What Is The Second Foundation In Personal Finance?

What is the second foundation in personal finance? Unlock financial freedom by mastering the second foundation: liberating yourself from debt. Explore strategies for debt elimination in personal finance.

Author:Liam EvansReviewer:Habiba AshtonJan 25, 202414.2K Shares259.7K Views

In the intricate realm of personal finance, the journey towards financial stability and security involves the meticulous construction of foundations. While the initial steps often encompass budgeting, expense management, and cultivating healthy financial habits, the second foundation stands as a formidable pillar.

So, what is the second foundation in personal finance? It is about liberating oneself from the clutches of debt.

Second Foundation In Personal Finance

Personal finance is based on a few main ideas that help people stay financially healthy and reach their financial goals. Together, these organizations help people learn about money, save money, make the most of their income, and put their money to good use so they can reach their current and future lifestyle goals.

Making a realistic budget by matching up your variable spending with more stable and regular income is the first step in managing your money well.

Learning how to balance your cash flow will keep you from having to struggle every month to pay for basic needs with debt or stop putting money into your savings account.

Paying off your debts is the second important part of personal spending. Pay off any debts you already have as soon as possible. This includes college loans, credit card payments, and so on. You'll have to pay less interest if you can pay off your debt faster. Long term, that means you'll be able to keep a lot more of your money. Cut back on your spending and stick to it to get out of debt.

Think about it:

- Do your costs usually exceed your income? How much more, if so?

- How can you start spending less?

- Where can I find ways to make a little extra money?

- How much do you want to pay each month toward your loans?

Keep the records for the things you buy so you can keep track of how much you spend each month. By looking at your records, you can learn more about how you spend your money and make changes as needed.

This crucial phase marks a turning point in the pursuit of financial well-being, empowering individuals to break free from the shackles of debt and pave the way for a more secure and prosperous future.

Understanding The Significance

In the intricate landscape of personal finance, the concept of the second foundation holds paramount significance. So, what is the second foundation in personal finance? It serves as a pivotal stage in the journey towards financial well-being, with its primary focus on liberating individuals from the burdensome shackles of debt.

This phase marks a critical turning point, representing a conscious effort to break free from the cycles of financial strain and pave the way for a future characterized by stability, security, and increased financial flexibility.

The Weight Of Debt

Debt, when left unaddressed, can cast a pervasive shadow over one's financial health. It has the potential to accumulate rapidly, especially in the case of high-interest debts such as credit cards or personal loans, creating a cycle of stress and constraints. The second foundation centers on a deep understanding of the impact of debt on financial well-being and the imperative to take proactive measures to eliminate it.

Empowering Financial Freedom

At its core, the second foundation is about empowering individuals to attain financial freedom. It involves breaking free from the chains of debt that may impede progress toward broader financial goals. By addressing and eliminating debt, individuals create a pathway towards increased cash flow, enabling them to redirect funds towards savings, investments, or other endeavors that contribute to long-term financial prosperity.

Psychological Impact

The psychological impact of the second foundation cannot be overstated. Reducing financial stress and anxiety through debt elimination fosters improved mental and emotional well-being. This liberation from the emotional burdens of debt allows individuals to approach their finances with a healthier mindset, fostering a positive relationship with money.

Key Components Of The Second Foundation

Debt Assessment

The journey to financial liberation begins with a comprehensive review of existing debts. This entails a meticulous examination of credit card balances, personal loans, student loans, and any other outstanding financial obligations. By understanding the depth of one's debt, individuals can tailor their approach to repayment more effectively.

Interest Rate Evaluation

Within the realm of debt assessment, attention is directed towards the interest rates associated with each debt. Prioritizing the repayment of high-interest debts becomes paramount. The second foundation encourages individuals to scrutinize the interest rates on various debts, identifying those that contribute most significantly to financial strain.

Creation Of A Debt Repayment Plan

A strategic and well-thought-out debt repayment plan is a cornerstone of the second foundation. This involves prioritizing the repayment of high-interest debts, considering methodologies such as the debt snowball or debt avalanche. The debt snowball method involves tackling the smallest debts first, fostering a sense of accomplishment and motivation as each debt is eliminated. On the other hand, the debt avalanche method focuses on high-interest debts, aiming to minimize overall interest costs.

Budget Adjustment

The second foundation necessitates a candid evaluation of personal budgets. This involves identifying areas where discretionary spending can be reduced to allocate more funds towards debt repayment. While this may require temporary adjustments in lifestyle, it represents a crucial step in achieving long-term financial goals.

Emergency Fund Consideration

Balancing priorities between debt repayment and emergency fund contributions is an integral aspect of the second foundation. While debt elimination is paramount, having a modest emergency fund provides a safety net, ensuring financial stability during unexpected events. Striking the right balance ensures financial resilience without compromising the momentum of debt reduction.

Negotiation With Creditors

Engaging in negotiations with creditors, particularly for credit cards, is a proactive strategy emphasized in the second foundation. Lowering interest rates through negotiation can significantly accelerate the debt repayment process, leading to quicker financial liberation.

