Understanding The Technical Analysis Of Cryptocurrency Markets - Mastering Cryptocurrency Trading

Technical analysis provides a way for investors to evaluate market trends by analyzing market data, such as price charts and trading volume. Understanding the technical analysis of cryptocurrency markets is essential for investors who want to make informed decisions.

Author:Camilo WoodReviewer:James PierceApr 07, 202338 Shares1.1K Views

Technical analysis provides a way for investors to evaluate market trends by analyzing market data, such as price charts and trading volume. Understanding the technical analysis of cryptocurrencymarkets is essential for investors who want to make informed decisions.

Cryptocurrency markets have been volatile since their inception. The price fluctuations of these digital assets can be daunting to investors who want to understand the trends and make informed decisions about when to buy or sell.

Understanding The Technical Analysis Of Cryptocurrency Markets

Technical analysis is a method used to evaluate the past and current trends of a market. This analysis is based on the assumption that the market trends will continue in the future.

Technical analysis is done by analyzing market data, such as price charts, trading volume, and other indicators, to identify patterns that may indicate future trends.

Price Charts

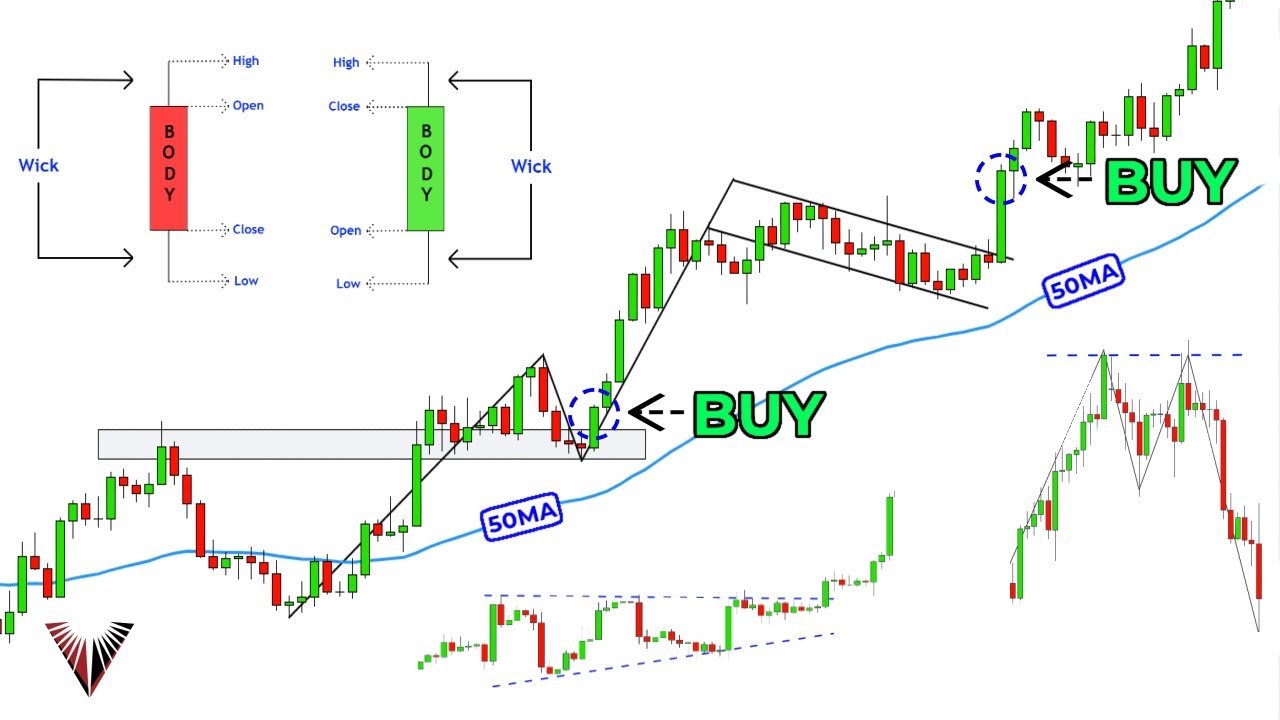

Price charts are the most commonly used tool in technical analysis. A price chart displays the price of a cryptocurrency over a period of time. The x-axis represents time, while the y-axis represents the price.

Price charts can be displayed in different timeframes, such as one minute, one hour, or one day. Traders use these charts to identify trends, such as uptrends and downtrends, and to determine the best time to buy or sell.

Indicators

Indicators are used to complement price charts and provide additional information about the market. There are two types of indicators: lagging indicators and leading indicators.

Lagging indicators are used to confirm market trends. These indicators are based on historical data and are used to identify trends that have already occurred.

Moving averages, which are lines that show the average price over a certain period of time, are an example of lagging indicators.

Leading indicators are used to predict future trends. These indicators are based on current market data and are used to identify potential trends before they occur.

