Wealth Inequality In America - Unveiling The Disparities And Exploring Solutions

Explore the intricate layers of wealth inequality in America, from causes and consequences to policy solutions and societal impact.

Author:Stefano MclaughlinReviewer:Luqman JacksonJan 26, 202412.6K Shares169.1K Views

Wealth inequality in Americahas reached staggering proportions, sparking intense debates on its origins, consequences, and potential solutions. This complex and multifaceted issue goes beyond mere economic statistics; it delves into systemic structures, social dynamics, and the very fabric of American society.

In this exploration, we unravel the intricacies of wealth inequality in America, shedding light on its root causes, pervasive effects, and proposed strategies for a more equitable future.

The Stark Reality Of Wealth Inequality

Recent data highlights the extreme wealth disparities that exist in the United States. A small fraction of the population controls a disproportionate share of the nation's wealth, while a significant portion struggles to make ends meet. Understanding the scale of this issue requires a comprehensive analysis of its various dimensions.

The Rich And The Rest - Unraveling Wealth Inequality In The U.S.

The State of U.S. Wealth Inequality1 is a current look at the average wealth of different groups of people, taking inflation into account. Based on the average wealth of U.S. households, the Institute for Economic Equity reportsevery three months on race, generational, and educational wealth inequality. Understanding the current level of wealth imbalance can help make the economy more fair so that everyone can do well.

These figures show how big the differences in wealth are between different groups of people and show which groups have the fewest resources. Finding out how big these gaps have grown over time is a key part of figuring out why they keep happening and what can be done to close them. All families should have the chance to get rich, which could lead to more economic equality.

From June 30 to July 31, 2023, the second quarter:

How Much Wealth Inequality Is There In The U.S.?

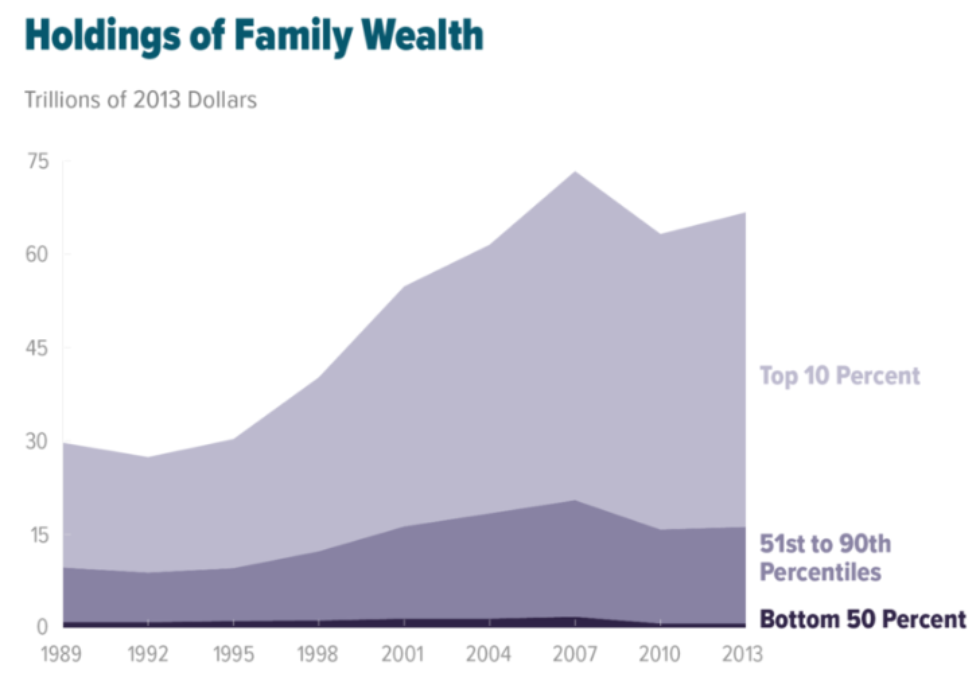

- The wealthiest 10% of families had an average of $7 million. They owned 69% of all the wealth in the family as a whole.

