What Is A Jumbo Loan And How Does It Work? From Mansions To Mortgages

Whether you're a seasoned homeowner or a first-time buyer, demystify what is a jumbo loan and how does it work? And make informed decisions for your real estate endeavors.

Author:Dexter CookeReviewer:Darren McphersonJan 05, 20249.6K Shares139.4K Views

Discover what is a jumbo loan and how does it work?Learn what sets these large mortgages apart and gain insights into how they work.In the dynamic landscape of real estate financing, navigating the complexities of mortgage options is crucial. One such financial instrument that often raises questions is the jumbo loan.

As the demand for high-value properties grows, understanding "what is a conventional loan and how does it work?" is essential for prospective homeowners. This article delves into the intricacies of jumbo loans, shedding light on their definition, features, and how they operate within the real estate market.

What Is A Jumbo Loan?

A jumbo loan is a specialized type of mortgage designed to facilitate the purchase of high-value real estate that exceeds the conforming loan limits set by government-sponsored enterprises (GSEs). In the United States, these limits are established by entities like Fannie Mae and Freddie Mac. What distinguishes a jumbo loan from conventional mortgages is its capacity to finance properties with loan amounts that surpass these predefined limits.

Typically, jumbo loans come into play when individuals seek to buy luxury homes or properties in expensive real estate markets where standard loan limits may prove insufficient. The defining feature of a jumbo loan is its ability to cater to borrowers looking to acquire residences with significant price tags.

Qualifying for a jumbo loan often involves meeting more stringent criteria than those for conventional mortgages. Lenders typically scrutinize applicants' credit scores, income levels, and debt-to-income ratios more closely, ensuring that borrowers can comfortably handle the higher loan amounts associated with luxury properties.

Despite the additional requirements, jumbo loans provide an avenue for individuals to access financing for upscale homes, expanding opportunities in the realm of high-end real estate.

How Does A Jumbo Loan Work?

So, what is a jumbo loan and how does it work? A jumbo loan functions similarly to a typical mortgage, but with stricter credit requirements than a normal loan. However, jumbo lenders must still follow the Consumer Financial Protection Bureau's (CFPB) qualifying mortgage criteria.

Borrowers' debt-to-income (DTI) ratio should be 43% or lower. Some lenders prefer a DTI of 36% or less, which might provide you with more loan options and better terms. While conventional lenders like a credit score of at least 620, most jumbo lenders prefer a credit score of 700 or higher.

A larger loan amount means a higher monthly mortgage payment and more scrutiny from lenders to ensure you can afford the mortgage. Expect to be asked to give at least two years' worth of W-2s and tax returns, as well as recent bank and investment statements.

To qualify, the borrower must be able to demonstrate sufficient cash reserves or liquid assets to cover up to a year's worth of mortgage payments. Lenders also want to see any ownership of non-liquid assets, which can include additional real estate properties.

Though down payment requirements vary, jumbo lenders normally want 10% to 15% down payment, though some may request 20% or more. If you put down less than 20%, the cost of private mortgage insurance (PMI) will be added to your monthly mortgage payment.

Jumbo Loan Pros & Cons

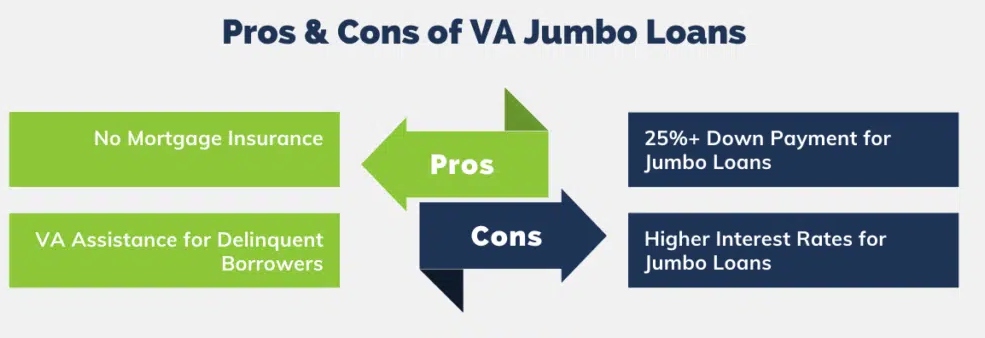

Jumbo loans, catering to the financing needs of high-value real estate, come with a distinct set of pros and cons that potential borrowers should carefully consider.

Pros Of Jumbo Loans

- Access to High-Value Properties -One of the primary advantages of jumbo loans is the ability to purchase properties that exceed conforming loan limits. This opens doors to high-end real estate markets, allowing individuals to acquire luxurious homes that might be out of reach with standard mortgages.

