Wealth Management Services - Navigating The Path To Financial Prosperity

Explore comprehensive Wealth Management Services, optimizing financial well-being through tailored solutions, expert guidance, and proactive adaptation strategies.

Author:Dexter CookeReviewer:Darren McphersonJan 23, 20247.8K Shares147.6K Views

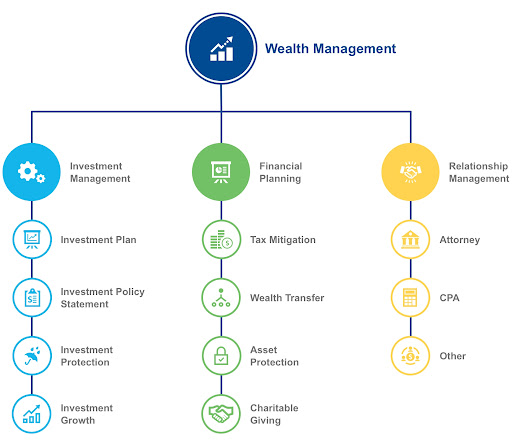

Wealth management servicesplay a pivotal role in helping individuals and families navigate the complexities of financial planning, investment management, and overall wealth optimization.

You should manage your wealth, as determined by both money and belongings, to ensure that it increases or does not depreciate. The practice of assessing and managing your wealth to help you reach your financial objectives is known as wealth management.

Although a wealth manager may hold a variety of credentials, in general, they are professionals who offer financial services and guidance to support you as you navigate the world of asset management. Investment, retirement, tax, and estate planning services are all included in the category of wealth management services.

In this comprehensive exploration, we delve into the multifaceted world of wealth management services, examining the key components, benefits, and considerations that define this essential financial discipline.

Understanding Wealth Management

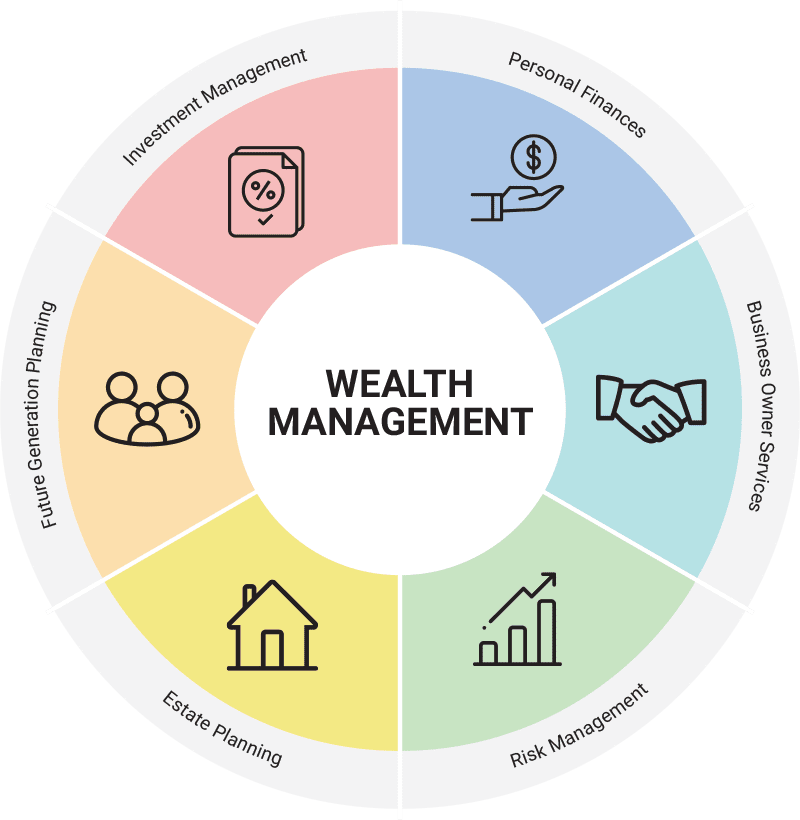

Wealth management is a dynamic and comprehensive approach to financial planning and investment management that goes beyond traditional services. It involves the integration of various financial disciplines to optimize an individual's or family's overall financial well-being. In this detailed exploration, we delve into the key components, principles, and benefits that define the realm of wealth management.

What Is Wealth Management?

In order to meet the needs of wealthy clients, wealth management is an investment advisory service that works in tandem with other financial services. The advisor gathers information about the client's goals and circumstances through a consultation process, after which they create a customized plan that makes use of a variety of financial goods and services.

