Tax-Efficient Investing - Your Guide To Maximizing Investments

Discover why tax-efficient investing is crucial for maximizing returns. Our guide covers 6 key strategies, practical steps, real-life scenarios, common mistakes to avoid, and answers to frequently asked questions.

Author:Dexter CookeReviewer:Darren McphersonSep 11, 202335K Shares594.2K Views

Investing is an effective way to build wealth, but many people overlook one crucial factor—taxes. What good is a high return if a large chunk goes to the taxman? Tax-efficient investingis a strategy aimed at minimizing tax liability, which can significantly increase your net returns over time. Let's dive into this topic, dissecting the various elements, and discover how to keep more money in your pocket.

The Basics

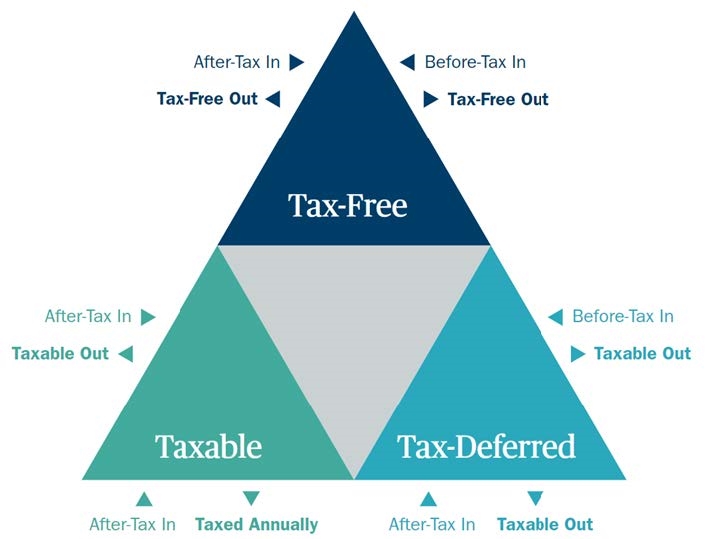

Tax-Deferred Vs. Tax-Free

- Tax-Deferred Accounts: Money you invest in these accounts grows without being taxed until you withdraw it. Think 401(k) or traditional IRA.

- Tax-Free Accounts: Contributions are taxed, but the growth and withdrawals are tax-free. Roth IRAs are a classic example.

Taxable Accounts

Taxable accounts are what most people think of when they consider investing. In these accounts, you're subject to three types of taxes:

- Capital Gains Tax: You pay this when you sell an investment for a profit.

- Dividend Tax: You pay this on income generated from your investments.

- Interest Income Tax: Taxed on interest received from bonds or cash savings.

In today's complex financial landscape, investing wisely is not enough. Efficient tax planning is crucial for achieving your financial goals without eroding your returns through tax liabilities.

Why Is Tax-Efficient Investing Crucial?

Tax-efficient investing is essential because it enables you to maximize your net returns by minimizing the tax impact on your investments. Through strategic planning, you can keep more of what you earn, accelerating the growth of your investment portfolio and helping you reach your financial goals more quickly.

The Cost Of Neglecting Taxes

Research by the Schwab Center for Financial Research underscores the long-term impact of taxes on investment returns. It shows that investment selection and asset allocation indeed play crucial roles in defining returns. However, minimizing tax liability also has a profound effect on your portfolio for two fundamental reasons:

- Immediate Loss of Capital- When you pay taxes, that's money you can't invest.

- Loss of Compounding Growth- The money paid in taxes could have been invested to generate further returns.

Additionally, the impact of taxes can be even more significant if you're investing in assets that are prone to high volatility, as the tax consequences of selling at a high could dramatically reduce your net gains.

Your after-tax returns, not your pre-tax returns, are what you'll spend now and in retirement. For this reason, tax-efficient investing becomes increasingly vital, especially as you move into higher tax brackets.