- Only $51,000 was in the bottom half of families in terms of wealth. They only had 2.5% of all family wealth between them.

What Is The Current Generational Wealth Gap?

- When they were the same age, millennials and Gen Zers had 70 cents for every dollar that Gen Xers had.Three, millennials and Gen Zers had 74 cents for every dollar that baby boomers had at the same age.

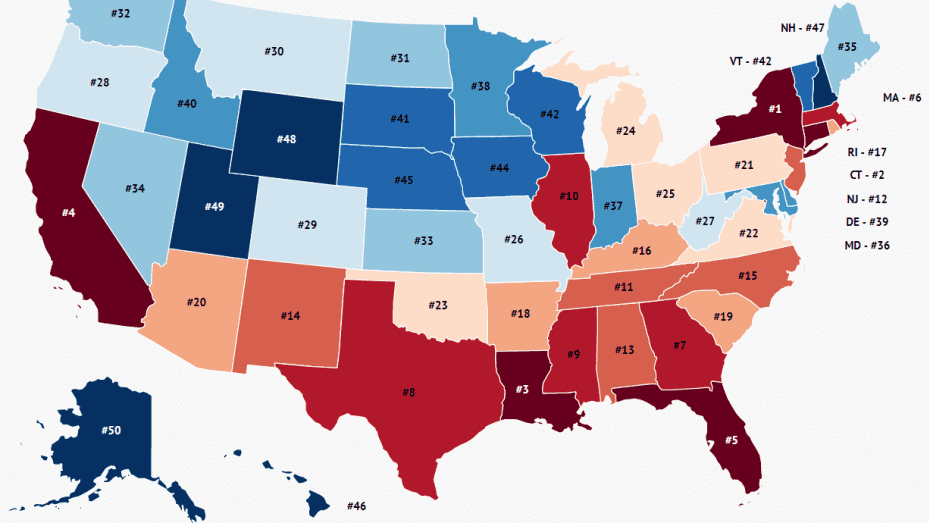

What Is The Current Racial Wealth Gap?

- In general, black families had about 24 cents for every $1 that a white family had.

- In general, Hispanic families had about 24 cents for every $1 that a white family had.

What Is The Current Wealth Gap By Household Education?

- Families with a head person who had some college but not a four-year degree had 30 cents for every dollar that a family with a head person who had a four-year degree had.

- People in families with only a high school diploma had 23 cents for every dollar that people in families with four years of college had.

- For every dollar that a family with a four-year college graduate had, a family with someone with less than a high school education had only 10 cents.

Even though there was more fluctuation, everyone's average wealth grew over the last four years, even during the pandemic. Some of the gains in wealth were lost in 2022 because of problems in the economy, such as inflation and the end of pandemic-related aid. Still, the average wealth results went up a lot in the second quarter of 2023.

A Reddit user shares an interesting videoabout wealth inequality in America. Another Reddit user says about the video,

This video is 10 years old. The situation is orders of magnitude more severe now. If you weren’t already depressed enough.

Scopa0304 shares his insights in response to the above comment,

I just did the math based on a 2022 chart.

In this video, he visualized all the wealth as 2,000 dollar bills. Based on that, today the top 1% have $612. 90-99% have about $75 ea. 50-90% have $14 ea. And the bottom 50% have between $0 and $1 each.

I’m sure if you were able to dig in to each segment, you’d see a big ramp between the low and high end. The 98-99% probably have way more than the 90-91%. But the fact remains, it’s obscene.