In wealth management, a holistic approach is frequently used. A wide range of services, including investment advice, estate planning, accounting, retirement, and tax services, may be offered to satisfy a client's complex needs. Although comprehensive wealth management services have different price structures, fees are usually determined by the assets under management (AUM) of the customer.

Financial Planning

Financial planning serves as the foundation of wealth management. It involves a comprehensive assessment of the client's current financial situation, goals, and aspirations. Wealth managers work closely with clients to create a detailed financial plan that addresses key areas such as budgeting, debt management, savings strategies, and goal setting. This collaborative process aims to provide a roadmap for achieving short-term and long-term financial objectives.

Investment Management

A crucial component of wealth management is strategic investment management. Wealth managers leverage their expertise to design investment portfolios that align with the client's risk tolerance, financial goals, and time horizon. This involves asset allocation, diversification, and continuous monitoring of the portfolio to adapt to changing market conditions. The primary goal is to optimize returns while managing risk, ensuring the long-term growth and preservation of wealth.

Tax Strategies

Effective tax planning is integral to wealth management. Wealth managers employ various strategies to enhance tax efficiency and minimize tax liability. This includes optimizing deductions, leveraging tax-advantaged accounts, and strategically managing investments to mitigate tax consequences. By implementing tax-efficient strategies, wealth managers aim to maximize after-tax returns and preserve more of the client's wealth.

Estate Planning

Estate planning is a critical aspect of wealth management that focuses on preserving and transferring wealth to future generations. Wealth managers collaborate with clients to develop comprehensive estate plans that include wills, trusts, and other legal instruments. This ensures a smooth transition of assets, minimizes potential estate taxes and aligns with the client's legacy and philanthropic goals.

Risk Management

Wealth managers actively engage in risk management to safeguard their clients' financial well-being. This involves assessing various risks, including market risk, longevity risk, and unexpected life events, and implementing strategies to mitigate these risks. By identifying and addressing potential challenges, wealth managers help clients navigate uncertainties and maintain financial resilience.

How Much Money Is Needed For Wealth Management?

The amount that must be paid in order for an investor to receive wealth management services is not set in stone. Wealth managers and their companies will determine any minimums pertaining to investable assets, net worth, or other indicators.

Having said that, a minimum of $2 million to $5 million in assets is the range in which hiring a wealth management company makes sense. Much less than that, and it could be difficult to defend the cost of this kind of service.

Once more, each firm will have different minimal standards. Your situation may also cause them to change slightly. For example, in order to guarantee that the wealth they inherit remains with their firm, a wealth manager could wish to take on the offspring of some of their larger current clients. When they start making much more money, they might also wish to build trusting ties with younger professionals like doctors or lawyers in order to keep their business.

Benefits Of Wealth Management Services

Wealth management services offer a comprehensive and tailored approach to financial planning, investment management, and overall wealth optimization. This holistic strategy goes beyond traditional financial planning, providing individuals and families with a range of benefits that contribute to long-term financial success.

Tailored Solutions For Individual Goals

One of the primary benefits of wealth management services is the highly customized and tailored approach to financial planning. Wealth managers work closely with clients to understand their unique financial goals, risk tolerance, and values.

By gaining a deep understanding of the client's individual circumstances, wealth managers can create a personalized wealth management plan that aligns seamlessly with the client's objectives. This tailored approach ensures that the strategies employed are specifically designed to address the client's financial aspirations and priorities.

Holistic Financial Oversight

Unlike traditional financial planning, which may focus on specific aspects of financial management, wealth management offers a holistic and integrated approach. Clients benefit from a coordinated strategy that considers all facets of their financial life, including investments, taxes, estate planning, risk management, and more.

This comprehensive perspective allows wealth managers to optimize financial outcomes by ensuring that all elements of the client's financial plan work together synergistically. It enables clients to navigate the complexities of their financial landscape with a comprehensive and cohesive strategy.

Professional Expertise And Guidance

Wealth managers bring a wealth of expertise and experience to the table. These professionals stay abreast of market trends, tax laws, and financial strategies, leveraging their knowledge to guide clients through complex financial decisions.

The expertise of wealth managers ensures that clients make informed choices aligned with their long-term financial objectives. From investment decisions to tax planning strategies, the guidance of a seasoned wealth manager provides clients with the confidence that their financial affairs are being managed by a knowledgeable and experienced professional.