Types Of Investment Accounts Revisited

Taxable Accounts - The Trade-Offs

While taxable accounts like brokerage accounts lack tax benefits, they offer unmatched flexibility. Unlike tax-advantaged accounts, you can withdraw from taxable accounts anytime, for any reason, without penalties. How returns from these accounts are taxed depends on your holding period:

- Long-term Capital Gains - Investments held for over a year are taxed at a more favorable rate (0%, 15%, or 20%, depending on your tax bracket).

- Short-term Capital Gains- If you hold an investment for less than a year, it's subject to your ordinary income tax bracket.

Moreover, some investments like certain international stocks may come with foreign tax credits, helping you offset the tax liability on your returns.

Tax-Advantaged Accounts - Restrictions And Rewards

Whether tax-deferred (like 401(k)s and traditional IRAs) or tax-exempt (Roth IRAs and Roth 401(k)s), these accounts come with contribution limits and restrictions on withdrawals. For example, as of 2023, you can contribute up to $22,500 in a 401(k), or $30,000 if you are 50 or older. Additionally, some plans allow for "catch-up" contributions that can be particularly beneficial for those closer to retirement.

These limitations make it impractical to hold all your investments in tax-advantaged accounts.

Amplifying Tax-Efficient Investing Strategies

Be Mindful Of Contribution Limits

Given the annual contribution limits on tax-advantaged accounts, a balanced approach is vital. Choose your investment avenues wisely to ensure maximum tax efficiency. Keep an eye out for changes in legislation, as contribution limits are periodically updated, which could either restrict or enhance your ability to invest tax-efficiently.

The Right Asset In The Right Account

Generally, tax-efficient investments should be in taxable accounts, while the less tax-efficient ones are better suited for tax-deferred or tax-exempt accounts. The key is to conduct periodic reviews of your investment portfolios across all account types to ensure that they align with your broader tax strategy.

When To Override Tax-Efficiency

Sometimes, liquidity or specific financial needs may compel you to override tax-efficiency principles. These situations might include emergency expenses or opportunities that require quick access to capital. For instance, you may choose to hold a corporate bond in a taxable account despite its tax inefficiency, simply for easier access to your money.

6 Tax-Efficient Investment Strategies

Efficient tax planning is crucial for achieving your financial goals without eroding your returns through tax liabilities. Here are six strategies you should look into:

Strategy 1 - Leverage Tax-Advantaged Retirement Accounts

Introduction

One of the most effective strategies for tax-efficient investing is utilizing tax-advantaged retirement accounts such as Traditional IRAs, Roth IRAs, and 401(k)s. These accounts offer a variety of tax benefits that can significantly enhance your long-term investment returns.

Benefits

- Current Tax Benefits

- Future Tax Benefits

Strategies

- Timing of Contributions -It’s essential to plan when you contribute to these accounts based on your expected future tax situation. For instance, if you expect to be in a lower tax bracket during retirement, it may be beneficial to contribute more to a Traditional IRA or 401(k) now.

- Employer Matching - If your employer offers a matching contribution on your 401(k), strive to contribute at least enough to get the full employer match. This is essentially "free money" that can grow tax-deferred or tax-free depending on the account type.

Strategy 2 - Align Asset Location With Tax Efficiency

Different types of assets are taxed differently, so placing them in the most tax-efficient account types can offer significant tax savings.

Stocks And Bonds

- Stocks in Taxable Accounts -Long-term capital gains, which apply to stocks held for more than one year, are generally taxed at a lower rate than short-term gains or ordinary income. Thus, it can be beneficial to hold stocks in taxable accounts to take advantage of these lower tax rates.

- Bonds in Tax-Deferred Accounts -The interest generated by bonds is usually taxed as ordinary income, which could be at a rate as high as your marginal tax rate. Therefore, it's often more tax-efficient to hold bonds in tax-deferred accounts like a Traditional IRA or 401(k), where high-tax liabilities can be deferred until retirement when you may be in a lower tax bracket.

Strategies

- Regular Review - Make it a habit to periodically review your investment accounts to ensure they align with your asset location strategy.

- Tax-Efficient Funds - Tax-efficient index funds or ETFs are generally well-suited for taxable accounts. These funds are designed to minimize taxable events, thereby reducing the tax drag on your investments.