Consolidation Options

Exploring consolidation options, such as debt consolidation loans, is part of the toolkit in the second foundation. Consolidating multiple debts into a single loan with a lower interest rate simplifies repayment and reduces overall interest costs. This strategy streamlines the financial landscape, making it more manageable for individuals seeking to eliminate debt systematically.

Professional Guidance

Recognizing the complexity of debt management, the second foundation encourages individuals to seek professional guidance. Financial advisors or credit counselors can offer valuable insights and personalized strategies, tailoring their advice to individual financial circumstances. This external perspective can provide clarity and enhance the effectiveness of debt elimination plans.

The Impact Of Debt Liberation

The journey through the second foundation in personal finance culminates in the profound impact of debt liberation. As individuals navigate the complexities of debt elimination, the repercussions extend far beyond mere financial transactions. The liberation from debt carries transformative effects on various facets of one's financial landscape, contributing to increased financial freedom, improved creditworthiness, reduced stress, and enhanced long-term financial planning.

Financial Freedom Unleashed

The core objective of debt liberation is to unshackle individuals from the financial constraints imposed by debts. As each debt is systematically paid off, the chains that may have hindered progress toward broader financial goals are released. Financial freedom, in this context, refers to the ability to allocate funds according to personal priorities rather than being encumbered by the burden of debt repayments.

Increased Cash Flow

One of the immediate and tangible outcomes of debt liberation is the augmentation of monthly cash flow. Funds that were previously earmarked for debt servicing are now liberated, offering individuals the flexibility to redirect these resources toward savings, investments, or discretionary spending aligned with their financial goals.

Improved Credit Score

Debt liberation has a direct and positive impact on an individual's credit score. As debts are systematically paid off, individuals contribute positively to their credit history. A positive credit history, in turn, enhances creditworthiness, leading to improved credit scores. This has broader implications, as a higher credit score can open doors to favorable interest rates on future loans and financial opportunities.

Reduced Stress And Anxiety

The psychological impact of debt liberation is profound. Reducing financial stress and anxiety is a direct outcome of systematically eliminating debts. The burden of debt, often accompanied by worry and uncertainty, dissipates as individuals witness progress in their debt repayment journey. This emotional relief fosters improved mental and emotional well-being, contributing to a healthier relationship with money.

Enhanced Long-Term Financial Planning

As individuals move through the second foundation and achieve debt liberation, the focus naturally shifts towards long-term financial planning. Freed from the immediate concerns of debt, individuals can contemplate and strategize for their financial future with a clearer perspective. This may involve robust retirement planning, investment strategies, and the pursuit of broader financial goals.

Navigating Challenges And Staying Committed

While the benefits of debt liberation are compelling, the journey is not without its challenges. Navigating through obstacles and staying committed to the debt repayment plan are critical aspects of successfully traversing the second foundation in personal finance. Understanding and addressing potential challenges, coupled with unwavering commitment, ensures a steady course toward financial freedom.

Addressing Lifestyle Changes

Embarking on the journey of debt repayment often requires individuals to make temporary adjustments in their lifestyle. Recognizing that short-term sacrifices may be necessary is crucial for a realistic and sustainable approach to debt elimination. This may involve reevaluating discretionary spending, finding cost-effective alternatives, and prioritizing financial goals over non-essential expenditures.

Setting Realistic Goals

Setting realistic and achievable goals is a fundamental aspect of staying committed to the debt repayment plan. While the overarching objective is debt liberation, breaking down the journey into smaller, manageable goals provides a roadmap for progress. Celebrating milestones along the way, whether paying off a credit card or reaching a specific debt reduction target, reinforces commitment and motivation.

Building Financial Literacy

A key element in navigating challenges is the continuous investment in financial literacy. Understanding the principles of personal finance equips individuals with the knowledge needed to make informed decisions and avoid potential pitfalls. Financial literacy also enables individuals to adapt to changing circumstances and adjust their strategies as needed throughout the debt elimination process.

Seeking Professional Guidance

In the face of challenges, seeking professional guidance becomes an invaluable resource. Financial advisors or credit counselors can offer insights, strategies, and personalized advice based on individual financial circumstances. Their expertise not only enhances the effectiveness of debt elimination plans but also provides a supportive framework for individuals navigating challenges.

