This Is What ChatGPT Said Ethereum Price Will Be In 2030

You will be surprised to know the answer about the Ethereum price in the future, this is what chatgpt said ethereum price will be in 2030.

Author:James PierceReviewer:Gordon DickersonFeb 24, 2023298 Shares297.8K Views

You will be surprised to know the answer about the Ethereum price in the future, this is what ChatGPT said Ethereum price will be in 2030.

The Role Of ChatGPT In Providing Insights Into The Future Price Of Ethereum In 2030

The text-based artificial intelligence (AI) platform ChatGPT is becoming increasingly popular, and it has shown that it can be useful in a variety of contexts and purposes.

One of these contexts is the cryptocurrency market, where it can provide helpful insights into the future price of digital assets such as Ethereum (ETH).

In light of this, Finbold posed the question to ChatGPT, an artificial intelligence tool, to determine the price range in which Ethereum might be expected to trade by the year 2030, taking into account both its historical price movements and the conditions of the market as it stands right now.

The result was an insightful look into the future of cryptocurrency with the second-largest market capitalization.

"Ethereum is a highly volatile asset, and its price is subject to fluctuations based on a variety of factors, such as market sentiment, adoption, network activity, and regulatory developments."

On the other hand, according to the explanation provided by the AI tool:

In light of the foregoing, it is important to note that Ethereum is one of the most successful cryptocurrencies, and the price of its token has seen a sizeable increase over the course of the past few years.

ChatGPT Says: $5,000 – $20,000

We asked ChatGPT “What will Bitcoins Price be in 2030?” #shorts

In addition, ChatGPT reported that "many experts believe that Ethereum’s price will continue to rise over the long term due to several factors."

These factors include the growing adoption of decentralized applications (dApps) created on its network as well as the expansion of the ecosystem surrounding decentralized finance (DeFi).

In addition to that, the chatbot mentioned the "potential for the network to evolve and become more efficient with upcoming updates like Ethereum 2.0." In terms of specific numbers, the AI was able to produce a specific range based on various indicators, which included the following:

Some industry professionals believe that the price of Ethereum could reach anywhere from $5,000 to $20,000 by the year 2030, depending on the rate of adoption and the technological developments that take place.

These beliefs are based on various price predictions and analyses. However, it is essential to keep in mind that these forecasts are based on a large amount of conjecture and are susceptible to change based on a variety of factors.

