economics. Alberto Thompson continues to make a significant impact in these fields, leaving an indelible mark through his commitment and expertise.

Latest Articles

Popular Articles