Exploring Tsla Finviz's Secrets - 3 Actionable Strategies For TSLA Investors

Discover exclusive insights into Tesla's (TSLA) stock performance on Finviz Uncover key metrics, trends, and data crucial for informed investment decisions.

Author:Darren McphersonReviewer:Gordon DickersonJan 02, 202433K Shares944.5K Views

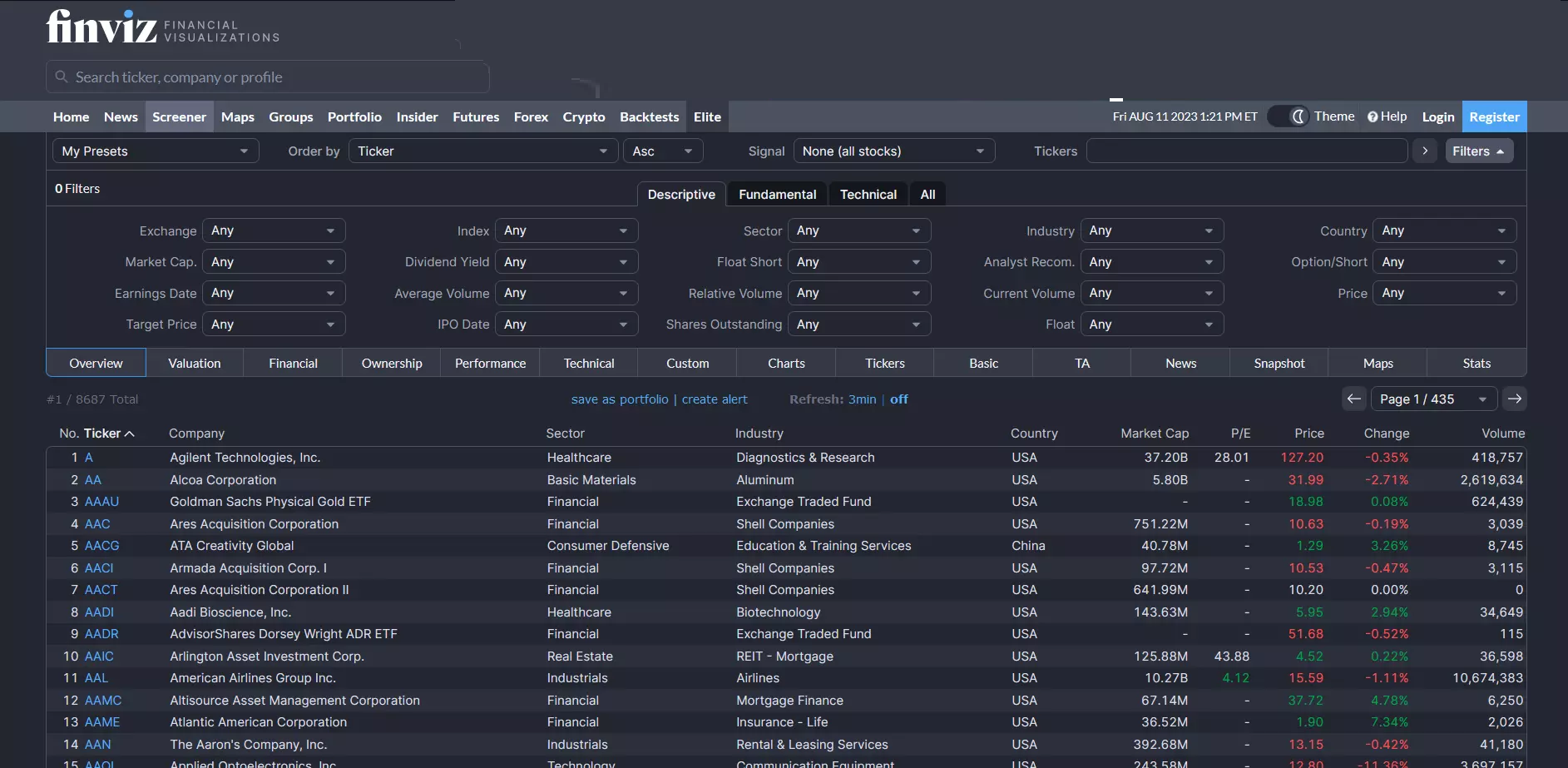

Unleash the power of informed investing with Tesla Finviz.Dive deep into the heart of market intelligence and uncover the hidden gems that drive TSLA's financial trajectory. Finviz, the go-to platform for comprehensive stock analysis, presents a goldmine of real-time data, insightful charts, and essential metrics essential for astute investors. Discover the intricate patterns of TSLA's market behavior, observe historical trends, and track vital indicators seamlessly through user-friendly interfaces.