Proactive Adaptation To Changing Circumstances

Financial markets and personal circumstances are subject to change. One of the significant benefits of wealth management services is the proactive adaptation to these changing conditions.

Wealth managers actively monitor financial plans and investment portfolios, adjusting strategies in response to changes in the market, economic conditions, and personal circumstances. This agility allows clients to navigate uncertainties and capitalize on opportunities, ensuring the ongoing relevance and effectiveness of their wealth management strategy.

Long-Term Relationship Building

Wealth management is inherently relationship-focused. Clients work closely with their wealth managers to build a trusting and long-term partnership. This enduring relationship facilitates continuous communication, regular reviews of financial goals, and adjustments to the wealth management plan as needed.

The relationship-building aspect of wealth management ensures that the strategies employed are not static but evolve with the client's changing needs and goals over time.

Enhanced Investment Management

Investment management is a core component of wealth management services, and it goes beyond simply selecting investments. Wealth managers strategically design investment portfolios that align with the client's risk tolerance, financial goals, and time horizon.

By leveraging their expertise and market insights, wealth managers aim to optimize returns while managing risk. The enhanced investment management offered by wealth managers allows clients to benefit from a sophisticated and well-informed approach to growing and preserving their wealth.

Tax Efficiency And Minimization

Wealth managers actively engage in tax planning to enhance efficiency and minimize tax liability. This involves optimizing deductions, leveraging tax-advantaged accounts, and strategically managing investments to mitigate tax consequences.

By implementing tax-efficient strategies, wealth managers aim to maximize after-tax returns, allowing clients to preserve more of their wealth. The ability to navigate the complexities of the tax landscape is a valuable benefit that contributes to overall financial optimization.

Estate Planning Expertise

Estate planning is a critical aspect of wealth management services, especially for those with significant assets. Wealth managers collaborate with clients to develop comprehensive estate plans that include wills, trusts, and other legal instruments.

This ensures a smooth transition of assets, minimizes potential estate taxes and aligns with the client's legacy and philanthropic goals. The expertise in estate planning provided by wealth managers ensures that clients can confidently plan for the transfer of their wealth to future generations.

Risk Management Strategies

Wealth managers actively engage in risk management to safeguard their clients' financial well-being. This involves assessing various risks, including market risk, longevity risk, and unexpected life events, and implementing strategies to mitigate these risks.

By identifying and addressing potential challenges, wealth managers help clients navigate uncertainties and maintain financial resilience. The integration of risk management strategies into the overall wealth management plan contributes to a more robust and resilient financial strategy.

Considerations In Wealth Management

Costs And Fees

Wealth management services often come with associated costs and fees. Clients should carefully consider and understand the fee structure, including management fees, advisory fees, and any additional charges.

Transparent communication regarding fees is crucial, allowing clients to assess the value proposition and make informed decisions about engaging with wealth management services. Wealth managers, in turn, should ensure that their fee structures align with the services provided, fostering a transparent and mutually beneficial client-advisor relationship.

Market Volatility

Financial markets are inherently volatile, and market fluctuations can impact investment portfolios. Clients entering wealth management should be prepared for the potential ups and downs of market conditions.

Wealth managers play a pivotal role in helping clients navigate market volatility by employing strategies to mitigate risks and capitalize on opportunities. Open communication about market dynamics and the potential impact on portfolios is essential to align client expectations and strategies effectively.

Regulatory Compliance

Wealth managers operate within a framework of regulatory compliance, adhering to industry standards and legal requirements. Clients should ensure that their wealth managers are appropriately licensed and comply with relevant regulations.

Regulatory compliance ensures the professionalism and integrity of wealth management services. Wealth managers must stay informed about changing regulatory landscapes, adapting their practices to align with evolving legal frameworks and industry standards.

Changing Life Circumstances

Individuals and families undergo changes in life circumstances, from career shifts to family milestones. A key consideration in wealth management is the flexibility of financial plans to adapt to these changes. Wealth management plans should be dynamic and adjustable, ensuring continued alignment with the client's evolving goals.

Open communication between clients and wealth managers is vital to address changing circumstances effectively. Regular reviews of financial plans provide opportunities to make necessary adjustments and ensure ongoing relevance.

Risk Tolerance And Communication

Effective wealth management requires a clear understanding of the client's risk tolerance and expectations. Wealth managers must communicate transparently about potential risks and rewards, helping clients make informed decisions in line with their comfort levels.