Source: Statista

Exploring The Causes Of Wealth Inequality In America

Wealth inequality in America is a result of a myriad of interconnected factors, some deeply ingrained in historical and economic structures. Key contributors include:

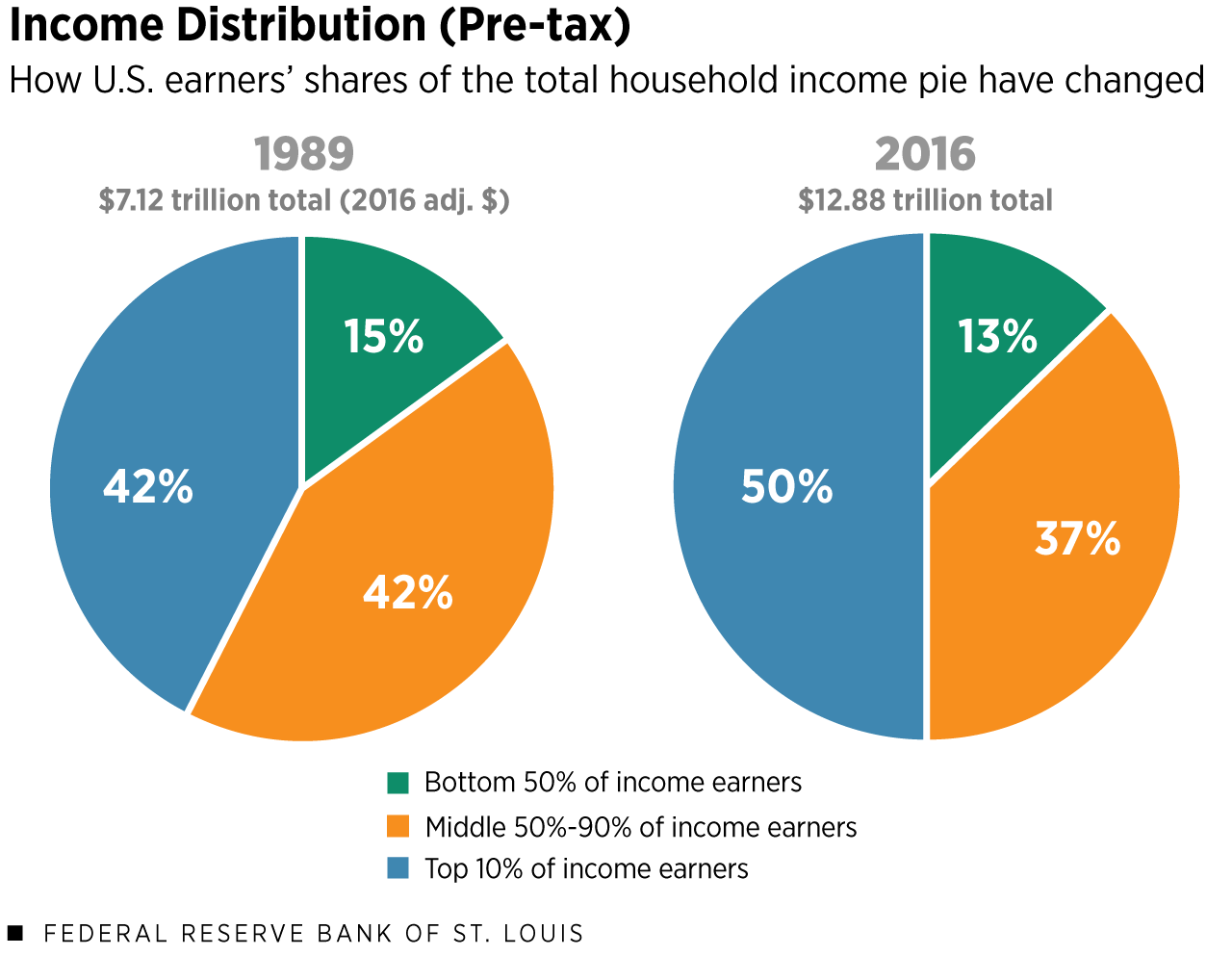

- Income Disparities -The widening gap between high and low-income earners contributes significantly to wealth inequality. Stagnant wages for the majority exacerbate this divide.