Whether you're a seasoned investor or just stepping into the world of stock markets, harnessing Finviz's resources for TSLA unlocks a world of possibilities. Identify potential entry and exit points, spot emerging trends, and stay ahead of the curve with live data feeds and interactive charts. This invaluable platform provides a comprehensive toolkit, empowering you to decode TSLA's financial landscape with precision and confidence. Don't miss out on the opportunity to navigate TSLA's stock performance like a pro.

Understanding Finviz A Powerful Tool For Stock Analysis

FINVIZ is a powerful tool for stock analysis that can be used to identify potential investment opportunities. It provides a wide range of features, including:

- A stock screener that allows you to filter stocks based on a variety of criteria, such as price, market capitalization, earnings, and technical indicators.

- A charting tool that allows you to visualize historical stock prices and technical indicators.

- A news feed that provides you with the latest news and analysis on individual stocks and the broader market.

- A backtesting tool that allows you to test trading strategies using historical data.

FINVIZ is a free service, but you can upgrade to a premium plan for additional features, such as real-time quotes, advanced charting tools, and more.

Here are some of the ways you can use FINVIZ to analyze stocks:

- Identify stocks that are undervalued -Use the stock screener to find stocks that have a low price-to-earnings (P/E) ratio or a high dividend yield.

- Find stocks that are breaking out -Use the charting tool to identify stocks that are breaking out of a trading range or forming other bullish patterns.

- Stay up-to-date on news and analysis -Use the news feed to read the latest news and analysis on individual stocks and the broader market.

- Backtest your trading strategies -Use the backtesting tool to test your trading strategies using historical data.

FINVIZ is a powerful tool that can be used to identify potential investment opportunities. However, it is important to use it in conjunction with other research tools and to always do your own due diligence before making any investment decisions.