What Is The Second Foundation In Personal Finance? - FAQs

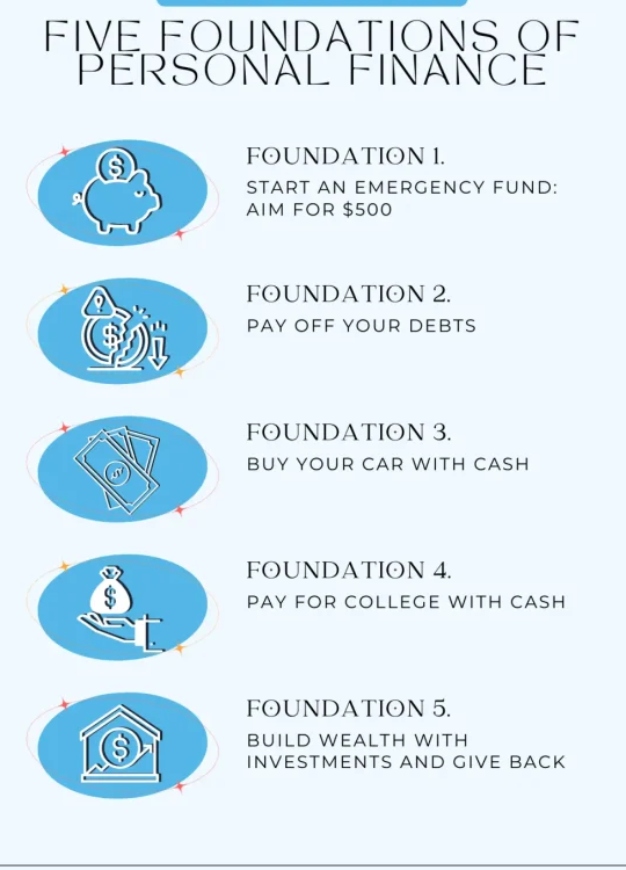

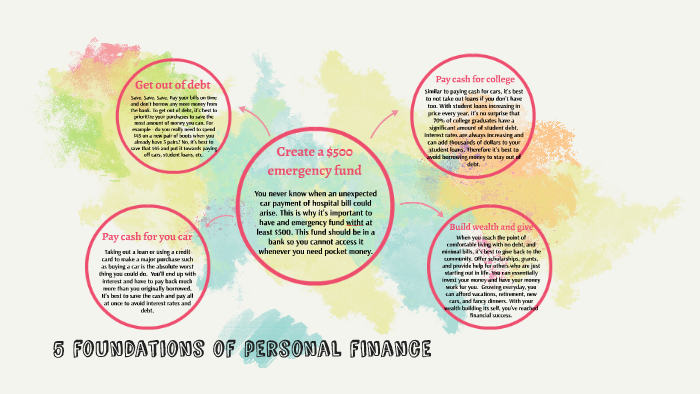

What Are 5 Foundations Of Personal Finance?

- Keep $500 in case of emergency.

- Get rid of your bills and debt.

- You should pay cash for your car.

- Pay for college with cash.

- Get rich and give.

Why Is Getting Out Of Debt Considered The Second Foundation In Personal Finance?

Getting out of debt is crucial as it liberates individuals from financial burdens, setting the stage for a more secure and prosperous financial future.

What Is The Debt Snowball Method Mentioned In The Second Foundation Of Personal Finance?

The debt snowball method involves prioritizing the repayment of the smallest debts first, creating a sense of accomplishment and motivation as each debt is eliminated.

What Is The Significance Of Setting Realistic Goals In The Second Foundation Of Personal Finance?

Setting realistic goals is essential for staying motivated and making consistent progress in debt repayment, contributing to overall financial well-being.

How Can Building Financial Literacy Impact The Second Foundation Of Personal Finance?

Building financial literacy empowers individuals to make informed decisions, avoid debt traps, and understand the principles of personal finance.

What Is The Third Foundation In Personal Finance?

Using cash to buy a car is the third Foundation in personal finance.

Conclusion

What is the second foundation in personal finance? In the intricate tapestry of personal finance, the second foundation, centered around liberating oneself from debt, serves as a transformative phase.

The second idea is to get out of debt. Good for you if you don't have any debt! You decide where your money goes and how it is spent or saved. Enjoy your freedom, and promise yourself that you won't go into debt again! It's important to pay off your debt as soon as possible so that you can start managing all of your money.

It's a conscious and proactive decision to break free from financial constraints, paving the way for a future marked by stability, security, and the pursuit of one's financial aspirations.

By meticulously crafting a debt repayment plan, making necessary lifestyle adjustments, and staying committed to financial goals, individuals can transcend the challenges posed by debt, ultimately unlocking the door to a more prosperous and liberated financial existence.

Liam Evans

Author

Liam Evans is a freelance writer and social media manager who specializes in assisting finance professionals and Fintech entrepreneurs in growing their online audience and attracting more paying customers. Liam worked as a bank teller and virtual assistant for financial firms in the United States and the United Kingdom for six years before beginning her writing career.

Habiba Ashton

Reviewer

BCS Growth Fund (Israel) L.P., a private investment fund specializing in investments in technologically focused businesses with high growth potential, employs Habiba as an analyst. Mrs. Ashton served as an analyst and information manager at the Israel International Fund, the first Israeli venture capital fund designed specifically for Japanese corporate investors, prior to joining BCS. Habiba graduated with honors from Israel's College of Management with a B.A. in Business Administration.

Latest Articles

Popular Articles