What Happens If You Overpay Your Estimated Taxes? 7 Key Insights

Discover the repercussions of What happens if you overpay your estimated taxes! Uncover the pitfalls and potential remedies for excess tax payments.Learn how overpayment impacts your finances and what steps you can take to rectify the situation.

Author:James PierceReviewer:Alberto ThompsonJan 16, 20243.5K Shares390.6K Views

Unravel the mystery behind: What happens if you overpay your estimated taxes?and discover the unexpected repercussions that could impact your financial landscape. Delve into the intricacies of this commonly overlooked scenario and gain clarity on its effects. When you overpay your estimated taxes, you might assume it's a harmless error. However, this action can disrupt your cash flow, potentially tie up funds unnecessarily, and even lead to missed investment opportunities.

Explore the ripple effects of overpaying estimated taxes and empower yourself with the knowledge to navigate this intricate aspect of personal finance. Beyond the monetary impact, overpayments might disrupt your budget planning, leading to unforeseen complications. Moreover, understanding the repercussions of this oversight is crucial for maximizing your financial resources.

What Happens If You Overpay Your Estimated Taxes?

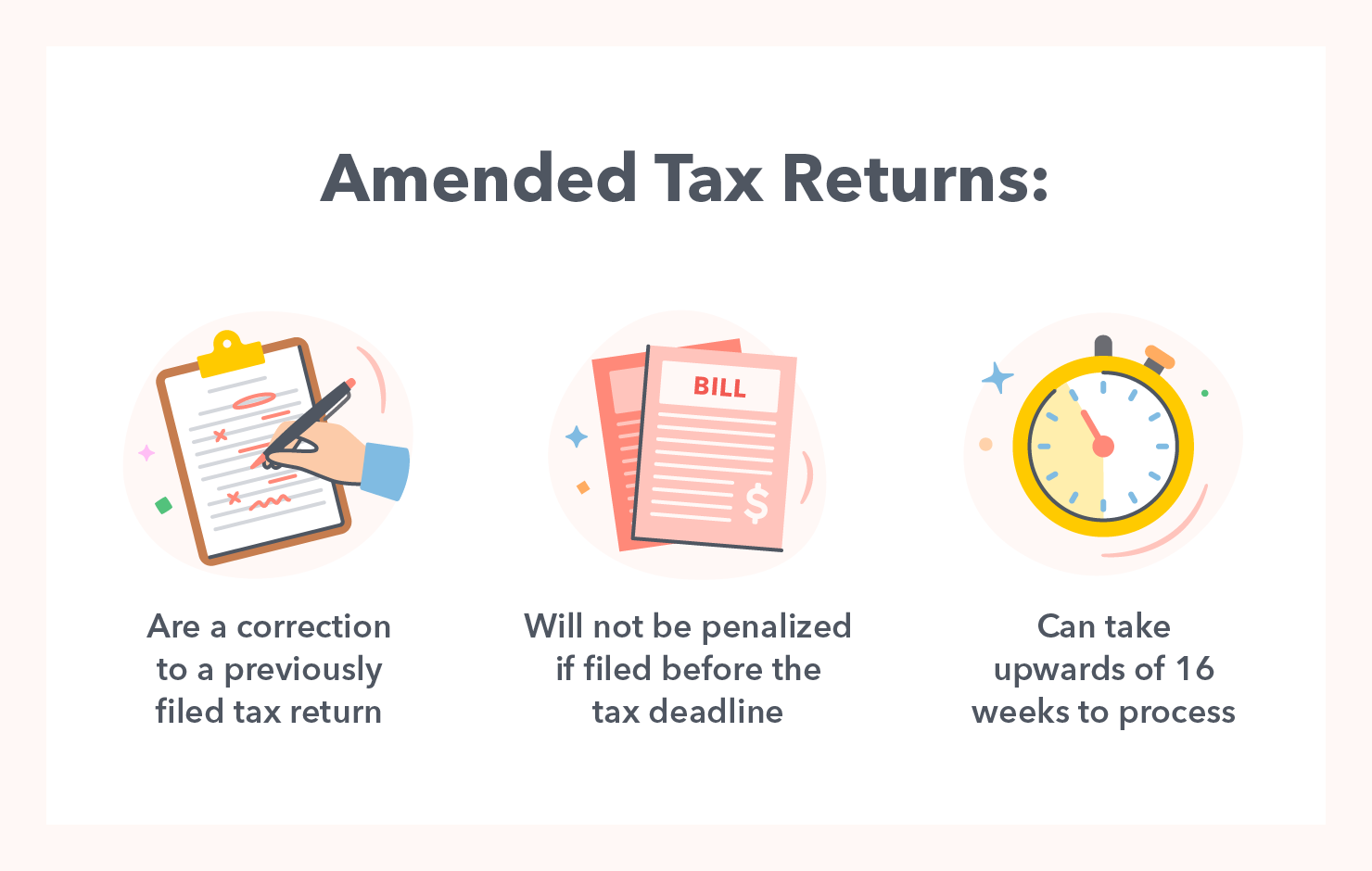

Overpaying your estimated taxes can happen for various reasons, like overestimating income or making extra payments throughout the year. While it's generally better than underpaying, understanding the consequences and options is crucial. Here are 7 key insights:

1. You Get A Refund

The most immediate outcome is a tax refund when you file your actual tax return. The overpaid amount gets credited back, sometimes with interest, depending on the timing and your location.

2. Reduced Tax Liability

The overpayment effectively reduces your final tax bill at filing time. This can be beneficial if you anticipate owing a significant amount, easing the financial burden.

3. Missed Credit Opportunities

Depending on the amount and timing of the overpayment, you might miss out on certain tax credits that incentivize specific actions like retirement contributions or education expenses.

4. Lower Penalties And Interest

Overpaying helps avoid underpayment penalties and interest, which can accrue if you fall short of your estimated tax obligation.

5. Potential Investment Opportunity

If you receive a sizable refund and have no immediate financial needs, consider investing it for potential long-term growth. However, consult a financial advisor for suitable investment options.

6. Adjust Future Payments

Once you understand the reason for the overpayment, you can adjust your estimated tax payments for the coming year to avoid repeating the situation. This might involve revising income projections or changing payment schedules.

7. Seek Professional Guidance

Complex tax situations or significant overpayments might warrant seeking guidance from a tax professional. They can help analyze your specific case, optimize future payments, and ensure you're taking advantage of all available benefits.