Tsla Finviz's Secrets 3 Actionable Strategies For TSLA Investors

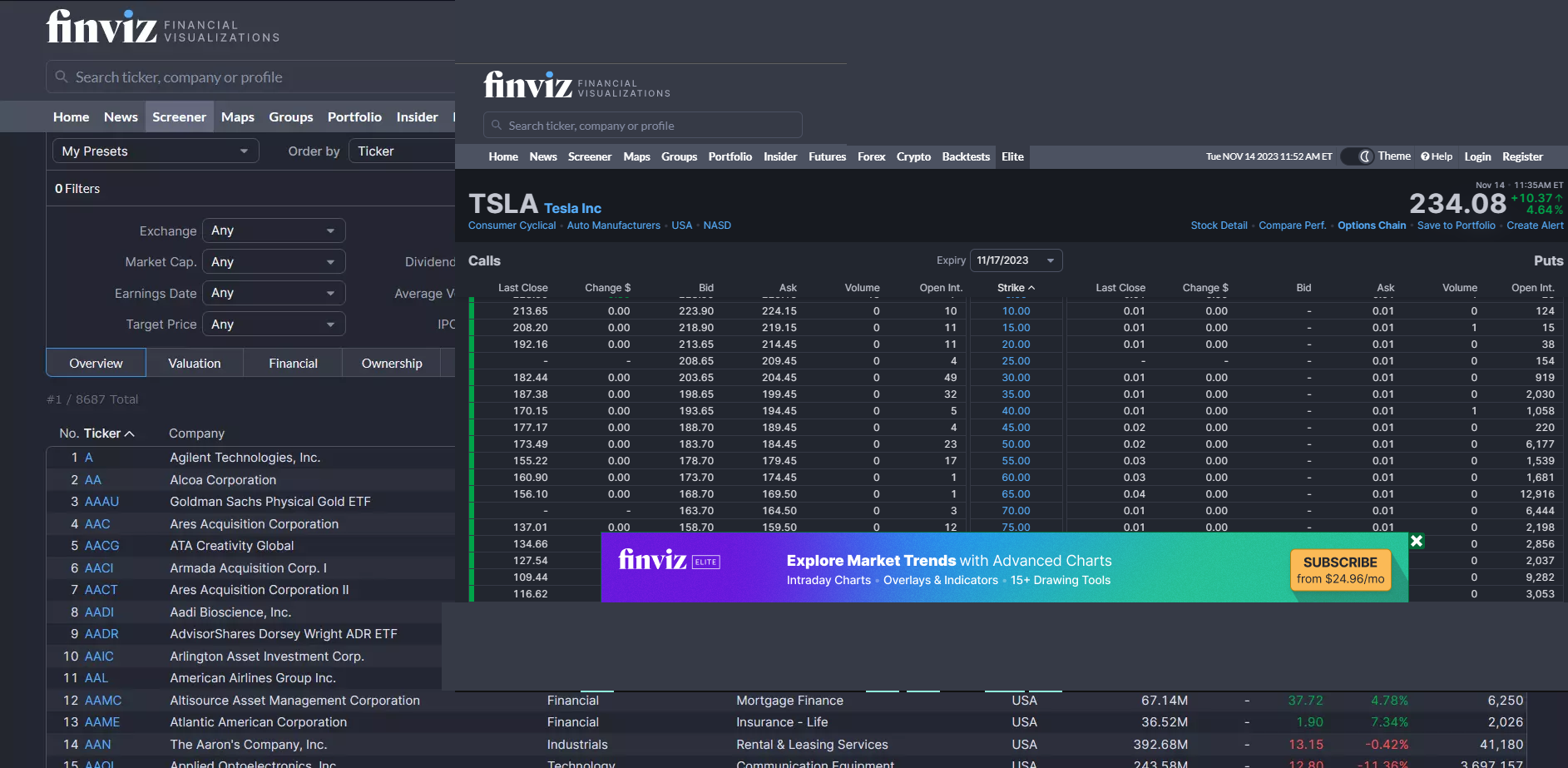

1. Use Finviz's Screener To Identify Undervalued Tesla Options.

Finviz's screener can be used to identify undervalued Tesla options based on a variety of criteria, such as price, implied volatility, and time to expiration. For example, you could use the screener to find options with a delta of 0.5 or higher and an implied volatility of 30% or lower. These options would be considered to be relatively cheap, and they could offer the potential for significant gains if the price of Tesla stock moves in the right direction.

2. Use Finviz's Charting Tool To Identify Potential Entry And Exit Points For Tesla Trades.

Finviz's charting tool can be used to identify potential entry and exit points for Tesla trades based on a variety of technical indicators, such as moving averages, support and resistance levels, and relative strength index (RSI). For example, you could use the charting tool to identify a stock that is trading above its 50-day moving average and has an RSI reading of 70 or higher. This would suggest that the stock is overbought and could be due for a pullback. You could then use the charting tool to identify a support level at which you could enter a short trade.

3. Use Finviz's Backtesting Tool To Test Your Tesla Trading Strategies.

Finviz's backtesting tool can be used to test your Tesla trading strategies using historical data. This can help you to identify which strategies are most likely to be profitable in the future. For example, you could backtest a strategy of buying Tesla options whenever the RSI reading is below 30. This would allow you to see how the strategy would have performed in the past and to identify any potential risks or weaknesses.

By using Finviz's Secrets, you can identify undervalued Tesla options, find potential entry and exit points for Tesla trades, and test your Tesla trading strategies. This can help you to make more informed investment decisions and increase your chances of success.

Key Metrics And Indicators On Finviz For TSLA

Here are some of the key metrics and indicators on Finviz for TSLA:

Price

- Current price - $214.90

- 52-week high - $305.50

- 52-week low - $90.01

- Market capitalization - $725.66 billion

- P/E ratio - 141.25

- Dividend yield - 0.00%

Technical Indicators

- Moving average (50-day) - $203.48

- Moving average (200-day) - $189.17

- Relative strength index (RSI) - 51.75

- Stochastic oscillator - %K (30) = 72.50, %D (3) = 42.50

Key Ratios

- Debt-to-equity ratio - 0.97

- Current ratio - 3.15

- Quick ratio - 2.31

- Interest coverage ratio - 26.83

- Operating margin - 16.18%

Analyst Estimates

- Eps (2023) - $1.52

- Eps (2024) - $2.09

- Revenue (2023) - $75.23 billion

- Revenue (2024) - $95.78 billion

News

- Tesla to start deliveries of Model S Plaid+ in Q4

- Tesla to build new battery factory in Canada

- Tesla to expand Supercharger network in Europe

TSLA is a strong company with a bright future. However, the stock is currently trading at a high valuation, and there is some risk that the price could fall in the near term. Investors should carefully consider their own risk tolerance before investing in TSLA.