- Flexible Financing Options -Jumbo loans often offer flexibility in terms of repayment options. Borrowers can choose between fixed-rate and adjustable-rate mortgages based on their financial preferences and risk tolerance. This flexibility allows for customized financial strategies tailored to individual needs.

- Investment Opportunities -Jumbo loans can be instrumental for real estate investors looking to acquire high-value properties for rental or resale. This financing option provides the capital needed to engage in upscale real estate ventures and capitalize on potential returns.

Cons Of Jumbo Loans

- Higher Interest Rates -One of the notable drawbacks of jumbo loans is the higher interest rates compared to conventional mortgages. Lenders charge elevated rates to compensate for the increased risk associated with larger loan amounts. Borrowers should be prepared for potentially higher monthly payments.

- Stringent Qualification Criteria -Qualifying for a jumbo loan is often more challenging than securing a conventional mortgage. Lenders may require a higher credit score, a more substantial income, and a lower debt-to-income ratio. Meeting these stringent criteria can be a barrier for some potential borrowers.

- Larger Down Payments -Jumbo loans typically necessitate larger down payments, often ranging from 10% to 20% of the property's purchase price. This requirement can pose a significant financial burden for buyers, limiting the pool of individuals who can access jumbo financing.

- Market Volatility Impact -The real estate market's volatility can have a pronounced effect on jumbo loans. In times of economic uncertainty, lenders may tighten their lending standards, making it even more challenging for borrowers to qualify for these substantial loans.

Qualifying For A Jumbo Loan - What You Need To Know

Though jumbo loan requirements vary by lender, you should anticipate needing more money in the bank, a higher salary, and a better credit score than you would for a conventional loan. Because jumbo loans are more risky for lenders, underwriting is more stringent.

Most lenders require the following to qualify for a jumbo mortgage:

- A credit score of 700 or above is required.

- A down payment of 10% to 20% or more is required.

- Higher fees and closing charges as a result of the larger loan size.

- There is the possibility of a second evaluation to confirm that the value is in accordance with the purchase price.

- Cash reserves of six to twelve months.

- A DTI of 45% or less.

For example, Chase wants 30 days of recent pay stubs and 60 days of recent bank statements, in addition to two years of W-2s and tax filings. Expect to present a balance sheet and profit-and-loss statement if you operate a firm or are self-employed.

Chase provides some wiggle room for jumbo loan borrowers. If you have a low DTI, for example, you may be able to get away with a credit score of less than 700. If you have a high DTI but significant cash reserves or a great credit score, you may still be eligible.

A jumbo loan from Ally can be used to finance investment properties, holiday homes, and principal residences. They also have down payments starting at 10.01%. There are no lender costs, and the application process can take as little as 15 minutes online if you have everything ready to go.

Furthermore, you can monitor the entire process from your phone or computer. Ally also provides customized loans and rates to suitable borrowers, with loans up to $4 million.

Advantages Of A Jumbo Loan

- Access to High-Value Properties - One significant advantage of a jumbo loan is the access it provides to high-value properties. In real estate markets where properties exceed the conforming loan limits, jumbo loans become instrumental in facilitating the purchase of luxury homes. This expands opportunities for homebuyers who aspire to own residences with substantial price tags, offering a solution beyond the constraints of conventional mortgages.

- Flexibility in Loan Amounts - Jumbo loans offer flexibility in loan amounts, allowing borrowers to secure financing for properties that conventional mortgages may not cover. This adaptability is particularly valuable in markets with rising property values, enabling individuals to navigate the dynamic landscape of real estate and acquire homes that align with their preferences and lifestyles.

- Tailored Financing Options - Another advantage of jumbo loans lies in the range of financing options they provide. Borrowers can choose between fixed-rate and adjustable-rate mortgages based on their financial goals and risk tolerance. This flexibility empowers individuals to craft a financing strategy that suits their unique circumstances, offering a personalized approach to managing their real estate investment.

- Potential for Investment Opportunities - Jumbo loans are not limited to primary residence purchases; they can also be utilized for investment properties. This opens doors for real estate investors to engage in upscale ventures, capitalizing on high-value properties for rental income or resale. The potential for significant returns on investment makes jumbo loans an attractive option for those looking to diversify their real estate portfolio.

- Competitive Interest Rates - While interest rates for jumbo loans are typically higher than those for conventional mortgages, borrowers with strong credit profiles may still secure competitive rates. This aspect adds a layer of affordability to jumbo loans, making them more accessible to individuals with favorable credit histories.