Tax regulations can vary depending on your location and individual circumstances. Consulting the relevant tax authority or a qualified professional is always recommended for personalized advice and accurate information.

What Does Overpayment Mean On Taxes?

In simple terms, an overpayment of taxes means you've paid more than what you actually owe to the government. This can happen for a few reasons, such as:

1. Overestimating your income -If you predict a higher income than you actually earn, your estimated tax payments might be too high.

2. Making extra payments -You might choose to pay more in estimated taxes throughout the year, preferring smaller installments to a larger lump sum at filing time.

3. Withholding or deductions exceeding your tax liability -Your employer or other payers might withhold more tax from your income than your actual obligation, leading to an overpayment.

The good news is that an overpayment generally results in a tax refund when you file your actual tax return. The government essentially returns the excess amount you paid. However, there are some nuances to consider.

- Timing -Depending on when you overpaid and the specific regulations in your location, you might receive interest on your refund.

- Missed benefits -While overpaying avoids penalties and interest from underpayment, it might also mean missing out on certain tax credits that rely on specific spending or actions.

- Future adjustments -To avoid overpaying again next year, analyze the reasons for the current overpayment and adjust your estimated tax payments accordingly.

Will The IRS let Me Know If I Overpaid?

No, the IRS won't typically notify you directly if you've overpaid your taxes. It's your responsibility to track your payments and income throughout the year and estimate your tax liability accurately. However, there are a few ways you might find out you overpaid.

- Reviewing your tax return -When you file your tax return, the IRS calculates your actual taxliability based on your reported income and deductions. If your total payments (including estimated taxes, withholdings, and any additional payments) exceed that liability, you'll see a refund amount on your return.

- Online account -The IRS website allows you to create an online account where you can view your tax transcripts and payment history. This can help you compare your total payments to your estimated liability and identify any potential overpayments.

- Notice from the IRS -In some cases, the IRS might send you a notice if you have a significant overpayment, especially if it's been several years since you filed a return. This notice typically informs you of the overpayment amount and your options for claiming a refund or applying it to future tax years.

Some Additional Things To Keep In Mind

- Interest on overpayments -If you overpay your taxes early enough in the year, you might earn interest on the overpaid amount. The IRS pays interest at a compounded rate, which can be a small financial benefit.

- Offsetting debts -The IRS can use any overpayment you have to offset outstanding debts you owe to the government, such as child support or student loans.

- Claiming your refund -You need to file a tax return to claim your refund, even if you're expecting one. The IRS won't automatically send you the money unless you file.

