What Is Child Identity Theft? Risks, Impacts, And Prevention

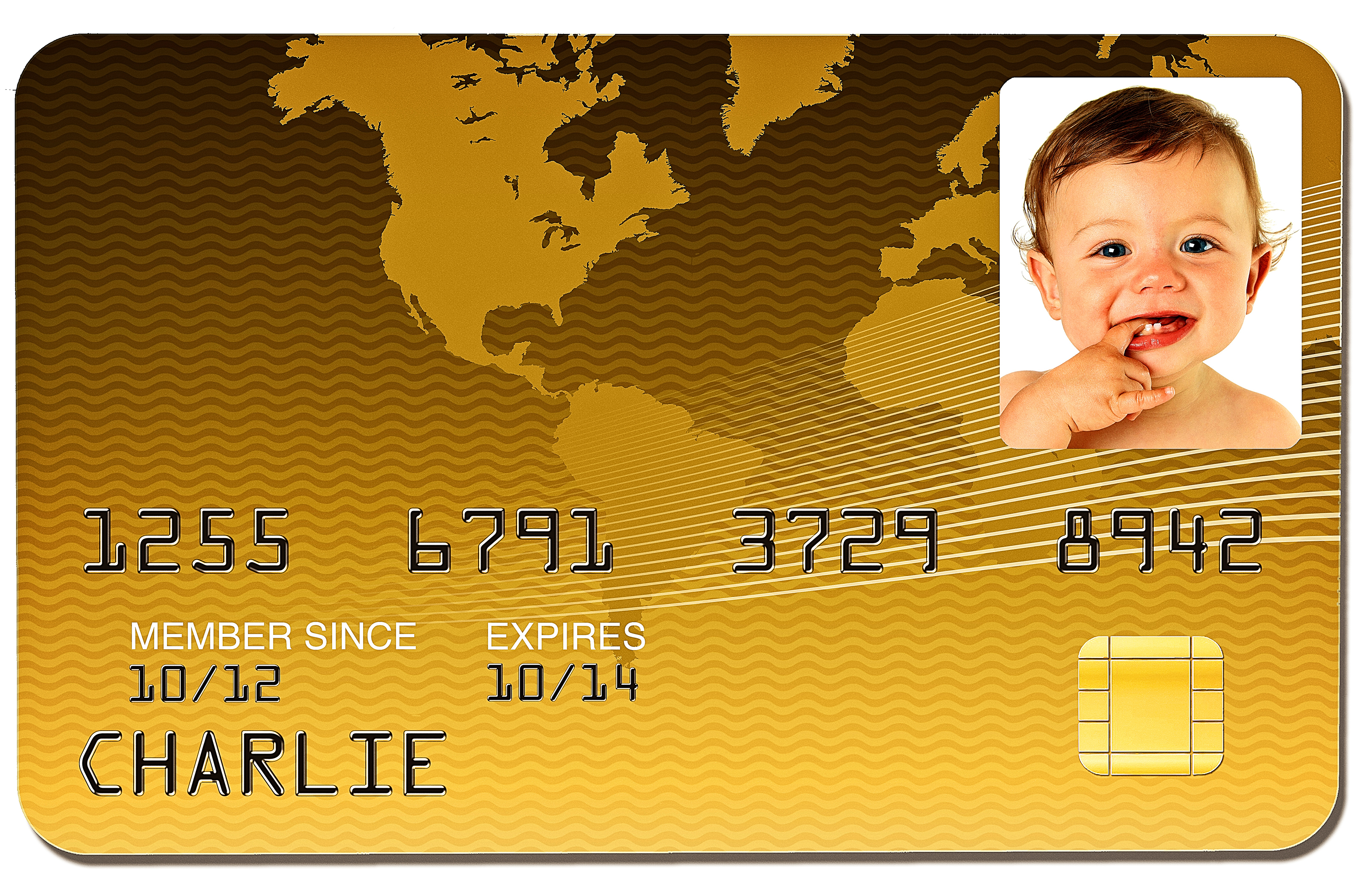

Child identity theft is a serious and often overlooked issue that can have devastating consequences for children and their families. While many people associate identity theft with adults, children are increasingly becoming targets of identity theft due to their clean credit histories and the ease with which their personal information can be exploited. In this article, we will explore the question "What is child identity theft?"—how "it occurs, its impact, signs of detection, prevention strategies, and the legal measures in place to address this growing problem.