- Inheritance and Family Wealth - The transmission of wealth across generations further entrenches inequality. Those born into affluent families often have access to better educational and financial opportunities.

- Tax Policies -Favorable tax policies for the wealthy, including capital gains and inheritance tax rates, contribute to the concentration of wealth among the affluent.

- Systemic Racism -Historical injustices and systemic racism have disproportionately affected minority communities, limiting their access to economic opportunities and wealth accumulation.

Impact Of Wealth Disparities On U.S. Society

Wealth inequality extends beyond economic figures, leaving a profound impact on society. Its repercussions manifest in areas such as education, health, and overall social mobility.

- Educational Disparities -Affluent individuals can afford better educational opportunities, perpetuating a cycle of privilege. In contrast, lower-income families face obstacles in accessing quality education.

- Health Disparities -Economic disparities directly impact healthcare access. Lower-income individuals often face challenges in receiving adequate medical care, leading to adverse health outcomes.

- Social Mobility -Limited economic opportunities hinder social mobility, making it difficult for individuals from disadvantaged backgrounds to rise through the socio-economic ranks.

Policy Proposals For Wealth Redistribution

Addressing wealth inequality requires comprehensive policy measures aimed at redistributing resources and providing equitable opportunities. Some proposed solutions include:

- Progressive Taxation -Implementing progressive tax policies ensures that those with higher incomes contribute a larger percentage of their wealth, helping fund social programs and reduce inequality.

- Universal Basic Income (UBI) -Exploring the concept of a universal basic income, providing all citizens with a regular stipend, aims to alleviate financial stress and reduce inequality.

- Education Reform -Investing in public education, particularly in low-income areas, can break the cycle of generational poverty by providing equal opportunities for all.

- Healthcare Access -Ensuring universal access to quality healthcare can mitigate health-related disparities linked to wealth inequality.

Wealth Inequality In America - FAQs

What Factors Contribute To Wealth Inequality In America?

Wealth inequality in America stems from income disparities, inheritance dynamics, tax policies, systemic racism, and other interconnected factors.

What Is The Global Perspective On Wealth Inequality In America?

Compared to other developed nations, the United States exhibits higher levels of wealth concentration, raising questions about the sustainability of such disparities.

How Can Corporate Responsibility Contribute To Reducing Wealth Inequality?

Shifting corporate practices toward greater social responsibility involves fair wages, transparent hiring, and ethical business conduct, contributing to a more equitable distribution of wealth.

What Grassroots Movements And Advocacy Efforts Focus On Wealth Inequality?

Grassroots movements and advocacy campaigns raise awareness, mobilize communities, and apply pressure for policy changes that address wealth inequality.

What Is The Wealth Inequality Score In The United States In 2023?

Around 66.6% of all the money in the United States was owned by the top 10% of earners in the third quarter of 2023. The bottom 50% of earners, on the other hand, only controlled 2.6% of all wealth.

Conclusion

Wealth inequality in America is not merely an economic challenge; it is a societal imperative demanding urgent attention. Addressing this issue requires a comprehensive and multi-faceted approach, involving policy changes, corporate responsibility, education, and grassroots advocacy.

As a nation confronts the complexities of wealth distribution, the pursuit of a fair and equitable society must remain at the forefront of public discourse and policy agendas. Only through concerted efforts can America hope to bridge the wealth divide and ensure a future where prosperity is accessible to all.

Stefano Mclaughlin

Author

For the first five years of his career, Stefano worked as a financial advisor on state and local tax matters, developing internal marketing technology for his multinational tax business. With over 12 years of experience designing high-performance web applications and interactive interactions, Stefano is now a marketing technology specialist and founder.

Luqman Jackson

Reviewer

Luqman Jackson is an entrepreneur, blogger and traveler. He teaches copywriting, creative discipline, and ethical marketing. For business owners who want to learn the basics of persuasive writing, she has a weekly column, a podcast, and a copywriting course.

Latest Articles

Popular Articles