While the IRS won't directly tell you if you've overpaid, there are ways to find out and claim your refund. By staying organized with your tax documents and filing your return on time, you can ensure you receive any owed money and avoid any complications.

Is There A Penalty For Overpaying Your Taxes?

The good news is, no, there is no penalty for overpaying your taxes to the IRS. Unlike underpaying, which can accrue hefty penalties and interest, overpaying simply means you'll receive a refund when you file your tax return. This refund will typically include the overpaid amount, and in some cases, even interest depending on the timing and location.

Here's a breakdown of why, there's no penalty for overpaying:

- You're fulfilling your tax obligation -By overpaying, you're essentially prepaying your taxes, ensuring you meet your legal obligation. The IRS appreciates this proactive approach.

- Administrative burden -Tracking, assessing, and applying penalties for overpayments would create additional administrative work for the IRS and taxpayers.

- Potential benefit for the government -The overpaid amount essentially acts as an interest-free loan from taxpayers to the government, which can be used to fund various programs and initiatives.

However, while there's no penalty, there are some potential downsides to consider:

- Missed opportunities -Overpaying might mean missing out on certain tax credits or deductions that require specific spending or actions within a given year.

- Loss of potential returns -Your overpaid money could be earning interest or generating returns if invested elsewhere. While the IRS pays some interest on early overpayments, it's usually lower than what you could get through other investment options.

- Future adjustments -To avoid unnecessary overpayments in future years, it's important to analyze the reasons behind your current overpayment and adjust your estimated tax payments accordingly.

Overpaying your taxes isn't necessarily bad, but it's important to be aware of its implications and consider alternative ways to manage your tax burden effectively. Consulting a qualified tax professional can help you understand your specific situation and optimize your tax payments for both financial benefit and compliance.

What Are Estimated Quarterly Taxes, and Who Pays Them?

Estimated quarterly taxes are advance payments made to the Internal Revenue Service (IRS) throughout the year on taxable income that isn't subject to federal withholding. This means your income tax isn't automatically deducted from your paycheck or other forms of income.

Who Needs To Pay Estimated Quarterly Taxes?

- Self-employed individuals -This includes freelancers, gig workers, independent contractors, and business owners.

- Investors with significant income from dividends or capital gains -If your investment income isn't subject to withholding at the source, you might need to make estimated payments.

- High-income earners -Even if you have withheld from your salary, if your total income exceeds a certain threshold ($151,200 for single filers and $236,100 for married filing jointly for 2024), you might need to make estimated payments to avoid an underpayment penalty.

Why Pay Estimated Quarterly Taxes?

Making estimated quarterly payments helps ensure you don't owe a large sum of money at tax filing time, potentially avoiding penalties and interest charges. It also helps spread out your tax payments throughout the year, making your tax burden more manageable.

When Are Estimated Taxes Due?

Estimated tax payments are due four times a year.

- April 15th

- June 17th

- September 16th

- January 15th of the following year (Note - For the 2023 tax year, the January 15th deadline falls on a Sunday, so the payment is due by January 16th, 2024.)

How To Calculate And Pay Estimated Taxes?

The IRS provides resources to help you estimate your income and tax liability for the year. You can use Form 1040-ES, Estimated Tax for Individuals, and its accompanying worksheet to calculate your expected tax payments. The worksheet guides you through various income and deduction estimates to arrive at an estimated tax amount.

You can make estimated tax payments electronically through the IRS website or EFTPS (Electronic Federal Tax Payment System), by mail with Form 1040-ES, or by phone.

It's Important To Remember

- Estimating your income and tax liability can be complex, and you might need to adjust your payments throughout the year based on changes in your income or deductions.

- If you're unsure whether you need to make estimated payments or how much to pay, it's best to consult a tax professional or review the IRS resources available online.

The Pros And Cons Of Overpaying On Your Taxes

While it's generally better than underpaying, overpaying taxes also has its own set of advantages and disadvantages to consider. Here's a breakdown of the pros and cons

Pros

- Reduced Tax Liability -The most obvious benefit is a smaller tax bill at filing time. If you anticipate owing a significant amount, prepaying through estimated taxes eases the financial burden later.

- Avoid Penalties and Interest -Overpaying helps dodge underpayment penalties and interest charges that can accrue if you fall short on your tax obligation.

- Potential Refund with Interest -You'll receive a refund for the overpaid amount when you file your return. Depending on the timing and your location, your refund might even earn some interest.