Author:Frazer PughReviewer:Karan EmeryJul 16, 202421.2K Shares408.8K Views

Child identity theft is a serious and often overlooked issue that can have devastating consequences for children and their families. While many people associate identity theft with adults, children are increasingly becoming targets of identity theft due to their clean credit histories and the ease with which their personal information can be exploited. In this article, we will explore the question "What is child identity theft?" and how it occurs, its impact, signs of detection, prevention strategies, and the legal measures in place to address this growing problem.

Child Identity Theft Occurrence

Child identity theft occurs when someone unlawfully uses a child's personal information for fraudulent purposes. This can include stealing the child's Social Security number, creating a synthetic identity using the child's information, or exploiting data breaches that expose sensitive information. Vulnerabilities in the system, such as lax security measures and limited oversight, contribute to the prevalence of child identity theft.

Impact Of Child Identity Theft

The impact of child identity theft can be significant and far-reaching. Beyond the immediate financial consequences for the child and their family, such as fraudulent charges and damaged credit, there are long-term effects on the child's credit history and future financial opportunities. Additionally, child identity theft can take a toll on the emotional well-being of the child and their family, leading to feelings of vulnerability, distrust, and anxiety.

Signs And Detection Of Child Identity Theft

Parents or guardians should be vigilant for signs that their child's identity may have been stolen, such as receiving pre-approved credit card offers in the child's name or notices from debt collectors. Steps for detecting child identity theft include regularly monitoring credit reports, being wary of unusual activity or requests for personal information, and promptly reporting any suspicious activity.

Prevention Of Child Identity Theft

Preventing child identity theft requires proactive measures to safeguard children's personal information. Parents or guardians can take steps such as limiting the sharing of sensitive information, storing documents securely, and educating children about online safety. Additionally, freezing a child's credit can prevent identity thieves from opening fraudulent accounts in their name.

Legal And Regulatory Measures

Several laws and regulations are in place to address child identity theft and protect children's identities. Efforts are underway to strengthen protections and enhance awareness of child identity theft, including advocating for stricter security standards and providing resources for victims of identity theft.

Environmental Effects Of Child Identity Theft

Child identity theft can have detrimental long-term psychological and financial impacts on the victims and their families. These effects can lead to considerable emotional distress, financial hardships, and significant legal and regulatory implications. Despite the severity of these consequences, it's essential to acknowledge that child identity theft also has environmental effects, although they are less talked about. Impact on the environment includes.

Paper Waste And Document Destruction

The process of rectifying child identity theft often involves a significant amount of paperwork and document destruction. This can lead to an increase in paper waste, which poses environmental concerns related to deforestation and waste management.

Energy Consumption And Carbon Footprint

Resolving instances of child identity theft can require numerous official appointments, phone communications, and administrative tasks, leading to increased energy consumption and a larger carbon footprint associated with travel, communication, and administrative processes.

Resource Usage

The depletion of resources occurs when additional documentation, materials, and resources are required to rectify child identity theft. This contributes to increased consumption of paper, ink, and other resources, affecting the natural environment and potentially contributing to deforestation and resource depletion.

Environmental Sustainability

Instances of child identity theft and the subsequent efforts to resolve these cases can impact environmental sustainability efforts. By requiring extensive administrative steps and resources, such instances can pose challenges to maintaining environmentally sustainable practices.

Overcoming - Child Identity Theft

To overcome child identity theft, it's essential to take immediate action to address the fraudulent activity and prevent further harm to your child's identity and financial well-being. Here are steps to help you overcome child identity theft.

Gather Documentation

Collect any documentation related to the identity theft, such as fraudulent accounts, credit reports showing unauthorized activity, and any correspondence from creditors or collection agencies.

Place A Fraud Alert

Contact one of the three major credit bureaus (Equifax, Experian, or TransUnion) and request to place a fraud alert on your child's credit report. This alert notifies creditors to take extra steps to verify the identity of anyone seeking credit in your child's name.

Report Identity Theft

File a report with the Federal Trade Commission (FTC) through their online complaint assistant or by calling the FTC's Identity Theft Hotline at 1-877-438-4338. The FTC will provide you with a personalized recovery plan and may assist in resolving fraudulent accounts and issues related to identity theft.

Contact Creditors And Financial Institutions

Contact the creditors and financial institutions associated with the fraudulent accounts to inform them of the identity theft and request that they close the accounts and remove any unauthorized charges or transactions.

Request A Credit Freeze

Consider requesting a credit freeze on your child's credit reports. A credit freeze restricts access to the child's credit report, making it more difficult for identity thieves to open new accounts in their name.