Strategy 3 - Maximize Tax-Loss Harvesting

Tax-loss harvesting involves selling securities at a loss to offset a capital gains tax liability. This strategy can be particularly effective in volatile markets where asset values fluctuate widely.

Strategies

- Active Monitoring -Keep an eye on the performance of your investments and be ready to act if you see opportunities for tax-loss harvesting.

- Avoid Wash Sales - The IRS disallows a tax loss if you buy a "substantially identical" asset within 30 days before or after the sale that generated the loss. Therefore, if you do sell to harvest losses, make sure not to violate the wash sale rule.

Strategy 4 - Employ Long-Term Holding Strategies

The length of time you hold an asset can significantly impact the taxes you owe on your gains. Assets held for over one year are subject to long-term capital gains tax, which is usually much lower than short-term capital gains tax.

Strategies

- Patience Pays -As a general rule of thumb, try to hold onto your investments for at least one year to qualify for lower long-term capital gains tax rates.

- Tax and Timing - Before selling any asset, consult a tax advisor, especially if you’re close to the one-year mark. The cost of paying higher short-term capital gains tax can sometimes outweigh the benefits of selling.

Strategy 5 - Choose Tax-Efficient Funds

Investment funds like mutual funds and ETFs come with their own tax consequences. However, some funds are designed to be more tax-efficient than others.

Examples

- Index Funds -Because they generally have lower turnover rates, index funds often realize fewer capital gains, making them more tax-efficient.

- Tax-Managed Funds - These funds are specifically managed to minimize tax liabilities and can be an excellent addition to taxable accounts.

Strategies

- Due Diligence -Always read the fund prospectus and look at the historical after-tax returns to gauge the fund’s tax efficiency.

- Fund Placement -Place these tax-efficient funds in taxable accounts to maximize their benefits.

Strategy 6 - Consider Municipal Bonds

Municipal bonds are often exempt from federal taxes and sometimes state and local taxes, making them a potentially attractive option for those in higher tax brackets.

Advantages

Triple Tax-Free -Many municipal bonds offer income that is exempt from federal, state, and local taxes, particularly if you reside in the issuing state.

Strategies

Risk Assessment -Just like any other investment, municipal bonds come with risks, including credit risk and interest rate risk. Always factor these into your investment decision-making process.

By strategically combining these tactics, and consulting with a tax advisor for personalized guidance, you can build a tax-efficient investment strategy tailored to your specific needs and financial goals.

Practical Steps

- Prioritize Tax-Advantaged Accounts -Max out your 401(k) and IRA contributions before investing in taxable accounts.

- Asset Location -Place tax-inefficient assets in tax-advantaged accounts.

- Watch for Dividends - Keep dividend-paying stocks in tax-deferred accounts.

- Harvest Your Losses - Regularly review your portfolio to offset gains with losses.

Real-Life Scenario

Imagine you have $10,000 to invest each year and assume an average annual return of 7%.

- Taxable Account -Subject to a 25% tax rate, after 30 years, you'd have about $552,000.

- Tax-Efficient Account -You'd have around $761,000—nearly $210,000 more.

Common Mistakes To Avoid

- Ignoring Turnover Rates -High-turnover funds can be tax-inefficient.

- Not Using Tax-Loss Harvesting - A potent tool, but often ignored.

- Overlooking Asset Location - Placing assets in the wrong type of account can be costly.

Tax-Efficient Investing FAQs

What Role Does Financial Planning Play In Tax-Efficient Investing?

Financial planning is integral to tax-efficient investing. It helps you understand your current financial standing, your investment objectives, and your risk tolerance. Knowing these factors can guide you in selecting tax-efficient assets and strategies, enabling you to minimize your tax liability while maximizing returns.

How Does Your Tax Bracket Affect Your Investment Choices?

Your tax bracket determines how much tax you'll pay on various forms of income, including capital gains and dividends. Understanding your tax bracket can help you decide between different investment opportunities, such as tax-deferred accounts, municipal bonds, or index funds, in order to optimize your after-tax returns.