- Peace of Mind -Knowing you're ahead on your taxes and won't face surprises or penalties at filing time can bring peace of mind and financial security.

Cons

- Missed Credit Opportunities -Depending on the amount and timing of the overpayment, you might miss out on certain tax credits that incentivize specific actions like retirement contributions or education expenses.

- Lower Investment Returns -The overpaid money could be earning interest or generating returns if invested instead. While the IRS pays some interest on early overpayments, it's usually lower than what you could get through other investment options.

- Future Adjustments -To avoid unnecessary overpayments in future years, you need to analyze the reasons behind your current overpayment and adjust your estimated tax payments accordingly. This might involve revising income projections or changing payment schedules.

- Potential for Missed Filing -If you receive a large refund due to overpayment, you might be less motivated to file your return promptly, risking penalties for late filing.

Decision Factors

Whether overpaying taxes is right for you depends on your individual circumstances and financial goals. Consider factors like.

- Income stability -If your income fluctuates, consistently overpaying might not be ideal.

- Investment opportunities -Compare the potential return on investments with the interest earned on overpayments.

- Tax burden -If you expect a large tax bill, prepaying can be beneficial.

- Risk of underpayment -Overpaying helps avoid penalties for underestimating your tax liability.

FAQ's About What Happens If You Overpay Your Estimated Taxes?

Do I Get Penalized For Overpaying Estimated Taxes?

No, the IRS doesn't penalize you for overpaying estimated taxes. However, keeping overpayments to a minimum is wise, as that money could be earning interest elsewhere instead of sitting with the IRS.

How Do I Get My Overpayment Back?

You'll receive your overpayment as a refund once you file your tax return. If you e-file, expect your refund within 2-3 weeks. Paper filing takes 6-8 weeks, potentially longer depending on individual circumstances.

Can I Apply The Overpayment To Next Year's Estimated Taxes?

Yes, you can choose to have the overpayment applied to your first installment of estimated taxes for the following year. This can be helpful if you anticipate owing taxes again next year.

What If I Forget To Claim My Overpayment On My Tax Return?

The IRS will automatically issue a refund if you overpaid, even if you don't claim it on your return. However, claiming it yourself ensures you receive it sooner.

Conclusion

The ramifications of overpaying your estimated taxes extend beyond mere financial transactions. This seemingly innocuous error can disrupt your financial planning, causing cash flow constraints and missed opportunities for investments or savings. The complexities involved in rectifying these overpayments can lead to undue stress and consume valuable time that could be better spent managing other aspects of your financial portfolio.

Moving forward, staying vigilant with your tax planning and payments is crucial. Regularly reviewing your estimated taxes and consulting with tax professionals can help prevent overpayments, ensuring that your funds are utilized optimally. By staying informed and proactive, you can safeguard your financial well-being, maintaining a healthy balance between fulfilling your tax obligations and utilizing your resources effectively for future financial endeavors.

Jump to

What Happens If You Overpay Your Estimated Taxes?

What Does Overpayment Mean On Taxes?

Will The IRS let Me Know If I Overpaid?

Is There A Penalty For Overpaying Your Taxes?

What Are Estimated Quarterly Taxes, and Who Pays Them?

The Pros And Cons Of Overpaying On Your Taxes

FAQ's About What Happens If You Overpay Your Estimated Taxes?

Conclusion

James Pierce

Author

James Pierce, a Finance and Crypto expert, brings over 15 years of experience to his writing. With a Master's degree in Finance from Harvard University, James's insightful articles and research papers have earned him recognition in the industry.

His expertise spans financial markets and digital currencies, making him a trusted source for analysis and commentary. James seamlessly integrates his passion for travel into his work, providing readers with a unique perspective on global finance and the digital economy.

Outside of writing, James enjoys photography, hiking, and exploring local cuisines during his travels.

Alberto Thompson

Reviewer

Alberto Thompson is an acclaimed journalist, sports enthusiast, and economics aficionado renowned for his expertise and trustworthiness. Holding a Bachelor's degree in Journalism and Economics from Columbia University, Alberto brings over 15 years of media experience to his work, delivering insights that are both deep and accurate.

Outside of his professional pursuits, Alberto enjoys exploring the outdoors, indulging in sports, and immersing himself in literature. His dedication to providing informed perspectives and fostering meaningful discourse underscores his passion for journalism, sports, and economics. Alberto Thompson continues to make a significant impact in these fields, leaving an indelible mark through his commitment and expertise.

Latest Articles

Popular Articles