Monitor Credit Reports

Regularly monitor your child's credit reports for any signs of unauthorized activity. You are entitled to one free credit report per year from each of the three major credit bureaus through AnnualCreditReport.com.

Document Everything

Keep detailed records of all communications, transactions, and steps taken to address identity theft. This documentation may be useful when working with creditors, financial institutions, and law enforcement agencies.

Consider Legal Assistance

If the identity theft is complex or has resulted in significant financial losses, you may want to consider seeking legal assistance from an attorney who specializes in identity theft cases.

Educate Your Child

Educate your child about the importance of safeguarding personal information, such as Social Security numbers, birthdates, and financial account details. Teach them about online safety and how to recognize and avoid potential scams or phishing attempts.

Stay Vigilant

Remain vigilant for any signs of continued identity theft or fraudulent activity. Continue to monitor your child's credit reports regularly and take prompt action to address any new issues that arise.

By taking proactive steps to address child identity theft and implementing preventive measures to protect your child's identity, you can overcome the challenges posed by identity theft and minimize the risk of future incidents.

What Is Child Identity Theft? (FAQs)

How Common Is Child Identity Theft?

Child identity theft is a growing problem, with millions of children falling victim to this crime each year. However, the exact prevalence of child identity theft is difficult to determine due to underreporting and the covert nature of the crime.

Why Are Children Targeted For Identity Theft?

Children are attractive targets for identity thieves because they have clean credit histories, and their personal information is often less closely monitored than that of adults. Additionally, child identity theft can go undetected for years, allowing perpetrators to exploit the stolen information for an extended period.

How Does Child Identity Theft Differ From Adult Identity Theft?

Child identity theft is often more difficult to detect than adult identity theft because children are not typically monitoring their credit reports or financial accounts. Additionally, child identity theft may go unnoticed until the child applies for credit or financial services as an adult.

Conclusion

While the environmental effects of child identity theft are often overlooked, it's important to recognize the broader implications of such crimes. Efforts to prevent and address child identity theft should not only focus on the direct psychological, financial, and legal impacts but also consider the broader environmental effects associated with the process of resolving these cases. By highlighting these environmental implications, a more comprehensive approach to addressing child identity theft can be developed, taking into account the broader societal and environmental impact of such criminal activities.

Jump to

Child Identity Theft Occurrence

Impact Of Child Identity Theft

Signs And Detection Of Child Identity Theft

Prevention Of Child Identity Theft

Legal And Regulatory Measures

Environmental Effects Of Child Identity Theft

Paper Waste And Document Destruction

Energy Consumption And Carbon Footprint

Resource Usage

Environmental Sustainability

Overcoming - Child Identity Theft

Gather Documentation

Place A Fraud Alert

Report Identity Theft

Contact Creditors And Financial Institutions

Request A Credit Freeze

Monitor Credit Reports

Document Everything

Consider Legal Assistance

Educate Your Child

Stay Vigilant

What Is Child Identity Theft? (FAQs)

Conclusion

Frazer Pugh

Author

Frazer Pugh is a distinguished expert in finance and business, boasting over 6 years of experience. Holding an MBA in Finance from Stanford University, Frazer's credentials underscore his authority and expertise in the field.

With a successful track record in executive roles and as a published author of influential articles on financial strategy, his insights are both deep and practical.

Beyond his professional life, Frazer is an avid traveler and culinary enthusiast, drawing inspiration from diverse cultures and cuisines.

His commitment in delivering trustworthy analysis and actionable advice reflects his dedication to shaping the world of finance and business, making a significant impact through his work.

Karan Emery

Reviewer

Karan Emery, an accomplished researcher and leader in health sciences, biotechnology, and pharmaceuticals, brings over two decades of experience to the table. Holding a Ph.D. in Pharmaceutical Sciences from Stanford University, Karan's credentials underscore her authority in the field.

With a track record of groundbreaking research and numerous peer-reviewed publications in prestigious journals, Karan's expertise is widely recognized in the scientific community.

Her writing style is characterized by its clarity and meticulous attention to detail, making complex scientific concepts accessible to a broad audience. Apart from her professional endeavors, Karan enjoys cooking, learning about different cultures and languages, watching documentaries, and visiting historical landmarks.

Committed to advancing knowledge and improving health outcomes, Karan Emery continues to make significant contributions to the fields of health, biotechnology, and pharmaceuticals.

Latest Articles

Popular Articles