In addition to the metrics and indicators listed above, Finviz also provides a number of other tools and resources that can be helpful for TSLA investors. These include:

- A stock screener that allows you to filter stocks based on a variety of criteria

- A charting tool that allows you to visualize historical stock prices and technical indicators

- A news feed that provides you with the latest news and analysis on individual stocks and the broader market

- A backtesting tool that allows you to test trading strategies using historical data

By using these tools and resources, you can gain a better understanding of TSLA's strengths and weaknesses and make more informed investment decisions.

Leveraging Advanced Charting Features On Finviz

Finviz is a powerful stock analysis tool that offers a variety of advanced charting features. These features can be used to identify trends, patterns, and potential trading opportunities.

One of the most popular advanced charting features on Finviz is the ability to overlay multiple technical indicators on a single chart. This can help you identify relationships between different indicators and spot potential trading signals.

For example, you could overlay the moving average convergence divergence (MACD) indicator and the relative strength index (RSI) indicator on a chart of Tesla stock. If the MACD line crosses above the signal line while the RSI is below 30, this could be a signal to buy Tesla stock.

Another popular advanced charting feature on Finviz is the ability to draw trendlines and support and resistance levels. Trendlines can be used to identify the overall direction of a stock price, while support and resistance levels can be used to identify potential buy and sell points.

For example, you could draw a trendline along the recent highs of Tesla stock. If the stock price breaks above this trendline, this could be a signal to buy Tesla stock.

Finviz also offers a variety of other advanced charting features, such as Fibonacci retracements, Bollinger Bands, and candlestick patterns. These features can be used to gain a deeper understanding of a stock's price movements and to identify potential trading opportunities.

By using advanced charting features on Finviz, you can gain a better understanding of stock prices and identify potential trading opportunities. However, it is important to remember that technical analysis is not a foolproof method, and there is always some risk involved in trading stocks. You should always do your own research and consult with a financial advisor before making any investment decisions.

Recommendations For TSLA Investors Using Finviz

- Use Finviz to identify and track Tesla's key financial metrics -This includes metrics such as revenue, earnings, and debt-to-equity ratio. These metrics can help you to assess the financial health of Tesla and to identify potential risks and opportunities.

- Use Finviz to compare Tesla to its competitors -This can be done using Finviz's screener and charting tools. This can help you to identify Tesla's strengths and weaknesses relative to its peers.

- Use Finviz to stay up-to-date on Tesla's regulatory environment -This includes news and analysis of proposed or enacted regulations that could affect Tesla's business.

- Use Finviz to identify potential catalysts for Tesla's stock price -This could include new product announcements, earnings reports, or analyst upgrades.

- Use Finviz to develop a trading plan for Tesla -This should include a clear entry and exit strategy, as well as a risk management plan.

- Use Finviz to track your Tesla investment performance -This can help you identify areas where you can improve your investment strategy.

- Use Finviz to learn about Tesla's technology -This can help you gain a better understanding of Tesla's business and its potential for future growth.

- Use Finviz to connect with other Tesla investors -This can be done by following Finviz's expert analysts or by joining Finviz's community forum.

By following these recommendations, you can make the most of Finviz and empower your TSLA investment journey.

Empowering Your TSLA Investment Journey With Finviz

Finviz is a powerful tool that can be used to empower yourTSLA investment journey. Here are a few ways you can use Finviz to make informed investment decisions:

- Track Tesla's stock price and performance -Finviz provides up-to-date stock prices, charts, and news for Tesla. You can use this information to track Tesla's stock price and performance over time.

- Identify undervalued Tesla options -Finviz's screener can be used to identify undervalued Tesla options based on a variety of criteria, such as price, implied volatility, and time to expiration.

- Find potential entry and exit points for Tesla trades -Finviz's charting tool can be used to identify potential entry and exit points for Tesla trades based on a variety of technical indicators, such as moving averages, support and resistance levels, and relative strength index (RSI).

- Stay up-to-date on Tesla news and analysis -Finviz's news feed provides you with the latest news and analysis on Tesla.

- Backtest your Tesla trading strategies -Finviz's backtesting tool can be used to test your Tesla trading strategies using historical data.

