What To Do To Apply For Unemployment Payments

Have you been laid off recently? Do you need financial assistance to survive the challenging times until you land your next job? You can qualify for unemployment payments.

Author:Frazer PughReviewer:Habiba AshtonJan 08, 202396.2K Shares1.5M Views

Have you been laid off recently? Do you need financial assistance to survive the challenging times until you land your next job? You can qualify for unemployment payments.

In many states, employees may apply by mail, phone, or on the web. You may find all the necessary information about the application in English and Spanish.

How to file for unemployment? What questions will you be asked?

Keep on reading to learn all the details concerning the application for unemployment benefits.

The Basics of Unemployment Insurance

When is unemployment insurance necessary? What does it mean? It assists employees who become laid off through no fault of their own.

The state law defines the amount of these payments, the length of eligibility time, and qualification criteria. You should contact your state department of unemployment to file for unemployment.

Such claims may be submitted by phone, mail, or online. More and more people choose online applications to save time and avoid tedious waiting lines.

Unemployment insurance presents financial support for a particular time till the individual lands a new position. The laws of your state determine eligibility for this insurance, so you should check the details of your local unemployment programs.

For example, the local filing system for unemployment is challenging and laze-like in Texas. Did you know that a credit builder loan like Moneylionis suitable for repairing your credit rating? Besides, it can be used for urgent situations when you feel pressed for cash.

For instance, if you aren’t eligible for filing for unemployment benefits, you may need to turn to a lending option to make ends meet.

Do I Qualify for Unemployment Benefits in Texas?

The system of getting unemployment payments in Texas is rather complicated and resembles a maze. Consumers who have been laid off and lost their wages may generally qualify for unemployment payments in this state.

If your working hours were reduced or you were laid off for reasons that aren’t connected with lousy performance or misconduct, you may file for unemployment in Texas.

Such payments replace your regular paycheck to help consumers survive while seeking a new position.

During the coronavirus pandemic, state unemployment systems have altered. Employees who suffered from COVID-19 could apply for unemployment aid through the CARES Act, passed last March.

Gig workers and independent contractors could apply for these payments. Besides, those whose paycheck wasn’t high enough to obtain regular unemployment payments and those who have used up these payments had the right to apply.

You should learn more about eligibility and benefitamounts if you are interested in getting potential unemployment benefits.

You can find all the necessary information on how and when to apply for unemployment benefits and what requirements you should meet.

Who Is Eligible to File for Unemployment?

The state you reside in establishes eligibility demands for getting unemployment payments.

Employees who were laid off should have worked for the same company for several months or even years and lost employment through no fault of their own.

If this is a leave or a layoff, your chances of getting approved for financial assistance are high.

What Questions Can You Be Asked

The unemployment office may ask whether you want your taxes withheld from the unemployment check. Besides, you may need to tell the reason you were laid off.

The unemployment office will want to know if your fault or economic circumstances made you redundant. More than that, a person can be asked whether they owe any holiday pay or vacation.

The application for unemployment payments can be challenging if the person quits or there are specific concerns about the termination.

What You Need to Apply for Unemployment Aid

You should check the information at the state unemployment office before filing for unemployment. It will give you a better understanding of how to open a claim and what exactly needs to be done.

Each state may have different requirements and eligibility criteria. Here are some of the documents and information you may need to provide to the office to file for unemployment insurance:

- Your state ID card number or driver’s license

- Your Social Security Number

- Your phone number

- Your current address

- An alien registration card number for non-US citizens

- The addresses and names of the companies you have been employed at for the past two years

- Copies of forms SF50 and SF8 for federal employees

- Federal Employer Identification Number (FEIN) or the Employer Registration Number

- A written or printed confirmation of unemployment request

- Consumers will get details about the debit card and how it works in states where individuals receive unemployment payments on these cards.

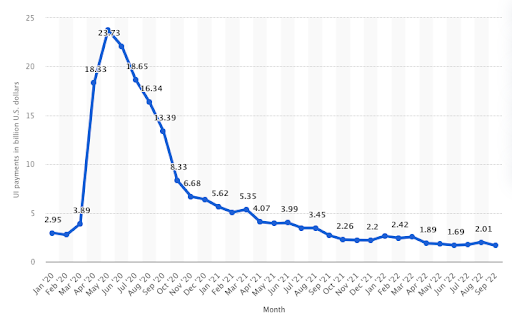

According to Statista, 1.65 billion US dollars were paid out in unemployment benefits in the USA in September 2022. It is much lower compared to 2.69 billion US dollars in September 2021.

Total monthly unemployment insurance benefits paid in the United States from January 2020 to September 2022

Filing for Unemployment on the Web

The application process differs among states. While consumers can file unemployment benefits through mail or phone, this process is even more facilitated online.

Apply for these benefits on the web from the comfort of your home. For instance, almost every state has a web platform where consumers can claim unemployment.

This platform contains all the details about the application process and the necessary documentation.

Residents of California may file for unemployment insurance by submitting their digital form. The request form may be faxed, mailed, or printed out.

If you reside in New York, you may visit the Unemployment Benefits platform, fill in the digital claim for these payments, and wait for the response.

The payments can be claimed weekly or monthly, depending on your needs. Besides, you can check your claim status on the same website.

The Bottom Line

If you were laid off, you have a chance to file for unemployment payments. These financial benefits help consumers and employees survive and pay for necessities while they are job searching. You will be able to receive unemployment insurance till you find a new position.

Your unemployment claim might be rejected if you quit or left your employment without reasonable cause or due to misconduct or another fault.

Each state has a slightly different application process and eligibility criteria.

Frazer Pugh

Author

Frazer Pugh is a distinguished expert in finance and business, boasting over 6 years of experience. Holding an MBA in Finance from Stanford University, Frazer's credentials underscore his authority and expertise in the field.

With a successful track record in executive roles and as a published author of influential articles on financial strategy, his insights are both deep and practical.

Beyond his professional life, Frazer is an avid traveler and culinary enthusiast, drawing inspiration from diverse cultures and cuisines.

His commitment in delivering trustworthy analysis and actionable advice reflects his dedication to shaping the world of finance and business, making a significant impact through his work.

Habiba Ashton

Reviewer

Habiba Ashton, an esteemed professional in Digital Marketing and Business, brings over 10 years of experience to the table. She holds a Master's degree in Marketing Management from Stanford University and is a certified Digital Marketing strategist.

Habiba has authored numerous articles on SEO, Social Media Marketing, and Branding, published across reputable platforms.

Her impactful projects have consistently driven growth and visibility for businesses, earning her accolades from clients and industry peers alike. One notable achievement includes leading a digital marketing campaign that resulted in a 30% increase in online sales for a major retail client.

Looking ahead, Habiba is committed to pioneering ethical digital marketing practices that prioritize customer trust and engagement. Her vision is to lead initiatives that foster a transparent and sustainable digital ecosystem for businesses and consumers alike.

In her free time, she enjoys cycling, stargazing, and staying updated on digital entertainment trends.

Latest Articles

Popular Articles