An Analysis Of The Ethereum Price

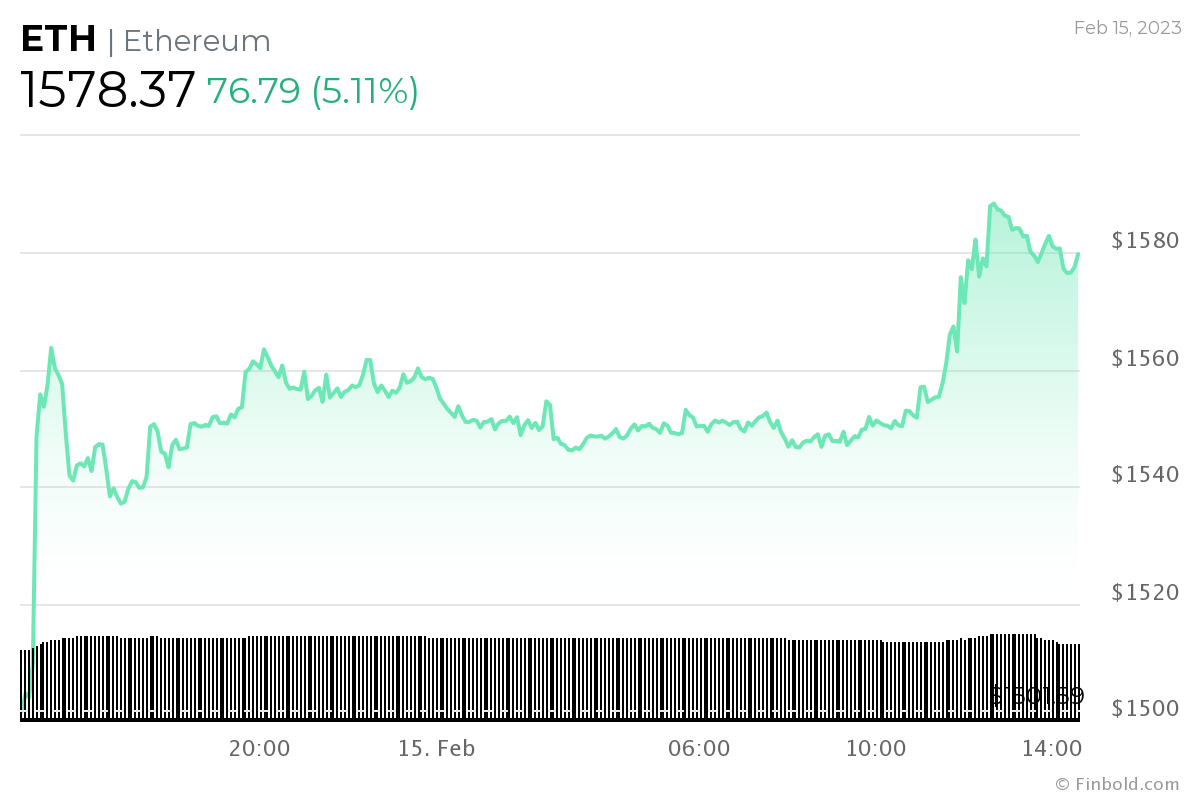

At the time of publication, the price of Ethereum's native token was $1,578. This represents an increase of 5.11% over the course of the previous 24 hours.

Although it has recovered from a decline of 5.65% over the course of the previous seven days, it still records a modest increase of 1.74% on its monthly chart. This information was obtained on February 15.

It is also important to note that, in addition to providing insight into the future of digital assets like Ethereum, XRP, Shiba Inu (SHIB), and Bitcoin (BTC), ChatGPT could assist in furthering the adoption of cryptocurrencies because it provides a one-of-a-kind opportunity for newcomers to learn about the industry's core concepts.

Please note that none of the information presented on this website should be construed as investment advice. Investing is a form of gambling. When you invest, the value of your capital could go up or down.

Can ChatGPT Help Ethereum To Increase In 2030?

As an AI language model, ChatGPT does not have the ability to directly influence the price of Ethereum or any other cryptocurrency.

ChatGPT can provide insights and analysis based on historical trends, current market conditions, and other factors, but ultimately, the price of Ethereum in 2030 and beyond will be determined by a wide range of factors, including market demand, adoption, regulatory developments, and technological advancements.

While ChatGPT can provide helpful insights into the cryptocurrency market, it is important to remember that any investment decision should be based on thorough research, analysis, and a proper understanding of the risks involved.

It is always recommended to approach any investment with caution and seek professional financial advice.

People Also Ask

What Are Some Potential Benefits Of Investing In Ethereum In 2030?

Investing in Ethereum in 2030 could potentially offer several benefits, including the opportunity for long-term growth, increased diversification in one's investment portfolio, and exposure to cutting-edge technology that may shape the future of finance and other industries.

What Are Some Risks Associated With Investing In Ethereum In 2030?

As with any investment, there are risks associated with investing in Ethereum in 2030. These risks may include the volatility of cryptocurrency markets, potential regulatory changes that could impact the value of Ethereum and the potential for hacks or other security breaches on the Ethereum network.

How Can I Stay Informed About Ethereum Price Changes In 2030?

To stay informed about Ethereum price changes in 2030, you can follow cryptocurrency news sources, subscribe to newsletters from trusted financial experts, and monitor the price of Ethereum using reliable cryptocurrency tracking websites and mobile apps.

Is It A Good Idea To Invest In Ethereum For The Long Term?

Whether or not it's a good idea to invest in Ethereum for the long term will depend on a variety of factors, including your risk tolerance, investment goals, and overall financial situation.

However, some experts believe that investing in Ethereum for the long term could offer potential benefits, including exposure to cutting-edge technology and the opportunity for long-term growth. As with any investment, it's important to do your own research and consider your own financial goals and risk tolerance before making a decision.

Final Thoughts

The future of Ethereum's price in 2030 remains uncertain and subject to a wide range of factors, including market demand, adoption, regulatory changes, and technological advancements.

While the use of AI language models such as ChatGPT can provide helpful insights and analysis, they do not have the ability to predict future market trends or provide financial advice.

As with any investment, it is important to conduct thorough research and analysis and approach any decision with caution and a proper understanding of the risks involved. The cryptocurrency market is notoriously volatile and subject to sudden changes, so it is essential to keep a long-term perspective and not rely solely on short-term price fluctuations.

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Gordon Dickerson

Reviewer

Gordon Dickerson, a visionary in Crypto, NFT, and Web3, brings over 10 years of expertise in blockchain technology.

With a Bachelor's in Computer Science from MIT and a Master's from Stanford, Gordon's strategic leadership has been instrumental in shaping global blockchain adoption. His commitment to inclusivity fosters a diverse ecosystem.

In his spare time, Gordon enjoys gourmet cooking, cycling, stargazing as an amateur astronomer, and exploring non-fiction literature.

His blend of expertise, credibility, and genuine passion for innovation makes him a trusted authority in decentralized technologies, driving impactful change with a personal touch.

Latest Articles

Popular Articles