What Is Taxable Income And How Is It Different From Capital Gains?

Taxable income includes all forms of income such as wages, interest, and dividends, and is subject to income tax. Capital gains, on the other hand, arise from selling an investment and are taxed differently. Knowing the difference can aid in selecting the appropriate assets and account types to manage both forms of income efficiently.

How Does Portfolio Management Affect Tax Efficiency?

Effective portfolio management involves regularly reviewing and rebalancing your investment assets to meet your financial goals. Good portfolio management can help you realize losses to offset gains (tax-loss harvesting) or switch to more tax-efficient assets, thereby reducing your tax liability.

What Is The Impact Of Income Tax On My Investments?

Income tax affects the net returns on your investments, particularly those that produce income like dividends or interest. Effective tax-efficient investing strategies can help you mitigate the impact of income tax, thus improving your overall financial situation.

How Is Asset Allocation Important In Tax-Efficient Investing?

Asset allocation involves distributing your investments across various asset classes like stocks, bonds, and real estate. A well-thought-out asset allocation can not only diversify your risk but also optimize the tax-efficiency of your investment portfolio.

How Are Dividend Taxes Different From Capital Gains Taxes?

Dividend taxes apply to the income you earn from owning shares of dividend-paying companies. Capital gains taxes apply when you sell an investment for a profit. Understanding the different tax rates and rules for each can be crucial for effective tax-efficient investing.

What Is Compound Interest And How Does It Affect Tax-Efficiency?

Compound interest refers to earning interest on both the principal and the interest that has previously been added. In a tax-efficient investment, the benefits of compound interest can be significantly higher because you're also minimizing the tax drag on your investments.

What Is The Tax Efficiency Ratio?

The tax efficiency ratio is a measure that evaluates how much an investor keeps in after-tax returns versus the fund's total returns. A higher ratio means the fund is more tax-efficient, and you're keeping more of what you earn.

How Does Federal Tax Impact My Investment Choices?

Federal tax laws have a significant impact on your investment choices. Understanding the nuances of federal taxation on different asset classes and investment vehicles can be crucial in devising a tax-efficient investment strategy.

Final Thoughts

Consult professionals but be proactive. While it's advisable to consult with a qualified investment planner or tax specialist, taking a proactive approach to understand tax-efficient strategies can significantly benefit you. New tax laws can affect your investment returns, so it's crucial to stay updated and possibly adjust your strategy accordingly. Always remember, that the ultimate aim is to minimize taxes to give your accounts the best opportunity to grow over time.

By arming yourself with a strong understanding of tax-efficient investing, you not only increase your returns but also take crucial steps toward financial independence. So, invest smartly, minimize your tax liability, and let your money work harder for you.

Dexter Cooke

Author

Dexter Cooke is an economist, marketing strategist, and orthopedic surgeon with over 20 years of experience crafting compelling narratives that resonate worldwide.

He holds a Journalism degree from Columbia University, an Economics background from Yale University, and a medical degree with a postdoctoral fellowship in orthopedic medicine from the Medical University of South Carolina.

Dexter’s insights into media, economics, and marketing shine through his prolific contributions to respected publications and advisory roles for influential organizations.

As an orthopedic surgeon specializing in minimally invasive knee replacement surgery and laparoscopic procedures, Dexter prioritizes patient care above all.

Outside his professional pursuits, Dexter enjoys collecting vintage watches, studying ancient civilizations, learning about astronomy, and participating in charity runs.

Darren Mcpherson

Reviewer

Darren Mcpherson brings over 9 years of experience in politics, business, investing, and banking to his writing. He holds degrees in Economics from Harvard University and Political Science from Stanford University, with certifications in Financial Management.

Renowned for his insightful analyses and strategic awareness, Darren has contributed to reputable publications and served in advisory roles for influential entities.

Outside the boardroom, Darren enjoys playing chess, collecting rare books, attending technology conferences, and mentoring young professionals.

His dedication to excellence and understanding of global finance and governance make him a trusted and authoritative voice in his field.

Latest Articles

Popular Articles