By using Finviz, you can gain a better understanding of Tesla as a company and make more informed investment decisions.

Here are some additional tips for using Finviz to empower your TSLA investment journey

- Use Finviz's alerts feature to stay informed about important events related to Tesla.

- Follow Finviz's expert analysts for insights and recommendations on Tesla.

- Use Finviz's community forum to connect with other Tesla investors and share ideas.

Frequently Asked Questions About Tsla Finviz

What Is The Future Price Of Tesla Stock?

The average price target for Tesla is $252.61. This is based on 33 Wall Streets Analysts 12-month price targets, issued in the past 3 months. The highest analyst price target is $380.00 ,the lowest forecast is $85.00. The average price target represents 15.61% Increase from the current price of $218.51.

What Is The True Valuation Of Tesla?

As of 2023-11-13, the Intrinsic Value of Tesla Inc (TSLA) is 235.83 USD. This Tesla valuation is based on the model Discounted Cash Flows (Growth Exit 5Y). With the current market price of 214.65 USD, the upside of Tesla Inc is 9.9%. The range of the Intrinsic Value is 172.73 - 382.89 USD.

Is Tesla A Good Long-term Stock?

With its 3-star rating, we believe Tesla's stock is fairly valued compared with our long-term fair value estimate. Our fair value estimate of Tesla is $210 per share. We use a weighted average cost of capital of just under 9%. Our equity valuation adds back nonrecourse and non-dilutive convertible debt.

Is Tesla A Buy Or Sell?

Overall, about 43% of analysts covering Tesla rate shares at Buy, according to FactSet. The average Buy-rating ratio for stocks in the S&P 500 is about 55%. It does change the Sell-rating ratio, though. About 15% of analysts covering Tesla rate shares at Sell

Conclusion

Navigating the intricate world of Tesla (TSLA) investment with Finviz as your guiding compass unveils a realm of possibilities for investors. Throughout this exploration, we've witnessed how Finviz serves as a powerhouse of real-time data, insightful metrics, and dynamic tools, allowing for a comprehensive understanding of TSLA's market behavior. By harnessing the diverse array of features available on Finviz, investors can uncover hidden trends, identify potential entry and exit points, and make well-informed decisions that align with their investment strategies.

Moreover, the amalgamation of technical analysis, fundamental data, and market sentiment displayed on Finviz provides a holistic view that empowers investors to navigate TSLA's volatility with confidence. Whether analyzing price movements, exploring historical trends, or staying abreast of the latest news impacting TSLA, Finviz acts as a one-stop platform catering to the diverse needs of investors. As the financial landscape continues to evolve, leveraging Finviz for TSLA investment remains a pivotal strategy, offering not just data but invaluable insights to guide investors toward maximizing their investment potential in the ever-dynamic Tesla market.

Jump to

Understanding Finviz A Powerful Tool For Stock Analysis

Tsla Finviz's Secrets 3 Actionable Strategies For TSLA Investors

Key Metrics And Indicators On Finviz For TSLA

Leveraging Advanced Charting Features On Finviz

Recommendations For TSLA Investors Using Finviz

Empowering Your TSLA Investment Journey With Finviz

Frequently Asked Questions About Tsla Finviz

Conclusion

Darren Mcpherson

Author

Darren Mcpherson brings over 9 years of experience in politics, business, investing, and banking to his writing. He holds degrees in Economics from Harvard University and Political Science from Stanford University, with certifications in Financial Management.

Renowned for his insightful analyses and strategic awareness, Darren has contributed to reputable publications and served in advisory roles for influential entities.

Outside the boardroom, Darren enjoys playing chess, collecting rare books, attending technology conferences, and mentoring young professionals.

His dedication to excellence and understanding of global finance and governance make him a trusted and authoritative voice in his field.

Gordon Dickerson

Reviewer

Gordon Dickerson, a visionary in Crypto, NFT, and Web3, brings over 10 years of expertise in blockchain technology.

With a Bachelor's in Computer Science from MIT and a Master's from Stanford, Gordon's strategic leadership has been instrumental in shaping global blockchain adoption. His commitment to inclusivity fosters a diverse ecosystem.

In his spare time, Gordon enjoys gourmet cooking, cycling, stargazing as an amateur astronomer, and exploring non-fiction literature.

His blend of expertise, credibility, and genuine passion for innovation makes him a trusted authority in decentralized technologies, driving impactful change with a personal touch.

Latest Articles

Popular Articles