Jumbo Loan Special Considerations

Just because you may be eligible for one of these loans does not imply you should take it out. You certainly shouldn't if you expect it to provide you with significant tax savings, for example.

You're probably aware that if you itemize your deductions, you can deduct the mortgage interest you paid in any given year from your taxes. But you probably never had to worry about the Internal Revenue Service (IRS) cap on this deduction, which was reduced by the Tax Cuts and Jobs Act. Anyone who obtained a mortgage on or before December 14, 2017, can deduct interest on up to $1 million in debt, which was the former limit.

However, after December 14, 2017, you can only deduct interest on up to $750,000 in mortgage debt. You don't get the entire deduction if your mortgage is greater. If you want to take out a $2 million jumbo mortgage with an annual interest rate of $80,000, you can only deduct $30,000—the interest on the first $750,000 of your mortgage. In practice, you only receive a tax reduction of 37.5% of your mortgage interest.

This implies you should borrow with caution and thoroughly crunch the figures to determine what you can genuinely afford and what kinds of tax benefits you will receive. Because the state and local tax deduction is limited to $10,000 per year, a highly taxed home will also cost you extra to own.

Another option is to compare conditions to see whether taking out a smaller conforming loan plus a second loan, rather than one large jumbo loan, will be better for your finances in the long run.

Who Should Look For A Jumbo Loan?

The amount you can ultimately borrow is determined by your assets, credit score, and the value of the property you want to buy. These mortgages are deemed best suitable for a subset of high-income individuals earning $250,000 to $500,000 per year.

This group is known as HENRY, which stands for high earners who are not yet rich. Essentially, these are folks who make a lot of money but do not have millions of dollars in excess cash or other assets accumulated, yet.

While an individual in the HENRY segment may not have amassed the wealth to buy a high-priced new home with cash, such high-income individuals typically have better credit scores and longer credit histories than the average homebuyer seeking a conventional mortgage loan for a lower amount.

They are also more likely to have well-established retirement accounts. They frequently have been contributing for a longer time than lower-income people.

These are the types of people who institutions love to sign up for long-term products, partially because they frequently require additional wealth management services. Furthermore, it is more practical for a bank to manage a single $2 million mortgage than ten $200,000 loans.

What Is A Jumbo Loan And How Does It Work? FAQs

What Are The Typical Qualifying Criteria For A Jumbo Loan?

Qualifying for a jumbo loan often involves a strong credit score, substantial income, and a lower debt-to-income ratio, given the higher loan amounts.

Can First-time Homebuyers Apply For Jumbo Loans?

Yes, first-time homebuyers can apply for jumbo loans, but they should be prepared for more stringent qualification requirements and higher down payment obligations.

How Do Interest Rates For Jumbo Loans Compare To Conventional Mortgages?

Interest rates for jumbo loans may be slightly higher than those for conventional mortgages, reflecting the increased risk associated with larger loan amounts.

Are There Variations Of Jumbo Loans, And If So, What Are They?

Yes, there are various types of jumbo loans, including fixed-rate and adjustable-rate options, providing borrowers with flexibility in choosing the right loan structure for their needs.

How Much Down Payment Is Typically Required For A Jumbo Loan?

Down payment requirements for jumbo loans can vary but generally range from 10% to 20%, depending on the lender and the borrower's financial profile.

Conclusion

Delving into the details of "what is a jumbo loan and how does it work?" is a crucial step for anyone navigating the complex landscape of real estate financing. A jumbo loan is not merely a financial term but a gateway to unlocking opportunities in the world of upscale real estate. As property values continue to rise, individuals aspiring to own luxury homes or high-end properties may find jumbo loans to be a viable solution.

Armed with a deeper understanding of what constitutes a jumbo loan and how it functions, prospective buyers can confidently approach the real estate market, making informed decisions that align with their financial goals and homeownership aspirations.

Dexter Cooke

Author

He is an orthopedic surgeon who insists that a physician's first priority should be patient care. He specializes in minimally invasive complete knee replacement surgery and laparoscopic procedures that reduce pain and recovery time. He graduated from the Medical University of South Carolina with a medical degree and a postdoctoral fellowship in orthopedic medicine.

Darren Mcpherson

Reviewer

Darren's gift and passion for seeing great potential and acting on it have helped him to develop his career and perform to audiences all over the world, stemming from a childhood obsession with magic and visualization. He now partners with leading brands to help their workers manage the high-stress, rapid change, and fast-paced world that has become the norm. Darren demonstrates how to reconnect with what matters most in life so that they can accomplish every goal while having the time of their lives.

Latest Articles

Popular Articles