Examples of leading indicators include the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD).

Trading Volume

Trading volume is the total number of cryptocurrencies that are traded during a specific period of time. High trading volume indicates that there is a lot of interest in a particular cryptocurrency. Traders use trading volume to determine the strength of a trend.

If a cryptocurrency is experiencing a high trading volume during an uptrend, this indicates that there is a lot of demand for the asset, and the trend is likely to continue.

Fundamental Analysis Of Cryptocurrency

Fundamental analysis is a method used to evaluate the intrinsic value of an asset by analyzing its underlying economic and financial factors. It is based on the belief that the market price of an asset will eventually converge to its intrinsic value over the long term.

In the context of cryptocurrency, fundamental analysis involves evaluating the underlying factors that drive the value of a cryptocurrency.

These factors include the technology behind the cryptocurrency, the network effects, the level of adoption, the regulatory environment, and the overall market sentiment.

Technology

One of the primary factors to consider when conducting a fundamental analysis of a cryptocurrency is the technology behind it. This includes the scalability, security, and overall functionality of the cryptocurrency.

The technology should be capable of handling a large number of transactions and have a high level of security to prevent hacking or theft. In addition, the technology should be user-friendly and have a clear value proposition that sets it apart from other cryptocurrencies.

Network Effects

Network effects refer to the idea that the value of a cryptocurrency increases as more people adopt and use it. The more users a cryptocurrency has, the more valuable it becomes, which can create a positive feedback loop.

Therefore, it is essential to evaluate the level of adoption of a cryptocurrency and the potential for future adoption. This can be assessed by looking at the number of active wallets, the number of transactions, and the level of community engagement.

Regulatory Environment

The regulatory environment can have a significant impact on the value of a cryptocurrency. Governments and regulatory bodies around the world are still trying to figure out how to regulate cryptocurrencies.

Some countries have banned cryptocurrencies altogether, while others have adopted a more liberal approach. Therefore, it is essential to evaluate the regulatory environment in the country where the cryptocurrency is based and its potential impact on the cryptocurrency.

The Only Technical Analysis Video You Will Ever Need... (Full Course: Beginner To Advanced)

Market Sentiment

Market sentiment refers to the overall attitude of investors towards a particular cryptocurrency. If investors have a positive outlook on the cryptocurrency, the price is likely to increase. Conversely, if investors have a negative outlook, the price is likely to decrease.

Therefore, it is essential to evaluate the overall sentiment in the cryptocurrency market and the potential impact on the cryptocurrency.

In short, fundamental analysis is an essential tool for evaluating the intrinsic value of a cryptocurrency.

It involves analyzing the underlying economic and financial factors that drive the value of the cryptocurrency, including the technology behind it, the network effects, the level of adoption, the regulatory environment, and the overall market sentiment.

By conducting fundamental analysis, investors can make informed decisions about which cryptocurrencies to invest in and avoid costly mistakes.

People Also Ask

What Is Technical Analysis In Cryptocurrency Trading?

Technical analysis is the study of past market data, such as price and volume, to make predictions about future market movements.

What Are The Key Technical Analysis Tools For Cryptocurrency Trading?

Key technical analysis tools include trend lines, support, and resistance levels, moving averages, and chart patterns.

How Can Technical Analysis Be Used To Make Cryptocurrency Trading Decisions?

Technical analysis can help traders identify trends and potential price reversals, which can inform buying and selling decisions.

Is Technical Analysis The Only Method For Analyzing Cryptocurrency Markets?

No, fundamental analysis, which involves analyzing the underlying economic and financial factors that drive the value of a cryptocurrency, is also an important method for analyzing cryptocurrency markets.

Can Technical Analysis Predict The Future Price Of A Cryptocurrency With Certainty?

No, technical analysis can only provide probabilities of future price movements based on past market data, and these predictions are subject to change based on new market developments.

Conclusion

In conclusion, understanding the technical analysis of cryptocurrency markets is essential for investors who want to make informed decisions.

Technical analysis is based on the assumption that market trends will continue in the future, and it is done by analyzing market data, such as price charts, trading volume, and other indicators.

Price charts are the most commonly used tool in technical analysis, and they display the price of a cryptocurrency over a period of time. Indicators are used to complement price charts and provide additional information about the market.

Trading volume is the total number of cryptocurrencies that are traded during a specific period of time, and it is used to determine the strength of a trend.

By understanding the technical analysis of cryptocurrency markets, investors can identify trends and make informed decisions about when to buy or sell.

This knowledge can help them avoid costly mistakes and increase their chances of success in the cryptocurrency market. Therefore, it is essential for investors to familiarize themselves with technical analysis and use it as a tool in their investment strategy.

Camilo Wood

Author

James Pierce

Reviewer

Latest Articles

Popular Articles