Aligning expectations and fostering open communication contribute to a successful and collaborative wealth management relationship. Wealth managers employ tools and assessments to gauge client risk tolerance accurately, ensuring that investment strategies align with the client's comfort level.

Challenges In Wealth Management

Cost-Benefit Analysis

While wealth management services offer substantial benefits, clients must conduct a cost-benefit analysis to evaluate the value proposition. Assessing whether the services provided align with the costs incurred is crucial for making informed decisions. Wealth managers, on the other hand, must consistently demonstrate the value they bring to the client's financial journey, ensuring that the benefits outweigh the associated costs.

Economic And Market Uncertainties

Wealth managers face the challenge of navigating economic and market uncertainties. Economic downturns, geopolitical events, and unexpected market fluctuations can impact investment portfolios.

Wealth managers must proactively monitor market conditions, employ risk management strategies, and communicate effectively with clients to mitigate potential risks. Adapting investment strategies in response to changing market dynamics is a continuous challenge that requires vigilance and expertise.

Client Education

A challenge in wealth management is the varying levels of financial literacy among clients. Wealth managers must take on the role of educators, providing clear explanations of complex financial concepts and strategies.

Improving client financial literacy enhances their understanding of the wealth management process, empowering them to make informed decisions. Client education is an ongoing effort that contributes to a more collaborative and successful client-advisor relationship.

Technological Advancements

The rapid evolution of technology poses both opportunities and challenges for wealth managers. While technological advancements enable more efficient processes, data analytics, and remote client engagement, wealth managers must also adapt to the changing landscape.

Embracing innovative technologies, such as robo-advisors and digital platforms, requires ongoing investment in training and infrastructure to ensure that wealth managers can leverage technology effectively while maintaining a high level of personalized service.

Personalized Service In A Digital Era

The digital era has ushered in a paradigm shift in client expectations. While technological tools enhance efficiency, clients still value personalized and human-centric service.

Wealth managers face the challenge of striking the right balance between leveraging technology for efficiency and maintaining a personal touch in client interactions. Building and sustaining meaningful relationships in a digital environment requires adaptability and a client-centric approach.

Wealth Management Services - FAQs

How Do Wealth Management Services Differ From Traditional Financial Planning

Wealth management services go beyond traditional financial planning by integrating various disciplines such as investment management, tax planning, estate planning, and risk management into a cohesive and comprehensive strategy.

How Can Wealth Managers Harness Technology To Enhance Their Services?

Wealth managers can integrate technology for real-time data analysis, personalized client portals, remote client engagement, and overall process efficiency.

What Is The Importance Of Transparent Communication In Wealth Management Relationships?

Transparent communication is essential for building trust, ensuring understanding of fees and strategies, and maintaining a strong and collaborative relationship between clients and wealth managers.

How Can Wealth Managers Adapt To Changing Life Circumstances?

Wealth managers should design flexible financial plans, conduct regular reviews, and engage in open communication to adapt to changing life circumstances effectively.

Conclusion

Wealth management services play a central role in guiding individuals and families toward financial prosperity. Through a holistic and client-centric approach, wealth managers provide tailored solutions that encompass financial planning, investment management, tax strategies, estate planning, and risk management.

The evolving landscape of wealth management, marked by technological advancements and changing trends, underscores the industry's commitment to adapting to the needs and expectations of clients.

As clients embark on their wealth management journey, understanding the benefits, considerations, and challenges is crucial. Transparent communication, alignment of expectations, and a long-term collaborative relationship between clients and wealth managers form the foundation for a successful and enduring wealth management experience.

In navigating the complexities of financial markets and individual circumstances, wealth management services serve as a guiding force, empowering clients to achieve their financial goals and cultivate lasting prosperity.

Dexter Cooke

Author

He is an orthopedic surgeon who insists that a physician's first priority should be patient care. He specializes in minimally invasive complete knee replacement surgery and laparoscopic procedures that reduce pain and recovery time. He graduated from the Medical University of South Carolina with a medical degree and a postdoctoral fellowship in orthopedic medicine.

Darren Mcpherson

Reviewer

Darren's gift and passion for seeing great potential and acting on it have helped him to develop his career and perform to audiences all over the world, stemming from a childhood obsession with magic and visualization. He now partners with leading brands to help their workers manage the high-stress, rapid change, and fast-paced world that has become the norm. Darren demonstrates how to reconnect with what matters most in life so that they can accomplish every goal while having the time of their lives.

Latest Articles

Popular Articles